UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ¨

Filed by a Party other than the Registrant x

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted

by Rule 14a-6(e)(2)) |

| ¨ | Definitive Proxy Statement |

| x | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

OCEAN POWER TECHNOLOGIES, INC.

(Name of Registrant as Specified in Its Charter)

PARAGON TECHNOLOGIES, INC.

HESHAM M. GAD

SHAWN M. HARPEN

JACK H. JACOBS

SAMUEL S. WEISER

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Fee computed on table in exhibit required by Item 25(b) per

Exchange Act Rules 14a-6(i)(1) and 0-11. |

On February 1, 2024, Paragon Technologies,

Inc. issued a press release relating to Ocean Power Technologies, Inc., a copy of which is set forth below:

Ocean Power Technologies

Board Postpones Annual Meeting After Failing to Obtain Enough Shareholder Support to Achieve a Quorum; Vote Paragons’ BLUE Proxy

Now to Save OPT

EASTON, PA / ACCESSWIRE / February 1, 2024

/ Paragon Technologies, Inc. (“Paragon”), a diversified holding company, owning approximately 4.8% of the outstanding

shares of Ocean Power Technologies, Inc. (NYSE American: OPTT), (“Company”) (“OPT”), today issues the following

statement to OPT shareholders:

This morning, OPT postponed its annual meeting

due to OPT’s inability to obtain a quorum. OPT’s failure to obtain a quorum for its “2023” annual meeting reflects

disapproval from shareholders related to OPT’s financial results and board actions. After months of soliciting shareholders and

moving its “2023” annual meeting into 2024, the OPT board has failed to convince more than half of its shareholders to vote.

On January 31, the judge in Paragon’s

books and records litigation against OPT confirmed that Paragon is entitled to review materials relating to OPT’s decision to adopt

a poison pill and bylaw changes that created new, burdensome advance notice provisions after Paragon informed OPT of its intent to seek

board representation. After having significant NOLs for over 30 years, the OPT board decided to adopt an NOL poison pill only after Paragon

began its campaign for change. This led the Delaware court to previously conclude that “the context and timing of the bylaw amendments

and poison pill suggest that thwarting [Paragon] was the board’s primary basis or driving purpose for such actions.”

OPT’s decisions to adopt a poison pill,

adopt new and unfair advance notice provisions, refuse to provide books and records to Paragon, appeal the court’s books and record

decision, refuse to use a universal proxy card, and attempt to increase Paragon’s expenses at every step of the way have had a significant

cost on OPT The OPT board could have saved millions of dollars by just facilitating a fair election and letting shareholders vote! As

OPT continues to slide towards insolvency, when will it disclose to shareholders how many millions the board has spent trying to save

their board seats?

The OPT board seems laser-focused on entrenchment,

but not so focused on preserving precious cash, making a profit, being honest with shareholders, or facilitating a fair election for shareholders.

If you have voted to Withhold on the

white proxy, you should revote the BLUE proxy instead to make your vote against the incumbent directors count. A withhold vote on the

white card does not support Paragon’s nominees and only enables the current board to take further measures to diminish shareholder

value, further dilute shareholders and increase their compensation.

Voting ONLY the BLUE proxy card is a vote

for change at the board level and the only way to change the direction of OPT’s share price.

If you didn’t receive a BLUE PROXY CARD

and want to vote to send OPT’s Board and CEO a message to stop the destruction of shareholder value, please let us know and we will

arrange to have the BLUE PROXY CARD sent to you.

Please email us at ir@pgntgroup.com with

any questions about how to vote your BLUE proxy card.

We appreciate the support from shareholders

thus far. If shareholders have any questions, please contact our Proxy Solicitor, Alliance Advisors at:

Alliance Advisors

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

Toll-Free Phone: 855-200-8651

Email: OPTT@allianceadvisors.com

No matter how many shares you hold, we

would like to hear from you. Please email us at ir@pgntgroup.com if you need any help in voting your BLUE proxy.

By voting on Paragon’s BLUE universal

proxy card, you can send a message to OPT that you do not support their actions in relation to the Annual Meeting and attempting to block

the recognition of Paragon’s nominees.

OPT has said that it will disregard proxy

votes in favor of Paragon’s director nominees. Whether OPT may lawfully disregard Paragon’s director nominees is an issue

that Paragon expects will be resolved by the Delaware courts.

Stockholders should review the section of

Paragon’s proxy statement titled “Questions And Answers Relating To This Proxy Solicitation--Why is OPT saying it will disregard

Paragon’s director nominations, and how does that impact proxies that stockholders provide to Paragon?”

Paragon Technologies, Inc., together with

the other participants named herein, has filed with the Securities and Exchange Commission (the “SEC”) a definitive proxy

statement and an accompanying proxy card soliciting votes for the election of director nominees at the 2023 annual meeting of shareholders

of Ocean Power Technologies, Inc., a Delaware corporation (the “company”).

Paragon Technologies, Inc. is the beneficial

owner of 2,639,853 shares of common stock of the company, par value $0.001 per share (“common stock”).

Paragon Technologies, Inc., and Paragon’s

director nominees Hesham M. Gad, Shawn M. Harpen, Jack H. Jacobs, and Samuel S. Weiser, are the participants in the proxy solicitation.

Mr. Gad, Executive Chairman of Paragon’s Board of Directors and Chief Executive Officer of Paragon, and Messrs. Jacobs and Weiser,

directors of Paragon, may be deemed to beneficially own the shares of the company’s common stock held by Paragon. Ms. Harpen does

not own beneficially or of record any securities of the company. Updated information regarding the participants and their direct and indirect

interests in the solicitation, by security holdings or otherwise, has been and will be included in Paragon’s proxy statement and

other materials filed with the SEC.

SHAREHOLDERS OF THE COMPANY SHOULD READ THE

PROXY STATEMENT AND OTHER PROXY MATERIALS CAREFULLY AND IN THEIR ENTIRETY AS THEY CONTAIN IMPORTANT INFORMATION RELATING TO THE COMPANY’S

ANNUAL MEETING, PARAGON’S SOLICITATION OF PROXIES AND PARAGON’S NOMINEES TO THE BOARD. SUCH PROXY MATERIALS ARE AVAILABLE

AT NO CHARGE ON THE SEC’S WEBSITE AT WWW.SEC.GOV OR FROM PARAGON TECHNOLOGIES, INC. REQUESTS FOR COPIES SHOULD

BE DIRECTED TO PARAGON’S PROXY SOLICITOR.

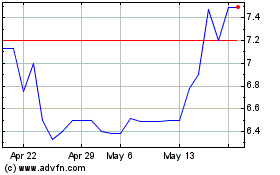

Paragon Technologies (PK) (USOTC:PGNT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Paragon Technologies (PK) (USOTC:PGNT)

Historical Stock Chart

From Dec 2023 to Dec 2024