Glencore Swings to 2nd Half Profit, Confirms Dividend Resumption -- Update

February 16 2021 - 3:19AM

Dow Jones News

--Glencore softened its full-year loss by achieving profit for

the second half of 2020

--Adjusted Ebitda was almost in line with 2019, helped by a

price recovery in the second half and the performance of the

marketing business

--The company is resuming the dividend this year after meeting

its debt reduction target

By Jaime Llinares Taboada

Glencore PLC on Tuesday reported a widened loss for 2020, but

the group swung to a profit for the second half and confirmed the

resumption of the dividend in 2021.

The FTSE 100 Anglo-Swiss mining-and-oil company booked a net

loss of $1.90 billion for the whole year, widening from a $404

million loss in 2019. It was worse than a consensus forecast of a

$1.73 billion net loss taken from FactSet and based on 13 analysts'

estimates.

However, Glencore delivered a net profit of $697 million for the

second half of the year, bouncing back from a $2.60 billion loss

for the first half, as commodity prices improved. Glencore had

booked impairment charges of $3.2 billion in the first half as a

result of lower prices.

Adjusted Ebitda came in at $11.56 billion, slightly below the

$11.60 billion in 2019, but well above the $10.69 billion market

consensus, taken from Vuma and based on 12 analysts.

"A notable improvement was seen at our Katanga operation in the

DRC, where its successful ramp-up lifted Africa copper Ebitda to

$712 million," Chief Executive Ivan Glasenberg said.

The marketing division helped maintain underlying performance

broadly in line with 2019 levels despite the effects of the

pandemic on operations and prices. Adjusted EBIT from the marketing

business was $3.3 billion, 41% higher than a year earlier.

Mr. Glasenberg added that strong second half cash flows helped

reduce net debt to $15.84 billion as at Dec. 31, meeting the

company's deleveraging target.

Glencore is therefore resuming the dividend by recommending a

distribution of $0.12 a share in 2021.

Glencore said in the summer that it wouldn't make any

distribution to shareholders in 2020 in order to prioritize

reducing net debt to below $16 billion.

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

February 16, 2021 03:04 ET (08:04 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

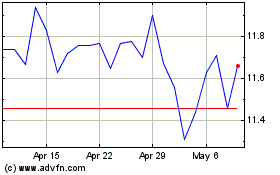

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Oct 2024 to Oct 2024

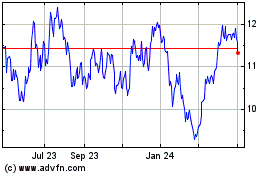

Glencore (PK) (USOTC:GLNCY)

Historical Stock Chart

From Oct 2023 to Oct 2024