UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ¨

Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

OCEAN POWER TECHNOLOGIES, INC.

(Name of Registrant as Specified in Its Charter)

PARAGON TECHNOLOGIES, INC.

HESHAM M. GAD

SHAWN M. HARPEN

JACK H. JACOBS

SAMUEL S. WEISER

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rules 14a-6(i)(1) and 0-11. |

On February 27, 2024, Paragon Technologies,

Inc. issued a press release relating to Ocean Power Technologies, Inc., a copy of which is set forth below:

Ocean Power Continues

to Ignore Small Individual Investors Instead Focusing on Institutional Investors Who Own Relatively Little OPT Stock

EASTON, PA / ACCESSWIRE / February 27,

2024 / Paragon Technologies, Inc. (“Paragon”), a diversified holding company, and the largest shareholders of Ocean

Power Technologies, Inc. (NYSE American:OPTT), (“Company”) (“OPT”), is dismayed at how OPT’s Board and CEO

continue to disregard individual shareholders and instead favor institutional investors who own relatively little OPT shares.

“By our estimate institutional investors,

in total, own about 4-5% of OPT, while the remaining 95% of shares are held by individual investors,” notes Sham Gad, Chairman of

Paragon Technologies. “Yet in announcing its upcoming earnings release OPT now wants to hear from and speak to portfolio managers.”

“What about listening to the individual

investors who have funded OPT with tens of millions of dollars from new equity sales that have funded OPT’s growing losses and paid

for growing board and executive compensation?” asks Gad. “And in return those shareholders have been rewarded with a 90% decline

in share price as a result of an incompetent and failing strategy by the Board and CEO.”

The stark reality is that with a market cap

of approximately $17 million, institutional investors are likely not interested in OPT. Analysts have nothing to say about a business

that has had the disastrous financial failings that OPT has had over the years.

The stock market is going up. OPT shares are

going down. And because OPT’s CEO and Board know they have failed shareholders every single day, they ignore them.

Perhaps the most egregious indication of the

little to no regard OPT has for its individual investors is the robo-calls and spam-like emails OPT is annoying shareholders with everyday

asking them to vote for their failed slate of candidates.

CEO Stratmann cannot take the time to personally

call his individual shareholders and talk about his supposed “working” strategy and explain why he and the board deserve their

vote after failing them for years.

But OPT is more than happy to chat to institutional

investors who invest other people’s money and are not feeling the financial pain that individual investors have suffered.

Instead of working constructively with Paragon

- OPT’s single largest shareholder - to reinvigorate OPT, the Board continues to spend millions putting up roadblocks to deny shareholders

the opportunity to benefit from Paragon’s nominees’ experience, ideas, and track record. As Paragon has stated from day one,

our sole objective is to drive a sustainable increase in shareholder value and we remain open to working existing directors in order to

put ALL OPT shareholders first.

Paragon urges OPT shareholders to continue

showing the OPT directors and executives that you will not be duped and misled about the state of OPT and ignore any and all

messages from OPT asking you to vote the white proxy card. Do not let this Board get away with another year of destroying shareholder

value.

If you have voted in ANY WAY on the

white proxy, you should revote the BLUE proxy to save your investment from a likely total loss.

If you have NOT YET VOTED, we urge you

to ignore any and all calls or emails from OPT and completely disregard the white proxy and cast your vote on the BLUE proxy.

Please email us at ir@pgntgroup.com with

any questions about how to vote your BLUE proxy card.

We appreciate the support from shareholders

thus far. If shareholders have any questions, please contact our Proxy Solicitor, Alliance Advisors at:

Alliance Advisors

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

Toll-Free Phone: 855-200-8651

Email: OPTT@allianceadvisors.com

No matter how many shares you hold, we

would like to hear from you. Please email us at ir@pgntgroup.com if you need any help in voting your BLUE proxy.

By voting on Paragon’s BLUE universal

proxy card, you can send a message to OPT that you do not support their actions in relation to the Annual Meeting and attempting to block

the recognition of Paragon’s nominees.

OPT has said that it will disregard proxy

votes in favor of Paragon’s director nominees. Whether OPT may lawfully disregard Paragon’s director nominees is an issue

that Paragon expects will be resolved by the Delaware courts.

Stockholders should review the section of

Paragon’s proxy statement titled “Questions And Answers Relating To This Proxy Solicitation--Why is OPT saying it will disregard

Paragon’s director nominations, and how does that impact proxies that stockholders provide to Paragon?”

Paragon Technologies, Inc., together with

the other participants named herein, has filed with the Securities and Exchange Commission (the “SEC”) a definitive proxy

statement and an accompanying proxy card soliciting votes for the election of director nominees at the 2023 annual meeting of shareholders

of Ocean Power Technologies, Inc., a Delaware corporation (the “company”).

Paragon Technologies, Inc. is the beneficial

owner of 2,472,011 shares of common stock of the company, par value $0.001 per share (“common stock”).

Paragon Technologies, Inc., and Paragon’s

director nominees Hesham M. Gad, Shawn M. Harpen, Jack H. Jacobs, and Samuel S. Weiser, are the participants in the proxy solicitation.

Mr. Gad, Executive Chairman of Paragon’s Board of Directors and Chief Executive Officer of Paragon, and Messrs. Jacobs and Weiser,

directors of Paragon, may be deemed to beneficially own the shares of the company’s common stock held by Paragon. Ms. Harpen does

not own beneficially or of record any securities of the company. Updated information regarding the participants and their direct and indirect

interests in the solicitation, by security holdings or otherwise, has been and will be included in Paragon’s proxy statement and

other materials filed with the SEC.

SHAREHOLDERS OF THE COMPANY SHOULD READ THE PROXY STATEMENT AND OTHER

PROXY MATERIALS CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN IMPORTANT INFORMATION RELATING TO THE COMPANY’S ANNUAL MEETING,

PARAGON’S SOLICITATION OF PROXIES AND PARAGON’S NOMINEES TO THE BOARD. SUCH PROXY MATERIALS ARE AVAILABLE AT NO CHARGE ON

THE SEC’S WEBSITE AT WWW.SEC.GOV OR FROM PARAGON TECHNOLOGIES, INC. REQUESTS FOR COPIES SHOULD BE DIRECTED TO PARAGON’S

PROXY SOLICITOR.

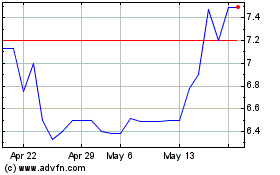

Paragon Technologies (PK) (USOTC:PGNT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Paragon Technologies (PK) (USOTC:PGNT)

Historical Stock Chart

From Dec 2023 to Dec 2024