Asia Stocks Higher, Australia Bucks Negative Growth Report

December 06 2016 - 11:40PM

Dow Jones News

Asian shares were broadly higher Wednesday, catching a lift from

gains in the U.S., as a weak Japanese yen helped exporters' stocks

on the Nikkei Stock Average.

The Nikkei was recently up 0.4% in morning trade. S&P/ASX

200 was 0.6% higher, even though Australia recorded its first

negative quarter of economic growth since 2011. Korea's Kospi added

0.1% and Hong Kong's Hang Seng Index rose 0.5%.

Overnight, the Dow Jones Industrial Average hit another record,

ending up 0.2%. The S&P 500 rose 0.3% and the Nasdaq Composite

gained 0.2%.

In Asia on Wednesday, the yen was recently down 0.3% against the

U.S. dollar, which improves the competitiveness of Japanese

exporters. Among individual stocks, Toyota Motor was 1.4% higher

and Panasonic rose 1.9%

"It's a combination of follow-on from positive sentiment in the

U.S. last night," said Alex Furber, a sales trader at CMC Markets

in Singapore. "Also remember, Japan is enjoying a slightly weaker

yen…so that helps buoy sentiment."

In Australia, gross domestic product fell 0.5% in the third

quarter from the second quarter. Economists surveyed by The Wall

Street Journal expected the economy to contract by 0.1%.

Treasurer Scott Morrison said a reluctance among businesses to

invest was to blame. He called on lawmakers outside the ruling

Liberal-National coalition to act "in the national interest" by

supporting budget bills, including tax cuts for small

businesses.

"Driving investment is the challenge," said Mr. Morrison, adding

that he wants to get "capital out of its cave."

Resilience in Australian stocks Wednesday was attributable to

gains by the country's big four banks, which make up about a third

of the weighting of the S&P/ASX 200 Index.

Bank stocks across Asia were benefiting from reports that Italy

was preparing to take a 2 billion euro ($2.1 billion) controlling

stake in Banca Monte dei Paschi di Siena, one of the country's many

troubled banks.

The Japanese Topix index that tracks banks was recently up 1.8%,

with Sumitomo Mitsui Financial adding 1.4% and Mitsubishi UFJ

Financial gaining 1.7%. In Australia, Westpac Banking added 1.3%,

while Commonwealth Bank of Australia gained 0.8%.

In China, the Shanghai Composite Index was recently down 0.2%,

as investors were concerned about additional scrutiny for insurers

that have been aggressive about buying stakes in companies.

On Wednesday, China's insurance regulator said it would send two

teams to inspect insurers Foresea Life and Evergrande Life, as the

government seeks to "contain possible financial risks brought by

massive stake buyouts by heavyweight insurance players," according

to the official Xinhua News Agency.

Equity investing by insurers in China has lately lifted the

Shanghai market and traders are worried that a crackdown will

remove this impetus.

"Now that insurance funds are in the regulatory crosshairs, they

will be much less of a driving force in the market," said Xiao

Shijun, an analyst at Guodu Securities.

More broadly, Asian markets are turning their attention to the

U.S. Federal Reserve meeting next week. According to CME Group's

FedWatch tool, the probability of a rise in interest rates remains

higher than 90%.

Signaling what comes after a December increase in interest rates

could prove thornier, though, due to continued uncertainty about

economic policy under a Trump administration and

Republican-controlled Congress. President-elect Donald Trump has

pledged to cut taxes and boost spending, which could spur

growth.

David Winning, Yifan Xie, Harriet Torry and Kenan Machado

contributed to this article.

Write to Ese Erheriene at ese.erheriene@wsj.com

(END) Dow Jones Newswires

December 06, 2016 23:25 ET (04:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

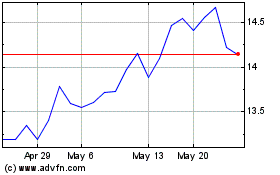

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Nov 2024 to Dec 2024

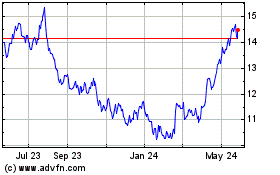

Hang Seng Bank (PK) (USOTC:HSNGY)

Historical Stock Chart

From Dec 2023 to Dec 2024