Portugal's Market Regulator Sets Terms for CTG's EDP Offer

April 15 2019 - 3:47AM

Dow Jones News

By Nathan Allen

Portugal's market regulator, the CMVM, on Friday set out the

necessary conditions for China Three Gorges Corp.'s proposed

takeover of EDP-Energias de Portugal SA (EDP.LB) to proceed.

For the bid to go ahead, EDP's shareholders must vote in favor

of scrapping a 25% cap on voting rights at the company's coming

annual general meeting, the regulator said. China Three Gorges

would then have 45 days to fulfill the other conditions, such as

regulatory approvals, to formally register the bid, the CMVM

said.

If shareholders reject the proposal the CMVM said it will

consider the bid invalid and the takeover won't go any further.

China Three Gorges is already EDP's largest shareholder, with a

stake of just over 23%. It launched a 9.07 billion euro ($10.25

billion) offer to acquire the remaining equity last May, but

progress has stalled amid concerns from European Union and U.S.

regulators, who are wary of ceding control over power-generation

assets to China.

EDP's board and activist investor Elliott Management Corp.,

which holds a roughly 2.3% stake in the company, have also voiced

their opposition to the takeover, dismissing the offer as too

low.

Rather than accepting the bid, Elliott has pushed EDP's board to

focus more on renewables and cut debt by selling off assets.

Bloomberg has reported that CTG is considering withdrawing its

takeover bid in favor of smaller alternative deals that wouldn't

attract so much regulatory scrutiny, such as pursuing EDP's

Brazilian assets.

Write to Nathan Allen at nathan.allen@dowjones.com

(END) Dow Jones Newswires

April 15, 2019 03:32 ET (07:32 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

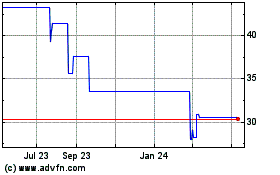

EDP Renovaveis (PK) (USOTC:EDRVY)

Historical Stock Chart

From Dec 2024 to Jan 2025

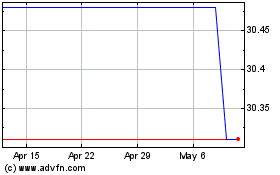

EDP Renovaveis (PK) (USOTC:EDRVY)

Historical Stock Chart

From Jan 2024 to Jan 2025