Current Report Filing (8-k)

July 08 2022 - 4:06PM

Edgar (US Regulatory)

0001680139

false

0001680139

2022-07-05

2022-07-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the

Securities Exchange

Act of 1934

Date of Report (Date of

earliest event reported): July 5, 2022

HealthLynked Corp.

(Exact name of registrant

as specified in charter)

| Nevada |

|

000-55768 |

|

47-1634127 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

1265 Creekside

Parkway, Suite 302, Naples FL 34108

(Address of principal executive offices)

(800)

928-714

(Registrant’s telephone

number, including area code)

N/A

(Former Name or Former Address, if Changed Since

Last Report)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Securities registered pursuant to Section 12(b)

of the Act: None.

Item 1.01 Entry into a Material Definitive Agreement.

On July 5, 2022, HealthLynked

Corp. (the “Company”) entered into a Standby Equity Purchase Agreement (the “SEPA”) with YA II PN, Ltd. (“Yorkville”).

Pursuant to the SEPA, the Company shall have the right, but not the obligation, to sell to Yorkville up to 30,000,000 of its shares of

common stock, par value $0.0001 per share, at the Company’s request any time during the commitment period commencing on July 5,

2022 and terminating on the earliest of (i) the first day of the month following the 36-month anniversary of the SEPA and (ii) the date

on which Yorkville shall have made payment of any advances requested pursuant to the SEPA for shares of the Company’s common stock

equal to the commitment amount of 30,000,000 shares of common stock. Each sale the Company requests under the SEPA (an “Advance”)

may be for a number of shares of common stock with an aggregate value of up to greater of: (i) an amount equal to thirty percent (30%)

of the aggregate daily volume traded of Common Shares on the Company’s Principal Market for the three (3) Trading Days immediately

preceding an Advance Notice, or (ii) 2,000,000 shares of common stock. The shares would be purchased at 96.0% of the Market Price (as

defined below) and would be subject to certain limitations, including that Yorkville could not purchase any shares that would result in

it owning more than 4.99% of the Company’s outstanding common stock at the time of an Advance (the "Ownership Limitation").

“Market Price” is defined in the SEPA as the average of the VWAPs (as defined below) during each of the three consecutive

trading days commencing on the trading day following the Company’s submission of an Advance notice to Yorkville. “VWAP”

is defined in the SEPA to mean, for any trading day, the daily volume weighted average price of the Company’s common stock for such

date on the Principal Market (as defined below) as reported by Bloomberg L.P. during regular trading hours. “Principal Market”

is defined in the SEPA as the New York Stock Exchange, the Nasdaq Global Select Market, the Nasdaq Global Market, the Nasdaq Capital Market,

OTC Markets’ OTCQB Market, or the NYSE Euronext, whichever is at the time the principal trading exchange or market for the Common

Shares.

Pursuant to the SEPA,

the Company (i) is required to register all shares which Yorkville may acquire and file with the Securities and Exchange Commission

an effective shelf registration statement on Form S-1 (the “Registration Statement”), registering the shares of Common

Stock that are to be offered and sold to Yorkville pursuant to the SEPA along with the Commitment Shares (as defined below), and

(ii) currently intends to use the net proceeds from any sale of the shares for working capital and other general corporate purposes.

As consideration for Yorkville’s commitment to purchase shares of common stock at our direction upon the terms and subject to

the conditions set forth in the SEPA, upon execution of the SEPA, we issued to Yorkville 895,255 shares of Common Stock pursuant to

the terms of the SEPA (the “Commitment Shares”), and (2) paid Yorkville’s structuring and due diligence fees of

$10,000.

Furthermore, the Company entered into a Note Purchase Agreement dated July 5, 2022 (the “Note Agreement”) pursuant to which,

within three business days after the effectiveness of the Registration Statement, the Company may request that Yorkville enter into a promissory note (“Promissory Note”) in an amount up to $550,000.

The Promissory Note will mature on the six-month anniversary of execution. The Promissory Note accrues interest at a rate of 0%, but will

be issued with 5% original issue discount, and will be repaid in 5 equal monthly installments beginning on the 30th day following the

date of the Promissory Note’s execution. The Promissory Note may be repaid with the proceeds of an Advance under the Purchase Agreement or repaid

in cash and, if repaid in cash, together with a 2% premium.

The foregoing is a summary

description of certain terms of the SEPA and Note Purchase Agreement. For a full description of all terms, please refer to the copies

of the SEPA and the Note Purchase Agreement that are filed herewith as Exhibit 10.1 and Exhibit 10.2 to this Current Report on Form 8-K

and is incorporated herein by reference.

This Current Report on Form

8-K shall not constitute an offer to sell or a solicitation of an offer to buy any shares of common stock, nor shall there be any sale

of shares of common stock in any state or jurisdiction in which such an offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or other jurisdiction.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits:

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this Current Report on Form 8-K to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

HEALTHLYNKED CORP. |

| |

|

| Date: July 8, 2022 |

/s/ George O’Leary |

| |

George O’Leary |

| |

Chief Financial Officer |

2

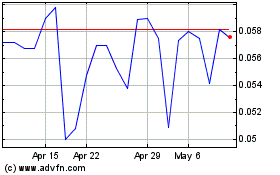

HealthLynked (QB) (USOTC:HLYK)

Historical Stock Chart

From Aug 2024 to Sep 2024

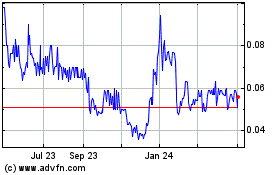

HealthLynked (QB) (USOTC:HLYK)

Historical Stock Chart

From Sep 2023 to Sep 2024