UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q/A

(Amendment No. 1)

|

|

|

|

þ

|

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

|

|

|

|

|

For the quarterly period ended:

June 30, 2012

|

|

|

|

Or

|

|

|

|

|

o

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

|

|

|

|

|

For the transition period from: _____________ to _____________

|

Commission File Number:

333-147629

MAJIC WHEELS CORP.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

98-0533882

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

1950 Custom Drive

Fort Myers, FL 33907

(Address of Principal Executive Office) (Zip Code)

239-313-5672

(Registrant’s telephone number, including area code)

(Former name, former address and former fiscal year, if changed since last report)

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was

required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

|

|

|

þ

|

Yes

|

o

|

No

|

|

|

|

|

|

|

|

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

and post such files).

|

|

|

o

|

Yes

|

o

|

No

|

|

|

|

Indicate by check mark whether the Registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company.

|

|

|

|

|

Large accelerated filer

|

o

|

|

|

Accelerated filer

|

o

|

|

|

Non-accelerated filer

|

o

|

|

|

Smaller reporting company

|

þ

|

|

|

(Do not check if a smaller

reporting company)

|

|

|

|

|

|

|

|

|

|

|

Indicate by check mark whether the Registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

|

|

|

o

|

Yes

|

þ

|

No

|

|

|

|

|

As of August 17, 2012, 371,441,575 shares of common stock, par value $0.0001 per share, were outstanding.

|

Explanatory Note

The purpose of this Amendment No. 1 to Majic Wheels Corp Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2012, filed with the Securities and Exchange Commission on August 20, 2012 (the “Form 10-Q”), is solely to furnish Exhibits 31.1, 32.1, and 101 to the Form 10-Q in accordance with Rule 405 of Regulation S-T. Exhibits 31.1 and 32.1 were inadvertently omitted from the Form 10-Q. Exhibit 101 to this report provides the consolidated financial statements and related notes from the Form 10-Q formatted in XBRL (extensible Business Reporting Language).

No other changes have been made to the Form 10-Q. This Amendment No. 1 to the Form 10-Q speaks as of the original filing date of the Form 10-Q, does not reflect events that may have occurred subsequent to the original filing date, and does not modify or update in any way disclosures made in the original Form 10-Q.

Pursuant to Rule 406T of Regulation S-T, the interactive data files on Exhibit 101 hereto are deemed not filed or part of a registration statement or prospectus for purposes of Sections 11 or 12 of the Securities Act of 1933, as amended, are deemed not filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and otherwise are not subject to liability under those sections.

TABLE OF CONTENTS

|

|

|

|

Page

|

|

|

PART I

|

|

|

|

|

|

Item 1

|

Financial Statements

|

|

|

3

|

|

|

Item 2

|

Management’s Discussion and Analysis of Financial Condition and Results of Operation

|

|

|

15

|

|

|

Item 3

|

Quantitative and Qualitative Disclosures About Market Risk

|

|

|

18

|

|

|

Item 4(T)

|

Controls and Procedures

|

|

|

18

|

|

|

|

|

|

|

|

|

|

PART II

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1

|

Legal Proceedings

|

|

|

19

|

|

|

Item 1A

|

Risk Factors

|

|

|

19

|

|

|

Item 2

|

Unregistered Sales of Equity Securities and Use of Proceeds

|

|

|

19

|

|

|

Item 3

|

Defaults Upon Senior Securities

|

|

|

19

|

|

|

Item 4

|

Submission of Matters to a Vote of Security Holders

|

|

|

19

|

|

|

Item 5

|

Other Information

|

|

|

19

|

|

|

Item 6

|

Exhibits

|

|

|

20

|

|

|

SIGNATURES

|

|

|

|

21

|

|

PART I - FINANCIAL INFORMATION

Item 1.

Consolidated Financial Statements

Majic Wheels Corp

Consolidated Balance Sheets

(Unaudited)

|

|

|

Successor

|

|

|

Predecessor

|

|

|

ASSETS

|

|

6/30/12

|

|

|

12/31/11

|

|

|

|

|

|

|

|

|

|

|

Current Assets

|

|

|

|

|

|

|

|

Cash

|

|

$

|

15,617

|

|

|

$

|

725

|

|

|

Accounts receivable, net

|

|

|

45,907

|

|

|

|

31,558

|

|

|

Total Current Assets

|

|

|

61,524

|

|

|

|

32,283

|

|

|

|

|

|

|

|

|

|

|

|

|

Restricted Cash

|

|

|

-

|

|

|

|

15,034

|

|

|

Property and equipment, net of accumulated depreciation of $73,092 and $443,734, respectively

|

|

|

895,560

|

|

|

|

484,208

|

|

|

Total Assets

|

|

$

|

957,084

|

|

|

$

|

531,525

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' DEFICIT

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities

|

|

|

|

|

|

|

|

|

|

Bank overdraft

|

|

$

|

395

|

|

|

$

|

-

|

|

|

Accounts payable

|

|

|

12,901

|

|

|

|

12,584

|

|

|

Accrued liabilities

|

|

|

1,259,194

|

|

|

|

662,879

|

|

|

Deferred Revenue

|

|

|

-

|

|

|

|

37,535

|

|

|

Loans payable, current

|

|

|

360,145

|

|

|

|

1,096,140

|

|

|

Related party loans payable, current

|

|

|

2,870

|

|

|

|

-

|

|

|

Convertible debt, current, net of unamortized discount of $77,524

|

|

|

1,076

|

|

|

|

-

|

|

|

Derivative liabilities

|

|

|

2,154,479

|

|

|

|

-

|

|

|

Capital leases payable, current

|

|

|

-

|

|

|

|

30,582

|

|

|

Total Current Liabilities

|

|

|

3,791,060

|

|

|

|

1,839,720

|

|

|

|

|

|

|

|

|

|

|

|

|

Promissory notes

|

|

|

969,324

|

|

|

|

11,365

|

|

|

Convertible debt, net of unamortized discount of $75,821

|

|

|

55,134

|

|

|

|

-

|

|

|

Total Liabilities

|

|

|

4,815,518

|

|

|

|

1,851,085

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMITMENTS AND CONTINGENCIES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' DEFICIT

|

|

|

|

|

|

|

|

|

|

Preferred stock, $.0001 per share, 10,000,000 shares authorized; 0 shares issued and outstanding

|

|

|

-

|

|

|

|

-

|

|

|

Common stock, $.0001 per share, 5,000,000,000 shares authorized; 217,621,147 shares issued and outstanding

|

|

|

21,762

|

|

|

|

-

|

|

|

Additional paid-in-capital

|

|

|

319,366

|

|

|

|

15,629

|

|

|

Accumulated deficit

|

|

|

(4,199,562

|

)

|

|

|

(1,335,189

|

)

|

|

Total Shareholders' Deficit

|

|

|

(3,858,434

|

)

|

|

|

(1,319,560

|

)

|

|

Total Liabilities & Shareholders’ Deficit

|

|

$

|

957,084

|

|

|

$

|

531,525

|

|

The accompanying notes are an integral part of these unaudited financial statements.

Majic Wheels Corp

Consolidated Statements of Operations

(Unaudited)

|

|

|

Successor

|

|

|

Predecessor

|

|

|

Predecessor

|

|

|

Successor

|

|

|

Predecessor

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

through

|

|

|

through

|

|

|

through

|

|

|

through

|

|

|

through

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service revenues

|

|

$

|

265,704

|

|

|

$

|

150,417

|

|

|

$

|

82,945

|

|

|

$

|

298,929

|

|

|

$

|

283,879

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of services

|

|

|

101,998

|

|

|

|

60,179

|

|

|

|

34,768

|

|

|

|

116,837

|

|

|

|

134,325

|

|

|

Salaries & Benefits

|

|

|

176,108

|

|

|

|

36,865

|

|

|

|

19,737

|

|

|

|

226,447

|

|

|

|

71,722

|

|

|

Professional fees

|

|

|

33,454

|

|

|

|

3,300

|

|

|

|

20

|

|

|

|

40,754

|

|

|

|

4,500

|

|

|

Depreciation expense

|

|

|

62,857

|

|

|

|

36,336

|

|

|

|

24,224

|

|

|

|

73,092

|

|

|

|

72,673

|

|

|

Loss on disposal of equipment

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

2,007

|

|

|

Selling, general and administrative expenses

|

|

|

109,139

|

|

|

|

54,487

|

|

|

|

27,880

|

|

|

|

218,309

|

|

|

|

99,324

|

|

|

Total operating expenses

|

|

|

483,556

|

|

|

|

191,167

|

|

|

|

106,629

|

|

|

|

675,439

|

|

|

|

384,551

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

(217,852

|

|

|

|

(40,750

|

|

|

|

(23,684

|

|

|

|

(376,510

|

|

|

|

(100,672

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(82,343

|

|

|

|

(45,010

|

|

|

|

-

|

|

|

|

(112,679

|

|

|

|

(89,139

|

|

|

Loss on derivative liability

|

|

|

(634,079

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(527,257

|

|

|

|

-

|

|

|

Total other expenses, net

|

|

|

(716,422

|

|

|

|

(45,010

|

|

|

|

-

|

|

|

|

(639,936

|

|

|

|

(89,139

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss

|

|

$

|

(934,274

|

|

|

$

|

(85,760

|

|

|

$

|

(23,684

|

|

|

$

|

(1,016,446

|

|

|

$

|

(189,811

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Loss per Share (Basic and Diluted):

|

|

|

(0.00

|

|

|

|

-

|

|

|

|

-

|

|

|

|

(0.01

|

|

|

|

-

|

|

|

Weighted Average Number of Common Shares Outstanding (Basic and Diluted)

|

|

|

203,083,005

|

|

|

|

-

|

|

|

|

-

|

|

|

|

200,797,446

|

|

|

|

-

|

|

The accompanying notes are an integral part of these unaudited financial statements.

Majic Wheels Corp

Consolidated Statements of Cash Flow

(Unaudited)

|

|

|

Predecessor

|

|

|

Successor

|

|

|

Predecessor

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

through

|

|

|

through

|

|

|

through

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities

|

|

|

|

|

|

|

|

|

|

|

Net loss

|

|

$

|

(23,684

|

)

|

|

$

|

(1,016,446

|

)

|

|

$

|

(189,811

|

)

|

|

Adjustments to reconcile net (loss) to net cash (used in) operating activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation

|

|

|

24,224

|

|

|

|

73,092

|

|

|

|

72,673

|

|

|

Loss on disposal of equipment

|

|

|

-

|

|

|

|

-

|

|

|

|

2,007

|

|

|

Amortization of debt discount

|

|

|

-

|

|

|

|

18,992

|

|

|

|

-

|

|

|

Loss on derivative

|

|

|

-

|

|

|

|

527,257

|

|

|

|

-

|

|

|

Franchise fees

|

|

|

|

|

|

|

75,000

|

|

|

|

|

|

|

Change in assets and liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accounts receivable

|

|

|

(1,854

|

)

|

|

|

(38,818

|

)

|

|

|

34,341

|

|

|

Related party receivable

|

|

|

(5,197

|

)

|

|

|

-

|

|

|

|

804

|

|

|

Prepaid expenses

|

|

|

-

|

|

|

|

-

|

|

|

|

663

|

|

|

Accounts payable and accrued liabilities

|

|

|

(40,621

|

)

|

|

|

321,064

|

|

|

|

98,674

|

|

|

Deferred revenue

|

|

|

14,735

|

|

|

|

-

|

|

|

|

(22,799

|

)

|

|

Net cash (Used in) Operating Activities

|

|

|

(32,397

|

)

|

|

|

(39,859

|

)

|

|

|

(3,448

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Purchase of equipment

|

|

|

-

|

|

|

|

(8,500

|

)

|

|

|

-

|

|

|

Proceeds from the sale of equipment

|

|

|

-

|

|

|

|

-

|

|

|

|

200

|

|

|

Net cash (used in) provided by investing activities

|

|

|

-

|

|

|

|

(8,500

|

)

|

|

|

200

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bank overdraft

|

|

|

-

|

|

|

|

(6,050

|

)

|

|

|

(1,732

|

)

|

|

Net proceeds from promissory notes

|

|

|

39,297

|

|

|

|

72,973

|

|

|

|

19,665

|

|

|

Net proceeds from related party debt

|

|

|

2,700

|

|

|

|

170

|

|

|

|

-

|

|

|

Repayments of promissory notes

|

|

|

-

|

|

|

|

(5,189

|

)

|

|

|

-

|

|

|

Repayments of capital lease

|

|

|

-

|

|

|

|

-

|

|

|

|

(12,123

|

)

|

|

Net cash provided by financing activities

|

|

|

41,997

|

|

|

|

61,904

|

|

|

|

5,810

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Increase in Cash

|

|

|

9,600

|

|

|

|

13,545

|

|

|

|

2,562

|

|

|

Cash - Beginning of Period

|

|

|

725

|

|

|

|

2,072

|

|

|

|

124

|

|

|

Cash - End of Period

|

|

|

10,325

|

|

|

|

15,617

|

|

|

|

2,686

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental Disclosure of Cash Flow Information:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid during the period for:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest

|

|

|

-

|

|

|

|

-

|

|

|

|

363

|

|

|

Income taxes

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash activities

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock issued for conversion of convertible notes into common stock

|

|

|

-

|

|

|

|

11,452

|

|

|

|

-

|

|

|

Debt issued for purchase of equipment

|

|

|

-

|

|

|

|

122,633

|

|

|

|

-

|

|

|

Reclassification from derivative liabilities to additional paid-in capital

|

|

|

-

|

|

|

|

86,353

|

|

|

|

-

|

|

|

Reclassification from accrued interests to convertible debt

|

|

|

-

|

|

|

|

18,562

|

|

|

|

-

|

|

The accompanying notes are an integral part of these unaudited financial statements.

MAJIC WHEELS CORP.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

JUNE 30, 2012

UNAUDITED

(1) Summary of Significant Accounting Policies

Organization

Majic Wheels Corp. (“Majic Wheels” or the “Company”) is a Delaware corporation. The Company was incorporated under the laws of the State of Delaware on March 15, 2007. The business plan of the Company was to develop a radio-controlled toy vehicle utilizing a patent pertaining to unique adhesive wheels. In July 2010, there was a change in control of the Company and its focus is now waste management. In 2012, the Company started operations in the waste management business through its wholly-owned subsidiary, MW Dumpster Services, Inc. (“MWDS”). In March 2012, the Company purchased the exclusive franchise rights of College Hunks Haul Junk and College Hunks Moving for Charlotte and Lee Counties located in Southwest Florida and created a wholly-owned subsidiary for its operations, CHHJ of Lee and Charlotte County, Inc. The accompanying consolidated financial statements of Majic Wheels Corp. were prepared from the accounts of the Company under the accrual basis of accounting.

On January 25, 2012, the Company filed with the Secretary of the State of Delaware to increase the authorized capital of the Corporation to be 5,000,000,000 shares of common stock plus 10,000,000 shares of preferred stock, both with a par value of $0.0001 per share.

Basis of Presentation-Successor

The accompanying unaudited consolidated balance sheet as of June 30, 2012 included herein has been prepared without an audit pursuant to the rules and regulations of the Securities and Exchange Commission. In the opinion of management, the interim financial statements include all adjustments, consisting only of normal recurring adjustments, necessary to present fairly the Company’s financial position as of June 30, 2012 and the results of its operations and its cash flows for the three and four months ended June 30, 2012. These results are not necessarily indicative of the results expected for the calendar year ending December 31, 2012. The accompanying consolidated financial statements and notes thereto do not reflect all disclosures required under accounting principles generally accepted in the United States of America. Refer to the Company’s audited financial statements as of December 31, 2011, filed with the SEC for additional information, including significant accounting policies.

Basis of Presentation-Predecessor

The accompanying unaudited balance sheet as of December 31, 2011, the statement of operations and the statement of cash flows for the three and six months ended June 30, 2011 include the accounts of Mark’s Dumpster Services Inc. The accompanying statement of operations and the statement of cash flows for the two months ended February 29, 2012 include the accounts of Mark’s Dumpster Services Inc and MW Dumpster Service Inc. These predecessor financial statements are disclosed in the Company’s Form 10-Q for purposes of complying with the rules and regulations of the Securities and Exchange Commission as required by S-X Rule 8-02. The accompanying financial statements have been prepared in accordance with accounting principles generally accepted in the United States of America using Mark’s Dumpster Services and MW Dumpster Service Inc specific information where available. These financial statements should be read in conjunction with Company’s Form 8-K filed on March 2, 2012.

Accounts Receivable and Allowance for Doubtful Accounts

Customers generally pay invoices between the time of order to 30 days after the service has commenced. The Company determines its allowance by considering a number of factors, including the length of time trade accounts receivable are past due, the Company’s previous loss history, the specific supplier’s current ability to pay its obligation to the Company and the condition of the general economy and the industry as a whole. At June 30, 2012 and December 31, 2011, the allowance for doubtful accounts was $0 and $18,726, respectively.

Property and Equipment

Property and equipment, including significant improvements, are recorded at cost. Repairs and maintenance and any gains or losses on dispositions are recognized as incurred. Depreciation is provided for on a straight-line basis to allocate the cost of depreciable assets to operations over their estimated service lives.

|

Asset Category

|

|

Depreciation Period

|

|

Dumpsters

|

|

10 Years

|

|

Machinery & equipment

|

|

5 Years

|

|

Trailers

|

|

5 Years

|

|

Transportation equipment

|

|

5 Years

|

|

Used vehicles

|

|

5 Years

|

Impairment of Long-Lived Assets

The Company evaluates the recoverability of long-lived assets and the related estimated remaining lives at each balance sheet date. The Company records an impairment or change in useful life whenever events or changes in circumstances indicate that the carrying amount may not be recoverable or the useful life has changed. For the six months ended June 30, 2012, no events or circumstances occurred for which an evaluation of the recoverability of long-lived assets was required.

Revenue Recognition

The Company recognizes revenue in accordance with Accounting Standards Codification subtopic 605-10, Revenue Recognition (“ASC 605-10”) which requires that four basic criteria must be met before revenue can be recognized: (1) persuasive evidence of an arrangement exists; (2) delivery has occurred; (3) the selling price is fixed and determinable; and (4) collectability is reasonably assured. Dumpster rental revenues are recognized at the end of the rental term. Upon pickup of the dumpster, additional charges such as rental fees, may be billed to the customer. The Company provides certain labor services and the revenue for these services is recognized when the service is complete. Advance payments from customer are deferred and revenue is recognized when service is complete. Deferred revenue as of June 30, 2012 and December 31, 2011 was $0 and $37,535, respectively.

Stock-based compensation

Accounting Standards Codification (“ASC”) 718, “Accounting for Stock-Based Compensation" established financial accounting and reporting standards for stock-based employee compensation plans. It defines a fair value based method of accounting for an employee stock option or similar equity instrument. The Company accounts for compensation cost for stock option plans and for share based payments to non-employees in accordance with ASC 718. Accordingly, employee share-based payment compensation is measured at the grant date, based on the fair value of the award, and is recognized as an expense over the requisite service period. Additionally, share-based awards to non-employees are expensed over the period in which the related services are rendered at their fair value. The Company accounts for share based payments to non-employees in accordance with ASC 505-50 “Accounting for Equity Instruments Issued to Non-Employees for Acquiring, or in Conjunction with Selling, Goods or Services”.

Embedded conversion features

The Company evaluates embedded conversion features within convertible debt and convertible preferred stock under ASC 815 “Derivatives and Hedging” to determine whether the embedded conversion feature should be bifurcated from the host instrument and accounted for as a derivative at fair value with changes in fair value recorded in earnings. If the conversion feature does not require derivative treatment under ASC 815, the instrument is evaluated under ASC 470-20 “Debt with Conversion and Other Options” for consideration of any beneficial conversion feature.

Fair Value of Measurement

As defined in ASC 820 “Fair Value Measurements”, fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (exit price). The Company utilizes market data or assumptions that market participants would use in pricing the asset or liability, including assumptions about risk and the risks inherent in the inputs to the valuation technique. These inputs can be readily observable, market corroborated, or generally unobservable. The Company classifies fair value balances based on the observability of those inputs. ASC 820 establishes a fair value hierarchy that prioritizes the inputs used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (level 1 measurement) and the lowest priority to unobservable inputs (level 3 measurement).

The three levels of the fair value hierarchy defined by ASC 820 are as follows:

Level 1 – Quoted prices are available in active markets for identical assets or liabilities as of the reporting date. Active markets are those in which transactions for the asset or liability occur in sufficient frequency and volume to provide pricing information on an ongoing basis. Level 1 primarily consists of financial instruments such as exchange-traded derivatives, marketable securities and listed equities.

Level 2 – Pricing inputs are other than quoted prices in active markets included in level 1, which are either directly or indirectly observable as of the reported date. Level 2 includes those financial instruments that are valued using models or other valuation methodologies. These models are primarily industry-standard models that consider various assumptions, including quoted forward prices for commodities, time value, volatility factors, and current market and contractual prices for the underlying instruments, as well as other relevant economic measures. Substantially all of these assumptions are observable in the marketplace throughout the full term of the instrument, can be derived from observable data or are supported by observable levels at which transactions are executed in the marketplace. Instruments in this category generally include non-exchange-traded derivatives such as commodity swaps, interest rate swaps, options and collars.Level 3 – Pricing inputs include significant inputs that are generally less observable from objective sources. These inputs may be used with internally developed methodologies that result in management’s best estimate of fair value.

The following table sets forth by level within the fair value hierarchy the Company’s financial assets and liabilities that were accounted for at fair value as of June 30, 2012. As required by ASC 820, financial assets and liabilities are classified in their entirety based on the lowest level of input that is significant to the fair value measurement. The Company’s assessment of the significance of a particular input to the fair value measurement requires judgment, and may affect the valuation of fair value assets and liabilities and their placement within the fair value hierarchy levels.

|

As of June 30, 2012

|

|

Total

|

|

|

Quoted Prices in Active Markets for Identical Instruments Level 1

|

|

|

Significant Other

Observable Inputs

Level 2

|

|

|

Significant Unobservable

Inputs Level 3

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Derivative liabilities

|

|

$

|

2,154,479

|

|

|

|

|

|

|

|

|

|

|

$

|

2,154,479

|

|

(2) Development Stage Activities and Going Concern

From the date of inception, March 15, 2007, through the date of the acquisition of assets (see Note 5), the Company was in the development stage as defined in ASC 915, Accounting and Reporting by Development Stage Enterprises”. As a result of the acquisition, the Company has begun to generate revenue from operations and has emerged from the development stage.

While management of the Company believes that it will be successful in its capital formation and planned operating activities, there can be no assurance that the Company will be able to raise additional equity capital or that its new business focus of waste management will generate sufficient revenues to sustain the operations of the Company.

The accompanying consolidated financial statements have been prepared in conformity with accounting principles generally accepted in the United States of America, which contemplate continuation of the Company as a going concern. The Company has incurred an operating loss since inception, had negative working capital as of

June 30, 2012

, and the cash resources of the Company were insufficient to meet its planned business objectives. These and other factors raise substantial doubt about the Company’s ability to continue as a going concern. The accompanying consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that may result from the possible inability of the Company to continue as a going concern.

(3) Promissory Notes

In December 2010, the Company issued a promissory note of $62,500 to American Settlement. The note accrues interest at 20% and is payable on demand. In June 2012, American Settlement sold the whole $62,500 debt to Garlette, LLC.

The Company then executed an amended and restated convertible debenture agreement to clarify the amount owed.

See discussion about the amended convertible debt agreement and debt modification in Note 4.

On January 4, 2012, the Company issued one promissory note of $32,400 as payment for an accounts payable invoice. The note accrues interest at 20%, unsecured and is payable on demand.

On February 29, 2012, the Company issued one promissory note of $837,519 to Connied, Inc for acquisition of assets used for the expansion of its waste management and site work division (see discussion in Note 6). The note accrues interest at 20%, is payable on February 28, 2014, secured by the assets that were purchased and it is convertible after six months at 25% of the average closing prices for the Company’s stock during the previous 10 trading days at date of conversion.

On March 26, 2012, the Company issued a $75,000 promissory note to a third party for the exclusive franchise rights of College Hunks Haul Junk and College Hunks Moving for Charlotte and Lee Counties located in Southwest Florida. The note accrues interest at 3%, is payable in two years, unsecured and is convertible after six months at the lowest closing price for the Company’s stock during the previous 10 trading days at date of conversion. The related cost is recorded as an operating expense during the four months ended June 30, 2012 due to uncertainty of the future expected cash flows to be derived from these rights.

On March 29, 2012, the Company entered into a debt agreement with GE Capital. This agreement is for the purchase of equipment. The Company promises to pay the Lender principal $54,475 plus pre-computed interest for a total of $59,021 in 26 monthly installments. The proceeds of the debt will be disbursed as follows: $190 to Florida Department of Revenue and $54,285 to Apex Equipment Sales, Inc.

On March 30, 2012, the Company issued two promissory notes totaling $30,337 to two third parties as payment for reimbursement of expenses incurred on behalf of the Company. The notes accrue interest at 20%, unsecured and are payable on demand.

On April 4, 2012, the Company entered into another debt agreement with GE Capital. This agreement is additional consideration due for the purchase of the College Hunks franchise as discussed in Note 1. The Company promises to pay the Lender principal of $47,658 plus pre-computed interest for a total of $55,610 in 48 monthly installments. The proceeds of the agreement will be disbursed as follows: $166 to Florida Department of Revenue, $30,216 to GE Capital, and $17,276 to CHHJ of Southwest Florida LLC. This debt agreement includes the purchase of a 2009 Isuzu truck.

On May 29, 2012, the Company entered into a future receivable purchase and sale agreement with a third party. The Company sold future receivables of $11,960 for a price of $8,000. The Company recognized the difference of $3,960 between the value of future receivables and sale price as interest expenses during the 4 months ended June 30, 2012.

On June 30, 2012, the Company issued two promissory notes totaling $15,645 to two third parties as payment for reimbursement of expenses incurred on behalf of the Company. The notes accrue interest at 20%, unsecured and are payable on demand.

On June 30, 2012, the Company issued a promissory note for $18,992 to a third party as payment for reimbursement of expenses incurred on behalf of the Company. This note accrues interest at 20%, is payable in one year, unsecured, and is convertible after six months

into common stock at the conversion rate of 25% of the average of the five lowest closing prices during the 30 trading days prior to notice of conversion. As of June 30, 2012, the note is not convertible yet.

(4) Convertible Debt, and Debt Modification

Connied, Inc

In May 2012, the Company issued a $20,500 convertible debenture Connied, Inc to purchase equipment. The convertible debenture matures two years from the date of issuance and bears interest at a 20% rate per annum, is unsecured, and is convertible into the Company’s common stock at any time at the holder’s option, into common stock at the conversion rate of 25% of the average of the five lowest trading days 30 days prior to notice of conversion.

The Company analyzed the conversion option for derivative accounting consideration under ASC 815-15 “Derivatives and Hedging” and determined that the instrument should be classified as liabilities due to there being no explicit limit to the number of shares to be delivered upon settlement of the above conversion options. The instrument is measured at fair value at the end of each reporting period or termination of the instrument with the change in fair value recorded to earnings. The fair value of the embedded conversion option resulted in a full discount to the note on the debt issuance date of $20,500. The discount will be amortized over the term of the note to interest expense. As of June 30, 2012, $1,292 of the discount had been amortized to interest expense. See Note 5 for additional information on the derivative liabilities.

Garlette, LLC

In June 2012, as discussed in Note 3, American Settlement sold its $62,500 promissory note plus $18,562 of accrued interest to Garlette, LLC. The Company then executed an amended and restated convertible debenture agreement to clarify the amount owed. The amended and restated convertible debenture has a principal of $81,062, bears interest at a 20% rate per annum, is unsecured, payable on June 26, 2013 and is convertible into the Company’s common stock at any time at the holder’s option, into common stock at the conversion rate of 25% of the average of the five lowest closing prices during the trading days 30 days prior to notice of conversion.

The Company analyzed the modification of the term under ASC 470-50 “Debt Modifications and Extinguishment”. The Company determined the debt holder has not granted a concession under the amended terms. As the modification adds a new conversion option to the debt, the Company concluded the modification is substantial and should be accounted as debt extinguishment.

The Company also analyzed the conversion option for derivative accounting consideration under ASC 815-15 “Derivatives and Hedging” and determined that the instrument should be classified as liabilities due to there being no explicit limit to the number of shares to be delivered upon settlement of the above conversion options. The instrument is measured at fair value at the end of each reporting period or termination of the instrument with the change in fair value recorded to earnings. The fair value of the embedded conversion option resulted in a full discount to the note on the debt modification date of $81,062. The discount will be amortized over the term of the note to interest expense.

On the debt issuance date, the Company converted the $2,462 convertible note into 9,117,185 common shares. As of June 30, 2012, $1,077 of the discount had been amortized to interest expense. See Note 5 for additional information on the derivative liabilities.

Other Convertible Notes

In August 2010, the Company issued a $120,695 convertible debenture in settlement of a debt that was owed to a former related party that was assigned to a third party in July 2010.

The convertible debenture matures two years from the date of issuance and bears interest at a 20% rate per annum, is unsecured, payable on August 1, 2012 and is convertible into the Company’s common stock at any time at the holder’s option, into common stock at the conversion rate of 25% of the average of the five lowest closing prices during the 30 trading days prior to notice of conversion.

In February 2012, the convertible debt holder sold $90,200 of its convertible note to six other parties. The Company then executed an amended and restated convertible debenture agreement with each of these companies to clarify the amount owed to each and executed an amended and restated convertible debenture agreement with the original debt holder for the remaining balance. The amended and restated convertible debentures bear interest at a 20% rate per annum, are unsecured, payable on February 24, 2014 and are convertible into the Company’s common stock at any time at the holder’s option, into common stock at the conversion rate of 25% of the average of the five lowest closing prices during the 30 trading days prior to notice of conversion. Subsequently, conversions occurred on five of the seven notes, for total share issuances of 58,503,962 for $10,240 of debt conversions of which $8,990 is converted during the four months ended June 30, 2012.

The Company analyzed the modification of the term under ASC 470-60 “Trouble Debt Restructurings”. The Company determined the debtor is experiencing financial difficulty and the creditor has a granted a concession under the modified terms and concluded the modification should be accounted under ASC 470-60 “Trouble Debt Restructurings”. The total future cash payments specified by the new terms is greater than the carrying amount of the promissory note of $157,665 (including accrued interest) prior to the modification. Accordingly, the Company did not change the carrying amount of the convertible debt at the date of modification.

The Company also analyzed the conversion option for derivative accounting consideration under ASC 815-15 “Derivatives and Hedging” and determined that the instrument should be classified as a liability due to there being no explicit limit to the number of shares to be delivered upon settlement of the above conversion options. The accounting treatment of derivative financial instruments requires that the Company record fair value of the derivatives as of the inception date of the convertible promissory note and to fair value the instrument as of each subsequent balance sheet date or termination of the instrument with the change in fair value recorded to earnings.

Summary of the convertible debentures at June 30, 2012 is as follows:

|

Convertible debenture – short term (Garletter, LLC)

|

|

$

|

78,600

|

|

|

Less unamortized debt discount

|

|

|

(77,524

|

)

|

|

Net

|

|

|

1,076

|

|

|

|

|

|

|

|

|

Convertible debentures – long term

|

|

|

|

|

|

Connied, Inc

|

|

$

|

20,500

|

|

|

Others

|

|

|

110,455

|

|

|

Less unamortized debt discount

|

|

|

(75,821

|

)

|

|

Net

|

|

|

55,134

|

|

(5) Derivative Liabilities

The Company valued the embedded derivatives (see discussion below) using the Black Scholes Option Pricing Model based on the following assumptions:

|

Dividend yield:

|

|

|

0

|

%

|

|

Volatility

|

|

|

365.97%-379.90

|

%

|

|

Risk free rate

|

|

|

0.21%-0.31

|

%

|

Connied, Inc

As discussed in Note 4, the Company determined that the instruments embedded in the convertible note should be classified as liabilities and recorded at fair value due to there being no explicit limit to the number of shares to be delivered upon settlement of the above conversion options. The Company valued the embedded derivative on the debt issuance date. The fair value of the instruments was determined to be $81,638 as of the debt issuance date, of which $20,500 was recorded as debt discount and $61,138 was recognized as loss on derivatives.

The Company revalued the embedded derivatives as of June 30, 2012. The fair value of the instruments was determined to be $211,855 as of June 30, 2012, and the increase from the debt issuance date was allocated to current period operations as a loss on derivative of $130,217.

Garlette, LLC

As discussed in Note 4, the Company determined that the instruments embedded in the convertible note should be classified as liabilities and recorded at fair value due to there being no explicit limit to the number of shares to be delivered upon settlement of the above conversion options. The Company valued the embedded derivative on the debt issuance date. The fair value of the instruments was determined to be $737,843 as of the debt issuance date, of which $81,062 was recorded as debt discount and $656,781 was recognized as loss on derivatives.

As a result of the note conversion on debt issuance date, under ASC 815-15 “Derivatives and Hedging”, the instrument is measured at fair value at the date of the termination with the change in fair value recorded to earnings. The fair value of the instruments on conversion date was $737,843 of which $22,410 was reclassified out of liabilities to equity.

The Company revalued the embedded derivatives as of June 30, 2012. The fair value was determined to be $802,161 as of June 30, 2012, and the increase from the debt issuance date was allocated to current period operations as a loss on derivative of $86,728.

Other Convertible Notes

As discussed in Note 4, the Company determined that the instruments embedded in the convertible note should be classified as liabilities and recorded at fair value due to there being no explicit limit to the number of shares to be delivered upon settlement of the above conversion options

As a result of the note conversions, under ASC 815-15 “Derivatives and Hedging”, the instrument is measured at fair value at the date of the termination with the change in fair value recorded to earnings. During the six months ended June 30, 2012, $67,735 was reclassified out of liabilities to equity, with $63,943 allocated to the four months ended June 30, 2012.

The Company revalued the embedded derivatives as of June 30, 2012. The fair value of the embedded derivative was determined to be $1,140,462. The increase from December 31, 2011 was recognized as a loss on derivative of $248,977, with gain of $407,607 allocated to four months ended June 30, 2012.

The following tables summarize the derivative liabilities included in the consolidated balance sheet:

|

Derivative Liabilities

|

|

|

|

|

Balance at December 31, 2011 (Successor)

|

|

$

|

959,221

|

|

|

ASC 815-15 addition

(Connied, Inc)

|

|

|

81,638

|

|

|

ASC 815-15 addition

(Garlette, LLC)

|

|

|

737,843

|

|

|

ASC 815-15 deletions

(Garlette, LLC)

|

|

|

(22,410

|

)

|

|

ASC 815-15 deletions

(Other)

|

|

|

(67,735

|

)

|

|

Change in fair value

|

|

|

465,922

|

|

|

Balance at June 30, 2012

|

|

$

|

2,154,479

|

|

The following table summarizes the derivative (gain) or loss for the four months period ended June 30, 2012 recorded as a result of the derivative liabilities above:

|

Derivative Liabilities

|

|

|

|

|

Balance at March 1, 2012 (Successor)

|

|

$

|

-

|

|

|

Excess of fair value of the derivative over note payable (Connied, Inc)

|

|

|

61,138

|

|

|

Excess of fair value of the derivative over note payable (Garlette, LLC)

|

|

|

656,781

|

|

|

Change in fair value

|

|

|

(190,662

|

)

|

|

Balance at June 30, 2012

|

|

$

|

527,257

|

|

(6) Asset Purchase Agreement

In February 2012, the Company completed the acquisition of assets to be used for the expansion of its waste management and site work division. The assets include 140 roll-off dumpsters, 3 roll-off trucks, and construction and site-clearing equipment, including a Bobcat and a grading tractor. As discussed in Note 3, the assets were purchased from Connied, Inc. for a purchase price of $837,519, which was paid with a Promissory Note. Connied, Inc obtained the assets in December 2011 through foreclosure on a loan from Mark’s Dumpster Services, Inc. (“MDS”), an entity controlled by the Company’s officers and directors. However on the date of acquisition, MDS were not control by the Company. The Company determined the purchase of the assets qualifies as a business under ASC 805 “Business Combinations”. The purchase price was allocated 100% to fixed assets and the Company did not identify any intangible assets and assume any liabilities from the predecessor. Additionally, the Company determined they succeeded to the business of MDS and therefore will be required to comply with the rules and regulations of the SEC as required by S-X Rule 8-02 for the presentation of predecessor financial statements. Accordingly, the interim financial statements as of June 30, 2011 and December 31, 2011 are that of MDS, the interim financial statements as of February 29, 2012 are that of MDS and MWDS, and the interim financial statements as of June 30, 2012 are that of the Company.

(7) Equity

Shares issued for convertible notes:

During the six months ended June 30, 2012, the Company converted a total of $12,702 convertible debt into 67,621,147 common shares. See discussion in Note 4.

(8) Related Party Transactions

As of June 30, 2012, the Company had a balance due to related parties of $2,870. This balance is from various advances from the Company’s directors and which are non-interest bearing, unsecured and due on demand.

(9) Subsequent Events

On July 24, 2012, the Company issued a convertible note of $32,500 to Asher Enterprise, Inc. The note accrues at 8%, is unsecured and due on April 23, 2013, and is convertible at any time 180 days after the debt issuance into the Company’s restricted common stock. The conversion price is 58% of the average of the 3 closing bid prices of the common stock during the 10 trading day period prior to conversion. Asher agreed to restrict its ability to convert the Note and receive shares of the Company if the number of shares of common stock beneficially held by Asher and its affiliates in the aggregate after such conversion exceeds 4.99% of the then outstanding shares of common stock.

On July 30, 2012, the Company issued 1,000,000 and 500,000 common shares to Denise Houghtaling and Mark Houghtaling, respectively, per terms of their employment agreements dated July 23, 2010. The Company issued 143,300,820 common shares to Denise Houghtaling as the settlement of salary payable accrued from July 23, 2010 to December 31, 2010, per terms of her employment agreement dated July 23, 2010.

On August 1, 2012, a debt holder converted $2,300 of debt into 9,019,608 shares of common stock at conversion rate of $0.000255 per share.

PART I

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operation

As used in this quarterly report on Form 10-Q (this “Report”), references to the “Company,” the “Registrant,” “we,” “our,” “us” or “Majic Wheels” refer to Majic Wheels Corp., unless the context otherwise indicates.

Forward-Looking Statements

The following discussion should be read in conjunction with our financial statements and related notes thereto, which are included elsewhere in this Form 10-Q (the “Report”). This Report contains forward-looking statements which relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

For a description of such risks and uncertainties, refer to our Annual Report on Form 10-K, filed with the Securities and Exchange Commission on September 22, 2011. While these forward-looking statements, and any assumptions upon which they are based, are made in good faith and reflect our current judgment regarding the direction of our business, actual results will almost always vary, sometimes materially, from any estimates, predictions, projections, assumptions or other future performance suggested herein. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Overview and Plan of Operation

We were incorporated in Delaware on March 15, 2007. We had intended to engage in the manufacturing and distribution of a radio-controlled toy vehicle using a patented technology that allowed the vehicle to climb inclined and vertical surfaces. In July 2010, there was a change in control of the Company and its focus is now waste management.

In 2007, we commenced a capital formation activity to effect a Registration Statement on Form S-1 with the SEC to raise capital of up to $160,000 from a self-underwritten offering of 20,000,000 (post forward stock split) shares of newly issued common stock in the public markets. The Registration Statement on Form S-1 was filed with the SEC on November 27, 2007, and declared effective on February 22, 2008. In March 2008, we commenced the offering of its registered securities. In April 2008, we completed and closed the offering by selling a total of 20,000,000 (post forward stock split) registered shares of its common stock, par value of $0.0001 per share, at an offering price of $0.00825 per share, for total proceeds of $144,481, net of deferred offering costs of $20,000.

On July 20, 2010, we sold an aggregate of 54,000,000 shares of Common Stock to Baja 4 X 4 Offroad & Fabrications, Inc. (“Baja”) for a total of $118,000 pursuant to an Agreement for the Purchase of Common Stock. The shares represent approximately 36% of the total outstanding securities of the Company. The shares were sold without registration under Section 5 of the Securities Act of 1933 in reliance on the exemption from registration contained in Section 4(2) of the Securities Act. Two other shareholders sold 22,000,000 shares of our Common Stock to Baja. As a result of the aforementioned stock purchases by Baja, control of the Company in the form of a total of 50.6% of the total issued and outstanding shares of common stock of the Company, which total 150,000,000 shares, was changed to Baja.

We have never declared bankruptcy, have never been in receivership, and have never been involved in any legal action or proceedings. We have not made any significant purchase or sale of assets, nor has the Company been involved in any mergers, acquisitions or consolidations. We are not a blank check registrant as that term is defined in Rule 419(a)(2) of Regulation C of the Securities Act of 1933, because we have a specific business plan and purpose.

We have entered the waste management business and plan to become the premier leader in the environmental safe junk removal, trash hauling, recycling, commercial and residential construction cleanup and demolition business.

The following discussion should be read in conjunction with the condensed financial statements and in conjunction with the Company's Form 10-K for the year ending December 31, 2011. Results for interim periods may not be indicative of results for the full year.

Results of Operations

For the three months ended June 30, 2012 as compared to the three months ended June 30, 2011

Revenues

During the three months ended June 30, 2012 and 2011, revenues for the predecessor company, Mark’s Dumpster Services, Inc. (“MDS”) were $150,417 compared with $265,704 for the Company.

Revenues have increased due to an increase in sitework business.

Total operating expenses

During the three months ended June 30, 2012 and 2011, total operating expenses for MDS were $191,167 compared with $483,556 for the Company. The increase was primarily due to higher compensation and SG&A costs for the Company.

Other expense

During the three months ended June 30, 2012 and 2011, total other expenses for MDS were $45,010 compared with $716,422 for the Company. The increase in other expense was primarily due to the change in the value of the derivative liability.

Net loss

During the three months ended June 30, 2012 and 2011, the net loss for MDS was $85,760 compared with $934,274 for the Company.

For the six months ended June 30, 2012 which is combined from the two months ended February 29, 2012 and four months ended June 30, 2012 as compared to the six months ended June 30, 2011

Revenues

During the six months ended June 30, 2012 and 2011, revenues for the predecessor company, Mark’s Dumpster Services, Inc. (“MDS”) were $283,879 compared with $381,874 for the combined predecessor and Company.

Revenues have increased due to an increase in sitework business.

Total operating expenses

During the six months ended June 30, 2012 and 2011, total operating expenses for MDS were $384,551 compared with $782,068 for the combined predecessor and Company. The increase was primarily due to higher compensation and SG&A costs for the combined Company.

Other expense

During the six months ended June 30, 2012 and 2011, total other expense for MDS were $89,139 compared with $639,936 for the combined predecessor and Company. The increase was primarily due to the change in the value of the derivative liability.

Net loss

During the six months ended June 30, 2012 and 2011, the net loss for MDS was $189,811 compared with $1,040,130 for the Company.

Going Concern Consideration

The Company is formerly a development stage company and only recently commenced principal operations. The Company incurred a net loss of $1,016,446 for the four months ended June 30, 2012. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

While management of the Company believes that it will be successful in its capital formation and planned operating activities, there can be no assurance that the Company will be able to raise additional equity capital, or be successful in the development of a waste management business that will generate sufficient revenues to sustain the operations of the Company.

Liquidity and Capital Resources

As of June 30, 2012, we had $15,617 in cash. The Company does not believe that its cash resources will be sufficient to fund its expenses over the next 12 months. There can be no assurance that additional capital will be available to the Company. The Company currently has no agreements, arrangements, or understandings with any person to obtain additional funds through bank loans, lines of credit, or any other sources. Since the Company has no such arrangements or plans currently in effect, its inability to raise funds for the above purposes will have a severe negative impact on its ability to remain a viable company.

Off Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, changes in financial condition, revenues or expenses, results of operations, liquidity, capital expenditures, or capital resources that are material to investors.

Item 3.

Quantitative and Qualitative Disclosures About Market Risk

A smaller reporting company, as defined by Item 10 of Regulation S-K, is not required to provide the information required by this item.

Item 4(T).

Controls and Procedures.

Evaluation of Disclosure Controls and Procedures

As of the end of the period covered by this Report, we conducted an evaluation, under the supervision and with the participation of our Chief Executive Officer and Chief Financial Officer, of our disclosure controls and procedures (as defined in Rules 13a-15(e) and 15d-15(e) under the 1934 Act). The Chief Executive Officer and Chief Financial Officer concluded that our disclosure controls and procedures not effective to ensure that information required to be disclosed by us in reports that we file or submit under the 1934 Act is recorded, processed, summarized and reported within the time periods specified in the Securities and Exchange Commission rules and forms.

Changes In internal Control Over Financial Reporting.

There have been no changes in the Company’s internal control over financial reporting identified in connection with the evaluation required by paragraph (d) of Rule 240.15d-15 that occurred during the Company’s last fiscal quarter that has materially affected, or is reasonable likely to materially affect, the Company's internal control over financial reporting.

PART II – OTHER INFORMATION

Item 1.

Legal Proceedings.

There are no pending legal proceedings to which the Company is a party or in which any Director, officer or affiliate of the Company, any owner of record or beneficially of more than 5% of any class of voting securities of the Company, or security holder is a party adverse to the Company or has a material interest adverse to the Company. The Company’s property is not the subject of any pending legal proceedings.

Item 1A.

Risk Factors

A smaller reporting company, as defined by Item 10 of Regulation S-K, is not required to provide the information required by this item.

Item 2.

Unregistered Sales of Equity Securities and Use of Proceeds.

None.

Purchases of equity securities by the issuer and affiliated purchasers

None.

Use of Proceeds

None

Item 3.

Defaults Upon Senior Securities.

None.

Item 4.

(Removed and Reserved).

Item 5.

Other Information.

None

Item 6.

Exhibits

|

31.1

|

Rule 13a-14(a)/15d14(a) Certifications of Denise S. Houghtaling, Chief Executive Officer, Chief Financial Officer and Director(attached hereto)

|

|

32.1

|

Section 1350 Certifications of Denise S. Houghtaling, Chief Executive Officer, Chief Financial Officer and Director(attached hereto)

|

|

101.DEF

|

XBRL Taxonomy Extension Definition Linkbase Document

|

|

101.INS

|

XBRL Instance Document

|

|

101SCH

|

XBRL Taxonomy Extension Schema Document

|

|

101.CAL

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

|

101.LAB

|

XBRL Taxonomy Extension Label Linkbase Document

|

|

101.PRE

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

|

101.DEF

|

XBRL Taxonomy Extension Definition Linkbase Document

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

MAJIC WHEELS CORP.

|

|

|

|

|

|

|

|

Dated: August 21, 2012

|

By:

|

/s/ Denise S. Houghtaling

|

|

|

|

|

Name:

Denise S. Houghtaling

|

|

|

|

|

Title:

Chief Executive Officer, Chief

Financial Officer and Director (Principal

Executive, Financial and Accounting Officer)

|

|

|

|

|

|

|

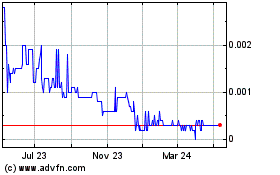

Majic Wheels (CE) (USOTC:MJWL)

Historical Stock Chart

From Oct 2024 to Nov 2024

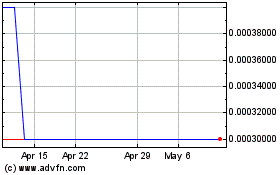

Majic Wheels (CE) (USOTC:MJWL)

Historical Stock Chart

From Nov 2023 to Nov 2024