UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

———————

FORM 10-K

———————

| |

þ

| ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the fiscal year ended: December 31, 2015

OR

| |

o

| TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from: _____________ to _____________

Commission file number: 000-54129

Evolutionary Genomics, Inc.

(Exact name of registrant as specified in its charter)

| |

Nevada

| 26-4369698

|

(State or Other Jurisdiction

| (I.R.S. Employer

|

of Incorporation or Organization)

| Identification No.)

|

| |

1026 Anaconda Drive, Castle Rock, CO 80108

|

(Address of Principal Executive Offices)

|

|

|

Registrant’s telephone number, including area code: (720) 900-8666

Securities registered pursuant to Section 12(g) of the Act: Common Stock, $.001 par value

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes o No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Exchange Act. Yes o No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No o

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No o

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company.

| | | |

Large accelerated filer

| o

| Accelerated filer

| o

|

Non-accelerated filer

| o

| Smaller reporting company

| þ

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). o Yes þ No

The aggregate market value of common stock held by non-affiliates of the Registrant as of June 30, 2015 was $201,277 based on the closing price on the last day of trading prior to June 30, 2015.

Shares outstanding as of February 15, 2016 was 7,894,111 shares of common stock, $.001 par value.

DOCUMENTS INCORPORATED BY REFERENCE: None

Evolutionary Genomics, Inc.

TABLE OF CONTENTS

| | |

|

| PAGE

|

| PART I

| |

ITEM 1.

| Business

| 1

|

ITEM 1A.

| Risk Factors

| 7

|

ITEM 1B.

| Unresolved Staff Comments

| 14

|

ITEM 2.

| Properties

| 15

|

ITEM 3.

| Legal Proceedings

| 15

|

ITEM 4.

| Mine Safety Disclosures

| 15

|

| | |

| PART II

| |

ITEM 5.

| Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities

| 16

|

ITEM 6.

| Selected Financial Data

| 16

|

ITEM 7.

| Management’s Discussion and Analysis of Financial Condition and Results of Operations

| 16

|

ITEM 7A.

| Quantitative and Qualitative Disclosures About Market Risk

| 20

|

ITEM 8.

| Financial Statements

| 20

|

ITEM 9.

| Changes in and Disagreements with Accountants on Accounting and Financial Disclosure

| 20

|

ITEM 9A.

| Controls and Procedures

| 21

|

ITEM 9B.

| Other Information

| 22

|

|

| |

| PART III

| |

ITEM 10.

| Directors, Executive Officers and Corporate Governance

| 23

|

ITEM 11.

| Executive Compensation

| 26

|

ITEM 12.

| Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters

| 27

|

ITEM 13.

| Certain Relationships and Related Transactions, and Director Independence

| 27

|

ITEM 14.

| Principal Accounting Fees and Services

| 28

|

|

| |

| PART IV

| |

ITEM 15.

| Exhibits, Financial Statement Schedules

| 29

|

|

| |

SIGNATURES

| 30

|

i

Cautionary Statement Regarding Forward-Looking Information

This report includes “forward-looking statements” that are subject to risks, uncertainties and other factors, including the risk that the Mergers will not be consummated, as the Mergers are subject to certain closing conditions. All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including statements regarding the expected timing of the completion of the mergers and to complete the mergers considering the various closing conditions; continued compliance with government regulations, changing legislation or regulatory environments; any statements of expectation or belief and any statements of assumptions underlying any of the foregoing. These risks, uncertainties and other factors, and the general risks associated with the businesses of the Company described in the reports and other documents filed with the SEC, could cause actual results to differ materially from those referred to in the forward-looking statements. The Company cautions readers not to rely on these forward-looking statements. All forward-looking statements are based on information currently available to the Company and are qualified in their entirety by this cautionary statement. The Company anticipates that subsequent events and developments may cause its views to change. The information contained in this report speaks as of the date hereof and the Company has or undertakes no obligation to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise unless required by law.

PART I

ITEM 1. BUSINESS

Evolutionary Genomics, Inc. (the "registrant" or "Company") was incorporated under the laws of the state of Minnesota in November 1990 under the name Fonahome Corporation. On March 24, 2009, the Company reincorporated in the state of Nevada and merged with its wholly-owned subsidiary, Fona, Inc., adopting the surviving company’s name, Fona, Inc. The Company was originally formed to develop and market an interactive information and advertising service.

From December 1999 through October 2015, the Company had no significant business operations. On March 3, 2009, the Company held a shareholder meeting approving the Stock Purchase Agreement and an Agreement and Plan of Merger effectively changing the name of the Company to Fona Inc., a Nevada corporation (“Re-incorporation Merger”) and simultaneously adopting the capital structure of Fona Inc., which includes total authorized capital stock of 800,000,000 shares, of which 780,000,000 are common stock and 20,000,000 are blank check preferred stock. The preferred stock may be issued from time to time in one or more series with such designations, preferences and relative participating, optional or other special rights and qualifications, limitations or restrictions thereof, as shall be stated in the resolutions adopted by the Corporation’s Board providing for the issuance of such preferred stock or series thereof. On March 24, 2009, the Articles of Merger of Fonahome Corporation, a Minnesota Corporation, into Fona, Inc., a Nevada Corporation, were filed with the Nevada Secretary of State.

On June 6, 2014, Evolutionary Genomics, Inc., a Delaware corporation (“EG”), EG I, LLC (“EG I”) and Fona, Inc., a Nevada corporation (“Fona”), Fona Merger Sub, Inc., a Delaware corporation (“Sub”) and Fona Merger Sub, LLC, a Colorado limited liability company (“Sub LLC”), entered into an Agreement and Plan of Merger as amended by the Amended and Restated Agreement and Plan of Merger dated March 2, 2015 (the “Merger Agreement”), pursuant to which, on October 19, 2015 Sub merged with EG and Sub LLC merged with EG I, with each EG and EG I surviving as wholly owned subsidiaries of Fona. On October 19, 2015, Fona changed its name to Evolutionary Genomics, Inc.

The Company maintains headquarters at the office of its Chief Executive Officer. The Company maintains a website at www.evolgen.com. The Company is not required to deliver an annual report to security holders and at this time does not anticipate the distribution of such a report. The Company will file reports with the SEC.

The public may read and copy any materials the Company files with the SEC in the SEC’s Public Reference Section, Room 1580, 100 F Street N.E, Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Section by calling the SEC at 1-800-SEC-0330. Additionally, the SEC maintains an Internet site that contains reports, proxy, and information statements, and other information regarding issuers that file electronically with the SEC, which can be found at http://www.sec.gov.

1

GENERAL BUSINESS PLAN

On August 14, 2000, the Company was issued patent number 6274319, titled “Methods to identify evolutionarily significant changes in polynucleotide and polypeptide sequences in domestic plants and animals”. On June 1, 2004, the Company was issued patent number 6743580, titled “Methods for producing transgenic plants containing evolutionarily significant polynucleotides”. These patents are for the core Adapted Traits Platform that we use for the discovery of genes in humans, animals and commercial crops. The Company has applied the Adapted Traits Platform in research projects including identifying genes believed to be responsible for increases in yield in corn, increases in yield in rice, salt tolerance and sugar content in tomatoes and pest/disease resistance in soybeans and multiple other crops.

EG Technology – The Adapted Traits Platform (“ATP’)

Genomics research generates vast amounts of sequence data for thousands of genes. Some companies use this sequence data to try to predict the function of each gene and its potential to impact key traits. Others try to match the thousands of random deoxyribonucleic acid (“DNA”) changes between individuals with differences in traits. Evolutionary Genomics’ approach is to first narrow the search to genes that have undergone adaptive evolution (positively selected genes) in an organism that has an adapted trait of potential commercial value. To identify genes with impact on commercially desirable traits, Evolutionary Genomics screens first for positively selected genes. Evolutionary Genomics then focuses functional genomics efforts on demonstrating the effects of these genes on the desired traits.

Evolutionary Genomics uses the Adapted Traits Platform to perform high throughput molecular evolution analysis to identify positively selected genes based on Ka/Ks analysis (as defined below). Ka/Ks analysis was developed to document the role of positive selection on known protein coding genes. Molecular-level adaptive evolution is indicated when comparisons of homologous protein coding sequences from closely related species show that the number of amino acid differences fixed due to selection exceeds what can be expected by neutral evolution. Molecular-level positive selection can be detected in protein-coding genes by pairwise comparisons of the ratios of non-synonymous nucleotide substitutions per non-synonymous site (Ka) to synonymous substitutions per synonymous site (Ks). The algorithm, by comparing substitutions per site, takes into account, in rigorous fashion, the effect of bias and degeneracy in the genetic code, and also compensates for the effects of multiple hits at the same site. Ka/Ks ratios significantly greater than unity strongly suggest that positive selection has fixed greater numbers of amino acid replacements than can be expected as a result of chance alone.

Dr. Walter Messier, a Company founder and our Chief Technology Officer, published a seminal paper in the field: Messier and Stewart (1997) “Episodic adaptive evolution of primate lysozymes” Nature 385:151-154. The work described in this publication demonstrated that a known lysozyme gene that had been recruited for a new function to aid in digestion of leaves as a food source in certain monkeys had the kind of adaptive genetic changes indicating that the lysozyme gene had evolved more rapidly than the neutral substitution rate, indicating Darwinian positive selection. Many groups have used such methods to document Darwinian positive selection in other proteins. It was Dr. Messier’s insight that genes controlling a trait of interest could be identified by using molecular evolution analysis as a screen, comparing genes in a species with a trait to genes of a closely related species lacking the trait. The adapted genes found in such a screen could then be validated to determine their role in the presence or absence of the trait of interest.

Agricultural Industry

In the past century, agriculture has been characterized by enhanced productivity, the use of synthetic fertilizers and pesticides, selective breeding, mechanization, water contamination, and farm subsidies. Proponents of organic farming such as Sir Albert Howard argued in the early 20th century that the overuse of pesticides and synthetic fertilizers damages the long-term fertility of the soil. While this feeling lay dormant for decades, as environmental awareness has increased in the 21st century there has been a movement towards sustainable agriculture by some farmers, consumers, and policymakers.

Advances in genetic research and modification of crop species has led to increased yield, drought tolerance and disease/pest resistance. These advances have also led to an increased concentration within the providers of seed to the industry. The top seed companies control much of the implementation of new seed varieties through patents and licensing agreements. Genetic traits providers, like Evolutionary Genomics, identify and develop genes that impact traits of interest to the industry and market those genes to these seed companies.

2

Business Model

Evolutionary Genomics’ primary source of revenue to date has been contract services revenue for research performed by Evolutionary Genomics on behalf of other commercial entities and grant income received from governmental agencies, industry associations and grant making foundations for research performed. Ownership of the intellectual property developed can vary from Evolutionary Genomics retaining all intellectual property rights to retaining none of the developed intellectual property for the crop that is the subject of the project. In addition to the revenue resulting from contract services and grants, Evolutionary Genomics has entered into licensing agreements for the commercial use of intellectual property that we have developed. Licensing revenue can be lump sum payments, milestone payments upon achievement of defined goals and/or percentages of revenue for products sold by licensee. These payments are often many years after completion of gene identification project as licensees engage in significant additional testing including field trials prior to integration into licensee commercial germplasm lines. There can be no guarantee that these licensing agreements will result in any additional revenue for Evolutionary Genomics as further development of licensed intellectual property is mostly controlled by the licensee.

The rice yield gene project that Evolutionary Genomics performed under contract with RiceTec, Inc. was contract research work that resulted in a licensing agreement. On September 2, 2004, EG entered into a Research and License Agreement with RiceTec, Inc., a Delaware corporation having its principal place of business in Alvin, TX for the purpose of researching and identifying adapted genes, including adapted rice genes associated with commercially useful phenotypic characteristics such as enhanced yield. On July 26, 2006, the Company entered into a Commercial License Agreement in the Field of Rice granting RiceTec, Inc. an exclusive, royalty free license for the use of intellectual property developed under the research agreement in North America, Central America and South America and Evolutionary Genomics received a lump sum payment. Evolutionary Genomics is also entitled to future royalties for the use of the intellectual property in the rest of the world if RiceTec, Inc. markets germplasm including genes that Evolutionary Genomics has provided. Evolutionary Genomics also entered into a Commercial License Agreement outside the field of rice on July 26, 2006 with RiceTec, Inc. granting Evolutionary Genomics an exclusive world-wide, royalty-free license to the intellectual property in any field other than rice. RiceTec, Inc. is performing field trials on the genes identified in the research project and the license agreement has not, to date, resulted in licensing revenue for Evolutionary Genomics beyond the initial lump sum payment. No future revenues are expected to result from this research and EG does not consider these to be material contracts of the Company.

Evolutionary Genomics’ soybean pest resistance project is an illustration of the evolution of a project from concept through marketing to seed companies. The project has yielded five genes for pest resistance in soybeans with partial validation complete and full validation results expected in 2016. Evolutionary Genomics has had discussions with seed companies to commercialize the genes and intends to return to those discussions in the fall of 2016 with validation results. The Company has extended this pest resistance research to other crops including beans, tomatoes, cotton, citrus and coffee.

On August 6, 2015, the Company was awarded an Advanced Industries Accelerator Grant by the State of Colorado in the amount of $250,000 to fund further research in the development of pest resistance genes in soybeans and other crops and sweetness genes in tomatoes. Through December 31, 2015, the Company has recognized $107,934 of revenue from the contract and expects the research to continue into 2017. The Company maintains ownership of all intellectual property developed from the use of grant funds.

During 2013 and 2014 EG performed research on two projects for the Bill and Melinda Gates Foundation. On November 1, 2012 Evolutionary Genomics entered into a Master Services Agreement and Work Order #1 under that agreement with the Bill and Melinda Gates Foundation for the validation of EG 261 orthologs in beans and cowpeas. We expect to continue that validation work through 2016. While the market for beans and cowpeas is considerably smaller than for soybeans, we intend to market any genes that show positive validation results to the seed companies for commercialization. Through December 31, 2015, Evolutionary Genomics has recognized $648,098 of the $762,000 it is entitled to under that work order and expects to finish the project in 2016. On March 29, 2012, the Bill and Melinda Gates Foundation awarded Evolutionary Genomics a $100,000 grant to fund research into wheat stem rust using the Adapted Traits Platform.

3

Evolutionary Genomics’ Business Strategy

On April 29, 2014, the United States Patent and Trademark Office issued patent 8,710,300 titled EXPRESSION OF DIRIGENT GENE EG261 AND ITS ORTHOLOGS AND PARALOGS ENHANCES PATHOGEN RESISTANCE IN PLANTS. Evolutionary Genomics has also filed international patents on EG261 and engaged in discussions with seed companies regarding further validation of the effectiveness of EG261. Based on information received in those discussions, Evolutionary Genomics has engaged in a whole plant validation trial of EG261, EG19 another soybean pest resistance gene and a synthetic gene with the University of Missouri. Results of this validation trial are expected in the fall of 2016. The Company has also discovered additional candidate genes that may impact pathogen resistance. There can be no assurance that any of these genes will be proven effective in validation testing or lead to licensing agreements or revenue.

In validation studies completed in 2013, the University of Wisconsin-Madison validated the effectiveness of EG261 in their lab. If results from the whole plant validation trial confirm the findings of the University of Wisconsin-Madison for EG261 and the effectiveness of the new genes, the Company will enter negotiations for a long term research collaboration and licensing agreement with seed companies. If these negotiations are successful, this type of agreement will likely have an upfront payment, milestone payments during their testing and a licensing royalty stream once the genes are incorporated into commercial seed lines. The testing phase includes field trials which may proceed for several years prior to generating licensing revenue. There are many risks in this process including some that are outside of Evolutionary Genomics’ control and there can be no guarantee that we will ever generate any revenue from these potential agreements. If Evolutionary Genomics receives product royalties from the soybean genes, it is required to pay the United Soybean Board a ten percent royalty stream not to exceed 150% of the grant amount of $262,476.

The Company has identified pest/disease resistance genes in other commercially valuable crops and intends to pursue research to identify and validate those genes. It is Evolutionary Genomics’ intention to engage in validation studies with independent labs to validate their resistance effectiveness, patent the genes and market them to the seed industry. This strategy will require Evolutionary Genomics to incur significant research costs prior to any confirmation of commercial viability and there can be no guarantee that the desired results can be achieved or that commercialization can be reached. The Company should finish the project funded by the Bill and Melinda Gates Foundation for the validation of bean and cowpea genes in 2016.

Evolutionary Genomics has identified a gene in tomatoes that appears to impact the plant’s ability to tolerate salt and a gene that appears to control sweetness. Evolutionary Genomics filed a patent application on the use of these genes and engaged the University of Florida to perform validation of these genes. Evolutionary Genomics received results from these tests in 2015 which confirm that these genes do significantly impact sweetness in tomatoes. Despite discussions with seed companies, the Company has not been able to reach any agreement to license these genes and there can be no assurance that we will ever realize any revenue from these genes.

In 2014, the Company began a project to identify genes in cotton that may impact traits of commercial interest. In particular, we intend to focus on pest resistance and fiber length. We have used our Adapted Traits Platform to identify positively selected candidate genes and, during 2016, intend to further research these genes to confirm that they were positively selected. If any of these genes remain promising, we intend to contract with an independent lab to validate the effectiveness of those genes. These studies can be very costly and there can be no assurance that we will be successful with this project.

Evolutionary Genomics intends to vigorously pursue grant funding from governmental agencies, industry associations and grant making foundations but these sources of funding are often subject to limitations in available funds, funding priorities in areas other than the our area of focus, political uncertainties, long approval processes and competition with other research proposals. If such funding is not available, Evolutionary Genomics may incur the costs of these projects with the prospect of revenue uncertain and likely many years in the future.

Competition

Evolutionary Genomics’ competition is very broad from the largest seed companies like Monsanto Company, Syngenta AG, Bayer Crop Science, Dupont Pioneer and Dow and others to the smallest grower who is successful in breeding new, improved varieties. These same competitors are also Evolutionary Genomics customers as Evolutionary Genomics seeks to license intellectual property for commercialization into their seed lines. Many of these companies are exponentially larger with many more resources at their disposal and there can be no assurance that EG can continue to compete with them or interest them in licensing our intellectual property.

4

Patents

Evolutionary Genomics is the owner of the following issued and pending patent applications and are not licensed from third parties:

| | | | | | |

Patent/App Serial #

| Jurisdiction

| Title

| Description

| Filing Date

| Issue Date

| Expire Date

|

6,274,319

| United States

| METHODS TO IDENTIFY EVOLUTIONARILY SIGNIFICANT CHANGES IN POLYNUCLEOTIDE AND POLYPEPTIDE SEQUENCES IN DOMESTICATED PLANTS AND ANIMALS

| Core Adapted Traits Platform method of gene identification

| 8/5/1999

| 8/14/2001

| 8/5/2019

|

6,743,580

| United States

| METHODS FOR PRODUCING TRANSGENIC PLANTS CONTAINING EVOLUTIONARILY SIGNIFICANT POLYNUCLEOTIDES

| Core Adapted Traits Platform method of gene identification

| 6/6/2001

| 6/1/2004

| 6/6/2021

|

7,439,018

| United States

| EG1117 POLYNUCLEOTIDES AND USES THEREOF

| Corn and rice yield genes

| 1/16/2003

| 10/21/2008

| 1/16/2023

|

8,710,300

| United States

| EXPRESSION OF DIRIGENT GENE EG261 AND ITS ORTHOLOGS AND PARALOGS ENHANCES PATHOGEN RESISTANCE IN PLANTS

| EG261 - soybean pathogen resistance gene

| 7/23/2013

| 4/29/2014

| 7/23/2033

|

13901071

| United States

| DIRIGENT GENE EG261 AND ITS ORTHOLOGS AND PARALOGS AND THEIR USES FOR PATHOGEN RESISTANCE IN PLANTS

| EG261 - plant pathogen resistance gene - broader claims than issued US patent 8710300

| 5/23/2013

|

| 5/23/2033

|

20130101827

| Argentina

| DIRIGENT GENE EG261 AND ITS ORTHOLOGS AND PARALOGS AND THEIR USES FOR PATHOGEN RESISTANCE IN PLANTS

| EG261 - plant pathogen resistance gene - broader claims than issued US patent 8710300

| 5/24/2013

|

| 5/24/2033

|

2872128

| Canada

| DIRIGENT GENE EG261 AND ITS ORTHOLOGS AND PARALOGS AND THEIR USES FOR PATHOGEN RESISTANCE IN PLANTS

| EG261 - plant pathogen resistance gene - broader claims than issued US patent 8710300

| 5/23/2013

|

| 5/23/2033

|

1120140293813

| Brazil

| DIRIGENT GENE EG261 AND ITS ORTHOLOGS AND PARALOGS AND THEIR USES FOR PATHOGEN RESISTANCE IN PLANTS

| EG261 - plant pathogen resistance gene - broader claims than issued US patent 8710300

| 5/23/2013

|

| 5/23/2033

|

10112/DELNP/2014

| India

| DIRIGENT GENE EG261 AND ITS ORTHOLOGS AND PARALOGS AND THEIR USES FOR PATHOGEN RESISTANCE IN PLANTS

| EG261 - plant pathogen resistance gene - broader claims than issued US patent 8710300

| 5/23/2013

|

| 5/23/2033

|

201380039727.4

| China

| DIRIGENT GENE EG261 AND ITS ORTHOLOGS AND PARALOGS AND THEIR USES FOR PATHOGEN RESISTANCE IN PLANTS

| EG261 - plant pathogen resistance gene - broader claims than issued US patent 8710300

| 5/23/2013

|

| 5/23/2033

|

14479550

| United States

| DIRIGENT GENE EG261 AND ITS ORTHOLOGS AND PARALOGS AND THEIR USES FOR PATHOGEN RESISTANCE IN PLANTS

| Continuation in Part of 61652029 and 61789463 and PCT/US2013/004382 to add data

| 9/8/2014

|

| 9/8/2034

|

62093705

| United States

| EXPRESSION OF F-BOX/KELCH-REPEAT GENE EG19, DIRIGENT GENE EG261, THEIR ORTHOLOGS AND PARALOGS ENHANCES PATHOGEN RESISTANCE IN PLANTS

| EG19, EG261 and EGSynthetic genes for pathogen resistance in soybeans

| 12/18/2014

|

| 12/18/2034

|

14775142

| United States

| IDENTIFICATION AND USE OF TOMATO GENES CONTROLLING SALT/DROUGHT TOLERANCE AND FRUIT SWEETNESS

| Tomato sweetness and salt tolerance genes

| 9/11/2015

|

| 9/11/2035

|

62168389

| United States

| IDENTIFICATION AND USE OF TOMATO GENES CONTROLLING SALT/DROUGHT TOLERANCE AND FRUIT SWEETNESS

| Tomato sweetness and salt tolerance genes

| 5/29/2015

|

| 5/29/2035

|

14769326.1

| Europe

| IDENTIFICATION AND USE OF TOMATO GENES CONTROLLING SALT/DROUGHT TOLERANCE AND FRUIT SWEETNESS

| Tomato sweetness and salt tolerance genes

| 3/14/2014

|

| 3/14/2034

|

5

Material Agreements

On November 1, 2012 Evolutionary Genomics entered into a Master Services Agreement and Work Order #1 with the Bill and Melinda Gates Foundation for the validation of EG 261 orthologs in beans and cowpeas. Through December 31, 2015, Evolutionary Genomics has recognized $648,098 of the $762,000 it is entitled to under that work order and expects to finish the project in 2016. Evolutionary Genomics retains ownership of patents and intellectual property developed during the project and will make intellectual property available to people in developing countries at an affordable price. For intellectual property developed during the project but not on intellectual property that Evolutionary Genomics developed prior to the project, Evolutionary Genomics will pay to the Bill and Melinda Gates Foundation a seven percent royalty on sales of products outside of the developing countries. Work Order #1 has a term from November 1, 2012 through September 30, 2016 and may be terminated by Evolutionary Genomics for breach or by the Bill and Melinda Gates Foundation, with or without cause, upon thirty days written notice. Upon termination, Evolutionary Genomics is entitled to receive all amounts due through date of termination.

Effective September 1, 2013, the Company entered into an agreement with Tennessee State University as amended for the phenotyping of cowpea and common beans. Evolutionary Genomics has paid $77,802 of the total $165,000 due under this contract and expects this work to be completed in 2016. There are no provisions for termination of the contract. Evolutionary Genomics retains ownership of all intellectual property.

Effective March 1, 2012, Evolutionary Genomics entered into an Agreement for Contract Services with Smith Bucklin Corporation (the “Contractor”) on behalf of the United Soybean Board. The contract includes the payment of certain royalties, as defined in the Agreement. Evolutionary Genomics retains all ownership of patents and intellectual property developed in the project and is obligated to pay royalties to the United Soybean Board of ten percent of the sale of products derived from the soybean genes that were the subject of the research performed or from royalties received from the sale of products by a third party not to exceed 150% of the total amount paid to Evolutionary Genomics under this Agreement. Evolutionary Genomics recognized revenue of $262,476 from this contract, thus limiting any future royalties to a total of $393,714. The project term has expired but the royalty provisions remain in perpetuity.

On December 3, 2014, Evolutionary Genomics entered into a Fee for Service Agreement with The Curators of the University of Missouri for the development of transgenic soybean plants with candidate genes for SCN resistance and, on February 21, 2015 entered into the Sponsored Research Contract for phenotyping of transgenic soybean samples. The total amount to be paid under these contracts is $348,020 and work to be performed under these contracts is the transgenic validation of Evolutionary Genomics soybean genes. The term of the project is November 1, 2014 through October 31, 2016 and may be terminated with thirty days prior written notice. Evolutionary Genomics will retain sole ownership of all patents and intellectual property, royalty free for all materials (including previously identified genes). Evolutionary Genomics also has a six month exclusive option period to license nay intellectual property developed during the project under reasonable and customary royalty terms.

On August 6, 2015, the Company was awarded an Advanced Industries Accelerated Grant by the State of Colorado in the amount of $250,000 to fund further research in the development of pest resistance genes in soybeans and other crops and sweetness genes in tomatoes. Through December 31, 2015, the Company has recognized $107,934 of revenue from the contract and expects the research to continue into 2017. The Company maintains ownership of all intellectual property developed from the use of grant funds.

Trademarks

Evolutionary Genomics has no registered trademarks.

Employees

Evolutionary Genomics had three full time employees and one part time employee as of the date of December 31, 2015.

6

Facilities

The Company leases its operating facility and prepaid twelve months of rent on June 16, 2014 for the period of July 1, 2014 through June 30, 2015 on the original lease term. The lease was extended and the second year rent of $27,500 is being paid in monthly installments of $2,291 per month during the second year. Renewals are by mutual agreement.

Legal Proceedings

Evolutionary Genomics is not currently involved in or aware of any threatened or actual legal proceedings.

Capitalization

The Company is authorized to issue up to 780,000,000 shares of Common Stock and up to 20,000,000 shares of preferred stock. As of December 31, 2015, the Company had 5,881,898 shares of Common Stock outstanding and no shares of preferred stock outstanding. 1,400,000 shares of common stock have been reserved for issuance pursuant to the Company’s 2015 Stock Incentive Plan. Option grants have been issued for 340,000 shares of common stock at an exercise price of $0.55 per share, options for 120,000 shares have been exercised and option grants of 220,000 shares remain outstanding. 113,479 shares of common stock have been reserved for issuance upon the exercise of warrants outstanding as of December 31, 2015. Those warrants have an average exercise price of $6.60 per share.

ITEM 1A. RISK FACTORS

We may require substantial additional funding and may be unable to raise capital when needed, which could force us to delay, reduce or eliminate planned activities or result in our inability to continue as a going concern.

We may require additional capital to pursue planned research projects. Our future capital requirements will depend on, and could increase significantly as a result of, many factors, including:

·

the duration and results of the research projects;

·

unexpected delays or costs incurred in the acquisition of plant materials needed in these research projects and with subcontracts that perform various parts of these projects;

·

the time and cost in preparing, filing, prosecuting, maintaining and enforcing patent claims;

·

other unexpected developments encountered in implementing our business development, research development and commercialization strategies; and

·

further arrangements, if any, with collaborators.

We may attempt to raise additional funds through public or private financings, collaborations with other companies or financing from other sources. Additional funding may not be available on terms which are acceptable to us. If adequate funding is not available to us on reasonable terms, we may need to delay, reduce or eliminate one or more of our research and development projects or obtain funds on terms less favorable than we would otherwise accept. To the extent that additional capital is raised through the sale of equity securities or securities convertible into or exchangeable for equity securities, the issuance of those securities could result in dilution to our stockholders. Moreover, the incurrence of debt financing could result in a substantial portion of our future operating cash flow, if any, being dedicated to the payment of principal and interest on such indebtedness and could impose restrictions on our operations. This could render us more vulnerable to competitive pressures and economic downturns.

In addition, if we do not meet our payment obligations to third parties as they come due, we may be subject to litigation claims. Even if we are successful in defending against these claims, litigation could result in substantial costs and be a distraction to management, and may result in unfavorable results that could further adversely impact our financial condition.

7

We have relied on the availability of grant funding to fund some of our research efforts and our inability to compete successfully for these limited grant funding opportunities may significantly affect our results of operations and our ability to complete research projects.

We have traditionally funded many of our research projects, partially or wholly, using grant funding provided by government programs, industry associations and grant making institutions. The availability of these funds is impacted by many factors including changing political priorities, fiscal budget issues, agency priorities, availability of funds and competition from other grant seekers. Our ability to present proposals that fit within grant making guidelines and which are attractive relative to other proposals submitted may significantly impact our ability to fund our research projects.

Efforts to protect our intellectual property rights and to defend claims against us can increase our costs and will not always succeed; any failures could adversely affect profitability or restrict our ability to do business.

Intellectual property rights are crucial to our business. We endeavor to obtain and protect our intellectual property rights in jurisdictions in which products are produced from the biotechnology that we produce and in jurisdictions into which those products are imported. Different nations may provide limited rights and inconsistent duration of protection for our intellectual property. We may be unable to obtain protection for our intellectual property in key jurisdictions. Even if protection is obtained, competitors, farmers or others may raise legal challenges to our rights or illegally infringe on our rights, including through means that may be difficult to prevent or detect. In addition, because of the rapid pace of technological change, and the confidentiality of patent applications in some jurisdictions, competitors may be issued patents from applications that were unknown to us prior to issuance. These patents could reduce the value of our commercial or pipeline biotechnology or, to the extent they cover key technologies on which we have unknowingly relied, require that we seek to obtain licenses or cease using the technology, no matter how valuable to our business. We cannot assure we would be able to obtain such a license on acceptable terms. In addition, patent laws are subject to change and any change in our ability to protect the intellectual property that we develop may impact our ability to commercialize that intellectual property. The extent to which we succeed or fail in our efforts to protect our intellectual property will affect our costs, sales and other results of operations.

Genes that we have discovered and may discover in the future with expected desirable impact on traits may, upon further research and field trials, be revealed to also have undesirable impact on traits.

Evolutionary Genomics’ gene discovery process focuses on the identification of positively selected genes that impact the trait of interest that we are working on. When we further test them in lab validation, we are again focused on whether they have the desired impact on the trait of interest and we are specifically testing for that outcome. Laboratory experiments are under more ideal circumstances than field trials and use in production and there can be no guarantee that the lab result will be repeated under those conditions. Additional field trials and use in production may also reveal undesirable impacts on other traits that were not a focused part of our research. For example, the soybean genes that we have discovered may be found to have a negative impact on yield, oil content or the growth cycle. These may impact our ability to realize revenue from the commercialization of our biotechnology and may expose us to liability for undesirable outcomes that we don’t anticipate.

Others may find additional genes or other methods of accomplishing the same desired outcome that our biotechnology does, rendering our biotechnology less valuable or commercializable.

There are many other companies pursuing similar gene discovery programs and other approaches to solving the same issues that we are addressing and many of these companies have vastly more resources than we do. Even when we identify genes that impact desired traits, there may be other genes that have a similar or greater effect on these traits. For example, one or more of the other 30,000 genes in soybeans may have an impact on pest/disease resistance similar to our genes or there may be other orthologs of the genes that we have discovered in other varieties that have a greater impact. In addition, other companies may develop commercial chemicals that compete with genetic changes to solve the issues that we are addressing. Any of these may impact our ability to realize revenue from the commercialization of our biotechnology.

8

The successful development of our research efforts and commercialization of our biotechnology will be necessary for our growth and profitability.

We intend to use recent successes in which we have identified genes that may have an impact on pest/disease resistance in soybeans and look for orthologs of those genes in other crops. There may not be orthologs of these genes in other crops and performing this research may result in significant costs incurred without any commercial value produced. We also intend to attempt to improve the potential pest/disease resistance genes we have identified. There can be no assurance we will be able to achieve any improvement and performing this research may also result in significant costs incurred without any commercial value produced. Additionally, we intend to use a similar method of gene identification that we used in the soybean project in other crops, including cannabis, and for many other traits but there can be no assurance that genes for these traits exist in those crops or that, if they do exist, we will be able to find them. The processes of breeding, biotechnology trait discovery and development and trait integration are lengthy and a very small percentage of the genes identified in research are selected for commercialization. The length of time and the risk associated with the breeding and biotech pipelines are interlinked because both are required as a package for commercial success in markets where biotech traits are approved for growers. Commercial success frequently depends on being the first company to the market, and many of our competitors are also making considerable investments in similar new biotechnology. Consequently, if we are not able to fund extensive research and development activities and deliver new products to the markets we serve on a timely basis, our growth and operations will be harmed.

We rely heavily on our founder, Walter Messier, our current Chief Technology Officer. The loss of his services would have a material adverse effect upon us and our business and prospects.

Our success depends, to a significant extent, upon the continued services of Walter Messier, who is a founder of Evolutionary Genomics and our current Chief Technology Officer. Since inception, we have been dependent upon Dr. Messier, who is the inventor on most of our patents and responsible for the development of our core Adapted Traits Platform. If Dr. Messier or any key management personnel resign to join a competitor or form a competing company, the loss of such personnel, together with the loss of any customers or potential customers due to such executive’s departure, could materially and adversely affect our business and results of operations.

We are dependent on a technically trained workforce and an inability to retain or effectively recruit such employees could have a material adverse effect on our business, financial condition and results of operations.

Our ability to compete effectively depends largely on our ability to attract and retain certain key personnel, including additional researchers that we intend to hire in order to pursue our planned research projects. Industry demand for such skilled employees, however, exceeds the number of personnel available, and the competition for attracting and retaining these employees is intense. Because of this intense competition for skilled employees, we may be unable to retain our existing personnel or attract additional qualified employees to keep up with future business needs. If this should happen, our business, operating results and financial condition could be adversely affected.

In addition, we intend to hire business development and marketing personnel and advisors to promote and market the biotechnology that we develop. We cannot assure you that we will be able to recruit and retain qualified personnel and advisors to perform these functions. Our inability to hire and then retain such personnel, advisors and scientists could have a materially adverse effect on our business and our projects.

Our investments in other entities may not be successful or may be illiquid for many years.

Evolutionary Genomics owns shares of series A-2 preferred stock in Vet DC, Inc., a Delaware corporation which is focused on developing pet therapeutic products. Vet DC, Inc. is related to the Evolutionary Genomics through common ownership and management. The investment was made for purposes of capital appreciation and from excess cash reserves. VetDC, Inc. is a private company with no plans to become publicly traded. There may never be a market for these shares and there can be no assurance that VetDC, Inc. will be successful with their business plan.

9

We may pursue future growth through strategic acquisitions and alliances which may not yield anticipated benefits and may adversely affect our operating results, financial condition and existing business.

We may seek to grow in the future through strategic acquisitions in order to complement and expand our business. The success of our acquisition strategy will depend on, among other things:

·

the availability of suitable candidates;

·

competition from other companies for the purchase of available candidates;

·

our ability to value those candidates accurately and negotiate favorable terms for those acquisitions;

·

the availability of funds to finance acquisitions;

·

the ability to establish new informational, operational and financial systems to meet the needs of our business;

·

the ability to achieve anticipated synergies, including with respect to complementary products; and

·

the availability of management resources to oversee the integration and operation of the acquired businesses.

If we are not successful in integrating acquired businesses and completing acquisitions in the future, we may be required to reevaluate our acquisition strategy. We also may incur substantial expenses and devote significant management time and resources in seeking to complete acquisitions. Acquired businesses may fail to meet our performance expectations. If we do not achieve the anticipated benefits of an acquisition as rapidly as expected, or at all, investors or analysts may not perceive the same benefits of the acquisition as we do. If these risks materialize, our stock price could be materially adversely affected.

We may not obtain the necessary permits and authorizations to operate our business.

We may not be able to obtain or maintain the necessary licenses, permits, authorizations or accreditations, or may only be able to do so at great cost, to operate our cannabis-related business. In addition, we may not be able to comply fully with the wide variety of laws and regulations applicable to the cannabis industry. Failure to comply with or to obtain the necessary licenses, permits, authorizations or accreditations could result in restrictions on our ability to operate our cannabis business, which could have a material adverse effect on our business.

If we incur substantial liability from litigation, complaints, or enforcement actions, our financial condition could suffer.

Our participation in the cannabis industry may lead to litigation, formal or informal complaints, enforcement actions, and inquiries by various federal, state, or local governmental authorities against these subsidiaries. Litigation, complaints, and enforcement actions involving these subsidiaries could consume considerable amounts of financial and other corporate resources, which could have a negative impact on our sales, revenue, profitability, and growth prospects.

Competition in agricultural biotechnology has significantly affected and will continue to affect our revenue and results of operations.

Many companies engage in research and development of plant biotechnology and breeding and speed in getting a new product to market can be a significant competitive advantage. Our competitors’ success could render the biotechnology that we identify as less competitive, resulting in reduced sales compared to our expectations or past results. We expect to see increasing competition from agricultural biotechnology firms and from major agrichemical, seed and food companies. The extent to which we can realize cash and profit from our business will depend on our ability to control research costs, predict and respond effectively to competitor products and marketing; and develop new products and services attractive to our customers.

10

Our customers are subject to extensive regulation affecting their use of our biotechnology, which may affect our revenue and profitability.

Regulatory and legislative requirements affect the development and distribution of products made from the biotechnology that we produce, including the testing and planting of seeds containing our biotechnology traits and the import of crops grown from those seeds, and non-compliance can harm our revenue and profitability. Obtaining testing, planting and import approvals for seeds or biotechnology traits can be time-consuming and costly, with no guarantee of success. The failure to receive necessary permits or approvals could have near- and long-term effects on our ability to sell some current and future biotechnology. Concern about unintended but unavoidable trace amounts (sometimes called “adventitious presence”) of commercial biotechnology traits in conventional (non-biotechnology) seed, or in the grain or products produced from conventional or organic crops, among other things, could lead to increased regulation or legislation, which may include: liability transfer mechanisms that may include financial protection insurance; possible restrictions or moratoria on testing, planting or use of biotechnology traits; and requirements for labeling and traceability, which requirements may cause food processors and food companies to avoid biotechnology and select non-biotechnology crop sources and can affect farmer seed purchase decisions and, ultimately the sale and use of the biotechnology that we produce. Legislation encouraging or discouraging the planting of specific crops can also harm our sales.

The degree of public acceptance or perceived public acceptance of products made from our biotechnology can affect our sales and results of operations by affecting planting approvals, regulatory requirements and farmer purchase decisions.

Some opponents of the use of biotechnology in agriculture raise public concern about the potential for adverse effects of products produced using genetic information that we provide to our customers on human or animal health, other plants and the environment. The potential for adventitious presence of commercial biotechnology traits in conventional seed, or in the grain or products produced from conventional or organic crops, is another factor that can affect general public acceptance of these traits. Public concern can affect the timing of, and whether our customers are able to obtain, government approvals. Even after approvals are granted, public concern may lead to increased regulation or legislation or litigation concerning prior regulatory approvals, which could affect our sales and results of operations by affecting planting approvals, and may adversely affect sales of our customers’ products to farmers, due to their concerns about available markets for the sale of crops or other products derived from biotechnology which may lead to less demand from our customers. In addition, opponents of agricultural biotechnology have attacked farmers’ fields and facilities used by agricultural biotechnology companies, and may launch future attacks against farmers’ fields and our field testing sites and research, production, or other facilities, which could affect our sales and our costs.

We are dependent upon other companies to integrate biotechnology that we have licensed to them into their breeding operations for our future license revenue.

We perform research for other entities under grant and research agreements that provide service revenue. In addition to the service revenue, our long term profitability depends on the commercialization of the biotechnology that we provide to other companies for their commercial breeding lines. The extent to which our biotechnology is integrated into these breeding lines is largely outside of our control and can take many years. If our biotechnology is not integrated into breeding lines, we may not realize license revenue which may affect our results of operations.

The biotechnology industry is subject to rapid technological change, and if we fail to keep up with such change, our results of operations and financial condition could be adversely impacted.

Biotechnology has undergone and is subject to rapid and significant change. We expect that the technologies associated with biotechnology research and development will continue to develop rapidly. Our failure to keep pace with such rapid change could result in our products becoming obsolete and we may be unable to recoup any expenses incurred with developing such products, which may adversely affect our future revenues and financial condition.

11

The Company may be required to expend substantial sums in order to bring it into compliance with the various reporting requirements applicable to public companies and/or to prepare required financial statements, and such efforts may harm operating results or be unsuccessful altogether.

We are subject to many of the requirements applicable to public companies, including Section 404 of the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, which requires that the combined company evaluate and report on its system of internal controls. If the combined company’s finance and accounting staff or internal controls over financial reporting are inadequate, it may be required to hire additional staff and incur substantial legal and accounting costs to address such inadequacies. Moreover, the combined company cannot be certain that its remedial measures to correct current material weaknesses will be effective. Any failure to implement required or improved controls, or difficulties encountered in their implementation, could harm the combined company’s operating results or increase its risk of material weaknesses in internal controls.

Members of our management team have significant influence over us.

Our officers and directors own, directly or indirectly approximately 40.1% of the outstanding shares of common stock, excluding options and warrants. Including options and warrants, our officers and directors own, directly or indirectly, approximately 41.0% of the outstanding shares of common stock. These stockholders, therefore, have a controlling influence in determining the outcome of any corporate transaction or other matters submitted to our stockholders for approval, including Mergers, consolidations and the sale of all or substantially all of our assets, election of directors, and other significant corporate actions. The interests of these stockholders may differ from the interests of our other stockholders.

Our certificate of incorporation and bylaws and Nevada law may have anti-takeover effects that could discourage, delay or prevent a change in control, which may cause our stock price to decline.

Our certificate of incorporation and bylaws and law could make it more difficult for a third party to acquire us, even if closing such a transaction would be beneficial to our stockholders. We are authorized to issue up to 20,000,000 shares of preferred stock. This preferred stock may be issued in one or more series, the terms of which may be determined at the time of issuance by our board of directors without further action by stockholders. The terms of any series of preferred stock may include voting rights (including the right to vote as a series on particular matters), preferences as to dividend, liquidation, conversion and redemption rights and sinking fund provisions. We currently have no shares of preferred stock issued and outstanding. The issuance of any preferred stock could materially adversely affect the rights of the holders of our common stock and existing holders of preferred stock, and therefore, reduce the value of those securities. In particular, specific rights granted to future holders of preferred stock could be used to restrict our ability to merge with, or sell our assets to, a third party and thereby preserve control by the present management.

Provisions of our certificate of incorporation and bylaws and law also could have the effect of discouraging potential acquisition proposals or making a tender offer or delaying or preventing a change in control, including changes a stockholder might consider favorable. Such provisions may also prevent or frustrate attempts by our stockholders to replace or remove our management. In particular, the certificate of incorporation and bylaws and law, as applicable, among other things:

·

provide the board of directors with the ability to alter the bylaws without stockholder approval;

·

place limitations on the removal of directors;

·

provide that the Board of Directors may change the size of the Board; and

·

provide that vacancies on the board of directors may be filled by a majority of directors in office, although less than a quorum.

These provisions may delay or prevent someone from acquiring or merging with us, which may cause the market price of our common stock to decline.

12

We do not foresee paying cash dividends in the foreseeable future and, as a result, our investors’ sole source of gain, if any, will depend on capital appreciation, if any.

We do not plan to declare or pay any cash dividends on our shares of common stock in the foreseeable future and currently intend to retain any future earnings for funding growth. As a result, investors should not rely on an investment in our securities if they require the investment to produce dividend income. Capital appreciation, if any, of our shares may be investors’ sole source of gain for the foreseeable future. Moreover, investors may not be able to resell their shares of our common stock at or above the price they paid for them.

The requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract and retain executive management and qualified board members.

As a public company, we are subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, the Sarbanes-Oxley Act of 2002, or the Sarbanes-Oxley Act, the Dodd-Frank Wall Street Reform and Consumer Protection Act, the listing requirements of The OTC Stock Market and other applicable securities rules and regulations. Compliance with these rules and regulations will increase our legal and financial compliance costs, make some activities more difficult, time-consuming or costly and increase demand on our systems and resources. The Exchange Act requires, among other things, that we file annual, quarterly and current reports with respect to our business and operating results. The Sarbanes-Oxley Act requires, among other things, that we maintain effective disclosure controls and procedures and internal control over financial reporting. In order to maintain and, if required, improve our disclosure controls and procedures and internal control over financial reporting to meet this standard, significant resources and management oversight may be required. As a result, management’s attention may be diverted from other business concerns, which could adversely affect our business and operating results. We will need to hire additional employees in the future or engage outside consultants to help us comply with these requirements, which will increase our costs and expenses. Specifically, management identified the following control deficiencies: (1) the Company has not properly segregated duties as one or two individuals initiate, authorize, and complete all transactions. The Company has not implemented measures that would prevent the individuals from overriding the internal control system. The Company does not believe that this control deficiency has resulted in deficient financial reporting because the Chief Financial Officer is aware of his responsibilities under the SEC’s reporting requirements and personally certifies the financial reports. (2) The Company has installed accounting software that does not prevent erroneous or unauthorized changes to previous reporting periods and does not provide an adequate audit trail of entries made in the accounting software.

In addition, changing laws, regulations and standards relating to corporate governance and public disclosure create uncertainty for public companies, increase legal and financial compliance costs and make some activities more time-consuming. These laws, regulations and standards are subject to varying interpretations, in many cases due to their lack of specificity, and, as a result, their application in practice may evolve over time as new guidance is provided by regulatory and governing bodies. This could result in continuing uncertainty regarding compliance matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We intend to invest resources to comply with evolving laws, regulations and standards, and this investment may result in increased general and administrative expenses and a diversion of management’s time and attention from our business activities to compliance activities. If our efforts to comply with new laws, regulations and standards differ from the activities intended by regulatory or governing bodies, regulatory authorities may initiate legal proceedings against us and our business may be adversely affected.

Being a public company and the associated public company rules and regulations make it more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. These factors could also make it more difficult for us to attract and retain qualified members of our board of directors, particularly to serve on our audit committee and compensation committee, and qualified executive officers.

As a result of disclosure of information in filings required of a public company, our business and financial condition has become more visible, which we believe may result in threatened or actual litigation. If such claims are successful, our business and operating results would be adversely affected, and even if the claims do not result in litigation or are resolved in our favor, these claims, and the time and resources necessary to resolve them, could divert the resources of our management and adversely affect our business and operating results.

13

As a result of being a public company, we are obligated to develop and maintain proper and effective internal control over financial reporting. We may not complete our analysis of our internal control over financial reporting in a timely manner, or these internal controls may not be determined to be effective, which may adversely affect investor confidence in our company and, as a result, the value of our common stock.

We are required pursuant to Section 404 of the Sarbanes-Oxley Act to furnish a report by management on, among other things, the effectiveness of our internal control over financial reporting. This assessment needs to include disclosure of any material weaknesses identified by our management in our internal control over financial reporting. We also are required to disclose changes made in our internal control and procedures on a quarterly basis. Eventually, we may be required to obtain a statement that our independent registered public accounting firm has issued an opinion on our internal control over financial reporting.

As we are unable to assert that our internal control over financial reporting is effective, or, if when required, our independent registered public accounting firm is unable to express an opinion on the effectiveness of our internal controls, we could lose investor confidence in the accuracy and completeness of our financial reports, which would cause the price of our common stock to decline, and we may be subject to investigation or sanctions by the SEC.

Our ability to use our net operating loss carry-forwards and certain other tax attributes is limited by Sections 382 and 383 of the Internal Revenue Code.

Subject to certain limitations, a corporation may offset a net operating loss carryforward against profit earned in a future year to determine its U.S. federal income tax expenses for such year. Sections 382 and 383 of the Internal Revenue Code of 1986 limit a corporation’s ability to utilize its net operating loss carryforwards and certain other tax attributes (including research credits) to offset future federal taxable income or tax if, in general, the corporation experiences a cumulative ownership change of more than 50% over any rolling three year period. State net operating loss carryforwards (and certain other tax attributes) may be similarly limited. For the year ended December 31, 2015, we recorded no state tax liability. An ownership change can therefore result in significantly greater tax liabilities than a corporation would incur in the absence of such a change and any increased liabilities could adversely affect the corporation’s business, results of operations, financial condition and cash flow.

As of December 31, 2015, we had available total federal and state net operating loss carryforwards of approximately $3,772,000, which expire in the years 2027 through 2033. We have not completed our analysis of any potential Section 382 ownership changes for the year ended December 31, 2015.

Additional ownership changes may occur in the future as a result of additional equity offerings or events over which we will have little or no control, including purchases and sales of our equity by our five-percent security holders, the emergence of new five-percent security holders, redemptions of our securities or certain changes in the ownership of any of our five percent security holders.

If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about our business, our stock price and trading volume could decline.

The trading market for our common stock depends in part on the research and reports that securities or industry analysts publish about us or our business. We do not currently have and may never obtain research coverage by securities and industry analysts. If no securities or industry analysts commence coverage of our company, the trading price for our stock would be negatively impacted. If we obtain securities or industry analyst coverage and if one or more of the analysts who covers us downgrades our stock, or publishes unfavorable research about our business, our stock price would likely decline. If one or more of these analysts ceases coverage of us or fails to publish reports on us regularly, demand for our stock could decrease, which could cause our stock price and trading volume to decline.

ITEM 1B. UNRESOLVED STAFF COMMENTS

Not applicable.

14

ITEM 2. PROPERTIES

The Company has no properties and at this time has no agreements to acquire any properties. The Company currently maintains a rent free mailing address at 1026 Anaconda Drive, Castle Rock, CO 80108, which is the address of the office of its Chief Executive Officer and lab facilities on lease at 1801 Sunset Place, Unit C, Longmont CO 80501.

ITEM 3. LEGAL PROCEEDINGS

The Company is not a party to any pending legal proceedings, and no such proceedings are known to be contemplated.

ITEM 4. MINE SAFETY DISCLOSURES

Not applicable.

15

PART II

ITEM 5. MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED STOCKHOLDER MATTERS, AND ISSUER PURCHASES OF EQUITY SECURITIES

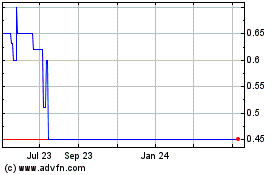

There is only a very limited market for the Company's securities. The Company’s securities are included on the bulletin board under the symbol FNAM. As of December 31, 2015, there were outstanding options for 220,000 shares of common stock and outstanding warrants to purchase 113,479 shares of common stock. The Company has no obligations to register any of its shares of common stock under the Securities Act of 1933. As of February 15, 2016, 32,204 of the Company’s outstanding shares were eligible for transfer without registration under the Securities Act.

As of February 15, 2016, there were approximately 350 holders of the Company's common stock.

No dividends have been paid by the Company on any of its securities since the renewal of its charter and such dividends are not contemplated in the foreseeable future.

ITEM 6. SELECTED FINANCIAL DATA

| | | | | | | | |

| | Year Ended December 31,

| |

| | 2015

| | | 2014

| |

|

| |

|

| |

|

Service and grant revenue

|

| $

| 262,924

|

|

| $

| 348,031

|

|

Gross profit (loss)

|

| $

| 116,348

|

|

| $

| (192,102

| )

|

Operating expenses

|

| $

| 839,206

|

|

| $

| 798,315

|

|

Net loss

|

| $

| (285,999

| )

|

| $

| (1,398,967

| )

|

| | | | | | | | |

| | As of December 31,

| |

| | 2015

| | | 2014

| |

|

| |

|

| |

|

Assets

|

| $

| 3,170,830

|

|

| $

| 1,358,345

|

|

Liabilities

|

| $

| 253,752

|

|

| $

| 176,465

|

|

Preferred stock

|

| $

| —

|

|

| $

| 1,341,168

|

|

Stockholders’ equity (deficit)

|

| $

| 2,917,078

|

|

| $

| (157,991

| )

|

ITEM 7. MANAGEMENT’S DICUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

The following discussion and analysis should be read in conjunction with the Audited Financial Statements and related notes included elsewhere in this 10-K. The following discussion includes certain forward-looking statements. For a discussion of important factors which could cause actual results to differ materially from the results referred to in the forward-looking statements, see “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements”.

Recent Highlights of Evolutionary Genomics

·

During 2013, Evolutionary Genomics finished a research project for SmithBucklin Corporation on behalf of the United Soybean Board for the validation, in transgenic soybeans, of candidate genes for mitigating losses caused by soybean cyst nematodes.

·

During 2013, Evolutionary Genomics received results from our contracted independent lab at the University of Wisconsin-Madison confirming that Evolutionary Genomics’ gene, EG261, has a significant impact on resistance to soybean cyst nematodes.

·

During 2014 and 2015, Evolutionary Genomics identified additional genes that we believe have an impact on pest/disease resistance in soybeans and other crops.

16

·

On April 29, 2014, the United States Patent Office issued patent number 13,949,035 to Evolutionary Genomics for DIRIGNET GENE EG261 AND ITS ORTHOLOGS AND PARALOGS AND THEIR USES FOR PATHOGEN RESISTANCE IN PLANTS.

·

During 2013, Evolutionary Genomics engaged with the University of Florida for the independent lab validation of the sweetness and salt resistance genes in tomatoes. Evolutionary Genomics received results of this validation testing in 2015 confirming the impact of these genes on sweetness.

·

During 2014 and 2015 and continuing into 2016, Evolutionary Genomics engaged the University of Missouri for the two generation, whole plant validation of the soybean pest resistance genes. Preliminary results on the first generation are expected in March 2016 with final results expected in the fall of 2016.

Audited Consolidated Results of Operations:

| | | | | | | | | | | | | | | | |

|

| Year Ended

|

|

| Year Ended

|

|

|

| December 31, 2015

|

|

| December 31, 2014

|

|

|

| Amount

|

|

| % of Revenue

|

|

| Amount

|

|

| % of Revenue

|

|

Service and grant revenue

|

| $

| 262,924

|

|

|

| 100.0

| %

|

| $

| 348,031

|

|

|

| 100.0

| %

|

Cost of services sold

|

|

| 146,576

|

|

|

| 55.7

| %

|

|

| 540,133

|

|

|

| 155.2

| %

|

Gross profit (loss)

|

|

| 116,348

|

|

|

| 44.3

| %

|

|

| (192,102

| )

|

|

| -55.2

| %

|

Research and development

|

|

| 416,160

|

|

|

| 158.3

| %

|

|

| 115,725

|

|

|

| 33.3

| %

|

Salaries and benefits

|

|

| 128,929

|

|

|

| 49.0

| %

|

|

| 212,021

|

|

|

| 60.9

| %

|

General and administrative

|

|

| 294,117

|

|

|

| 111.9

| %

|

|

| 470,569

|

|

|

| 135.2

| %

|

Total operating expenses

|

|

| 839,206

|

|

|

| 319.2

| %

|

|

| 798,315

|

|

|

| 229.4

| %

|

Operating (loss)

|

|

| (722,858

| )

|

|

| -274.9

| %

|

|

| (990,417

| )

|

|

| -284.6

| %

|

Other income and (expenses)

|

|

| 436,859

|

|

|

| 166.2

| %

|

|

| (409,847

| )

|

|

| -117.8

| %

|

Net loss

|

| $

| (285,999

| )

|

|

| -108.8

| %

|

| $

| (1,400,264

| )

|

|

| -402.3

| %

|

Service and Grant Revenue

Service and grant revenue decreased $85,107, or 24.5%, to $262,924 for the year ended December 31, 2015 from $348,031 for the year ended December 31, 2014. The decrease was primarily due to decreases in service revenue received from EG I, LLC partially offset by grant revenue received from the State of Colorado Advanced Industries Grant.

Cost of Services Sold

Cost of services sold decreased $393,557, or 72.9%, to $146,576 for the year ended December 31, 2015 from $540,133 for the year ended December 31, 2014. The decrease was primarily due to decreased costs on our project for EG I, LLC and on our grant project for Bill and Melinda Gates Foundation. As a percentage of revenue, cost of services sold decreased to 55.7% for the year ended December 31, 2015 from 155.2% for the year ended December 31, 2014.

Operating Expenses

Operating expenses increased $40,891, or 5.1%, to $839,206 for the year ended December 31, 2015 from $798,315 for the year ended December 31, 2014 and increased to 319.2% of revenue from 229.4% of revenue. Operating expenses consist of research and development expense, salaries and benefits and general and administrative expense. Changes in these items are described below.

Research and Development