Siemens Upbeat Despite Weak Quarter

November 12 2015 - 4:20AM

Dow Jones News

BERLIN—Siemens AG reported a worse-than-expected 33% drop in

fourth-quarter net profit, but the German industrial giant forecast

sales and earnings growth in the quarters ahead as it plans to

return more cash to shareholders.

Siemens said on Thursday that net profit fell to €959 million

($1.03 billion) in the three months to end-September from €1.45

billion during the same period last year, falling short of

analysts' expectations. Analysts had forecast a net profit of €1.2

billion in the latest period, according to a recent poll conducted

by The Wall Street Journal.

Part of the decline reflected an impairment charge of €138

million in connection with the company's stake in Primetals

Technologies Ltd.

The group—whose activities range from making power equipment to

trains and medical scanners—reported a 10.1% profit margin for its

industrial businesses in the year to Sept. 30, at the lower end of

the range of its target range of 10% to 11%.

"We delivered what we promised and are well prepared to deliver

on our plans for the year ahead," said Siemens Chief Executive Joe

Kaeser.

Despite a "further softening" in the macroeconomic environment

and ongoing geopolitical "complexity" in fiscal 2016, Siemens said

it expects an industrial profit margin in the range of 10% to 11%,

"moderate" revenue growth, a book-to-bill ratio above one, and

earnings a share between €5.9 and €6.2, up from €5.18 in 2015.

Siemens proposed a shareholders dividend of €3.5 for fiscal year

2015, up 6% from €3.3 for the previous year, while also announcing

plans for a new share buyback program with a volume up to €3

billion over the next 36 months.

Siemens's fourth-quarter profit margin rose to 11.3% from 10.9%

last year, with an improved performance at its energy-management,

wind-power and renewables, health-care and transport divisions

offset squeezed margins at its conventional energy and

industrial-drives units.

Profitability at the group's power and gas business was

primarily held back by severance charges and lower margins in the

gas-turbine business, though the acquisitions of Rolls-Royce's

energy business and U.S. oil equipment manufacturer Dresser-Rand

boosted revenue and orders. This was the first quarter that Dresser

Rand--the $7.8 billion deal closed in June--was consolidated in

Siemens's results.

That acquisition, first announced last year, was part of a

larger move by Mr. Kaeser to focus the company more squarely on

energy, a strategy that has come under pressure amid lower global

oil prices over the past year.

Fourth-quarter revenue rose by 4%, to €21.33 billion, while new

orders climbed by 15%, to €23.72 billion, helped by the tailwind of

the euro's weakness against major currencies, the company said.

Among the new orders was a €1.2 billion contract for an offshore

wind farm and wind-power services in Germany.

Write to Christopher Alessi at christopher.alessi@wsj.com

Access Investor Kit for "Siemens AG"

Visit

http://www.companyspotlight.com/partner?cp_code=P479&isin=DE0007236101

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 12, 2015 04:05 ET (09:05 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

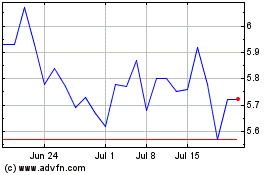

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rolls Royce (PK) (USOTC:RYCEY)

Historical Stock Chart

From Jul 2023 to Jul 2024