- Drill Hole KMDD0084 records multiple intersections

including 5.82 m at 486.78 g/t Au, 21 g/t Ag and

0.15% Cu (487.1 g/t Au Eq) plus 4.68 m at 73.54

g/t Au, 4 g/t Ag and 0.33% Cu (74.1 g/t AuEq)

- Drill Hole KMDD0082 records multiple intersections

including 2.75 m at 21.41 g/t Au, 6 g/t Ag and 1.13% Cu (23.20 g/t

AuEq) plus 3.78 m at 32.54 g/t

Au, 62 g/t Ag and 2.59% Cu (37.29 g/t AuEq)

VANCOUVER, British Columbia, April 25, 2018

(GLOBE NEWSWIRE) -- K92 Mining Inc. (“K92”) (TSXV:KNT)

(OTCQB:KNTNF) is pleased to announce results from the

continuing grade control drilling of the Kora North Extension.

The results reported are from the first two

holes from the new Diamond Drill Cuddy Three (DDC3), with both

holes drilled recording intersections of the K1, KL and K2

Lodes.

Results from Hole KMDD0084

included 5.82 m at 486.78 g/t Au, 21 g/t Ag and 0.15% Cu (487.1 g/t

Au Eq) plus 4.68 m at 73.54 g/t Au, 4 g/t Ag and 0.33% Cu (74.1 g/t

AuEq) plus 4.12 m at 7.59 g/t Au, 21 g/t Ag and 1.92% Cu (10.79 g/t

AuEq), while Hole KMDD0082 recorded 2.75 m 21.41

g/t Au, 6 g/t Ag and 1.13% Cu (23.20 g/t AuEq) plus 3.78 m at 32.54

g/t Au, 62 g/t Ag and 2.59% Cu (37.29 g/t AuEq) plus 3.31 m at 8.37

g/t Au, 2 g/t Ag and 0.39% Cu (8.99 g/t AuEq).

The results from DDC3 are now the furthest

drilled to the south and continue to confirm the consistency of

both the K1 and K2 lodes within this area while also further

delineating the KL structure and confirming its continuity. A plan

showing the Kora North development, location of the three diamond

drill cuddies and of the latest grade control drill holes is

provided below.

John Lewins, K92 Chief Executive Officer and

Director, states, “The first hole drilled from the new drill

cuddy DDC3, KMDD0082 was possibly our best hole to date however

this has been totally eclipsed by the results from the second hole,

KMDD0084 which included a section of 0.72 metres assaying at over

3,500 g/t Au. These two holes are the furthest south that we have

drilled and appear to indicate a general increase in both copper

and gold grades as we move further south. Importantly from the

perspective of building our confidence in the continuity of the

Kora – Irumafimpa system, hole KMDD0084 is just over 200 metres

along strike from the deepest hole drilled by Barrick from surface,

BKDD0023. This hole reported over 30 metres of continuous

mineralization from 920 metres down hole and finished in

mineralization as the hole could not be drilled any

deeper.

We have already completed the drilling of

the next grade control hole from DDC3, which is a further 25 metres

to the south, and await the assay results with great

anticipation”.

Table 1 below provides a summary of the results

from the latest diamond grade control drill holes drilled into the

Kora North Vein system from DDC3. Table 2 provides details of

collar location and hole orientation.

Table 1.0 Kainantu Gold Mine –

Significant Intercepts from Kora Diamond Drill Cuddy

2

|

Hole_id |

From (m) |

To (m) |

Interval (m) |

True width (m) |

Gold g/t |

Silver g/t |

Copper % |

Gold equivalent |

Comment |

|

KMDD0082 |

35.55 |

38.30 |

2.75 |

2.67 |

21.41 |

6 |

1.13 |

23.20 |

K1E |

|

including |

35.55 |

36.26 |

0.71 |

0.69 |

56.70 |

14 |

3.44 |

62.15 |

|

|

including |

36.26 |

36.59 |

0.33 |

0.32 |

1.07 |

4 |

1.04 |

2.71 |

|

|

including |

36.59 |

37.24 |

0.65 |

0.63 |

0.57 |

3 |

0.32 |

1.09 |

|

|

including |

37.24 |

37.50 |

0.26 |

0.25 |

30.45 |

6 |

0.16 |

30.78 |

|

|

including |

37.50 |

38.10 |

0.60 |

0.58 |

9.50 |

2 |

0.03 |

9.57 |

|

|

including |

38.10 |

38.30 |

0.20 |

0.19 |

21.34 |

1 |

0.19 |

21.65 |

|

|

KMDD0082 |

38.45 |

40.48 |

2.03 |

1.97 |

3.74 |

1 |

0.02 |

3.78 |

K1W |

|

including |

38.45 |

39.58 |

1.13 |

1.10 |

3.01 |

1 |

0.01 |

3.04 |

|

|

including |

39.58 |

39.78 |

0.20 |

0.19 |

6.64 |

1 |

0.02 |

6.69 |

|

|

including |

39.78 |

40.38 |

0.60 |

0.58 |

4.23 |

1 |

0.02 |

4.28 |

|

|

including |

40.38 |

40.48 |

0.10 |

0.10 |

3.18 |

1 |

0.04 |

3.26 |

|

|

KMDD0082 |

46.09 |

49.40 |

3.31 |

2.62 |

8.37 |

2 |

0.39 |

8.99 |

KL1 |

|

including |

46.09 |

47.80 |

1.71 |

1.35 |

0.52 |

3 |

0.60 |

1.48 |

|

|

including |

47.80 |

48.14 |

0.34 |

0.27 |

1.50 |

1 |

0.06 |

1.60 |

|

|

including |

48.14 |

49.40 |

1.26 |

1.00 |

20.88 |

2 |

0.19 |

21.19 |

|

|

KMDD0082 |

64.88 |

68.66 |

3.78 |

3.59 |

32.54 |

62 |

2.59 |

37.29 |

K2 |

|

including |

64.88 |

65.30 |

0.42 |

0.40 |

4.35 |

15 |

0.55 |

5.38 |

|

|

including |

65.30 |

66.37 |

1.07 |

1.02 |

1.52 |

25 |

0.83 |

3.12 |

|

|

including |

66.37 |

66.93 |

0.56 |

0.53 |

209.70 |

338 |

14.92 |

236.93 |

|

|

including |

66.93 |

68.66 |

1.73 |

1.64 |

1.22 |

7 |

0.18 |

1.59 |

|

|

KMDD0084 |

38.5 |

43.18 |

4.68 |

4.14 |

73.54 |

4 |

0.33 |

74.10 |

K1W |

|

including |

38.5 |

39.57 |

1.07 |

0.95 |

96.96 |

10 |

0.83 |

98.35 |

|

|

including |

39.57 |

40.8 |

1.23 |

1.09 |

0.87 |

2 |

0.22 |

1.23 |

|

|

including |

40.8 |

41.15 |

0.35 |

0.31 |

18.84 |

3 |

0.32 |

19.36 |

|

|

including |

41.15 |

41.8 |

0.65 |

0.57 |

8.96 |

2 |

0.22 |

9.32 |

|

|

including |

41.8 |

42.31 |

0.51 |

0.45 |

36.88 |

1 |

0.02 |

36.93 |

|

|

including |

42.31 |

42.64 |

0.33 |

0.29 |

623.77 |

6 |

0.13 |

624.05 |

|

|

including |

42.64 |

43.18 |

0.54 |

0.48 |

4.24 |

3 |

0.15 |

4.50 |

|

|

KMDD0084 |

48.3 |

54.12 |

5.82 |

5.46 |

486.78 |

6 |

0.16 |

487.10 |

KL1 |

|

including |

49.61 |

49.85 |

0.24 |

0.23 |

2.52 |

5 |

0.07 |

2.70 |

|

|

including |

49.85 |

50.61 |

0.76 |

0.71 |

3585.93 |

21 |

0.15 |

3586.43 |

|

|

including |

50.61 |

50.93 |

0.32 |

0.30 |

3.31 |

2 |

0.00 |

3.34 |

|

|

including |

50.93 |

51.28 |

0.35 |

0.33 |

11.39 |

11 |

0.32 |

12.02 |

|

|

including |

51.28 |

52.2 |

0.92 |

0.86 |

0.88 |

1 |

0.12 |

1.07 |

|

|

including |

52.2 |

52.48 |

0.28 |

0.26 |

3.56 |

4 |

1.14 |

5.35 |

|

|

including |

52.48 |

52.78 |

0.3 |

0.28 |

273.33 |

6 |

0.19 |

273.69 |

|

|

including |

52.78 |

53.2 |

0.42 |

0.39 |

2.88 |

1 |

0.05 |

2.97 |

|

|

including |

53.2 |

53.66 |

0.46 |

0.43 |

25.15 |

6 |

0.15 |

25.46 |

|

|

including |

53.66 |

54.12 |

0.46 |

0.43 |

8.36 |

1 |

0.11 |

8.54 |

|

|

KMDD0084 |

62 |

66.12 |

4.12 |

4.00 |

7.59 |

21 |

1.92 |

10.79 |

K2 |

|

including |

62 |

62.6 |

0.6 |

0.58 |

2.59 |

2 |

0.16 |

2.85 |

|

|

including |

62.6 |

63 |

0.4 |

0.39 |

0.16 |

1 |

0.06 |

0.26 |

|

|

including |

63 |

63.56 |

0.56 |

0.54 |

16.83 |

19 |

2.42 |

20.77 |

|

|

including |

63.56 |

64.21 |

0.65 |

0.63 |

19.98 |

14 |

1.20 |

21.99 |

|

|

including |

64.21 |

65.1 |

0.89 |

0.86 |

7.22 |

51 |

5.19 |

15.80 |

|

|

including |

65.1 |

66.12 |

1.02 |

0.99 |

0.79 |

19 |

1.03 |

2.60 |

|

Notes

Gold Equivalent uses Copper price – US$2.90/lb; Silver price

US$16.5/oz and Gold price of US$1300/oz

Table 2.0 Kainantu Gold Mine – Collar

Locations for Kora Underground Diamond

Drilling

|

Hole_id |

Collar location |

Collar orientation |

EOH depth (m) |

Lode |

|

|

Local north |

Local East |

mRL |

Dip |

Local azimuth |

|

|

|

KMDD0082 |

58903.06 |

29868.16 |

1191.07 |

18.57 |

291.0 |

89.9 |

Kora |

|

KMDD0084 |

58901.94 |

29868.29 |

1190.97 |

17.86 |

265.6 |

101.1 |

Kora |

The current Kora/Eutompi inferred resource, as

defined by previous drilling to date, is 4.36 million tonnes at a

grade of 7.3 g/t Au, 35 g/t Ag and 2.23 per cent Cu, or 11.2 g/t

gold equivalent (see attached table) and is open for expansion at

depth and in both directions along strike.

K92 has filed and made available for download on

the company's SEDAR profile a technical report titled "Independent

Technical Report, Mineral Resource Update and Preliminary Economic

Assessment of Irumafimpa and Kora Gold Deposits, Kainantu Project,

Papua New Guinea," with an effective date of March 2, 2017, that

provides additional information on the geology of the deposits,

drilling and sampling procedures, lab analysis, and quality

assurance/quality control for the project, and additional details

on the resource estimates.

The PEA estimates for Kora, based on the current

resource estimates (4.36 million tonnes of 7.3 g/t Au, 35 g/t Ag

and 2.23 per cent Cu):

- Over a nine-year operating life,

the plant would treat 3.2 million tonnes averaging 7.1 g/t Au, 25

g/t Ag and 1.7 per cent Cu (9.3 g/t AuEq (1));

- This would generate an estimated

positive cash flow of $537-million (U.S.) using current metal

prices if 15-metre levels are used in mining; if 25-metre levels

are used, then net cash flows are estimated as $558-million (U.S.);

this cash flow includes conceptual allowances for capital;

- Production of an estimated average

of 108,000 AuEq (1) ounces per annum over an eight-year period from

year 2 through to year 9;

- An estimated pretax net present

value (NPV) of $415-million (U.S.) for 25-metre levels, or

$397-million (U.S.) for 15-metre levels, using current metal

prices, exchange rates and a 5-per-cent discount;

- An estimated after-tax NPV of

$329-million (U.S.) for 25-metre levels, or $316-million (U.S.) for

15-metre levels, using current metal prices, exchange rates and a

5-per-cent discount;

- Initial capital cost is estimated

to be $13.8-million (U.S.), including the $3.3-million (U.S.) for

the plant upgrade identified in the Mincore scoping study, but

excluding the proposed Kora exploration inclines and diamond

drilling; sustaining capital cost is estimated to a further

$64-million (U.S.) spent over the life of the Kora mining for

25-metre levels, or $83-million (U.S.) for 15-metre levels;

- Operating cost per tonne is

estimated to be $125 (U.S.) per tonne for 25-metre levels, or $126

(U.S.) per tonne for 15-metre mining levels;

- Excluding initial capital

expenditure of $14-million (U.S.), cash cost is estimated to be

$547 (U.S.) per ounce AuEq (inclusive of a 2.5-per-cent net smelter

return (NSR) royalty) and all-in sustaining cost (AISC) of $619

(U.S.) per ounce AuEq for 25-metre mining levels, or $549 (U.S.)

per ounce (inclusive of a 2.5-per-cent NSR royalty) and AISC of

$644 (U.S.) per ounce AuEq for 15-metre mining levels.

Metal prices used were $1,300 per ounce for

gold, $18 (U.S.) per ounce for silver and $4,800 per tonne for

copper.

(1) Gold equivalent calculated on above metal

prices.

Kora remains open for expansion in every

direction and strongly mineralized at the extent of all

drilling.

The PEA is preliminary in nature and includes

inferred mineral resources that are considered too speculative

geologically to have the economic considerations applied to them

that would enable them to be categorized as mineral reserves, and

there is no certainty that the PEA will be realized. The technical

report contains a full description of all underlying assumptions

relating to the PEA. Mineral resources that are not mineral

reserves and do not have demonstrated economic viability.

Table 3.0 IRUMAFIMPA AND KORA/EUTOMPI

RESOURCES

|

|

Resource by Deposit and Category |

| Deposit |

Resource

Category |

Tonnes |

Gold |

Silver |

Copper |

Gold Equivalent |

|

Mt |

g/t |

MOz |

g/t |

MOz |

% |

Mlb |

g/t |

MOz |

| Irumafimpa |

Indicated |

0.56 |

12.8 |

0.23 |

9 |

0.16 |

0.28 |

37 |

13.4 |

0.24 |

|

Inferred |

0.53 |

10.9 |

0.19 |

9 |

0.16 |

0.27 |

74 |

11.5 |

0.20 |

|

Kora/Eutompi |

Inferred |

4.36 |

7.3 |

1.02 |

35 |

4.9 |

2.23 |

215 |

11.2 |

1.57 |

| Total Indicated |

0.56 |

12.8 |

0.23 |

9 |

0.16 |

0.3 |

4 |

13.4 |

0.24 |

| Total Inferred |

4.89 |

7.7 |

1.21 |

32 |

5.06 |

2.0 |

218 |

11.2 |

1.76 |

M in Table is millions. Reported

tonnage and grade figures are rounded from raw estimates to reflect

the order of accuracy of the estimate. Minor variations may occur

during the addition of rounded numbers. Gold equivalents are

calculated as AuEq = Au g/t + Cu%*1.52+ Ag g/t*0.0141.

K92 Mine Geology Manager and Mine Exploration

Manager, Mr. Andrew Kohler, PGeo, a qualified person under the

meaning of Canadian National Instrument 43-101, has reviewed and is

responsible for the technical content of this news release. Data

verification by Mr. Kohler includes significant time onsite

reviewing drill core, face sampling, underground workings and

discussing work programs and results with geology and mining

personnel.

On Behalf of the Company,

John Lewins, Chief Executive Officer and

Director

Neither TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in policies

of the TSX Venture Exchange) accepts responsibility for the

adequacy or accuracy of this release.

CAUTIONARY STATEMENT REGARDING

FORWARD-LOOKING INFORMATION: This news release includes certain

“forward-looking statements” under applicable Canadian securities

legislation. Forward-looking statements are necessarily based upon

a number of estimates and assumptions that, while considered

reasonable, are subject to known and unknown risks, uncertainties,

and other factors which may cause the actual results and future

events to differ materially from those expressed or implied by such

forward-looking statements. All statements that address future

plans, activities, events, or developments that the Company

believes, expects or anticipates will or may occur are

forward-looking information, including statements regarding the

realization of the preliminary economic analysis for the Project,

expectations of future cash flows, the proposed plant expansion,

potential expansion of resources and the generation of further

drilling results which may or may not occur. Forward-looking

statements and information contained herein are based on certain

factors and assumptions regarding, among other things, the market

price of the Company’s securities, metal prices, exchange rates,

taxation, the estimation, timing and amount of future exploration

and development, capital and operating costs, the availability of

financing, the receipt of regulatory approvals, environmental

risks, title disputes, failure of plant, equipment or processes to

operate as anticipated, accidents, labour disputes, claims and

limitations on insurance coverage and other risks of the mining

industry, changes in national and local government regulation of

mining operations, and regulations and other matters.. There can be

no assurance that such statements will prove to be accurate, as

actual results and future events could differ materially from those

anticipated in such statements. Accordingly, readers should not

place undue reliance on forward-looking statements. The Company

disclaims any intention or obligation to update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by

law.

A map accompanying this announcement is available at

http://resource.globenewswire.com/Resource/Download/ae4178fe-3488-4278-9062-395984d29dba

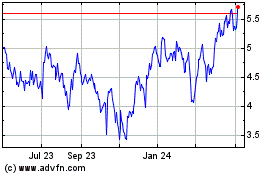

K92 Mining (QX) (USOTC:KNTNF)

Historical Stock Chart

From Oct 2024 to Nov 2024

K92 Mining (QX) (USOTC:KNTNF)

Historical Stock Chart

From Nov 2023 to Nov 2024