BofA Vends Strategic Partners - Analyst Blog

September 06 2012 - 1:54PM

Zacks

On Wednesday, The Wall Street Journal reported that

Partners Group Holding AG (PGPHF) and Avista

Capital Partners have acquired California-based apparel maker

Strategic Partners Inc. from Bank of America

Corporation (BAC). This sale is part of BofA’s stratagem

to do away with non-core assets so that it can focus on the

fundamental activities.

Although the terms of the deal have not been disclosed, it is

estimated that Partners group and Avista Capital have shelled-out

$200 million to purchase Strategic Partners. The acquiring firms

are planning to expand Strategic Partners into overseas areas. Two

years ago, BofA acquired the apparel maker for $212 million.

For the past two years, BofA is in the process of selling non-core

units, which do not fit into the company’s strategic setting. By

doing so, the bank expects to concentrate more on core business,

reduce expenditures and raise additional liquidity. The need for

extra fund stems from the new Basel III regulations that require

banks to maintain more liquidity in order to withstand severe

financial crisis.

Moreover, divesting unproductive units could help BofA rationalize

its operations and work towards building a sound capital position.

As a result, the bank has been selling everything from credit card

operations to wealth management units.

Earlier in August this year, BofA announced the divestiture of its

international wealth management unit to Swiss private bank JULIUS

BAER GRPN. The deal is anticipated to fetch BofA about $1.5 - $2.0

billion. However, the company has retained the Japanese division of

its overseas wealth management wing and will continue to manage its

international clients through domestic offices.

Earlier this year, BofA also sold its entire Irish credit card

operations to Apollo Global Management LLC’s (APO)

fund affiliate, Apollo European Principal Finance Fund I (Apollo

EPF). It had also sold its Spanish consumer credit card operations

and Canadian credit card portfolio to Apollo and The

Toronto-Dominion Bank (TD), respectively, in 2011.

BofA’s efforts to shed non-core units and realigning its balance

sheet in accordance with the regulatory changes, post-meltdown to

remain afloat, have proved to be highly beneficial. The company has

completed the divestiture of more than 20 non-core assets to

strengthen its capital position in order to meet the new

international capital standards (Basel III), focus on corporate

borrowers and the U.S. retail clients as well as strengthen its

investment banking.

The proceeds obtained from non-core assets and businesses,

generated nearly 79 basis points (bps) of Tier 1 common equity and

reduced risk-weighted assets (RWAs) by approximately $29 billion in

the last year. Moreover, these initiatives helped BofA clear the

March 2012 Stress test. We anticipate the company to aspire for

dividend hike and share repurchase in the upcoming year, when it

will submit a new capital plan for next round of stress test in

2013.

Currently, BofA retains a Zacks #3 Rank, which translates into a

short-term Hold rating. Considering the fundamentals, we also

maintain a long-term Neutral recommendation on the stock.

APOLLO GLOBAL-A (APO): Free Stock Analysis Report

BANK OF AMER CP (BAC): Free Stock Analysis Report

(PGPHF): ETF Research Reports

TORONTO DOM BNK (TD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

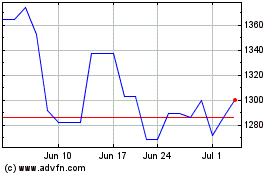

Partners (PK) (USOTC:PGPHF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Partners (PK) (USOTC:PGPHF)

Historical Stock Chart

From Dec 2023 to Dec 2024