Glencore Backs 2021 Production View; Sees Marketing Earnings at Top Half of Range

April 29 2021 - 2:59AM

Dow Jones News

By Jaime Llinares Taboada

Glencore PLC on Thursday said that first-quarter production was

in line with expectations, maintained guidance for its key

commodities, and said full-year marketing earnings will be within

the higher end of the guidance range.

The Switzerland-headquartered, natural-resources company

reported that its coal production declined 23% to 24.5 million

metric tons in the first quarter from a year earlier, reflecting

the Prodeco operation in Colombia being in care and maintenance and

market-related production cuts in Australia.

As for metals, copper output was up 3% in the period, cobalt

increased 11%, zinc fell 4%, lead was down 10%, nickel dropped 11%,

and ferrochrome rose 3%.

Gold production was up 6% and silver stayed broadly flat. Oil

output plunged 41% to 1.07 million barrels.

Glencore reaffirmed full-year production guidance for copper,

cobalt, zinc, nickel, ferrochrome and coal.

In addition, Chief Executive Ivan Glasenberg said that 2021

earnings before interest and taxes from the marketing business are

expected to sit within the top half of Glencore's long-term $2.2

billion-$3.2 billion annual guidance range.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

April 29, 2021 02:44 ET (06:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

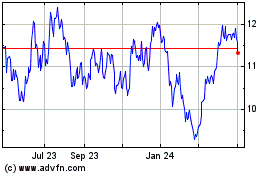

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Oct 2024 to Oct 2024

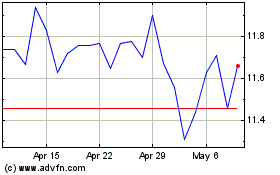

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Oct 2023 to Oct 2024