0001119190

false

0001119190

2023-10-23

2023-10-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): October 23, 2023

HUMBL,

Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

000-31267 |

|

27-1296318 |

| (State

or other jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

incorporation) |

|

File

Number) |

|

Identification

No.) |

| 101

W. Broadway |

|

|

| Suite

1450 |

|

|

| San

Diego, CA |

|

92101 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (786) 738-9012

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

HMBL |

|

OTC

Pink |

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

1.01 Entry into a Material Definitive Agreement.

On

October 23, 2023, HUMBL, Inc. (“HUMBL”) entered into an Exchange Agreement (the “Exchange Agreement”) and an

Investor Rights Agreement (the “Investor Rights Agreement”) with Sartorii, LLC (“Sartorii”). Pursuant to the

Exchange Agreement, Sartorii agreed to exchange all outstanding promissory notes issued by HUMBL to Sartorii for 8,775 shares of HUMBL’s

Series C Preferred Stock. The aggregate outstanding balance of the promissory notes at the time of the exchange was approximately $6,500,000.00.

The exchange was completed as part of HUMBL’s efforts to reduce its outstanding debt load.

The

foregoing description of the Exchange Agreement and Investor Rights Agreement does not purport to be complete and is qualified in its

entirety by reference to the Exchange Agreement which is filed as Exhibit 10.1 to this Current Report on Form 8-K and the Investor Rights

Agreement which is filed as Exhibit 10.2 to this Current Report on Form 8-K. The terms of the Series C Preferred Stock were filed as

Exhibit 10.3 to the Current Report on Form 8-K filed by HUMBL on October 13, 2023.

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, HUMBL has duly caused this report to be signed on its behalf by the undersigned

thereunto duly authorized.

| Date:

October 25, 2023 |

HUMBL,

Inc. |

| |

|

|

| |

By: |

/s/

Brian Foote |

| |

|

Brian

Foote |

| |

|

President

and CEO |

Exhibit

10.1

THE

EXCHANGE CONTEMPLATED HEREIN IS INTENDED TO COMPORT WITH THE REQUIREMENTS OF SECTION 3(a)(9) OF THE SECURITIES ACT OF 1933, AS AMENDED.

EXCHANGE

AGREEMENT

This

Exchange Agreement (this “Agreement”) is entered into as of October __, 2023 (the “Effective Date”)

by and between Sartorii, LLC, a Delaware limited liability company (“Sartorii”), and HUMBL, Inc., a Delaware corporation

(“Company”).

A.

Company issued to Sartorii the following Promissory Notes: (i) that certain Promissory Note dated March 30, 2022 in the original principal

amount of $1,500,000 (“Note #1”); (ii) that certain Promissory Note dated July 26, 2022 in the original principal

amount of $2,000,000 (“Note #2”); (iii) that certain Promissory Note dated November 15, 2022 in the original principal

amount of up to $2,200,000 (“Note #3”); (iv) that certain Promissory Note dated June 12, 2023 in the original principal

amount of $450,000 (“Note #4”); (v) that certain Promissory Note dated July 3, 2023 in the original principal amount

of $200,000 (“Note #5”); (vi) that certain Promissory Note July 11, 2023 in the original principal amount of $50,000

(“Note #6”); and (vii) that certain Promissory Note dated September 14, 2023 in the original principal amount of $100,000

(“Note #7”, and together with Note 1, Note 2, Note 3, Note 4, Note 5 and Note 6, the “Notes”).

B.

Company and Sartorii desire to exchange (such exchange is referred to as the “Note Exchange”) the Notes for 8,775

shares of Company’s Series C Preferred Stock (the “Exchange Shares”) according to the terms and conditions of

this Agreement.

C.

The Note Exchange will consist of Sartorii surrendering the Notes in exchange for the Exchange Shares.

D.

Other than the surrender of the Notes, no consideration of any kind whatsoever will be given by Sartorii to Company in connection with

this Agreement.

E.

Sartorii and Company now desire to exchange the Notes for the Exchange Shares on the terms and conditions set forth herein.

NOW,

THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

1.

Recitals and Definitions. Each of the parties hereto acknowledges and agrees that the recitals set forth above in this Agreement

are true and accurate, are contractual in nature, and are hereby incorporated into and made a part of this Agreement.

2.

Issuance of Shares. The Note Exchange will occur with Sartorii surrendering the Notes to Company on the Effective Date and Company

issuing the Exchange Shares to Sartorii.

3.

Section 3(a)(9). The transaction contemplated hereby and all other documents associated with this transaction comport with the

requirements of Section 3(a)(9) of the Securities Act of 1933, as amended. The Exchange Shares are being issued in substitution of and

exchange for and not in satisfaction of the Notes. The Exchange Shares shall not constitute a novation or satisfaction and accord of

the Notes.

4.

Company’s Representations and Warranties. In order to induce Sartorii to enter into this Agreement, Company, for itself,

and for its affiliates, successors and assigns, hereby acknowledges, represents, warrants and agrees as follows: (a) Company has full

power and authority to enter into this Agreement and to incur and perform all obligations and covenants contained herein, all of which

have been duly authorized by all proper and necessary action, (b) no consent, approval, filing or registration with or notice to any

governmental authority is required as a condition to the validity of this Agreement or the performance of any of the obligations of Company

hereunder, (c) the issuance of the Exchange Shares is duly authorized by all necessary corporate action and the Exchange Shares are validly

issued, fully paid and non-assessable, free and clear of all taxes, liens, claims, pledges, mortgages, restrictions, obligations, security

interests and encumbrances of any kind, nature and description, (d) Company has not received any consideration in any form whatsoever

for entering into this Agreement, other than the surrender of the Note, and (e) Company has taken no action which would give rise to

any claim by any person for a brokerage commission, placement agent or finder’s fee or other similar payment by Company related

to this Agreement.

5.

Sartorii’s Representations and Warranties. In order to induce Company to enter into this Agreement, Sartorii, for itself,

and for its affiliates, successors and assigns, hereby acknowledges, represents, warrants and agrees as follows: (a) Sartorii has full

power and authority to enter into this Agreement and to incur and perform all obligations and covenants contained herein, all of which

have been duly authorized by all proper and necessary action, (b) no consent, approval, filing or registration with or notice to any

governmental authority is required as a condition to the validity of this Agreement or the performance of any of the obligations of Sartorii

hereunder, and (c) Sartorii has taken no action which would give rise to any claim by any person for a brokerage commission, placement

agent or finder’s fee or other similar payment by Company related to this Agreement.

6.

Governing Law; Venue. This Agreement shall be construed and enforced in accordance with, and all questions concerning the construction,

validity, interpretation and performance of this Agreement shall be governed by, the internal laws of the State of Delaware, without

giving effect to any choice of law or conflict of law provision or rule (whether of the State of Delaware or any other jurisdiction)

that would cause the application of the laws of any jurisdiction other than the State of Delaware. Each party hereto hereby (i) consents

to and expressly submits to the exclusive personal jurisdiction of any state or federal court sitting in San Diego County, California,

(ii) expressly submits to the exclusive venue of any such court for the purposes hereof, and (iii) waives any claim of improper venue

and any claim or objection that such courts are an inconvenient forum or any other claim, defense or objection to the bringing of any

such proceeding in such jurisdiction or to any claim that such venue of the suit, action or proceeding is improper. EACH PARTY HEREBY

IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE TO, AND AGREES NOT TO REQUEST, A JURY TRIAL FOR THE ADJUDICATION OF ANY DISPUTE HEREUNDER OR

IN CONNECTION WITH OR ARISING OUT OF THIS AGREEMENT OR ANY TRANSACTION CONTEMPLATED HEREBY.

7.

Counterparts. This Agreement may be executed in any number of counterparts with the same effect as if all signing parties had

signed the same document. All counterparts shall be construed together and constitute the same instrument. The exchange of copies of

this Agreement and of signature pages using electronic signatures shall constitute effective execution and delivery of this Agreement

as to the parties and may be used in lieu of the original Agreement for all purposes. Signatures of the parties transmitted by electronic

transmission (including email) shall be deemed to be their original signatures for all purposes.

8.

Attorneys’ Fees. In the event of any action at law or in equity to enforce or interpret the terms of this Agreement, the

parties agree that the prevailing party shall be awarded the full amount of the attorneys’ fees and expenses paid by such prevailing

party in connection with the litigation and/or dispute without reduction or apportionment based upon the individual claims or defenses

giving rise to the fees and expenses.

9.

Severability. If any part of this Agreement is construed to be in violation of any law, such part shall be modified to achieve

the objective of the parties to the fullest extent permitted and the balance of this Agreement shall remain in full force and effect.

10.

Entire Agreement. This Agreement supersedes all other prior oral or written agreements between Company, Sartorii, its affiliates

and persons acting on its behalf with respect to the matters discussed herein, and this Agreement contain the entire understanding of

the parties with respect to the matters covered herein and therein and, except as specifically set forth herein or therein, neither Sartorii

nor Company makes any representation, warranty, covenant or undertaking with respect to such matters.

11.

Amendments. This Agreement may be amended, modified, or supplemented only by written agreement of the parties. No provision of

this Agreement may be waived except in writing signed by the party against whom such waiver is sought to be enforced.

12.

Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and their respective successors

and assigns.

13.

Time of Essence. Time is of the essence with respect to each and every provision of this Agreement.

14.

Further Assurances. Each party shall do and perform or cause to be done and performed, all such further acts and things, and shall

execute and deliver all such other agreements, certificates, instruments and documents, as the other party may reasonably request in

order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated hereby.

[Remainder

of page intentionally left blank]

IN

WITNESS WHEREOF, the undersigned have executed this Agreement as of the date first set forth above.

| |

COMPANY: |

| |

|

| |

HUMBL,

INC. |

| |

|

|

| |

By:

|

|

| |

|

Jeffrey

Hinshaw, COO |

| |

Sartorii: |

| |

|

| |

Sartorii,

LLC |

| |

|

|

| |

By:

|

|

| |

|

Stephen

Foote, Manager |

[Signature Page to Exchange

Agreement]

Exhibit

10.2

INVESTOR

RIGHTS AGREEMENT

This

INVESTOR RIGHTS AGREEMENT (this “Agreement”) is made and entered into as of October 23, 2023, by and between HUMBL,

Inc., a Delaware corporation (the “Company”), and Sartorii, LLC, a Delaware limited liability company (the “Investor”)

(individually a “Party” and collectively the “Parties”).

RECITALS:

WHEREAS,

the Investor is acquiring 8,775 shares of the Company’s Series C Convertible Preferred Stock (the “Series C Preferred

Stock”) pursuant to the terms of an Exchange Agreement dated October 23, 2023, by and among the Company and the Investor (the

“Purchase Agreement”); and

WHEREAS,

in order to induce the Investor to enter into the Purchase Agreement, the Company hereby agrees that this Agreement shall govern certain

rights of the Investor including the right to cause the Company to register shares of common stock issuable to the Investor upon conversion

of the Series C Preferred Stock, the right to access similar benefits offered to subsequent investors with convertible share rights,

and certain other matters as set forth in this Agreement.

NOW,

THEREFORE, in consideration of the mutual promises and covenants set forth herein, and other consideration, the receipt and adequacy

of which is hereby acknowledged, the Parties hereto agree as follows:

AGREEMENT:

1.

Definitions. For purposes of this Agreement:

1.1

“Affiliate” of a Person means any other Person that directly or indirectly, through one or more intermediaries, controls,

is controlled by, or is under common control with, such Person. The term “control” (including the terms “controlled

by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause

the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise.

1.2

“Board of Directors” means the board of directors of the Company.

1.3

“Closing” has the meaning provided in the Purchase Agreement.

1.4

“Common Stock” means the common stock of the Company and any other common equity securities issued by the Company

(whether voting or non-voting).

1.5

“days” refer to calendar days unless otherwise specified.

1.6

“Demand Registration” means a process initiated by the Investor, as provided in Section 2.1 of this Agreement, whereby

the Investor submits a request to the Company, expressing the desire to register the Registrable Securities with the SEC.

1.7

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

1.8

“Person” means any individual, corporation, partnership, trust, limited liability company, association, or other entity.

1.9

“Prospectus” means the prospectus or prospectuses included in any Registration Statement, as amended or supplemented

by any prospectus supplement with respect to the terms of the offering of any portion of the Registrable Securities covered by such Registration

Statement and by all other amendments and supplements to the prospectus, including post-effective amendments and all material incorporated

by reference in such prospectus or prospectuses.

1.10

“Registrable Securities” means (a) any shares of Common Stock held by the Investor that is issuable upon conversion

of the Series C Preferred Stock, and (b) any shares of Common Stock issued or issuable with respect to any shares described in subsection

(a) above by way of a stock dividend or stock split or in connection with a combination of shares, recapitalization, merger, consolidation

or other reorganization (it being understood that for purposes of this Agreement, a Person shall be deemed to be a holder of Registrable

Securities whenever such Person has the right to then acquire or obtain from the Company any Registrable Securities, whether or not such

acquisition has actually been effected). As to any particular Registrable Securities, such securities shall cease to be Registrable Securities

when (i) a Registration Statement covering such securities has been declared effective by the SEC and such securities have been disposed

of pursuant to such effective Registration Statement, (ii) such securities are sold under circumstances in which all of the applicable

conditions of Rule 144 (or any similar provisions then in force) under the Securities Act are met, (iii) such securities are otherwise

transferred and such securities may be resold without subsequent registration under the Securities Act, or (iv) such securities shall

have ceased to be outstanding.

1.11

“Registration Statement” means any registration statement registering the securities of the Company under the Securities

Act. which covers any of the Registrable Securities pursuant to the provisions of this Agreement, including the Prospectus, amendments,

and supplements to such Registration Statement, including post-effective amendments, all exhibits, and all materials incorporated by

reference in such Registration Statement.

1.12

“SEC” means the Securities and Exchange Commission.

1.13

“Rule 144” means Rule 144 promulgated by the SEC under the Securities Act.

1.14

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

1.15

“Selling Expenses” means all underwriting discounts, selling commissions and stock transfer taxes applicable to the

sale of Registrable Securities, and any fees and disbursements to Investor’s counsel.

1.16

“Uplist” means when the Company is listed for trading on a U.S. national securities exchange, including but not limited

to the New York Stock Exchange, the NASDAQ Stock Market, or any other national exchange recognized by the relevant regulatory authorities.

1.17

“Variable Rate Transaction” has the meaning provided in Section 7.

2.

Registration Rights

2.1.

Concurrently with the Uplist or at any time after the consummation of the Uplist, unless the Registrable Securities are eligible for

legend removal pursuant to Rule 144 at such time (as further set forth in Section 3), the Investor may request registration under the

Securities Act of all of the Registrable Securities on a Registration Statement. The Company shall then cause a Registration Statement

to be filed and shall use its commercially reasonable efforts to cause such Registration Statement to be declared effective by the SEC

as soon as practicable thereafter. The Company shall not be required to effect a registration of the Registrable Securities more than

once, and the Investor agrees and acknowledges that it shall only be allowed one Demand Registration for not less than ALL of the Registrable

Securities held by Investor subject to one Company delay period in processing the demand or any cutbacks from any underwriter associated

with the Registration Statement, if any, and as further set forth in Sections 2.2 and 2.3.

2.2.

The Company may postpone for up to 120 days the filing or effectiveness of a Registration Statement for a Demand Registration if the

Board of Directors determines in its good faith judgment that such Demand Registration would (i) materially interfere with a significant

acquisition, corporate organization or other similar transaction involving the Company; (ii) require premature disclosure of material

information that the Company has a bona fide business purpose for preserving as confidential; or (iii) render the Company unable to comply

with requirements under the Securities Act or Exchange Act; provided, that in such event the Investor shall be entitled to withdraw

the Demand Registration and, if such request is withdrawn, such Demand Registration shall not count against the Investor as a complete

and effective Demand Registration. Following the withdrawal of the request, the Investor shall be entitled to resubmit a Demand Registration

in respect of the Registrable Securities in accordance with the provisions of this Agreement.

2.3.

If the Investor elects to distribute the Registrable Securities in an underwritten offering, the Investor shall inform the Company of

this election in its request for registration made pursuant to Section 2.1. Investor may not participate in any registration hereunder

which is underwritten unless Investor (a) agrees to sell Investor’s securities on the basis provided in any underwriting arrangements

approved by the Investor; (b) agrees to any reduction in the number of shares suggested by any underwriter to be included in a registration

under a Registration Statement; and (c) completes and executes all questionnaires, powers of attorney, indemnities, underwriting agreements

and other documents required under the terms of such underwriting arrangements.

3.

Termination of Registration Rights. The Investor shall not be entitled to exercise any right provided in this Agreement with respect

to the Registrable Securities (i) after the date on which the Registrable Securities has been registered under a Registration Statement

filed in accordance with this Agreement or (ii) if all Registrable Securities held by the Investor (and any Affiliate of the Investor

with whom the Investor must aggregate its sales under Rule 144) can be sold without registration in compliance with Rule 144 under the

Securities Act.

4.

Registration Procedure. If and whenever the Investor requests that any Registrable Securities be registered pursuant to the provisions

of this Agreement, the Company shall use its reasonable best efforts to effect the registration and the sale of such Registrable Securities

in accordance with the intended method of disposition thereof with the assessment of reasonableness made by both parties hereto.

5.

Expenses. All expenses (other than Selling Expenses) incurred by the Company in complying with its obligations pursuant to this

Agreement and in connection with the registration and disposition of Registrable Securities, including, without limitation, all registration

and filing fees, underwriting expenses (other than fees, commissions or discounts), expenses of any audits incident to or required by

any such registration, fees and expenses of complying with securities and “blue sky” laws, printing expenses, and fees or

expenses of the Company’s counsel and accountants, shall be paid by the Company. All Selling Expenses relating to Registrable Securities

registered pursuant to this Agreement shall be borne and paid by the Investor.

6.

Leak Out and Maximum Sale. For a one-year period following the consummation of the Uplist (the “Leak-Out Period”),

the Investor agrees that the maximum aggregate number of Common Stock that all holders of the Series C Preferred Stock may sell in each

calendar month, as a group, shall be limited to one-twelfth (1/12th) of the total number of Common Stock that was automatically

converted at the time of the Uplist. The calculation of the maximum number of shares the Investor can sell shall be based on the total

number of Common Stock resulting from the automatic conversion, as set forth and provided for in the Certificate of Designation of the

Series C Preferred Stock. The Investor agrees to consider prevailing market conditions and the potential impact on the Company’s

stock price when determining the timing and quantity of shares to sell during the Leak-Out Period. Following the expiration of the Leak-Out

Period, there shall be no restrictions on the sale or transfer of the Common Stock held by the Investor, and the Investor shall be free

to sell, transfer, or otherwise dispose of its shares.

7.

Variable Rate Transactions. From the Closing until the consummation of the Uplist, the Company shall be prohibited from effecting

or entering into a Variable Rate Transaction (except for issuances to the Investor or its affiliates). For the purpose of this Section,

a “Variable Rate Transaction” means a transaction in which the Company issues or sells any debt securities that are

convertible into Common Stock either (i) at a conversion price that is based upon and/or varies with the trading prices for the shares

of Common Stock at any time after the initial issuance of such securities; or (ii) with a conversion price that is subject to being reset

at some future date after its initial issuance or upon the occurrence of specified events related to the business of the Company or the

market for the Common Stock.

8.

Availability of Rule 144. With a view to making available to the Investor the benefits of Rule 144 under the Securities Act and

any other rule or regulation of the SEC that may at any time permit the Investor to sell securities of the Company to the public without

registration or pursuant to a Registration Statement, the Company shall use best efforts to file with the SEC in a timely manner all

required reports under Sections 13 or 15(d) of the Exchange Act, if the Company is then subject to such reporting requirements.

9.

Most Favored Nation. From the later of the (i) consummation of the Uplist and (ii) the one year anniversary of the Closing, if

the Company offers or grants to a purchaser or investor any rights or preferences in any subsequent issuance of securities convertible

into Common Stock, which rights or preferences are more favorable than those granted to the Investor in this Agreement (collectively,

the “Benefit”), the Company agrees to notify the Investor of the Benefit within ten days of the grant of the Benefit

to such purchaser. Upon receiving the Company’s notification, the Investor shall have a period of ten days to notify the Company

of its desire to receive the Benefit. Where the Investor provides the Company with a timely notice of its desire to receive the Benefit,

this Agreement shall be deemed amended and modified in an economically and legally equivalent manner such that the Investor shall receive

the Benefit. The Investor acknowledges and agrees that failure to provide timely notice within the stipulated ten day period shall be

deemed a waiver of the Investor’s right to receive the Benefit.

10.

Confidentiality. The Investor agrees to keep confidential and will not disclose, divulge, or use for any purpose (other than to

monitor or make decisions with respect to its investment in the Company) any confidential information obtained from the Company pursuant

to the terms of this Agreement (including notice of the Company’s intention to file a Registration Statement), unless such confidential

information (a) is known or becomes known to the public in general (other than as a result of a breach of this Section by the Investor),(b)

is or has been independently developed or conceived by the Investor without use of the Company’s confidential information, or (c)

is or has been made known or disclosed to the Investor by a third party without a breach of any obligation of confidentiality such third

party may have to the Company; provided, however, that the Investor may disclose confidential information (i) to its attorneys,

accountants, consultants, and other professionals to the extent reasonably necessary to obtain their services in connection with monitoring

its investment in the Company; (ii) to any prospective purchaser of any Registrable Securities from the Investor, if such prospective

purchaser agrees to be bound by the provisions of this Section; (iii) to any existing or prospective Affiliate, partner, member, stockholder,

or wholly owned subsidiary of the Investor in the ordinary course of business, provided that the Investor informs such Person

that such information is confidential and directs such Person to maintain the confidentiality of such information; or (iv) as may otherwise

be required by law, regulation, rule, court order or subpoena, provided that the Investor promptly notifies the Company of such

disclosure and takes reasonable steps to minimize the extent of any such required disclosure.

11.

Miscellaneous

11.1.

Successors and Assigns. The rights under this Agreement may be assigned (but only with all related obligations) by the Investor

to a transferee of Registrable Securities that is (i) a subsidiary, parent, current or former partner, current or former limited partner,

current or former member, current or former manager or stockholder of the Investor, or (ii) an entity controlling, controlled by or under

common control with the Investor, including without limitation a corporation or limited liability company that is a direct or indirect

parent or subsidiary of the Investor; provided, however, that the Company is, within a reasonable time after such transfer,

furnished with written notice of the name and address of such transferee and the Registrable Securities with respect to which such rights

are being transferred; and such transferee agrees in a written instrument delivered to the Company to be bound by and subject to the

terms and conditions of this Agreement. The terms and conditions of this Agreement inure to the benefit of and are binding upon the respective

successors and permitted assignees of the parties. Nothing in this Agreement, express or implied, is intended to confer upon any party

other than the parties hereto or their respective successors and permitted assignees any rights, remedies, obligations, or liabilities

under or by reason of this Agreement, except as expressly provided herein.

11.2.

Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together

shall be deemed to be one and the same agreement. A signed copy of this Agreement delivered by facsimile, e-mail or other means of electronic

transmission shall be deemed to have the same legal effect as delivery of an original signed copy of this Agreement.

11.3.

Titles and Subtitles. The titles and subtitles used in this Agreement are for convenience only and are not to be considered in

construing or interpreting this Agreement.

11.4.

Notices.

Any

notice, request, instruction, or other document required by the terms of this Agreement, or deemed by any of the Parties hereto to be

desirable, to be given to any other Party hereto shall be in writing and shall be given by personal delivery, overnight delivery, mailed

by registered or certified mail, postage prepaid, with return receipt requested, or sent by electronic mail (with receipt confirmed)

to the addresses of the parties as follows:

| |

If

to Investor: |

To the address previously provided to

|

| |

|

Company by Investor. |

| |

|

|

| |

If

to Company:

|

HUMBL,

Inc.

|

| |

|

Attn:

Brian Foote |

| |

|

101

W. Broadway, Suite 1450, |

| |

|

San

Diego, California 92101 |

| |

|

Email:

brian@humbl.com |

| |

|

|

| |

with

a copy to: |

FitzGerald

Kreditor Bolduc Risbrough LLP

|

| |

|

Attn:

Lynne Bolduc |

| |

|

2

Park Plaza, Suite 850 |

| |

|

Irvine,

CA 92614 |

| |

|

lbolduc@FKBRLegal.com |

The

persons and addresses set forth above may be changed from time to time by a notice sent as aforesaid. If notice is given by personal

delivery or overnight delivery in accordance with the provisions of this Section, such notice shall be conclusively deemed given at the

time of such delivery provided a receipt is obtained from the recipient. If notice is given by mail in accordance with the provisions

of this Section, such notice shall be conclusively deemed given upon receipt and delivery or refusal. If notice is given by electronic

mail transmission in accordance with the provisions of this Section, such notice shall be conclusively deemed given at the time of delivery

if between the hours of 9:00 a.m. and 5:00 p.m. Pacific time on a business day (“business hours”) and if not during

business hours, at 9:00 a.m. on the next business day following delivery, provided a delivery confirmation is obtained by the sender.

11.5.

Amendments. Any term of this Agreement may be amended, modified, or terminated only with the written consent of the Company and

the Investor.

11.6.

Waiver. No waiver of any of the provisions of this Agreement will be deemed, or will constitute, a waiver of any other provision,

whether or not similar. No waiver will constitute a continuing waiver. No waiver will be binding unless executed in writing by the party

charged with the waiver. Failure by either party to exercise any right hereunder shall not operate or be construed as a waiver of any

breach of that right or a waiver of any other right.

11.7.

Severability. In case any one or more of the provisions contained in this Agreement is for any reason held to be invalid, illegal,

or unenforceable in any respect, such invalidity, illegality, or unenforceability shall not affect any other provision of this Agreement,

and such invalid, illegal, or unenforceable provision shall be reformed and construed so that it will be valid, legal, and enforceable

to the maximum extent permitted by law.

11.8.

Entire Agreement. This Agreement, together with the Purchase Agreement and any related exhibits and schedules thereto, constitutes

the sole and entire agreement of the parties to this Agreement with respect to the subject matter contained herein, and supersedes all

prior and contemporaneous understandings and agreements, both written and oral, with respect to such subject matter. Notwithstanding

the foregoing, in the event of any conflict between the terms and provisions of this Agreement and those of the Purchase Agreement, the

terms and conditions of this Agreement shall control.

11.9.

Dispute Resolution.

a)

Governing Law. This Agreement and the rights of the parties hereunder shall be governed by and construed in accordance with the

laws of the State of California including all matters of construction, validity, performance, and enforcement and without giving effect

to the principles of conflict of laws.

b)

Exclusive Jurisdiction and Venue. The parties agree that the state and federal courts in the County of Orange, State of California

shall have sole and exclusive jurisdiction and venue for the resolution of all disputes arising under the terms of this Agreement and

the transactions contemplated herein.

c)

Attorneys’ Fees. In the event any party hereto shall commence legal proceedings against the other to enforce the terms hereof,

or to declare rights hereunder, as the result of a breach of any covenant or condition of this Agreement, the prevailing party in any

such proceeding shall be entitled to recover from the losing party its costs of suit, including reasonable attorneys’ fees, as

may be fixed by the court.

d)

Delays or Omissions. No delay or omission to exercise any right, power, or remedy accruing to any party under this Agreement,

upon any breach or default of any other party under this Agreement, shall impair any such right, power, or remedy of such nonbreaching

or non-defaulting party, nor shall it be construed to be a waiver of or acquiescence to any such breach or default, or to any similar

breach or default thereafter occurring, nor shall any waiver of any single breach or default be deemed a waiver of any other breach or

default theretofore or thereafter occurring. All remedies, whether under this Agreement or by law or otherwise afforded to any party,

shall be cumulative and not alternative.

[SIGNATURE

PAGE FOLLOWS]

IN

WITNESS WHEREOF, the parties have executed this Investor Rights Agreement as of the date first written above.

| |

COMPANY: |

| |

|

|

| |

HUMBL,

INC., |

| |

a

Delaware corporation |

| |

|

|

| |

By: |

|

| |

|

Jeffrey

Hinshaw |

| |

|

Chief

Financial Officer |

| |

INVESTOR:

|

| |

|

| |

SARTORII,

LLC, |

| |

a

Delaware limited liability company |

| |

|

|

| |

By: |

|

| |

|

Stephen

Foote |

| |

|

Manager |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

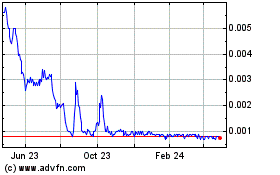

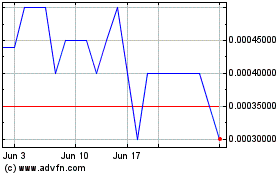

HUMBL (PK) (USOTC:HMBL)

Historical Stock Chart

From Nov 2024 to Dec 2024

HUMBL (PK) (USOTC:HMBL)

Historical Stock Chart

From Dec 2023 to Dec 2024