Current Report Filing (8-k)

February 02 2018 - 9:12AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of

1934

January 29, 2018

Date of

Report

Q BioMed Inc.

(Exact

name of registrant as specified in its charter)

|

Nevada

|

333-193328

|

46-4013793

|

|

(State

or other jurisdiction of incorporation)

|

(Commission

File Number)

|

(IRS

Employer Identification No.)

|

|

c/o Ortoli Rosenstadt LLP

|

|

10022

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

(212) 588-0022

Registrant’s

telephone number, including area code

Check

the appropriate box below if the Form 8-K is intended to

simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

|

[ ]

|

Written

communications pursuant to Rule 425 under the Securities Act (17

CFR 230.425)

|

|

[ ]

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR

240.14a-12)

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17

CFR 240.14d-2(b))

|

|

[ ]

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17

CFR 240.13e-4(c))

|

Item 1.01

Entry into a Material Definitive Agreement.

On

February 1, 2018, we raised $5,478,000 of gross proceeds in a

public offering. In the offering, we sold an aggregate of 1,711,875

shares of our common stock and 1,711,875 warrants to purchase

shares of our common stock exercisable for five years at $3.20 per

share.

Roth

Capital Partners acted as lead placement agent and CIM Securities

acted as co-lead placement agent for the offering pursuant to a

Placement Agency Agreement entered into on January 29, 2018, the

form of which was included in our registration statement on Form

S-1/A no. 3 as filed with the U.S. Securities and Exchange

Commission on January 12, 2018 and which form is incorporated into

this filing. Pursuant to the terms of the Placement Agency

Agreement, we paid the placement agents commissions of

approximately $418,000. After the placement agents’

commissions and offering expenses, we netted approximately

$4,915,000. We also issued the placement agents warrants

exercisable for five years into 81,688 shares of our common stock

at $3.84 per share as additional consideration under the Placement

Agency Agreement.

We

intend to use the net proceeds from the offering to:

●

launch our

non-opioid FDA approved Strontium Chloride 89 USP Injection (SR89),

a therapeutic drug for the treatment of skeletal pain associated

with metastatic cancers,

●

focus on the

clinical planning and IND filing for a Phase 4 post-marketing study

to expand the indication of the approved SR89,

●

complete pre-IND

studies and the filing of an IND for a phase II/III clinical

program to test the efficacy of QBM-001, our product candidate for

the treatment of young children with a rare autistic spectrum

disorder that severely inhibits their ability to

communicate,

●

continue

development work on our novel chemotherapeutic drug for liver

cancer and

●

further the

optimization and pre-clinical testing of our glaucoma drug Man-01

for the treatment of open angle glaucoma.

We conducted the offering pursuant to a Registration Statement on

Form S-1 (File No. 333-222008), which was declared effective by the

Securities and Exchange Commission on January 12,

2018.

The foregoing description of the Placement Agency Agreement is not

complete and is qualified in its entirety by reference to the full

text of the Placement Agency Agreement, the form of which is

incorporated by reference hereto and was filed as Exhibit 1.1 to

the Company’s Amendment No. 3 to the Registration Statement

on Form S-1, which was filed with the Securities and Exchange

Commission on January 12, 2018.

Item 7.01

Regulation FD Disclosure.

On January 30, 2018, we issued a press release entitled “Q

BioMed Inc. Prices $5.5 Million Public Offering.” A copy of

the press release is furnished herewith as

Exhibit 99.1.

On February 1, 2018, we issued a press release entitled

“

Q Biomed Inc. Closes

$5.48 Million Public Offering.” A copy of the press release

is furnished herewith as Exhibit 99.2.

The information in this Item 7.01 of this Form 8-K is being

furnished and shall not be deemed “filed” for the

purposes of Section 18 of the Securities Exchange Act of 1934, or

otherwise subject to the liabilities of that

section. The information in this Item 7.01 of this Form

8-K also shall not be deemed to be incorporated by reference into

any filing under the Act or the Securities Exchange Act of 1934,

except to the extent that we specifically incorporate it by

reference.

Item 9.01

Financial Statements and Exhibits.

99.1

Press Release

entitled “Q BioMed Inc. Prices $5.5 Million Public

Offering”

99.2

Press Release

entitled “Q Biomed Inc. Closes $5.48 Million Public

Offering”

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

Q BioMed Inc.

|

|

Date: February 1, 2018

|

By: /s/

William Rosenstadt

Name:

William Rosenstadt

Title:

Chief Legal Officer

|

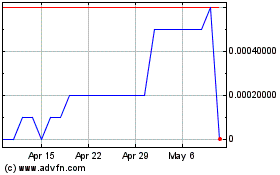

Q BioMed (CE) (USOTC:QBIO)

Historical Stock Chart

From Sep 2024 to Oct 2024

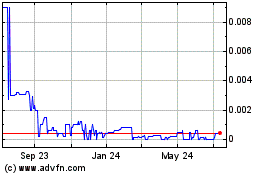

Q BioMed (CE) (USOTC:QBIO)

Historical Stock Chart

From Oct 2023 to Oct 2024