3

Small-Cap Stocks To Play The Oil Recovery

The oil markets have been held hostage since entering into its

latest bear market, which began in July 2014 when the price of oil

was still around $100 per barrel. The subsequent bearish

fundamentals pushed oil prices all the way to the low $20s by early

2016.

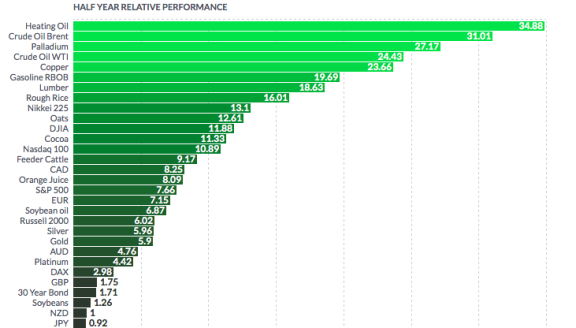

However, oil prices are making a major comeback in 2017. Over the

past six months, WTI crude oil has

jumped 24.43% and Brent crude oil has surged 31.01%, as rising

geopolitical concerns around the world give oil producers a chance

to benefit from higher prices.

Saudi Arabian Crackdown

Leads To Rallying Oil Prices

Middle Eastern oil powerhouse, Saudi Arabia, is the latest source

of oil price appreciation. On Saturday, November 4, 2017, Saudi

Arabia began to crackdown on high-level officials in an effort to

curb corruption. Among the prominent leaders arrested was the

billionaire investor, Prince Alwaleed bin Talal, which would be the

equivalent of the U.S. government arresting Bill Gates or Warren

Buffet.

The major crackdown and potential

political destabilization of Saudi Arabia is one of the most

bullish factors for underlying oil prices right now. As commodity

markets opened on the Monday following the crackdown, oil prices

surged over 2% in early trading. Other major geopolitical issues,

such as the escalating Kurdish-Iraqi violence, could easily help

provide further gains for oil prices.

Bullish Analyst

Projections

The latest developments have prompted many analysts to revise their

oil outlooks upward. Phil Streible, a senior market strategist at

RJO Futures, told clients that the oil outlook remains bullish.

"A combination of internal political trouble in Saudi Arabia

combined with another decline in U.S. rig operating counts and a

definitive extension in 'risk on' psychology leaves the path of

least resistance pointing upward," added Streible.

Furthermore, analysts at several major

brokerages collectively raised their oil price targets. Jefferies

analysts are now estimating WTI prices of $55 per barrel by the end

of 2018. Bank of America (NYSE:

BAC) chose to raise its fourth quarter 2017 oil price target to

$49 from $47.

As oil prices rebound and look to be coming out of their bearish

trend, here are three small-cap oil stocks to keep on your

radar:

American Patriot Oil & Gas, Ltd. (OTCQB:

ANPOF) (ASX:

AOW): American Patriot Oil & Gas, Ltd. operates as

an oil & gas production company. The company has been making

major acquisitions over the past

several months that have bolstered the company’s U.S. oil & gas

production assets. After its latest oil acquisition in East Texas,

American Patriot Oil & Gas, Ltd. now has independent proven oil

reserves of around 2.1 million barrels of oil equivalent.

The company’s acquisition spree has led to seven active oil and gas assets

with the focus on the Texas and Gulf Coast Regions.

Furthermore, American Patriot Oil & Gas, Ltd. is now on track

to produce 500 barrels of oil per day by the end of the year. Under

production estimates ran by management, reports indicate they could

earn $50 million in revenue at $50 oil. If oil can continue to rise

and even break $60 per barrel, the company could be on track to

generate tens of millions more in revenue.

American Patriot Oil & Gas, Ltd. recently provided an update on

its $40 million financing facility. The facility is nearly

finalized and should be closed within the next 40 days, subject to

further due diligence. However, the company has already been able

to utilize the financing facility for its recent major Texas

acquisitions.

American Patriot Oil & Gas, Ltd. may be an under-the-radar

stock right now, but the company’s well-executed growth plan will

likely help make 2018 a very profitable year with an aggressive oil

and gas production acquisition plan underway.

Petro River Oil Corp. (OTC

Pink: PTRC): Petro River Oil operates as an

independent energy company, which maintains the majority of its

assets in Osage County, Oklahoma and Kern County, California. The

company made headlines in first half of 2017, after making several

sizable oil field discoveries while utilizing its 3D seismic

imaging technology.

The company recently announced that it has acquired an additional

46.81% stake in its Osage Project. Management plans on drilling

nine new development wells and three exploration wells at the

Osage Project. In order to fund the drilling

program, the company closed a $2.5 million secured debt financing

agreement with Petro Exploration Funding II, LLC. Under the terms

of the deal, there will be a three-year note holding a 10% annual

interest rate and 2% in overriding royalty interest. Furthermore,

the financing company received warrants to purchase $1.25 million

shares of the common stock at a price of $2.00 per share.

Petro River Oil Corp. is moving from the exploration phase to the

development phase, after making several discoveries earlier this

year. Overall, the company appears to have a solid strategy in

finding “untouched” oil reserves.

MMEX Resources Corporation (OTCQB:

MMEX): MMEX Resources Corporation is engaged within

the acquisition, exploration and development of oil and gas

properties across Texas, Peru, and other Latin American

countries.

The company is set to begin building its 10,000 barrel-per-day oil refinery

located near Fort Stockton, Texas. It will take about 15 months to

complete, but it will serve as a major revenue generator once it is

operational. In addition, the company recently completed a

successful uplisting to the OTCQB Venture

Market, which will help increase investors’ trust in the company.

Overall, MMEX Resources Corporation is well positioned to generate

sizable revenues from its oil refinery located near the highly

prized Permian Basin formation.

Disclaimer:

Spotlight Growth is compensated,

either directly or via a third party, to provide investor relations

services for its clients. Spotlight Growth creates exposure

for companies through a customized marketing strategy, including

design of promotional material, the drafting and editing of press

releases and media placement.

All information on featured

companies is provided by the companies profiled or is available

from public sources. Spotlight Growth and its employees are not a

Registered Investment Advisor, Broker Dealer or a member of any

association for other research providers in any jurisdiction

whatsoever and we are not qualified to give financial advice. The

information contained herein is based on external sources that

Spotlight Growth believes to be reliable, but its accuracy is not

guaranteed. Spotlight Growth may create reports and content

that has been compensated by a company or third-parties, or for

purposes of self-marketing. Spotlight Growth was compensated five

hundred dollars cash and three hundred dollars in restricted stock

from American Patriot Oil & Gas, Ltd. for the creation and

dissemination of this content.

This material does not represent an

investment solicitation. Certain statements contained herein

constitute “forward-looking statements” within the meaning of the

Private Securities Litigation Reform Act of 1995. Such statements

may include, without limitation, statements with respect to the

Company’s plans and objectives, projections, expectations, and

intentions. These forward-looking statements are based on current

expectations, estimates and projections about the Company’s

industry, management’s beliefs and certain assumptions made by

management.

The above communication, the

attachments and external Internet links provided are intended for

informational purposes only and are not to be interpreted by the

recipient as a solicitation to participate in securities

offerings. Investments referenced may not be suitable for all

investors and may not be permissible in certain

jurisdictions.

Spotlight Growth and its affiliates,

officers, directors, and employees may have bought or sold or may

buy or sell shares in the companies discussed herein, which may be

acquired prior, during or after the publication of these marketing

materials. Spotlight Growth, its affiliates, officers, directors,

and employees may sell the stock of said companies at any time and

may profit in the event those shares rise in value. For more

information on our disclosures, please visit: http://spotlightgrowth.com/index.php/disclosures/

Petro River Oil (CE) (USOTC:PTRC)

Historical Stock Chart

From Dec 2024 to Jan 2025

Petro River Oil (CE) (USOTC:PTRC)

Historical Stock Chart

From Jan 2024 to Jan 2025