Filed pursuant to Rule 253(g)(2)

File No. 024-10795

OFFERING CIRCULAR DATED JUNE 13, 2019

73 Greentree Drive, #558

Dover, DE 19904

(888) 546-7980

100,000,000 shares of

Series A Non-Voting Preferred Stock

SEE “SECURITIES BEING OFFERED” AT PAGE 28

|

|

|

Price to Public

|

|

|

Underwriting

discount and

commissions

(1)

|

|

|

Proceeds

to issuer

(2)

|

|

|

Per share

|

|

$

|

0.15

|

|

|

|

0

|

|

|

$

|

0.15

|

|

|

Total Maximum

|

|

$

|

15,000,000

|

|

|

|

0

|

|

|

$

|

15,000,000

|

|

(1) The company does not currently intend to use commissioned

sales agents or underwriters. In the event it uses commissioned sales agents or underwriters, it will file an amendment to this

Offering Circular.

(2) Does not include expenses of the Offering, including costs

of blue sky compliance. See “Plan of Distribution.”

This Offering Circular covers the offer and sale of

Series A Non-Voting Preferred Stock to:

|

|

●

|

New

investors in the company who will pay cash for their investments; and

|

|

|

●

|

Members

of the company (people who use the company’s website) who will receive stock in reward for using the company’s services,

which we refer to as our Stock Award program.

|

See “Plan of Distribution.”

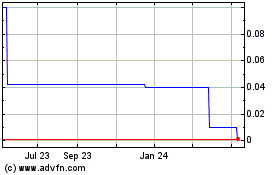

Prior to December 1, 2017, there was no public market for

our Series A Non-Voting Preferred Stock.

Our Series A Non-Voting

Preferred Stock began being quoted on the OTCQB Venture Market operated by OTC Markets Group Inc. (“OTCQB”) under

the symbol “RWRDP” on December 1, 2017. The Depositary Trust Company made RWRDP DTC-eligible and the first trades

happened in March, 2018. As of May 7, 2019 the company had issued 217,525 shares in this offering for total proceeds of $32,627.25.

The company is offering a maximum of

100,000,000 shares of Series A Non-Voting Preferred Stock on a “best efforts” basis (the “Offering”). There

is no minimum offering amount. The Offering will continue until the earlier of (1) the date when all shares have been sold and

(2) the date on which the Offering is earlier terminated by the company at its sole discretion. See “Plan of Distribution”

and “Securities Being Offered” for a description of the company’s capital stock.

THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES

NOT PASS UPON THE MERITS OR GIVE ITS APPROVAL OF ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE

ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO

AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT

THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

GENERALLY NO SALE MAY BE MADE TO YOU

IN THIS OFFERING IF THE AGGREGATE PURCHASE PRICE YOU PAY IS MORE THAN 10% OF THE GREATER OF YOUR ANNUAL INCOME OR NET WORTH. DIFFERENT

RULES APPLY TO ACCREDITED INVESTORS AND NON-NATURAL PERSONS. BEFORE MAKING ANY REPRESENTATION THAT YOUR INVESTMENT DOES NOT

EXCEED APPLICABLE THRESHOLDS, WE ENCOURAGE YOU TO REVIEW RULE 251(d)(2)(i)(C) OF REGULATION A. FOR GENERAL INFORMATION ON

INVESTING, WE ENCOURAGE YOU TO REFER TO

www.investor.gov

.

This offering is inherently risky. See “Risk Factors” on page 5.

Sales of these securities will commence on approximately June 13, 2019.

The company is following the “Offering

Circular” format of disclosure under Regulation A.

TABLE OF CONTENTS

In this Offering Circular, the term “iConsumer”

or “the company” refers to iConsumer Corp.

THIS OFFERING CIRCULAR MAY CONTAIN FORWARD-LOOKING STATEMENTS

AND INFORMATION RELATING TO, AMONG OTHER THINGS, THE COMPANY, ITS BUSINESS PLAN AND STRATEGY, AND ITS INDUSTRY. THESE FORWARD-LOOKING

STATEMENTS ARE BASED ON THE BELIEFS OF, ASSUMPTIONS MADE BY, AND INFORMATION CURRENTLY AVAILABLE TO THE COMPANY’S MANAGEMENT.

WHEN USED IN THE OFFERING CIRCULAR, THE WORDS “ESTIMATE,” “PROJECT,” “BELIEVE,” “ANTICIPATE,”

“INTEND,” “EXPECT” AND SIMILAR EXPRESSIONS ARE INTENDED TO IDENTIFY FORWARD-LOOKING STATEMENTS, WHICH CONSTITUTE

FORWARD LOOKING STATEMENTS. THESE STATEMENTS REFLECT MANAGEMENT’S CURRENT VIEWS WITH RESPECT TO FUTURE EVENTS AND ARE SUBJECT

TO RISKS AND UNCERTAINTIES THAT COULD CAUSE THE COMPANY’S ACTUAL RESULTS TO DIFFER MATERIALLY FROM THOSE CONTAINED IN THE

FORWARD-LOOKING STATEMENTS. INVESTORS ARE CAUTIONED NOT TO PLACE UNDUE RELIANCE ON THESE FORWARD-LOOKING STATEMENTS, WHICH SPEAK

ONLY AS OF THE DATE ON WHICH THEY ARE MADE. THE COMPANY DOES NOT UNDERTAKE ANY OBLIGATION TO REVISE OR UPDATE THESE FORWARD-LOOKING

STATEMENTS TO REFLECT EVENTS OR CIRCUMSTANCES AFTER SUCH DATE OR TO REFLECT THE OCCURRENCE OF UNANTICIPATED EVENTS.

LETTER TO PROSPECTIVE SHAREHOLDERS

May 15, 2019

Millions of people want to learn about and experience ownership

in public companies. Especially in the context of the world of start ups. We’ve made it as simple as shopping. iConsumer

members shop, earn, and learn. They see the example of eBates and RetailMeNot, and farther afield, the long list of tech unicorns,

and they say, I’d like to participate.

They read about the SEC chairman, Jay Clayton, saying he’d

like to see more companies become public earlier in their growth cycles so that more ordinary people can take part in the prospects

of early stage investing. He’s reacting to the amazing stories of companies like Uber and Pinterest. We’ve done just

that. iConsumer is very definitely early stage, and the participants are by far and away ordinary people. Certainly not venture

capitalists.

We created a classic two-sided market. Just like Google,

where consumers search for free, and advertisers and retailers pay the bills, at iConsumer, members get rewarded with RWRDP, our

OTC quoted stock. All that’s required is shopping at our network of ~2,000 worldwide retailers. That’s about as free

as it gets. And those retailers, advertisers, and others interested in equity pay us. Whether their interest is education, speculation,

accumulation, the blockchain, or simply pride of ownership, our members are becoming actively involved in the fabric of our economy.

Which is good for all of us. And especially good for investors in RWRDP.

This filing represents the second year of our continuous

offering. Lots of things have changed. Most notably, we put using Bitcoin as a reward on hiatus in November, 2018. We completed

our rescission offer (two people took us up on it) in December. We resumed offering RWRDP as a reward in June, 2018. With this

requalification, we have ceased accepting Bitcoin or Ether as payment for investing in our equity. We filed our 2018 financial

statements (our Form 1-K).

Our history really starts with the pricing of our stock

(RWRDP) in February and its first trade in March 2018. At that point, members could Google our ticker symbol and see the market

price. Everything else we’d done was prelude. Making it legal to have 1,000,000 shareholders, getting our stock quoted on

the OTCQB, getting market makers, and getting our ticker symbol were all necessary, but insufficient. It was being traded on a

market that began to make a difference.

But we couldn’t really take off yet. As pioneers,

we were certain to find some bumps in the road. One of those bumps involved making sure we had a qualified offering in place.

Because of mistakes on our part, coupled with being the first to try to get a Regulation A offering through FINRA in order to

trade on OTC Markets, we didn’t have a qualified offering between mid-February and mid-June of last year. No offering of

stock as a reward. Put a big crimp in our plans. To fix that, we offered to buy back (to rescind) shares and Bitcoin earned during

that period. The uncertainty of that put another crimp in our plans. For most of 2018 we were hobbled. But that’s all behind

us.

Shopper acquisition is the name of the game.

Which is one reason we’re raising money in this offering.

Our first round got us to this point. We’re very lightly traded and still early-stage. Now it’s time to scale our

marketing. We estimate we need about 20,000 net new members, just like the ones who joined and shopped in the first quarter of

2018, to become comfortably cash flow positive. And while we were able to attract those members in the first quarter for less

than $10 in cash each, we’re expecting our acquisition costs to rise as we scale, so we’re estimating $50 per member

in acquisition costs. Not coincidentally, marketing should help RWRDP’s liquidity, too.

Based on unaudited results through May 31, 2019, the members

who joined in the first quarter of 2019 have had purchase behavior that is similar in timing and quantity to the members who joined

in the first quarter of 2018. We have not raised sufficient capital to scale our marketing. So the rate of acquiring new members

(and the expected increase in cost per acquisition) have not changed measurably. We believe we can be cash flow self-sustaining

within a year of raising additional capital. At a $50 projected cost of acquisition, that means we need to raise $1,000,000.

Notably, the first quarter of 2019 results represent the

changed reward offering. New members are no longer earning Bitcoin. We were pleased to see that the economics of acquiring new

members did not fundamentally change with the change in the underlying reward being offered.

Until we scale our marketing and become cash flow positive, we will continue to require outside funding.

There is no certainty that we will continue to be able to secure outside funding.

Our first goal is to be cash flow positive, but we don’t

plan to stop there. Our potential markets are large, our current membership is small (only 56,000 members) in comparison. Whether

our potential market is defined as online shoppers who are stock curious or start up curious, we believe the market opportunity

is tens of millions of people. We base this on the fact that other rewards programs that we compete with have large member bases.

Rakuten alone has tens of millions of members in the United States and elsewhere. Our potential market also includes people who

have chosen to carry rewards cards from credit card issuers, whether those rewards are miles, points, or cashback. American Express

numbers its membership rewards program in the tens of millions. Chase Rewards likewise. We’re primarily focused on millennials

but being curious truly has no demographic. Whether they’re in North America or elsewhere. The ability to trade our stock

isn’t limited to just one continent, or the young, or the old.

Thanks for helping us Change the Faces of Wall Street.

Robert N. Grosshandler

Sanford D. Schleicher

Kimberly Logan

Co-Founders

RISK FACTORS

The Securities and Exchange Commission (the “Commission”)

requires the company to identify risks that are specific to its business and its financial condition. The company is still subject

to all the same risks that all companies in its business, and all companies in the economy, are exposed to. These include risks

relating to economic downturns, political and economic events and technological developments (such as hacking and the ability to

prevent hacking). Additionally, early-stage companies are inherently more risky than more developed companies. You should consider

general risks as well as specific risks when deciding whether to invest.

Risks Related to the Company and its Business

The company has only recently commenced its planned principal

operations.

iConsumer was formed in 2010 and recognized no significant revenues

prior to 2016. In the first quarter of 2016, the company experienced positive results from its market testing. This testing was

limited in scope and duration. After the positive testing results, the company reduced its marketing expenditures in anticipation

of a first closing on its initial offering, which it did in December 2016. Throughout the balance of 2016, and until January 2017,

its focus had been on preparing a marketing campaign, not member acquisition or revenue growth. Its preferred equity was first

traded on the OTCQB market in March 2018. Accordingly, the company has a limited history upon which an evaluation of its performance

and future prospects can be made. iConsumer’s current and proposed operations are subject to all the business risks associated

with new enterprises. These include likely fluctuations in operating results as the company reacts to developments in its market,

including purchasing patterns of shoppers and the reaction of existing competitors to iConsumer’s offerings and entry of

new competitors into the market. iConsumer will only be able to pay dividends on any shares once its directors determine that it

is financially able to do so.

The company depends on one source of revenue.

The company is completely dependent on online shopping.

If this market were to cease to grow, or to decrease, for reasons that may include economic or technological reasons (including,

for example, recessions or loss of confidence in online commerce due to hacking) the company may not succeed. The company’s

current member base is small compared to competitors, having begun post-testing operations in February 2017, and the company will

only succeed if it can attract a significant number of members.

The company’s current member base of retailers and

advertisers (to whom it provides advertising and loyalty services) numbers approximately 2,000. The company will only succeed

if these retailers choose to continue to do business with iConsumer. They may choose to stop doing business with the company for

reasons in or out of the control of the company. There are no contractual requirements binding the retailer or advertiser to continue

a relationship. Most of these retailers are primarily focused on the U.S. market.

The company is depending on the incentive of ownership

in the company to attract members.

iConsumer is using the prospect of ownership in the company

and the ability to share in its success as an incentive to use the company’s products. If potential consumers do not find

this a compelling reason to use iConsumer as opposed to its competitors, the company will have fewer unique selling propositions

to distinguish it from its competitors. This incentive requires that potential shareholders be able to ascertain the value of

their ownership, which may be hard or impossible to do. The amount of the incentive is calculated based upon a consumer receiving

ownership using the price per share specified in the offering statement in effect as of the date that consumer makes a purchase

with a merchant via the company's website. If that incentive does not work, the company is less likely to succeed.

The value of the ownership earned by consumers is a

non-cash expense to the company.

This non-cash expense will depress earnings for the foreseeable

future. This may affect the price future prospective shareholders are willing to pay for the stock. The company’s financial

projections assume that there is a tax benefit to this non-cash expense. If that assumption is false, the company will have a larger

tax liability than anticipated. The company is recording the cost of the incentive compensation at the last public price paid for

its stock in its qualified offerings. If the market price of the company as quoted on a market (e.g. OTCQB) is different from that

price, and if there is sufficient liquidity in that market, the company will need to use the market price to ascertain the value

of the stock earned by members. If there is no price quoted publicly or in a prior offering, the company will need to use other

valuation methodologies.

The company is challenged in raising capital.

Until the company is cash flow positive, it requires outside

financing to meet its obligations, and to fund its growth. Raising such outside financing is extremely hard to do, and there is

no certainty that the company will succeed in raising sufficient financing.

The company’s operations are reliant on technology

licensed from a related company.

iConsumer’s operations are run on technology licensed

from Outsourced Site Services, LLC (“OSS”), a company under common control, pursuant to an Amended and Restated License

Agreement dated May 25, 2016 (the “License Agreement”), which is summarized under “Interest of Management and

Others in Certain Transactions". iConsumer pays OSS a license fee for the use of this technology, and it is the intention

of Robert Grosshandler, who controls both companies, to reduce the fee over time, as described in “Management’s Discussion

and Analysis of Financial Condition and Results of Operations”. Changes in the license fee will impact the company’s

expenses and profitability. Since Mr. Grosshandler controls both companies, and will continue to control iConsumer after this offering,

he will have the power to determine whether the company will continue to be able to rely on the OSS license, and the price (whether

at market rate, or above or below market rate) it pays for the license.

A related company provides operational and other services,

which eventually the company will have to pay for at market rates.

The company’s personnel and other operational support

such as web hosting, site maintenance, member support, retailer support and marketing are currently provided by OSS, pursuant

to the License Agreement, as described in “Interest of Management and Others in Certain Transactions”. The company

will eventually have to pay its own personnel and perform these functions itself or outsource them to other providers. This may

have the result of increasing the company’s expenses. The current arrangement also means that the financial results of the

company in the current stage of operations are unlikely to be a good indicator of future performance.

The company depends on a small management team.

The company depends primarily on the skill and experience

of three individuals, Robert Grosshandler, Kimberly Logan, and Sanford Schleicher. If the company is not able to call upon any

of these people, for any reason, its operations and development could be harmed.

The company is controlled by its officers and directors.

Robert Grosshandler currently holds all of the company’s

voting stock, and at the conclusion of this offering will continue to hold all of the company’s common stock. Investors in

this offering will not have the ability to control a vote by the shareholders or the board of directors.

Competitors may be able to call on more resources than the

company.

While the company believes that its approach to online shopping

is unique, it is not the only way to attract users. Additionally, existing or new competitors may replicate iConsumer’s

business ideas (including the issuance of shares to users) and produce directly competing offerings. These competitors may be

better capitalized than iConsumer, which might give them a significant advantage, for example, in surviving an economic downturn

where shoppers pull back. Competitors may be able to use their greater resources to provide greater rebates or cashback to consumers,

even to uneconomic levels that iConsumer cannot match.

There are logistical challenges involved in the management

of large numbers of shareholders.

iConsumer’s business plan is based upon using share ownership

as a way to attract online shoppers to its services, and the more it succeeds in doing so, the larger the number of shareholders

it will have to manage. The need to address shareholder concerns with respect to recording of ownership, transfer and communications

with shareholders may take up a disproportionate amount of management time and increase costs.

Our accountant has included a “going concern”

note in its audit report.

We may not have enough funds to sustain the business until it

becomes profitable. Even if we raise funds in this offering, we may not accurately anticipate how quickly we may use the funds

and if these funds are sufficient to bring the business to profitability. Our ability to remain in business is reliant on either

generating sufficient cash flows from operations, raising additional capital, or likely a combination of the two.

Rebate oriented members are demanding and aggressive.

Companies that offer rebates on member purchases attract

members who enjoy pushing the limits in order to maximize their rebates and stock compensation. This aggressive buying behavior

can turn into fraudulent behavior against iConsumer or its partners. The company believes that it was the first established company

to offer rebates in the form of Bitcoin, which effort it ceased in November, 2018. It is possible that members drawn to this offer

will be more or less aggressive than cash back members. The company will need to manage this risk and behavior. Doing so may take

up a disproportionate amount of management’s time. This behavior may have unknown financial exposure for iConsumer.

The transition to providing rebates in the form of cash

back may cause confusion.

The company’s more than 55,000 members had the opportunity

to earn Bitcoin during 2018. As of November 23, 2018 the company transitioned to providing cash back instead of Bitcoin. Existing

members, having earned Bitcoin, may find the transition confusing. Members may spend more or less than their historical averages,

due to the transition to Bitcoin. The cost to market to potential members may be uneconomical. There are no historical precedents

to guide the company’s forecasting, making it more likely that our forecasts will be inaccurate.

Having used Bitcoin as compensation creates speculative

risk to the company.

The company ceased offering Bitcoin as a reward on November

23, 2018. The company is required to purchase Bitcoin at prevailing market rates in order to satisfy its need to fulfill previously

earned Bitcoin to members. As the markets for Bitcoin are new, thinly capitalized, and unregulated, the company is not able

to foresee all of the risks the need to purchase Bitcoin might entail. At a minimum, this need to participate in the cryptocurrency

markets exposes the company to the extreme volatility in the market price of Bitcoin, plus the potential inability to purchase

sufficient Bitcoin at any price. While the company intends to use commercially reasonable means to mitigate those risks

(including, but not limited to, engaging in hedging operations), it may lack the expertise, capital, or other elements necessary

to successfully purchase Bitcoin to fulfill its obligations to members.

Having earned Bitcoin as compensation creates speculative

risk to the member.

The price of Bitcoin in the market may drop radically between

the time the award to the member was calculated (Bitcoin awards ceased in November, 2018), and the time the member is able to

transfer the Bitcoin from iConsumer into his or her account or wallet. The member bears that speculative risk.

The value of Bitcoin earned by a member may decrease

between the date it was earned and the date at which it is transferred.

The price of Bitcoin in the market may drop radically between

the time the award to the member was calculated, and the time the member requests a transfer of the Bitcoin from iConsumer into

his or her account or wallet. The company anticipates transferring Bitcoin immediately upon request. However, there may be a delay

between the request and the transfer. The member bears the risk of fluctuation between the time of the award and the time of the

ultimate transfer to the member.

The company has no management with international experience.

The company may need to expand its marketing, investment efforts,

and operations beyond North America. Current management has no experience in this area. It may need to hire employees, or retain

contractors and advisors, with applicable experience. There is no assurance that such employees, contractors, or other resources,

will be available and/or affordable at the point the company seeks such assistance.

The estimates used to provide forecasts may not scale

with additional marketing expenditures and could prove inaccurate.

As outlined in the letter to shareholders, the

company is forecasting cash flow break even status when it acquires approximately 20,000 more shoppers who behave like the

273 shoppers acquired in the first quarter of 2018 and the 205 shoppers acquired in the first quarter of 2019 (unaudited, as

of May 31, 2019). Those estimates are based on behaviors observed over a small number of early adopting individuals. That

behavior may not be indicative of future performance. If we attract sufficient capital to scale our marketing efforts,

we’re predicting that our cost of member acquisition will rise. Additionally, if the new members behave differently

than the members acquired during that quarter, it may take longer for the company to reach cash flow break even. It is

possible that the company does not raise enough money in this offering to fund its continued operations. At an acquisition

cost of $50 per shopper, it will take $1,000,000 of additional funding to achieve the goal of 20,000 net new shoppers. The

company believes it will be cash flow break even within a year of raising that $1,000,000.

The company used the following unaudited data (as of May

1, 2019) to estimate the number of new shoppers required to reach cash flow break even status:

|

Shoppers Acquired 1

st

Quarter 2018

|

|

|

273

|

|

|

Total Net Cash Generated by New Shoppers 1

st

Quarter

2018 after Rebate

|

|

$

|

2,837

|

|

|

Cash Cost of Acquisition

|

|

$

|

1,365

|

|

|

Net Cash Generated Per New Shopper in 1

st

Quarter

2018

|

|

$

|

5.39

|

|

|

Net Cash Generated by Existing Shoppers 1

st

Quarter

2018 after Rebate

|

|

$

|

17,085

|

|

|

Average Number of Days before Shopper Covered Acquisition Cost

|

|

|

35

|

|

|

|

|

|

|

|

|

Estimated Annual Net Cash Generated by New Shopper

|

|

$

|

50

|

|

|

Estimated Number of Net New Shoppers

|

|

|

23,000

|

|

|

Estimated Cost to Acquire Net New Shopper

|

|

$

|

45

|

|

|

Estimated Total Cost of Acquiring New Shoppers to Reach Cash Flow Break Even

|

|

$

|

1,000,000

|

|

The company used the following assumptions in making its

forecasts. The first quarter is a “slow” quarter. The company will require approximately $1,000,000 in cash annually

(net of the cash required for member acquisition) to operate once it acquires 20,000 net additional shoppers. Net cash assumes

that all revenues are collected. We assume we can acquire new members rapidly. Investors should take the assumptions into consideration

when reading the estimates and consider whether they think they are reasonable. The 205 shoppers who joined in the first quarter

of 2019 behaved similarly to the shoppers acquired in 2018.

Members who earned shares under the company’s Stock

Award program may have remaining rescission rights.

Under Commission rules, an issuer that is offering securities

on a continuous basis under Rule 251 of Regulation A promulgated under the Securities Act of 1933, as amended (the “Securities

Act”) must amend its offering statement annually to update the financial information in the offering circular and to reflect

any other changes to its disclosure. The company failed to amend its offering statement that was re-qualified by the SEC on February

13, 2017 on a timely basis. As a result, that offering statement was no longer available for the company to make stock awards

to members who made purchases from February 14, 2018 until May 23, 2018. We permitted members to earn stock awards until May 23,

2018. Stock awards earned during that period may not have been exempt from the registration or qualification requirements under

federal securities laws, may have been awarded in violation of federal securities laws and may be subject to rescission. In order

to address this issue, we made a rescission offer to all members who earned stock awards from February 14, 2018 until May 23,

2018. Two members accepted our offer of rescission, for a total of 1,824 shares.

Federal securities laws do not provide that a rescission

offer will terminate a purchaser’s right to rescind a sale of stock that was not registered as required or was not otherwise

exempt from such registration requirements. We may continue to be liable under federal and state securities laws for up to an

amount equal to the value of those shares plus any statutory interest since February 13, 2018, which we may be required to pay.

Risks Related to the Company's Securities

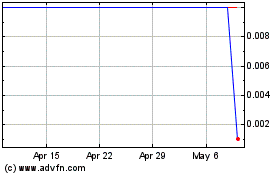

There is no current liquid market for the preferred stock. We

may not continue to satisfy the requirements for quotation on the OTCQB market and, even if we do, an active market for the preferred

stock may not develop.

Prior to December 1, 2017, there was no formal marketplace for

the resale of the company’s preferred stock. Our preferred stock is quoted on the OTCQB over-the-counter market operated

by OTC Markets Group Inc. under the symbol “RWRDP”. Even though our stock is quoted, that does not mean that there

is or will be a liquid market for our equity. If we fail to continue to meet the requirements for quotation on OTCQB, the shares

may be quoted on other tiers of the over-the-counter market to the extent any demand exists. Whether or not we’re quoted

on a market, or listed on an exchange, investors should assume that they may not be able to liquidate their investment for some

time, or be able to pledge their shares as collateral, or be able to hold the stock in a traditional brokerage account. Without

a liquid market for the preferred stock, it may be impossible for shareholders to be able to value their stock, reducing or eliminating

the value of the stock as an incentive. Even if we continue to satisfy the requirements of the OTCQB, it is not a stock exchange.

As a result, there may be significantly less trading volume and analyst coverage of, and significantly less investor interest in,

our preferred stock than there would be if the shares were listed on a stock exchange, which may lead to lower trading prices for

our preferred stock.

If we are successful in continuing to be quoted on a market,

we will be considered a “penny stock”.

Among other consequences, this will make it harder, potentially

impossible, for a liquid market in our securities to develop. Without a liquid market, it is harder, potentially impossible, for

a shareholder to find a buyer for his, hers, or its securities at an acceptable price. For example, many institutional investors

will not invest in the “penny stocks”. Many brokerage firms do not trade in penny stocks, or trade in stock quoted

on the OTC markets.

If and when our quoted stock price goes down, members

/ shareholders may react negatively.

Many of the company’s shareholders are first time

investors in a public company. Their reaction to a fluctuating stock price is unknown. For example, they may choose to stop being

members or they may choose to air their grievances on social media platforms.

Alternative forms of investment and reward points may become

popular.

Competitors, and potential competitors to the company, are rumored

to be announcing cryptocurrencies that allow them to raise capital or compete in ways that the company may not be able to replicate.

This increases the number of probable competitors to the company. For example, we are aware that the parent company of eBates,

Rakuten, has announced that Rakuten points will be blockchain-based. The BAT token (basicattentiontoken.org), associated with the

Brave browser, may also directly compete with us. Another token that may compete is LOYYAL. The increasing popularity of this fundraising

mechanism is making qualified resources able to assist with the process hard to find, and if available, very expensive. There is

no assurance that the company will be able to compete with these well-funded competitors.

Risks Related to Bitcoin

The fundamental value of Bitcoin is sensitive to subjective

perception.

The value of Bitcoin can be based on its ease of use, the

energy used to mine it, what it can be used to purchase, or its revolutionary technology, but there is no underlying value or

institution supporting its value. This results in price volatility, which encourages speculative behavior. Speculative subscribers

may hold Bitcoin instead of spending it, which makes the currency illiquid. Furthermore, any particular cryptocurrency may become

worthless, which could result in an adverse effect on the company and members who have previously received Bitcoin and continue

to hold a balance.

A disruption of the Internet or the Bitcoin network could

impair the value and the ability to transfer Bitcoin.

A significant disruption in Internet connectivity could disrupt

the Bitcoin network, until the disruption is resolved, and could have an adverse effect on the value of Bitcoin. It is possible

that such an attack could adversely affect the value of Bitcoin.

The price of Bitcoin and Ether assets are extremely volatile.

Fluctuations in the price of Bitcoin could materially and adversely affect the company and the value of members’ rebates

and rewards.

The prices of blockchain assets are significant uncertainties

for the company and members. The price of Bitcoin and other cryptocurrencies such as Ether, Ripple, and Litecoin are subject to

dramatic fluctuations. The company uses the Gemini digital asset exchange to set the price at which it awards Bitcoin. For example,

the price of Bitcoin on the Gemini exchange on December 24, 2017 at 4 pm Eastern Standard Time (“EST”) was

$13,586.76.

The company purchased a futures contract on January 12, 2018. At that date, the futures contract reflected a market price of approximately

$9,000.00. The 4 pm EST price of Bitcoin on March 5, 2018 on the Gemini exchange was $11,570.00. During the year, the company

continued to hedge its Bitcoin exposure by purchasing contracts. Those contracts had expired by December 31, 2018. To further

illustrate the volatility of Bitcoin and Ether, we have set forth in the table below the US dollar prices quoted at 4pm EST on

the Gemini exchange since September 1, 2017

.

|

Date

|

|

Price of Bitcoin

|

|

|

Price of Ether

|

|

|

September 1, 2017

|

|

$

|

4,855.44

|

|

|

$

|

391.50

|

|

|

September 15, 2017

|

|

$

|

3,690.00

|

|

|

$

|

257.97

|

|

|

October 1, 2017

|

|

$

|

4,298.25

|

|

|

|

—

|

|

|

October 15, 2017

|

|

$

|

5,506.37

|

|

|

$

|

329.00

|

|

|

November 1, 2017

|

|

$

|

6,570.00

|

|

|

$

|

297.50

|

|

|

November 15, 2017

|

|

$

|

7,260.00

|

|

|

|

—

|

|

|

December 1, 2017

|

|

$

|

10,717.48

|

|

|

|

—

|

|

|

December 15, 2017

|

|

$

|

17,715.85

|

|

|

$

|

688.90

|

|

|

January 1, 2018

|

|

$

|

13,411.49

|

|

|

|

—

|

|

|

January 15, 2018

|

|

$

|

13,700.00

|

|

|

$

|

1,287.28

|

|

|

February 1, 2018

|

|

$

|

9,099.99

|

|

|

$

|

1,012.24

|

|

|

February 15, 2018

|

|

$

|

10,081.89

|

|

|

$

|

927.13

|

|

|

April 30, 2018

|

|

$

|

9,307.30

|

|

|

$

|

676.37

|

|

|

April 1, 2019

|

|

$

|

4,115.29

|

|

|

$

|

140.32

|

|

|

May 1, 2019

|

|

$

|

5,299.11

|

|

|

$

|

157.45

|

|

The company is exposed to these fluctuations

until such time as it transfers a member’s remaining Bitcoin earnings, earned while the company still offered Bitcoin as

a reward.

While the company intends to continue to use commercially reasonable

means to mitigate its exposure to such fluctuations, several factors may affect price, including, but not limited to:

|

|

●

|

Global blockchain asset supply;

|

|

|

●

|

Global blockchain asset demand, which can be influenced by the growth of retailers’ and commercial businesses’ acceptance of blockchain assets like cryptocurrencies as payment for goods and services, the security of online blockchain asset exchanges and digital wallets that hold blockchain assets, the perception that the use and holding of blockchain assets is safe and secure, and the regulatory restrictions on their use;

|

|

|

●

|

Changes in the software, software requirements or hardware requirements underlying a blockchain network;

|

|

|

●

|

Changes in the rights, obligations, incentives, or rewards for the various participants in a blockchain network;

|

|

|

●

|

Currency exchange rates, including the rates at which Bitcoin and other cryptocurrencies such as Ether, which the company accepts as payment for subscriptions in this offering, may be exchanged for fiat currencies;

|

|

|

●

|

Fiat currency withdrawal and deposit policies of blockchain asset exchanges and liquidity on such exchanges;

|

|

|

●

|

Interruptions in service from or failures of major blockchain asset exchanges;

|

|

|

●

|

Investment and trading activities of large investors, including private and registered funds, that may directly or indirectly invest in blockchain assets;

|

|

|

●

|

Monetary policies of governments, trade restrictions, currency devaluations and revaluations;

|

|

|

●

|

Regulatory measures, if any, that affect the use of blockchain assets;

|

|

|

●

|

The maintenance and development of the open-source software protocol of the Bitcoin or other cryptocurrency networks;

|

|

|

●

|

Global or regional political, economic or financial events and situations;

|

|

|

●

|

Expectations among blockchain participants that the value of blockchain assets will soon change; and

|

|

|

●

|

A decrease in the price of blockchain assets that may have a material adverse effect on the company’s financial condition and operating results.

|

If someone gains access to a member’s login credentials

to an iConsumer account, the account holder may lose the value of their account.

If someone gains access to or learns of a member’s login

credentials or private keys, that person may be able to dispose of the member’s account and the member’s Bitcoin, and

they may lose the entirety of their holdings.

Most holders of cryptocurrencies can only gain access to

them by use of a private key. The loss of access to private keys may result in the permanent loss of access to an account and the

value of the cryptocurrencies therein

.

Bitcoin is stored in a digital wallet on the blockchain and

is controllable only by the individual who controls the private key. If the private key is lost or destroyed an investor may be

unable to access the Bitcoin held in the digital wallet, which may result in permanent loss of funds. In addition, if the private

key becomes known to a third party, it may result in misappropriation and therefore permanent loss of funds. Internet errors related

to cyber malfunction of the wallet where the Bitcoin is held could also result in its loss.

While securities accounts at U.S. brokerage firms are often

insured by the Securities Investor Protection Corporation (SIPC) and bank accounts at U.S. banks are often insured by the Federal

Deposit Insurance Corporation (FDIC), Bitcoin held in a digital wallet currently does not have similar protections.

Unlike bank accounts, credit unions or accounts at other financial

institutions that provide certain safety guarantees, such as insurance, to depositors, coins and tokens held in digital wallets

on a blockchain are currently uninsured. In the event of loss or loss of utility value there is no public insurer or private insurance

to offer recourse to the injured holder.

Cryptocurrency markets are subject to market manipulations

and schemes that may decrease the value of Bitcoin.

There is a risk of market manipulation, such as the spreading

of false and misleading information about Bitcoin to affect its price. Rumors about Bitcoin may be spread in a variety of ways,

including on websites, press releases, email spam, posts on social media, online bulletin boards, and chat rooms. The false or

misleading rumors may be negative and could result in a decrease in the value of Bitcoin.

DILUTION

Dilution means a reduction in value, control or earnings of

the shares the investor owns.

Immediate dilution

An early-stage company typically sells its shares (or grants

options over its shares) to its founders and early employees at a very low cash cost, because they are, in effect, putting their

“sweat equity” into the company. When the company seeks cash investments from outside investors, like you, the new

investors typically pay a much larger sum for their shares than the founders or earlier investors, which means that the cash value

of your stake is diluted because each share of the same type is worth the same amount, and you paid more for your shares than earlier

investors did for theirs.

The following table compares the price that new investors

are paying for their shares with the effective cash price paid by existing shareholders. Investors in this offering will pay $.15

per share. The table reflects all transactions since inception (including the Recapitalization and Exchange effected in July 2015

and discussed in more detail in “The Company’s Business”), establishing a net tangible book value deficit of

$(

604,465

) or $(0.0029) per share as of December 31, 2018. Net tangible book value

is calculated as tangible assets less tangible liabilities. This method gives investors a better picture of what they will pay

for their investment compared to the company’s insiders and earlier investors than just including such transactions for

the last 12 months, which is what the Commission requires. The table then gives effect to the sale of shares assuming we issue

A) a low-range number of shares, B) a mid-range number of shares and C) the maximum number of shares in this offering.

|

|

|

Low-Range

Raise

|

|

|

Mid-Range

Raise

|

|

|

Maximum

Raise

|

|

|

Price per Share

|

|

$

|

0.15

|

|

|

$

|

0.15

|

|

|

$

|

0.15

|

|

|

Shares Issued

|

|

|

1,000,000

|

|

|

|

10,000,000

|

|

|

|

100,000,000

|

|

|

Capital Raised

|

|

$

|

150,000

|

|

|

$

|

1,500,000

|

|

|

$

|

15,000,000

|

|

|

Less: Offering Costs

|

|

$

|

(26,500

|

)

|

|

$

|

(40,000

|

)

|

|

$

|

(150,000

|

)

|

|

Net Offering Proceeds

|

|

$

|

123,500

|

|

|

$

|

1,460,000

|

|

|

$

|

14,850,000

|

|

|

Net Tangible Book Value (12/31/18)

|

|

$

|

(604,465

|

)

|

|

$

|

(604,465

|

)

|

|

$

|

(604,465

|

)

|

|

Increase to Net Tangible Value

|

|

$

|

123,500

|

|

|

$

|

1,460,000

|

|

|

$

|

14,850,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Tangible Book Value Post-Financing

|

|

$

|

(480,965

|

)

|

|

$

|

855,535

|

|

|

$

|

14,245,535

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Shares Issued and Outstanding (12/31/2018)

|

|

|

208,505,206

|

|

|

|

208,505,206

|

|

|

|

208,505,206

|

|

|

No-fee Shares Earned

|

|

|

14,223,960

|

|

|

|

14,223,960

|

|

|

|

14,223,960

|

|

|

Post-Financing Shares Issued and/or Earned and Outstanding

|

|

|

223,729,166

|

|

|

|

232,729,166

|

|

|

|

322,729,166

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net tangible book value (deficit) per share prior to offering

|

|

$

|

(0.0029

|

)

|

|

$

|

(0.0029

|

)

|

|

$

|

(0.0029

|

)

|

|

Increase/(Decrease) per share attributable to new investors

|

|

$

|

0.0007

|

|

|

$

|

0.0066

|

|

|

$

|

0.047

|

|

|

Net tangible book value (deficit) per share after offering

|

|

$

|

(0.0022

|

)

|

|

$

|

0.0037

|

|

|

$

|

0.0441

|

|

|

Dilution per share to new investors

|

|

$

|

0.1522

|

|

|

$

|

0.1463

|

|

|

$

|

0.1059

|

|

The table reflects past issuances to members on a no-fee

basis under the prior offering. It does not reflect future issuances to members on a no-fee basis. Any no-fee issuances to members

will further dilute investors in this offering. Under this offering, between June 13, 2018 and May 7, 2019, the company issued

372,491 no-fee shares. It issued 217,525 shares for a total consideration of $32,627.25.

No-fee issuances are those shares issued and transferred

to members as consideration for the member making purchases from network retailers using the iConsumer platform. No cash is received

from the member as part of the consideration. iConsumer is under no obligation to issue shares unless it has an offering statement

qualified by the Commission at the time a member makes a purchase. iConsumer has not, and will not, issue no-fee shares unless

it has a qualified offering statement. We refer to these no-fee issuances as iConsumer’s “Stock Award” program.

Future dilution

Another important way of looking at dilution is the dilution

that happens due to future actions by the company. The investor’s stake in a company could be diluted due to the company

issuing additional shares, whether as part of a capital-raising event, or issued as compensation to the company’s members,

employees, or marketing partners. In other words, when the company issues more shares, the percentage of the company that you own

will go down, even though the value of the company may go up. You will own a smaller piece of a larger company. This increase in

number of shares outstanding could result from a stock offering (such as a public offering, another crowd funding round, a venture

capital round, angel investment), employees exercising stock options, compensation to members, or by conversion of certain instruments

(e.g. convertible bonds, preferred shares or warrants) into stock.

If the company decides to issue more shares, an investor could

experience value dilution, with each share being worth less than before, and control dilution, with the total percentage an investor

owns being less than before. There may also be earnings dilution, with a reduction in the amount earned per share.

The type of dilution that hurts early-stage investors most occurs

when the company sells more shares in a “down round,” meaning at a lower valuation than in earlier offerings.

An example of how this might occur is as follows (numbers are

for illustrative purposes only):

|

|

●

|

In

June 2018 Jane invests $20,000 for shares that represent 2% of a company valued at $1 million.

|

|

|

●

|

In December the company is doing very well and sells $5 million in shares to venture capitalists on a valuation (before

the new investment) of $10 million. Jane now owns only 1.3% of the company but her stake (at least on paper) is worth $200,000.

|

|

|

●

|

In

June 2019 the company has run into serious problems and in order to stay afloat it raises $1 million at a valuation of only $2

million (the “down round”). Jane now owns only 0.89% of the company and her stake is worth only $26,660.

|

If you are making an investment expecting to own a certain percentage

of the company or expecting each share to hold a certain amount of value, it’s important to realize how the value of those

shares can decrease by actions taken by the company. Dilution can make drastic changes to the value of each share, ownership percentage,

voting control, and earnings per share.

PLAN OF DISTRIBUTION

The Offering Statement filed with the Commission covers the

offer and sale of preferred shares to:

|

|

●

|

New investors in the company who will pay cash for their investments; and

|

|

|

●

|

Members of the company (people who use the company’s website) who will be awarded “no-fee shares” in reward

for using iConsumer’s services and to encourage them to shop more through iConsumer and urge their friends to do the same.

Members will earn shares of the company based on the amount of shopping rebates they earn. Members may also earn shares as incentive

for other activities, including, but not limited to, signing up to become a member. The issuance of shares to members in exchange

for their activities is a “sale” of shares under securities law, and thus must be registered with the Commission or

made in reliance on an exemption from registration, such as Regulation A. This Offering Circular therefore covers the issuance

of 75,000,000 preferred shares to members. The company will not receive cash from the issuance to members; the cash accounted

for in “Use of Proceeds” will come from new investors. Under this and prior offerings, as of December 31, 2018 the

company had transferred 2,089,455 shares to the transfer agent to reflect the earnings of approximately 2,600 members. In

this offering, through May 7, 2019, the company issued and transferred 381,032 shares to the transfer agent to reflect the earnings

of 52 members.

|

TAX CONSEQUENCES FOR RECIPIENT (INCLUDING FEDERAL, LOCAL AND

FOREIGN INCOME TAX CONSEQUENCES) WITH RESPECT TO THE ISSUANCE OF SHARES TO MEMBERS ARE THE SOLE RESPONSIBILITY OF THE INVESTOR.

INVESTORS MUST CONSULT WITH THEIR OWN PERSONAL ACCOUNTANT(S) AND/OR TAX ADVISOR(S) REGARDING THESE MATTERS.

The cash price per share of Series A Non-Voting Preferred

Stock is $0.15, which may be paid in cash.

The company intends to market the shares in this offering both

through online and offline means. Online marketing may take the form of contacting potential investors through social media and

posting the company’s Offering Circular and supporting materials on an online investment platform.

In the event the company makes arrangements with a broker-dealer

to sell its shares, it will file a supplement to this Offering Circular.

No securities are being sold for the account of security holders;

all net proceeds of this offering will go to the company.

Investors’ Tender of Funds

After the Offering Statement has been qualified by the Commission,

the company will accept tenders of funds to purchase the preferred shares. The company may close on investments on a “rolling”

or “continuous” basis (so not all investors will receive their shares on the same date). Each time the company accepts

funds is defined as a “Closing." Funds tendered in cash by potential investors will be held by the Escrow Agent and

will be transferred to the company upon Closing. The escrow agreement can be found in Exhibit 8 to the Offering Statement of which

this Offering Circular is a part. FundAmerica and the Escrow Agent are performing AML and OFAC due diligence on investors. All

cash funds are held in escrow pending satisfactory due diligence. The company will accept a subscription (i.e., hold a Closing)

within 30 calendar days after due diligence is successfully completed. Given the timing of completion of diligence, it is possible

that the company could conduct a Closing every weekday, which would be administratively burdensome. In order to reduce the number

of Closings, the company may wait until it has completed due diligence on several investments before submitting a disbursement

request to the Escrow Agent.

In the event that it takes some time for the company to raise

funds in this offering, the company will rely on income from sales, as well support from OSS. It has only a limited amount of cash

on hand, but the License Agreement with OSS provides that OSS will be responsible for much of the company’s operations, as

set out in “Interests of Management and Others in Certain Transactions.”

Processing of Subscriptions

You will be required to complete a subscription agreement in

order to invest or to receive “no-fee” shares in the Stock Award program. The subscription agreement includes a representation

by the investor (including members receiving no-fee shares) to the effect that, if you are not an “accredited investor”

as defined under securities law, you are investing an amount that does not exceed the greater of 10% of your annual income or 10%

of your net worth (excluding your principal residence).

The company has previously paid Fund America, Inc., a technology

and escrow service provider, an escrow fee of $500. Additionally, the company will pay Fund America $7.50 per transaction processed

for investments over $250. Direct Transfer, LLC, an affiliate of Issuer Direct Corp., serves as transfer agent to maintain stockholder

information on a book-entry basis and will charge $2.50 for a new cash shareholder who invests less than $1,000, $5.00 for a new

cash shareholder who invests $1,000 or more, and $1.50 for each new no-fee shareholder, upon transfer and issuance of their shares.

If each investor were to invest a subscription amount of $200.00 for the offering per investor, the company estimates the maximum

fee that could be due to Fund America and Issuer Direct Corp. for the aforementioned services would be $125,000 if it achieved

the maximum offering proceeds.

The company may also engage additional broker-dealers or processing

agents to perform administrative functions, who may have different financial arrangements and costs.

Upon acceptance of an investment, the FundAmerica platform

automatically generates and sends an email with the details of the transaction to the investor. In the event that the company

does not accept an investment in whole or in part, it will notify an investor via email through the FundAmerica platform.

The company anticipates that the share register as maintained

by the transfer agents will reflect the issuance and transfer of shares to investors within two weeks after the company accepts

and closes on an investment.

The company is absorbing all fees connected to cash investments

charged by FundAmerica and/or Issuer Direct, where practicable.

The Incentive Program

The primary business of iConsumer is helping its members

understand and participate in the stock market. To facilitate that, consumers are incented to utilize the services of iConsumer

to earn rebates and save money via coupons and “deals” whenever they shop at participating retailers. The retailers

pay iConsumer for this service, and iConsumer shares those payments with its members as a rebate.

The incentive is delivered in two ways. Consumers receive

a portion in the equity of iConsumer – RWRDP – and a portion in cash. The company will only issue shares (“no-fee

shares”) to members while it has an Offering Statement qualified by the Commission, such Offering Statement remains qualified,

and upon each member's execution of a subscription agreement, as well as their compliance with other requirements as set out in

the company’s terms of service. The rebate percentage (typically the rebate is a percentage of the purchase amount) is displayed

to the user on iConsumer’s site, in its apps, or as a banner on the retailer’s site prior to the user making a purchase.

The rebate percentage varies from retailer to retailer and is

set by iConsumer. iConsumer may vary the rebate percentage frequently.

The rebates that are to be delivered as equity are calculated

as a percentage of the purchase price, if possible. The price used for this calculation is the price of the stock as set forth

in the offering statement that is qualified as of the date of purchase. That price is displayed in the footer of most pages of

the iConsumer website. iConsumer may vary the number of shares earned per purchase at its sole discretion.

The rebates that are to be delivered as cash (cash back)

are typically calculated as a percentage of the purchase price. A member may request their cash back earnings to be remitted in

the form of Bitcoin. We use the Gemini closing price of Bitcoin as of the date the request is made.

The consumer thus knows the percentages (or fixed “special

rate”) of the rebates to be received, prior to making a purchase.

As of December 31, 2018, the company’s books reflected

a liability of $31,801 for Bitcoin earned as a reward between December, 2017 and November, 2018. It may purchase futures contracts

to cover this liability and to protect from cryptocurrency volatility, in addition to purchasing Bitcoin. The company currently

holds less than one month’s anticipated demand for Bitcoin in a wallet or in an account on an exchange. As its redemption

experience grows, it may hold more or less Bitcoin in a crypto wallet on in an account on an exchange.

The security of the exchange-based account is a feature of the

exchange. Where the Bitcoin is held in iConsumer’s wallet, that wallet is kept on a computer that is not publicly accessible,

or in cold storage in a hardware wallet like a Nano. The wallet technology is provided by a third party. The state of wallet technology

is rapidly changing, and we expect to change wallet providers as technology improves. For security reasons, we are not disclosing

the vendors of the products and services we employ to transact in and store cryptocurrencies.

The company used Bitcoin for rewards between December 23,

2017 and November 12, 2018. The company believes it currently holds Bitcoin sufficient to meet anticipated redemption needs through

June 30, 2019.

Until such time as a member requests, and the company completes,

a transfer of Bitcoin to the member’s wallet or exchange account, ownership of the Bitcoin does not pass to the member.

The company does not allocate a specific purchase of Bitcoin to a specific member. The company’s Bitcoin is an asset of

the company and may be used for any purpose it deems appropriate.

The company intends to keep Bitcoin purchases at a minimum

to reduce security concerns. It may continue to use futures contracts to protect against upward price movements of Bitcoin.

In February 2018 the company introduced a Bitcoin-based

incentive for members to refer new members. It ended that promotion in November, 2018. The incentive had two components. First,

a fixed amount of Bitcoin is awarded upon the shopping activity of the recruited member. Second, the referring member earns Bitcoin

equal to 5% of the referred member’s earned Bitcoin from shopping, for as long as the referring and referred members remains

active on the iConsumer platform (by making purchases through iConsumer’s platform). like all incentives the company offers,

these terms may be changed or withdrawn at any time, in the company’s sole discretion, prospectively.

An example from a retailer’s site.

The consumer is able to see a ledger recapping purchase

amounts, cash back rebate, and stock earned amounts.

Current examples of both of these incentives (incentives

change frequently) are as follows:

Jody learns about iConsumer from her friend George. When

Jody becomes an iConsumer member and makes her first purchase from a participating retailer, iConsumer awards her 100 shares of

equity, subject to the existence of a qualified offering statement for the shares. When she makes her first purchase from a participating

retailer (in any amount), iConsumer rewards George with $5 in cash back.

Jody makes a $100 purchase at jet.com via iConsumer because

she knows she’ll accrue $2 in cash back and 22.22 iConsumer shares (assuming a qualified offering statement is on file with

the Commission).

After approximately 75 days have passed (to allow for returns),

Jody may request the company to issue and transfer her earned shares. The company will automatically send her cash back rebate

to her in accordance with the then current cash back guidelines. Upon her request, the execution of the appropriate subscription

agreement, confirmation that Jody has complied with iConsumer’s terms and conditions, and assuming a qualified offering

statement is on file with the Commission, her accrued shares will be issued and transferred to the transfer agent’s books

in about a month.

From time to time the company may offer or withdraw additional

incentives for George to recruit Jody.

As of December 31, 2018, iConsumer had transferred Bitcoin

to 83 members. As of May 7, 2019, it had transferred Bitcoin to 137 members.

As of December 31, 2018 iConsumer had transferred 2,089,455

shares to approximately 2,600 members as a result of their joining, shopping, and recruiting other members. Between January 1,

2019 and May 6, 2019, inclusive, the company transferred an additional 165,130 shares to the transfer agent to reflect the earnings

of its members in the current and prior offerings. Of those shares, 8,541 shares were earned in the current offering.

Offering Circular Supplements and Post-Qualification Amendments

The company undertakes to file, during any period in which offers

or sales are being made,

|

|

1)

|

Any supplement required pursuant to Rule 253(g) under the Securities Act; and

|

|

|

2)

|

A post-qualification amendment to the Offering Statemen to reflect in the offering circular any facts or events arising after the qualification date of the Offering statement (or the most recent post-qualification amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the Offering Statement.

|

USE OF PROCEEDS

Assuming the Maximum Offering amount is raised, the net proceeds

of this offering to the issuer, after expenses of the offering (payment to Fund America, Issuer Direct Corp. LLC, professional

fees and other expenses) will be approximately $14,850,000. All cash proceeds will be derived from the sale of preferred shares

to new investors as opposed to the issuance of preferred shares to members.

There is no minimum offering amount.

If iConsumer receives the maximum proceeds in this offering,

it plans to use the net proceeds as follows:

|

|

·

|

Marketing

expenses (primarily new member acquisition) in the amount of approximately $12,000,000.

|

|

|

·

|

Web site

and technological development in the amount of approximately $1,000,000.

|

Approximately $1,850,000, or 12.5% of the net proceeds,

assuming the maximum amount offered is raised, has not been allocated for any particular purpose. Through May 7, 2019, we have

sold 217,515 shares for cash, for total proceeds of $32,627.25, which we have used for marketing. Through May 7, 2019 we have

issued 381,032 no-fee shares under this offering. See “Management’s Discussion and Analysis of Financial Condition

and Results of Operations.”

Because the offering is a “best efforts” offering,

iConsumer may close the offering without sufficient funds for all the intended purposes set out above. In that event it will “bootstrap”

its expenses and only spend funds on marketing when it has cash to do so.

The company reserves the right to change the above use of

proceeds if management believes it is in the best interests of the company.

THE COMPANY’S BUSINESS

Overview

The company was founded in 2010 and began operations in

2015. Since founding, it has not undergone any reorganization or acquisitions. Prior to 2016, the company had negligible revenues.

In 2016, the company began offering consumers the opportunity to learn about the stock market by becoming shareholders in a publicly

quoted company. They receive rebates from shopping in the form of equity (Series A Non-Voting Preferred shares) in the company,

in addition to other forms of incentives, including cash rebates, and, from December 2017 through November 2018, Bitcoin.

In order to have a platform that could comply with U.S.

securities regulations, the company filed an offering statement with the Commission under Regulation A. That offering statement

was first qualified in September 2016 and the company began an offering under Regulation A. This offering was a continuous

offering and remained open through February 13, 2018.

In February 2017 the company raised the price per share

in the offering from $.045 to $.09. The company’s offering statement was requalified by the Commission on February 13, 2017.

Under Commission rules, an issuer that is offering securities on a continuous basis under Rule 251 of Regulation A must amend

its offering statement annually to update the financial information in the offering circular and to reflect any other changes

to its disclosure. The company failed to amend its offering statement on a timely basis. As a result, that offering statement

was no longer available for the company to make stock awards to members who made purchases after February 13, 2018 and through

May 23, 2018, a period during which the company permitted members to earn stock. Stock awards accrued during that period may not

have been exempt from the registration or qualification requirements under federal securities laws, may have been accrued in violation

of federal securities laws and may have been subject to rescission. As of December 31, 2017, it had closed on cash investments

in that offering from 188 individuals, representing $174,866 of invested capital since the inception of the offering. From May

2017 until February 13, 2018, the company did not issue any shares under the offering statement.

On June 13, 2018, the Commission qualified the company’s

offering statement for a new offering under Regulation A. The share price in this offering was raised to $.15/share. This offering

is a continuous offering and remained open as of December 31, 2018. As of December 31, 2018, it had closed on cash investments

in that offering from 40 individuals, representing $40,288 of invested capital.

On October 26, 2018 the Commission qualified the company’s

offering statement in connection with a rescission offer under Regulation A. This offering covered stock that may have been earned

by members between February 13, 2018 and May 23, 2018. It provided a mechanism for eligible members to, at their option, reverse

the transactions that resulted in them earning stock and other rebates during the period in question. Two people took advantage

of the rescission offer.

As of December 31, 2016, the company had 12,804 members.

As of December 31, 2017, the company had 49,989 members. As of December 31, 2018, the company had 54,056 members.

The company applied to FINRA to obtain a ticker symbol in

January 2017 so that the company’s Series A Non-Voting Preferred shares could be traded on a market. In December 2017 FINRA

issued the company the ticker symbol RWRDP. In March 2018 the first trading of RWRDP occurred on the OTCQB market.

Principal Products and Services

The company provides its members the opportunity to experience

the ownership of an asset that members find challenging, without cost to the member: ownership in a company quoted on the over-the-counter

market (iConsumer). The company generates revenue by providing an online shopping portal where the company’s members can

shop at approximately 2,000 participating retailers worldwide. The retailers pay the company commissions and advertising fees

in exchange for members’ shopping. In turn, the company rebates a portion of its revenues to its members in the form of

equity and cash back. In 2016 and 2017, revenue from advertising was negligible.

The company launched its online shopping services to the

general public on June 19, 2015. From that date until December 23, 2017, it offered rebates in the form of its equity and cash.

On December 23, 2017, the company transitioned from offering cash rebates to offering Bitcoin rebates. On November 12, 2018, the

company transitioned back to offering cash rebates. It retained the ability to fulfill its cash obligation to a member by remitting

Bitcoin instead of cash, at the member’s option.

Market

The company’s target market encompasses all online shoppers,

with the initial target being those shoppers located in the United States. With the transition from cash rebates to Bitcoin rebates,

the company expanded its potential market worldwide. While the company has no direct competitors, the company’s indirect

competitors include companies that offer cash back or frequent flyer miles or points as incentives for their shopping behavior.

Those indirect competitors estimate that they have nearly 100 million global users, and those shoppers located in the United States

are the initial target of the company’s marketing efforts.

The company uses social media, PR, display and other forms of

paid and unpaid advertising to attract new members to its site. The initial marketing strategy includes “influencers”

such as bloggers, writers, and other outlets reachable through social media and public relations. After establishing this beachhead,

the company intends to use its own members to spread the word about the advantages of the company’s offering.

A further source of potential members is the people who

have expressed interest in the company’s offering of shares through its offering under Regulation A.

Competition

The company’s indirect competitors include eBates,

Shopathome, RetailMeNot, MyPoints, CouponCabin, Brads Deals, and swagbucks. iConsumer offers the same ability to save money shopping

by offering coupons but differentiates itself by additionally offering its members the ability to earn ownership in the company

through the acquisition of shares, as well as cash back. This further incentivizes members to prefer iConsumer’s offering

and to encourage their friends to do the same.

Participating Merchants

Through an agreement with OSS, an affiliated company, iConsumer

represents approximately 2,000 retailers, providing cash and equity back and coupon-based savings to consumers when they shop

at these retailers. OSS personnel are responsible for attracting and maintaining those relationships. iConsumer pays OSS a fee

based on revenues for this service. OSS provides similar services to iGive.com Holdings, LLC, an affiliated company.

Research and Development

The company is licensing technology developed by its affiliate

OSS and has begun to make expenditures on research and development.

Employees

The company has no directly paid employees. Its management and

operations are provided by the affiliated company OSS, as described in “Interest of Management and Others in Certain Transactions.”

Intellectual Property

iConsumer has a copyright in its web site, applications, and

other computer software. It has received trademark registrations for iConsumer, the logo, and related marks. The technology upon

which the company is relying for its operations is owned by OSS and licensed to iConsumer.

Litigation

The company is not involved in any litigation.

THE COMPANY’S PROPERTY

The company does not own any real estate or significant real

assets. The company owns, to the extent permitted by law and end-user agreements, the data generated by its members, and about

its members. The cost of creating this data is reflected as expenses in the company’s financial statements. The value of

these assets is not reflected in the financial statements.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

The following discussion of our financial condition and