M&F Bancorp, Inc. Announces Third Quarter Net Income on Strong Loan Growth

November 06 2008 - 3:09PM

Business Wire

M&F Bancorp, Inc. (OTCBB:MFBP), the parent company of Mechanics

and Farmers Bank (�M&F Bank�), today reported net income for

the three months ended September 30, 2008 of $0.1 million compared

to $0.4 million for the three months ended September 30, 2007.

Earnings per share on a fully diluted basis was $0.05 for the three

months ended September 30, 2008 compared to $0.25 per share for the

three months ended September 30, 2007. Net income was $1.3 million,

or $0.69 per share, for the nine months ended September 30, 2008

compared to $0.9 million, or $0.55 per share for the nine months

ended September 30, 2007. The�results for the nine months ended

September 30, 2008 reflect a year to date extraordinary gain of

$1.8 million from the acquisition of Mutual Community Savings Bank,

Inc., SSB (�MCSB�) in March 2008. �In light of recent events in the

national and international economy, as well as the banking industry

as a whole, we are very pleased with our profitability after

incurring significant costs during the first two quarters of 2008

in acquiring and absorbing MCSB. I believe that the Bank is

performing very well with 11.0% in organic growth in our loan

portfolio this year and stable relationships with our deposit

customers in spite of competitive pressures in our five service

areas of Charlotte, Durham, Greensboro, Raleigh and Winston-Salem.

We also participate in the CDARS� program which has enabled us to

provide full FDIC insurance coverage up to $50 million if desired

for our customers� deposit relationships,� said Kim D. Saunders,

President and CEO. M&F Bank is proudly celebrating a century of

service to its community this year. It is one of very few banks in

North Carolina that is designated as a Community Development

Financial Institution (�CDFI� Bank) and is recognized as such for

its record of service in distressed communities. As part of its

expression of gratitude for 100 years of business success,�the

Company�provided the opportunity for a chance to win a grand prize

of $100,000 through its year-long �100 years/100 grand� promotion.

In August, upon the anniversary of the opening of the Bank�s first

office on Parrish Street in Durham, the promotion culminated with a

luncheon and drawing for the�grand prize. M&F Bank has had an

unbroken record of profitability for 100 consecutive years,

including keeping its doors open throughout the Great Depression.

�During these uncertain economic times, it is reassuring to the

Bank�s customers to work with an institution with such a great

legacy and community commitment,� Saunders added. Total assets

increased 23.3%, or $51.8 million, to $274.0 million as of

September 30, 2008 from $222.2 million at December 31, 2007. Total

assets acquired from MCSB were $64.6 million. Cash and cash

equivalents increased $1.8 million or 9.8%, to $20.0 million as of

September 30, 2008, compared to $18.2 million at December 31, 2007.

Loans increased 40.3%, or $58.8 million, to $204.9 million as of

September 30, 2008, from $146.1 million as of December 31, 2007.

The�Bank continues to increase its loan portfolio through organic

growth, with a net increase of $16.1 million�during the first nine

months of 2008. Deposits increased 28.4%, or $48.9 million, to

$220.9 million as of September 30, 2008 from $172.1 million at

December 31, 2007. Net income for the three months ended September

30, 2008, decreased $0.3 million, to net income of $0.1 million,

compared to net income of $0.4 million for the same period in 2007.

For the three months ended September 30, 2008 interest income

increased $0.3 million when compared to the three month period

ended September 30, 2007�and interest expense decreased $0.4

million resulting in an improvement in net interest income of $0.7

million. The primary driver of the decrease in net income was

increased non-interest expense of $1.1 million in the quarter ended

September 30, 2008�compared to�the same period in 2007. Reflected

in this increase�are the higher costs associated with the larger

institution after the acquisition of MCSB, as well as the added

costs of dual operating systems. Net income for the nine months

ended September 30, 2008, increased $0.4 million, or 40.9%, to $1.3

million, compared to net income of $0.9 million for the same period

in 2007. The increase is primarily a result of a $1.8 million

extraordinary gain from application of a credit excess in

the�acquisition of MCSB. Net income from operations decreased $1.5

million to a loss of $0.5 million primarily as a result of a $2.4

million increase in noninterest expense during the nine month

period ended September 30, 2008 compared to the same period in

2007. Non-interest expense increased 31.4% for the nine months

ended September 30, 2008 as compared to the same period in 2007, in

part the result of the addition of former MCSB employees, together

with the Company�s decision to reassess its staffing needs after

the acquisition of MCSB, resulting in temporary increased salary

expense and the accrual�of severance benefits for those employees

whose positions were eliminated effective June 30, 2008 totaling

$0.4 million. During the nine months ended September 30, 2008, the

Company completed a review of premises and equipment and recorded

an expense of $0.3 million ($0.2 million net of taxes, or $0.11 per

share), for a change in estimated useful lives of long-lived

assets. Noninterest expenses also increased due to duplication of

systems during the integration of MCSB resulting in increased

information technology costs of $0.5 million in the nine months

ended September 30, 2008 compared to the same period in 2007, legal

fees, audit fees and increasing professional fees by approximately

$0.5 million in the nine months ended September 30, 2008. M&F

Bancorp, Inc., a bank holding company with assets of approximately

$274.0 million as of September 30, 2008, is the parent company of

Mechanics and Farmers Bank. The Company�s common stock is quoted in

the over-the-counter market through the OTC Bulletin Board under

the symbol �MFBP.� Mechanics and Farmers Bank has banking service

centers in Raleigh, Durham, Greensboro, Winston-Salem and

Charlotte. For additional information, contact M&F Bank

Corporate Headquarters, 2634 Durham Chapel Hill Blvd., Durham,

North Carolina at 919-687-7800, or visit www.mfbonline.com. This

release contains certain forward-looking statements with respect to

the financial condition, results of operations and business of the

Company and M&F Bank. These forward-looking statements involve

risks and uncertainties and are based on the beliefs and

assumptions of management of the Company and M&F Bank and on

the information available to management at the time that these

disclosures were prepared. These statements can be identified by

the use of words like �expect,� �anticipate,� �estimate� and

�believe,� variations of these words and other similar expressions.

Readers should not place undue reliance on forward-looking

statements as a number of important factors could cause actual

results to differ materially from those in the forward-looking

statements. Neither the Company nor M&F Bank undertakes an

obligation to update any forward-looking statements. Additional

information is detailed in the Company�s filings with the

Securities and Exchange Commission, and is available at

www.sec.gov.

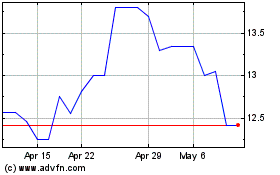

M and F Bancorp (PK) (USOTC:MFBP)

Historical Stock Chart

From Oct 2024 to Nov 2024

M and F Bancorp (PK) (USOTC:MFBP)

Historical Stock Chart

From Nov 2023 to Nov 2024