Vaycaychella could help change the real estate

investment landscape by including retail investors, says Soulstring

Media

Miami Beach, FL -- March 17, 2021 -- InvestorsHub

NewsWire -- World Series of Golf, Inc. (OTC

Pink: WSGF), Vaycaychella, is planning to get even better.

After completing its final beta testing before its planned June

production launch, the company said it intends to do more than

empower a new generation of short-term rental property operator

entrepreneurs. Now, they are extending the concept to include

cryptocurrency and crowdfunding features. Thus, like all

potentially great apps, Vaycaychella

is evolving in a pro-active manner.

Vaycaychella 1.0 is expected to hit the market with demand

waiting. For WSGF, they believe the app can generate upwards of

$100 million in its first 12-months of global service. It very well

could. In fact, Vaycaychella is building what could be the very

first alternative real estate finance application designed to

facilitate the purchase of short-term rental properties. Some

believe it can become the Robinhood app for retail traders wanting

to build a property portfolio.

For WSGF, the app has been a dedicated work in progress. WSGF

acquired Vaycaychella last year, making the new business

acquisition its primary focus. Following the purchase, WSGF has

filed for a name change that more reflects the company's mission.

The company said in a release on Tuesday that no reverse or forward

split is concurrently underway with the name and ticker change.

That's good news for investors. And with the launch expected to

happen in roughly 90 days, investors may start to position ahead of

the announcement. The app, after all, can be a game-changer to

retail estate investors interested in building a real estate

portfolio.

Cannot view this video? Visit:

https://www.youtube.com/watch?v=jkef-9j999Y

Beta Launch Ongoing

The company launched its final beta testing of the app in

February, which was met with intense interest. More than 200 users

are currently testing the Vaycaychella app, who will provide

comments about the app and make suggestions that could possibly be

integrated into the app. The company expects to include more users

in the test, with additional applications being sent this week.

Management also confirmed that the app is on schedule to meet

its full product launch in June. That sets up at least one

near-term catalyst. When WSGF announced the official beta launch in

March, shares rallied by 97% intraday before profit-takers stepped

in. Speculators believe that a rally of a more significant

proportion will happen on the official global launch and suggest a

wait-and-see strategy instead of flipping shares.

Keep in mind, too, WSGF is working to make this app better and,

at the same time, is said to be evaluating strategic options to

complement the app. Thus, 2021 could be a big year for the company

and its investors.

Behind The Curtain

As noted, Vaycaychella is roughly halfway through its planned

March beta test. Investors are paying attention. Volume has been

growing, and during the first week in March, shares surged by more

than 100% intraday on the announcement that the final beta testing

of the Vaycaychella app had started. Since then, shares have been

consolidating and generally following the overall market

trends.

The good news is that volume remains high, trading between 25M

and 366M shares this month. The 366M share day took the stock from

$0.028 to $0.0699 in early morning trade. Investors believe the

actual product launch can outperform that day.

There is good reason to believe the share price can rally

substantially higher. After all, Vaycaychella is designed to change

the landscape for retail investor participation in the

billion-dollar vacation real estate market. At its core,

Vaycaychella is an alternative finance application designed to

facilitate the purchase of short-term rental properties, empower a

new generation of short-term rental property operator entrepreneurs

(or Rentrepreneurs), and give them quick access to the tool needed

to build a property interest portfolio.

After seeing the app in beta testing, some users posted that the

app's functionality could push it toward becoming the "Robinhood" app

of real estate investing. They may be right. Vaycaychella

is being built to target a massive retail investor market shut out

from buying substantial real estate ownership positions. The most

significant part of the app, according to test users, is that it

can facilitate fractional ownership in multiple properties

worldwide. Thus, like a stock portfolio, investors can build a

portfolio in numerous properties worldwide to diversify their

holdings and risk.

And while some compare it to apps like Airbnb and VRBO, it's not

a fair comparison. While ABNB and VRBO focus on connecting renters

and landlords, Vaycaychella is designed to bring together investors

and owners. Thus, the model is entirely different, and investors

need not fear competing against the industry giants. Moreover, the

app has a further distinction by staying exclusively focused on the

vacation rental property market and could place Vaycaychella

ideally positioned to accelerate planned expansion into the

short-term rental ecosystem. Of course, further development of the

app is expected.

For now, though, Vaycaychella can transform parts of an

industry. But for WSGF investors, it may transform a portfolio.

WSGF Stockholders Expected To Benefit

While Vaycaychella can be transformational to the real estate

market, for WSGF investors, a transformation could happen as well-

to their portfolios. Mainly, if WSGF's lofty projections prove

correct, WSGF stock could experience exponential gains. Management

has said they expect the app's potential can deliver upwards of

$100 million in revenues in the first year of its full production

launch.

True, it's a lofty estimate. But, considering that investment

app Robinhood has an $11 billion valuation, and Acorns is valued at

roughly $870 million in less than ten years from their respective

launch, it's not an out of the ballpark projection. Those two grew

swiftly to earn those valuations as well. Moreover, if Vaycaychella

was to only reach $50 million in its first year,

WSGF stock would most likely be trading in dollars, not

pennies.

Thus, as consolidation continues and the stock trading at

two-week lows, the time may be right to pick at shares. Remember,

WSGF tends to follow penny stock trends, so the recent weakness may

not be company-specific at all.

Undoubtedly, March and April will be pivotal times in WSGF's

history. Not only are catalysts in play, but if reached could

transform WSGF from an app developer to a real estate investment

app juggernaut. And if the company announces in April that the beta

test was a huge success, expect the value to increase.

After all, WSGF is known to trade higher on good news. And a

successful beta test and a confirmed June launch could deliver a

punch.

Media contact:

Kenny Feigeles

ken@soulstringmedia.com

Disclaimers: Hawk Point Media, an affiliate of Soulstring

Media Group, is responsible for the production and distribution of

this content. Hawk Point Media is not operated by a licensed

broker, a dealer, or a registered investment adviser. It should be

expressly understood that under no circumstances does any

information published herein represent a recommendation to buy or

sell a security. Our reports/releases are a commercial

advertisement and are for general information purposes ONLY. We are

engaged in the business of marketing and advertising companies for

monetary compensation. Never invest in any stock featured on our

site or emails unless you can afford to lose your entire

investment. The information made available by Hawk Point Media is

not intended to be, nor does it constitute, investment advice or

recommendations. The contributors may buy and sell securities

before and after any particular article, report and publication. In

no event shall Hawk Point Media be liable to any member, guest or

third party for any damages of any kind arising out of the use of

any content or other material published or made available by Hawk

Point Media, including, without limitation, any investment losses,

lost profits, lost opportunity, special, incidental, indirect,

consequential or punitive damages. Hawk Point Media was compensated

three-thousand-five-hundred-dollars by wire transfer to produce

research, video, email, newsletters, and editorial commentary for

World Series of Golf, Inc. by a third party. Past performance is a

poor indicator of future performance. The information in this

video, article, and in its related newsletters, is not intended to

be, nor does it constitute, investment advice or recommendations.

Hawk Point Media strongly urges you conduct a complete and

independent investigation of the respective companies and

consideration of all pertinent risks. Readers are advised to review

SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports,

Forms 3, 4, 5 Schedule 13D.

The Private Securities Litigation Reform Act of 1995

provides investors a safe harbor in regard to forward-looking

statements. Any statements that express or involve discussions with

respect to predictions, expectations, beliefs, plans, projections,

objectives, goals, assumptions or future events or performance are

not statements of historical fact may be forward-looking

statements. Forward-looking statements are based on expectations,

estimates, and projections at the time the statements are made that

involve a number of risks and uncertainties which could cause

actual results or events to differ materially from those presently

anticipated. Forward-looking statements in this action may be

identified through use of words such as projects, foresee, expects,

will, anticipates, estimates, believes, understands, or that by

statements indicating certain actions & quote; may, could, or

might occur. Understand there is no guarantee past performance will

be indicative of future results. Investing in micro-cap and growth

securities is highly speculative and carries an extremely high

degree of risk. It is possible that an investors investment may be

lost or impaired due to the speculative nature of the companies

profiled.

To view the source version of this press release, please

visit https://www.newsfilecorp.com/release/77518

Other stocks on the move -

ICBU,

VBHI and

OZSC

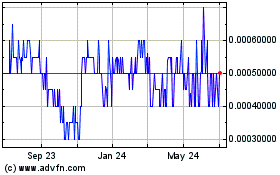

IMD Companies (PK) (USOTC:ICBU)

Historical Stock Chart

From Dec 2024 to Jan 2025

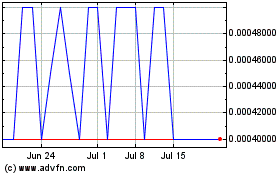

IMD Companies (PK) (USOTC:ICBU)

Historical Stock Chart

From Jan 2024 to Jan 2025