U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM 10-K

(Mark One)

|

x

|

ANNUAL REPORT PURSUANT TO UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For Fiscal Year Ended: December 31, 2011

OR

|

¨

|

TRANSITION REPORT PURSUANT TO UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

|

For the transition period from _______________

to _______________

Commission file number: 333-140148

|

Dynastar Holdings, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

Nevada

|

|

32-0309317

|

(State or other jurisdiction of

incorporation or

organization)

|

|

(IRS Employer Identification No.)

|

|

|

|

|

|

1311 Herr Lane

|

|

|

|

Louisville, Kentucky

|

|

40222

|

|

(Address of principal executive offices)

|

|

(Postal Code)

|

Registrant’s telephone

number:

(502) 326-8100

Securities registered under Section 12(b) of the Act:

None

Securities registered under Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned

issuer, as defined in Rule 405 of the Securities Act.

Yes

¨

No

x

Indicate by check mark if the

registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act. Yes

x

No

¨

Indicate by check mark whether

the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding past

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days. Yes

x

No

¨

Indicate by check mark if disclosure of delinquent filers pursuant

to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant's knowledge, in definitive

proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K.

¨

Indicate by check mark whether

the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required

to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months

(or for such shorter period that the registrant was required to submit and post such files) and 2) has been subject to such filing

requirements for the past 90 days. Yes

x

No

¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, or a smaller reporting company. See the definitions of the “large accelerated filer,”

“accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act:

|

Large Accelerated Filer

¨

|

Accelerated Filer

¨

|

|

Non-Accelerated Filer

¨

|

Smaller reporting company

x

|

|

(Do not check if a smaller reporting company)

|

|

Indicate by check mark whether the registrant is a shell company

(as defined in Rule 12b-2 of the Exchange Act).

Yes

¨

No

x

The registrant did not have an active market

for its common stock as of the last business day of its most recently completed second fiscal quarter; therefore, an aggregate

market value of the shares of voting and non-voting common equity held by non-affiliates cannot be determined.

The number of shares outstanding of the

registrant’s commons stock as of March 27, 2012 was 38,084,247.

DOCUMENTS INCORPORATED BY REFERENCE

Not Applicable.

TABLE OF CONTENTS

|

Item Number and Caption

|

|

Page

|

|

Forward-Looking Statements

|

|

3

|

|

|

|

|

|

PART I

|

|

|

4

|

|

|

|

|

|

|

1.

|

Business

|

|

4

|

|

1A.

|

Risk Factors

|

|

5

|

|

1B.

|

Unresolved Staff Comments

|

|

7

|

|

2.

|

Properties

|

|

7

|

|

3.

|

Legal Proceedings

|

|

7

|

|

4.

|

Mine Safety Disclosures

|

|

7

|

|

|

|

|

|

|

PART II

|

|

|

8

|

|

|

|

|

|

|

5.

|

Market For Registrant’s Common Equity, Related Stockholder Matters And Issuer Purchases Of Equity Securities

|

|

8

|

|

6.

|

Selected Financial Data

|

|

9

|

|

7.

|

Management’s Discussion and Analysis of Financial Condition and Results of Operations

|

|

9

|

|

8.

|

Financial Statements and Supplemental Data

|

|

10

|

|

9A.

|

Controls And Procedures

|

|

10

|

|

9B.

|

Other Information

|

|

12

|

|

|

|

|

|

|

PART III

|

|

|

12

|

|

|

|

|

|

|

10.

|

Directors, Executive Officers, and Corporate Governance

|

|

12

|

|

11.

|

Executive Compensation

|

|

15

|

|

12.

|

Security Ownership Of Certain Beneficial Owners And Management And Related Stockholder Matters

|

|

17

|

|

13.

|

Certain Relationships And Related Transactions and Director Independence

|

|

21

|

|

14.

|

Principal Accountant Fees And Services

|

|

23

|

|

|

|

|

|

|

PART IV

|

|

|

25

|

|

|

|

|

|

|

15.

|

Exhibits and Financial Statement Schedules

|

|

25-29

|

FORWARD-LOOKING STATEMENTS

Except for historical

information, this report contains forward-looking statements. Such forward-looking statements involve risks and uncertainties,

including, among other things, statements regarding our business strategy, future revenues and anticipated costs and expenses.

Such forward-looking statements include, among others, those statements including the words “expects,” “anticipates,”

“intends,” “believes” and similar language. Our actual results may differ significantly from those projected

in the forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to,

those discussed in the sections “Business” and “Management’s Discussion and Analysis of Financial Condition

and Results of Operations.” You should carefully review the risks described in this Annual Report and in other documents

we file from time to time with the Securities and Exchange Commission (the “SEC”). You are cautioned not to place undue

reliance on the forward-looking statements, which speak only as of the date of this report. We undertake no obligation to publicly

release any revisions to the forward-looking statements or reflect events or circumstances after the date of this document.

Although we believe that

the expectations reflected in these forward-looking statements are based on reasonable assumptions, there are a number of risks

and uncertainties that could cause actual results to differ materially from such forward-looking statements.

PART I

Recent Developments

On October 14, 2011,

we filed a certificate of amendment (the “Certificate”) with the Secretary of State of Nevada (i) changing our name

to Dynastar Holdings, Inc. (“Pubco,” “we,” “us,” or “our”), (ii) increasing our

authorized shares of Common Stock, par value $0.001 per share, from 74,000,000 shares to 300,000,000 shares, and (iii) increasing

its authorized shares of our blank check Preferred Stock, par value $0.001 per share, from 1,000,000 shares to 10,000,000 shares.

Also on October 14, 2011, our Board of the Directors authorized a 40.25-for-1 (Forty and 25/100 for One) forward stock split in

the form of a dividend (the “Stock Split”) on all of the outstanding shares of our Common Stock. All shares and per

share amounts in our financial statements included in this Annual Report have been adjusted to give retroactive effect to the Stock

Split.

On November 2, 2011,

we formed a wholly owned subsidiary, Dynastar Acquisition Corp., a Delaware corporation (“Acquisition Corp.”), for

the purpose of entering into a merger transaction described below. Effective November 2, 2011, our trading symbol was changed from

“MEDD.OB” to “DYNA.OB”.

On October 6, 2011,

Dynastar Ventures, Inc., a Delaware corporation (“Dynastar”), purchased an aggregate of 271,400,076 (6,742,859 pre-split)

shares of Pubco’s restricted common stock from the previous owner for cash consideration of $100,000. The 271,400,076 shares

purchased by Dynastar represented approximately 94.4% of Pubco’s issued and outstanding common stock as of the purchase date.

On January 17, 2012,

which we refer to as the “Closing Date,” Pubco, Acquisition Corp. and Dynastar entered into a merger agreement (“Merger Agreement”) and completed the merger (“Merger”).

As a result of the Merger, we acquired the business of Dynastar and will continue the existing business operations of Dynastar

as our wholly owned subsidiary. As further discussed below, on the Closing Date and as a condition to the Merger closing, Dynastar

surrendered for cancellation the 271,400,076 shares of our common stock that it had previously purchased.

The Merger

Pursuant to the Merger

Agreement, on the Closing Date, Acquisition Corp. merged with and into Dynastar, with Dynastar remaining as the surviving entity.

As a result of the Merger, each share of Dynastar common stock outstanding was cancelled and converted into the right to receive

one (1) share of our common stock. Prior to the Merger, no material relationship existed between Acquisition Corp. and Dynastar.

Prior to the closing

of the Merger, holders of the Series A Convertible Preferred Stock of Dynastar (the “Dynastar Preferred Stock”) agreed

(i) that their shares of Dynastar Preferred Stock would automatically convert into shares of Dynastar common stock immediately

prior to, and conditional upon, the closing of the Merger at the anti-dilution adjusted conversion price of $0.20 per share, rather

than at the original conversion price of $0.33 per share, and (ii) to waive certain rights they may have had under the terms of

the Dynastar Preferred Stock.

Prior to the closing

of the Merger, holders of the Dynastar 10% Secured Convertible Promissory Notes (the “Bridge Notes”) agreed (i) that

their Bridge Notes would automatically convert into shares of our common stock upon the closing of the Merger at the anti-dilution

adjusted conversion price of $0.20 per share, rather than at the original conversion price of $0.40 per share, (ii) that the Dynastar

warrants (“Dynastar Warrants”) to purchase one-half share of common stock of Dynastar, exercisable for a period of

five (5) years, at an exercise price of $0.80 per share, would automatically convert upon the closing of the Merger into our warrants

exercisable for a period of five (5) years, at an exercise price of $0.80 per share and (iii) to waive certain rights they may

have had under the terms of the Dynastar Warrants.

Pursuant to, and

upon closing of the Merger, the stockholders of Dynastar surrendered all of the issued and outstanding shares of Dynastar’s

capital stock, assuming conversion of Dynastar’s outstanding Dynastar Preferred Stock at the as adjusted conversion price

of $0.20 per share, and received, in exchange for such shares, an aggregate of 15,872,000 shares of our common stock. Our pre-merger

closing stockholders, other than Dynastar retained 16,103,541 shares of our common stock. Dynastar surrendered its 271,400,076

shares of our common stock, purchased on October 6, 2011, for cancellation pursuant to the Merger Agreement. The Bridge Notes were

converted, as to their outstanding principal amount, into an aggregate of 5,724,925 shares of our common stock and as to their

accrued interest amount, into an aggregate of 258,781 shares of our common stock. The Dynastar Warrants were exchanged into our

warrants to purchase an aggregate of 2,862,463 shares of our common stock and 125,000 shares of our common stock and a warrant

to purchase 62,500 shares of our common stock were issued to an investor in the initial closing of a private offering described

below.

For financial reporting

purposes, the Merger represents a capital transaction of Dynastar or a “reverse merger” rather than a business combination,

because the sellers of Dynastar controlled the combined company immediately following the completion of the Merger. As such, Dynastar

is deemed to be the accounting acquirer in the transaction and, consequently, the transaction is being treated as a recapitalization

of Dynastar. Accordingly, the assets and liabilities and the historical operations that will be reflected in our ongoing financial

statements will be those of Dynastar and will be recorded at the historical cost basis of Dynastar. Our assets, liabilities and

results of operations will be consolidated with the assets, liabilities and results of operation of Dynastar after consummation

of the Merger. Our historical financial statements before the Merger will be replaced with the historical financial statements

of Dynastar before the Merger and all future filings with the SEC. The Merger is intended to be treated as, and the parties have

agreed to take all actions necessary to ensure that the Merger is treated as, a tax-free exchange under Section 368(a) of the Internal

Revenue Code of 1986, as amended.

The Offering

Concurrently with

the closing of the Merger and in contemplation of the Merger, we completed a closing of a private offering (the “Offering”)

of 125,000 units of our securities, at a price of $0.20 per unit for an aggregate of $25,000. Each unit consisted of one share

of our common stock and a warrant to purchase one-half share of our common stock. The warrants are exercisable for a period of

five years at a purchase price of $0.80 per whole share of our common stock. A second closing of the Offering occurred on February

24, 2012 when a second investor in the Offering purchased 125,000 units for cash consideration of $25,000.

The Offering was

conducted on a “best efforts” basis. The closing of the Offering and the closing of the Merger were not conditioned

upon each other.

We paid the

placement agent in the offering, Gottbetter Capital Markets, LLC, a commission of 10% of the funds raised in the initial

closing of the offering. In addition the placement agent received five-year warrants to purchase a number of shares of our

common stock equal to five (5%) of the units sold in the initial closing of the Offering. As a result of the foregoing

arrangement, at the closing of the initial closing of the Offering, the placement agent was paid commissions of $2,500 and

was issued broker warrants to purchase 6,250 shares of our common stock at an exercise price of $0.20 per share.

Post Acquisition Reporting –

Rule 13a-1:

The

Merger, described above, was effective January 17, 2012, after our most recent fiscal year ended December 31, 2011. As a result,

the pre-merger business of Pubco, although dormant as of December 31, 2011, ceased to exist as of the Closing Date, January 17,

2012. To prevent a gap in financial reporting, in accordance with SEC Rule 13a-1, we are required to report all information normally

required in an Annual Report on Form 10-K related solely to the business of pre-merger Pubco as of December 31, 2011, and for the

fiscal year then ended. Unless otherwise indicated, all of the information furnished in this report refers solely to the business

activities of Pubco before the Merger.

Unless

otherwise indicated or the context otherwise requires, the terms “Company,” “we,” “us,” and

“our” refer to Dynastar Holdings, Inc. and its Subsidiary, before giving effect to the Merger. Unless otherwise indicated

or the context otherwise requires, the term “our business” refers to the business of Dynastar Holdings, Inc. and its

Subsidiary, before giving effect to the Merger.

For

information regarding the ongoing business of Dynastar Holdings, Inc. post-Merger, we advise you to refer the reader to the Current

Report on Form 8-K originally filed with the SEC on January 23, 2012 as amended on January 27, 2012.

Our Historical Development

We were founded as

an unincorporated business in January 2004 and became a C corporation in the State of Nevada on February 1, 2005. Historically,

we were a digital medical illustrator and animator providing digital displays and enhancements to companies that assist attorneys

to prepare or enhance exhibits for trials involving medical issues. On July 5, 2010, we transferred to a newly-formed company controlled

by Justin N. Craig, our former President, Chief Executive Officer, Chief Financial Officer and Chairman, certain operating assets

associated with the continuing operations of the digital medical illustrations business, subject to related liabilities, effectively

splitting off and terminating our digital medical illustration business. Following this split-off, our principal business objective

was to achieve long-term growth potential through a combination with a business rather than immediate, short-term earnings. As

of December 31, 2011, we were in discussions with Dynastar with regard to pursuing a business combination with Dynastar. We changed

our name to Dynastar Holdings, Inc. on October 17, 2011 in anticipation of a successful outcome to those discussions.

Our operations as of

December 31, 2011 were inactive, except for filing periodic reports with the SEC pursuant to the Securities Exchange Act of 1934

(the “Exchange Act”) and the rules and regulations promulgated thereunder and making other related corporate filings.

Based on our limited operations as of December 31, 2011, we qualified as a “shell company,” as that term is defined

under the Exchange Act, because we had no or nominal assets (other than cash) and no or nominal operations. We exited shell company

status on January 17, 2012 with the closing of the Merger.

As a result of the

Merger, we ceased to be a development stage company and ceased our search for a business combination.

Employees

As of December 31,

2011, we had no employees.

|

|

ITEM 1B.

|

UNRESOLVED STAFF COMMENTS

|

None.

As of December 31,

2011, we did not own or lease any property.

|

|

ITEM 3.

|

LEGAL PROCEEDINGS

|

As

of December 31, 2011, No legal or governmental proceedings are presently pending or, to our knowledge, threatened, to which we

are a party.

|

|

ITEM 4.

|

MINE SAFETY DICLOSURES.

|

Not

applicable.

PART II

|

|

ITEM 5.

|

MARKET FOR REGISTRANT’S COMMON EQUITY, RELATED

STOCKHOLDER MATTERS AND ISSUER PURCHASES OF EQUITY SECURITIES

|

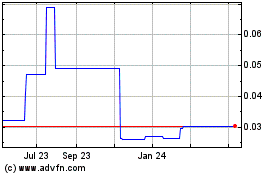

There is no established

current public market for our shares of common stock. A symbol was assigned for our common stock so that our common stock could

be quoted for trading on the OTCBB under MEDD prior to October 14, 2011 and then under DYNA thereafter. A minimal number of public

trades have occurred since April 30, 2007. There can be no assurance that a liquid market for our securities will ever develop.

Transfer of our common stock may also be restricted under the federal securities laws or the blue sky laws of various states and

foreign jurisdictions. Consequently, investors may not be able to liquidate their investments and should be prepared to hold the

common stock for an indefinite period of time.

We have never paid

any cash dividends on shares of our common stock and do not anticipate that we will pay dividends in the foreseeable future. We

intend to apply any earnings to fund the development of our business. The purchase of shares of common stock is inappropriate for

investors seeking current or near term income. We have never repurchased any of our equity securities.

Following the Merger,

our shares of common stock will remain eligible for quotation on the OTCBB. There is currently no established market for our common

stock.

Holders

As of March 27, 2012,

we had 38,084,247 shares of our common stock issued and outstanding held by 84 shareholders of record.

Securities Authorized For Issuance Under

Equity Compensation Plans

Our Board of Directors

and shareholders owning a majority of our outstanding common stock adopted our 2011 Equity Incentive Plan (the 2011 Plan”)

on October 14, 2011. The 2011 Plan provides for the issuance of up to 5,000,000 shares of our common stock as incentive awards

to be granted to executive officers, key employees, consultants, advisors and directors of the Company or its affiliates. As of

December 31, 2011, we had not granted any awards under the 2011 Plan.

Dividends

We have never paid

any cash dividends on our capital stock and do not anticipate paying any cash dividends on our common stock in the foreseeable

future. We intend to retain future earnings to fund ongoing operations and future capital requirements. Any future determination

to pay cash dividends will be at the discretion of our Board and will be dependent upon financial condition, results of operations,

capital requirements and such other factors as the Board deems relevant.

Recent Sales of Unregistered Securities

During the period covered

by this Annual Report, Pubco did not sell any of its securities.

|

|

ITEM 6.

|

SELECTED FINANCIAL DATA

|

Not applicable.

ITEM 7. MANAGEMENT’S

DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

EXPLANATORY

NOTE

Due to the

post acquisition reporting requirements of SEC Rule 13a-1, as discussed further in Item 1 above, the following discussion in this

section entitled, “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” only

refers to the business and financial position and related results of Pubco before the Merger. It does not include any information

on Dynastar or Dynastar Holdings, Inc. post-Merger. For information regarding the ongoing business of Dynastar Holdings, Inc. post-Merger,

we refer the reader to our Current Report on Form 8-K filed with the SEC as an amendment to our Form 8-K filed with the SEC on

January 23, 2012, as amended on January 27, 2012.

Results of Operations - Pubco

Fiscal year Ended December 31, 2011 and 2010

Revenues

We did not generate

any revenues from for the years ended December 31, 2011 and 2010.

Total operating expenses

For the years ended

December 31, 2011 and 2010, total operating expenses were $46,818 and $22,495, respectively. Administrative expenses increased

$24,323 during the year ended December 31, 2011 to $46,818 compared to $22,495 for the year ended December 31, 2010 primarily due

to an increase in professional fees related to the Merger.

Net Loss

Our net losses for

years ended December 31, 2011 and 2010 were $46,818 and $44,688, respectively.

We have generated no

revenues and our net operating loss from inception through December 31, 2011 was $185,074.

Off-Balance Sheet Arrangements

We have no off-balance

sheet arrangements, obligations under any guarantee contracts or contingent obligations. We also have no other commitments, other

than the costs of being a public company that will increase our operating costs or cash requirements in the future.

|

|

ITEM 7A.

|

QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET

RISK

|

Not

applicable.

|

|

ITEM 8.

|

FINANCIAL STATEMENTS AND SUPPLEMENTAL DATA

|

Our audited financial

statements are included beginning immediately following the signature page to this report. See Item 15 for a list of the financial

statements included herein.

The audited financial

statements of Dynastar for the period from May 4, 2010 (inception) through December 31, 2011 will be filed with the SEC as an amendment

to our Form 8-K filed with the SEC on January 23, 2012, as amended on January 27, 2012, to report the Merger and related matters.

|

|

ITEM 9A.

|

CONTROLS AND PROCEDURES

|

Evaluation of Disclosure Controls and Procedures

Pursuant to Rule 13a-15(b)

under the Securities Exchange Act, we carried out an evaluation, with the participation of our management, including our Interim

Chief Executive Officer (“CEO”) (our principal executive and financial officers), who are the same person, of the effectiveness

of our disclosure controls and procedures (as defined under Rule 13a-15(e) under the Exchange Act) as of the end of the period

covered by this report. Based upon that evaluation, our CEO concluded that our disclosure controls and procedures are effective

to ensure that information required to be disclosed by us in the reports that we file or submit under the Exchange Act, is recorded,

processed, summarized and reported, within the time periods specified in the SEC’s rules and forms, and that such information

is accumulated and communicated to our management, including our CEO, as appropriate, to allow timely decisions regarding required

disclosure.

Management’s Annual Report on Internal Control over

Financial Reporting

Our management is responsible

for establishing and maintaining adequate internal control over financial reporting for our company. Our internal control system

was designed to, in general, provide reasonable assurance to our management and board regarding the preparation and fair presentation

of published financial statements, but because of its inherent limitations, internal control over financial reporting may not prevent

or detect misstatements. Also, projections of any evaluation of effectiveness to future periods are subject to the risk that controls

may become inadequate because of changes in conditions, or that the degree of compliance with the policies or procedures may deteriorate.

Our management assessed

the effectiveness of our internal control over financial reporting as of December 31, 2011. The framework used by management in

making that assessment was the criteria set forth in the document entitled “Internal Control – Integrated Framework”

issued by the Committee of Sponsoring Organizations of the Treadway Commission. Based on that assessment, our management has determined

that as of December 31, 2011, our internal control over financial reporting was not effective for the purposes for which it is

intended. Management did not identify any material weaknesses in our internal control over financial reporting as of December 31,

2011; however, it has identified the following deficiencies that, when aggregated, may possibly be viewed as a material weakness

in our internal control over financial reporting as of that date:

|

|

1.

|

We do not have an audit committee. While we are not currently obligated to have an audit committee,

including a member who is an “audit committee financial expert,” as defined in Item 407 of Regulation S-K, under applicable

regulations or listing standards; however, it is management’s view that such a committee is an important internal control

over financial reporting, the lack of which may result in ineffective oversight in the establishment and monitoring of internal

controls and procedures.

|

|

|

|

|

|

|

2.

|

We did not maintain proper segregation of duties for the preparation of our financial statements.

We currently only have one officer overseeing all transactions. This has resulted in several deficiencies including the lack of

control over preparation of financial statements, and proper application of accounting policies.

|

This Annual Report

does not include an attestation report of our registered public accounting firm regarding internal control over financial reporting.

Management’s report was not subject to attestation by our registered public accounting firm pursuant to temporary rules of

the SEC that permit us to provide only management’s report in this annual report.

Changes in Internal Control over Financial

Reporting

There were no changes

in our internal control over financial reporting during the year ended December 31, 2011 that have materially affected, or are

reasonably likely to materially affect, our internal control over financial reporting.

Officers’ Certifications

Appearing as exhibits

to this Annual Report are “Certifications” of our Chief Executive and Chief Financial Officer. The Certifications are

required pursuant to Section 302 of the Sarbanes-Oxley Act of 2002 (the “Section 302 Certifications”). This section

of the Annual Report contains information concerning the Controls Evaluation referred to in the Section 302 Certification. This

information should be read in conjunction with the Section 302 Certifications for a more complete understanding of the topics presented.

|

|

ITEM 9B.

|

OTHER INFORMATION

|

Not applicable.

PART III

|

|

ITEM 10.

|

DIRECTORS, EXECUTIVE OFFICERS, AND CORPORATE GOVERNANCE

|

Executive Officers and Directors

Before the closing

of the Merger Agreement on January 17, 2012, Kenneth Spiegeland served as our Interim CEO and President and sole Director. Upon

closing of the Merger, the number of directors was increased to seven and Jerry W. Tyler and John S. Henderson IV were appointed

as directors until the Company’s next annual meeting of shareholders or until the director’s death, resignation or

removal. Also upon closing of the Merger, John S. Henderson IV was appointed Chief Executive Officer, President and Chairman of

the Board, and Robert R. Mohr was appointed Chief Financial Officer, Treasurer and Secretary of the company. Subsequently, Kevin

Grangier and J. Sherman Henderson III were appointed directors on January 31, 2012. Jerry W. Tyler Jr. resigned from his director

position on March 18, 2012. Mr. Tyler’s resignation did not arise from any disagreements with us.

Below are the names

and certain information regarding the Company’s current executive officers and directors:

|

Name

|

|

Age

|

|

Position

|

|

|

|

|

|

|

|

|

|

John S. Henderson IV

|

|

39

|

|

Chief Executive Officer, President and Chairman of the Board

|

|

|

|

|

|

|

|

|

|

Robert R. Mohr

|

|

46

|

|

Chief Financial Officer, Treasurer and Secretary

|

|

|

|

|

|

|

|

|

|

Kenneth Spiegeland

|

|

48

|

|

Director

|

|

|

|

|

|

|

|

|

|

Kevin Grangier

|

|

47

|

|

Director

|

|

|

|

|

|

|

|

|

|

Sherman Henderson III

|

|

69

|

|

Director

|

|

Directors are elected

to serve until the next annual meeting of stockholders and until their successors are elected and qualified. Officers

are appointed by the Board of Directors and serve until their successors are appointed by the Board of Directors.

Biographical resumes of each officer and

director of the Company are set forth below:

John S. Henderson, Chief Executive

Officer, President and Chairman of the Board

, has served as Chief Executive Officer, President, and the Chairman of the

Board of Dynastar since May 4, 2010. Mr. Henderson previously served as President of Lightyear Wireless Solutions, a division

of Lightyear Network Solutions, Inc. (LYNS), from 2003 to 2010 where he founded and built the direct sales division to $12 million

in revenue. Prior to Lightyear, Mr. Henderson served as Vice President of Sales and Marketing of the Direct Sales division

of Excel Communications, a billion dollar direct sales company, from 2001 to 2003.

Robert R. Mohr, Chief Financial Officer

,

Treasurer and Secretary

, has served as Chief Financial Officer of Dynastar since November of 2010. Mr. Mohr previously

served as Chief Accounting Officer and principal financial officer of Beacon Enterprise Solutions Group, Inc. (BEAC.OB) from 2007

to 2010 in charge of finance and administration. Prior to that, Mr. Mohr served as Director of Financial Reporting for Triple

Crown Media, Inc. (TCMI), a $130 million sports marketing, association management and newspaper concern, where he was in charge

of SEC compliance, financial reporting and analysis from 2005 to 2007. Over the past 22 years, Mr. Mohr has served in senior

financial roles in both public and private companies in varying stages of development including start-ups, mergers and acquisitions,

restructurings, leveraged buy-outs and turnarounds. Pursuant to financial roles, Mr. Mohr has also served as the leader of

human resources, information technology, logistics, distribution and customer service.

Kenneth Spiegeland, Director,

served as Pubco’s sole director from October 12, 2011 until the Merger closing on January 17, 2012. Mr. Spiegeland will remain

as one of our directors following the Merger closing. He became Pubco’s interim Chief Executive Officer, President and Interim

Chief Financial Officer on September 14, 2011 and served in those capacities until the Merger closing on January 17, 2012. Mr.

Spiegeland has been a member of the Board of Directors of Rackwise, Inc. (OTCBB: RACK) since February 1, 2011. From February 1,

2011 through September 21, 2011, he served as the Chief Executive Officer, Chief Financial Officer, President, Treasurer and Secretary

of Rackwise. He has been a Senior Account Manager with Concord Private Jet since January 2010. From April 2008 to January

2010, he was a real estate broker and a partner in KBS Partnership, a real estate holding company he founded in 1985, and from

January 2005 to December 2008, he was the Managing Member of New Space Closet. Prior to this, from January 2000 to November 2005,

he was Division Manager with Masco Contractor Services, a subsidiary of Masco Corporation, a leading manufacturer of home improvement

and building products, and from February 1998 to January 2000, he was the General Manager of Gabriel-Spry Services, a division

of Gale Industries, and prior to this he served as Executive Vice President of Gabriel-Spry Company Inc. since 1983.

Kevin S. Grangier

,

Director

,

APR

, was appointed to our board of directors on January 31, 2012 and brings more than 25 years of brand development, marketing

and communication experience to the Company. Mr. Grangier currently is CEO of CarryOn Public Relations, Inc., a full-service

public relations and brand communication agency founded by Mr. Grangier in Los Angeles in 1998. CarryOn has represented more than

100 of the top 1,000 brands in the United States, including Coors Brewing, Pharmavite, the NHL, ESPN, IHOP, GOT MILK?, Beverly

Hills Tourism, Jacuzzi, Yahoo!, Pfizer, Lindt Chocolate, AstraZeneca, Symantec, and dozens of other products representing virtually

every category. Mr. Grangier also founded CarryOn Interactive (Coi), an interactive and social media agency, Brandeavor,

Inc. and LabelConscious, Inc., brand research and identity development firms that represent companies in a variety of manufacturing,

healthcare, food and industrial industries. Mr. Grangier was accredited by The Public Relations Society of America at age 26 and

currently holds board positions or serves in advisory capacities for a variety of for-, not-for- and non-profit organizations.

He earned his bachelors degree in communication and health administration from Western Kentucky University and also attended Indiana

University and Bellarmine University in Louisville.

Sherman Henderson III, Director,

has more than 37 years of business experience, including roles spanning company ownership, sales, marketing and management. He

began his career in the telecom industry in 1986, when he oversaw Charter Network, a long-distance carrier serving the Midwestern

United States. He founded Lightyear, which began operations as UniDial, in 1993 in Louisville, Kentucky and served as its chief

executive officer from its founding until May 2011. He currently serves as its chairman emeritus. Additionally, Mr. Henderson served

six terms as chairman of COMPTEL, the leading association representing competitive communications service providers and their supplier

partners. He currently serves as a director of Rackwise, Inc. (OTCBB: RACK) and Beacon Enterprise Solutions Group Inc. (OTCBB:

BEAC), where he is a member of the compensation committee. Sherman Henderson III is the father of John S. Henderson IV.

Board of Directors and Corporate Governance

Our Board

consisted of four (4) members, two of which are independent. Pubco’s pre-Merger stockholders appointed one (1) of the

current members of the Board. The Board may be increased up to seven (7) members, provided that at least two of the

additional directors is independent.

Director Independence

We are not currently

subject to listing requirements of any national securities exchange or inter-dealer quotation system which has requirements that

a majority of the board of directors be “independent” and, as a result, we are not at this time required to have our

Board comprised of a majority of “Independent Directors.” Nevertheless, our Board has determined that two

of our four directors, Mr. Kenneth Spiegeland and Mr. Kevin Grangier, are “independent” within the definition of independence

provided in the Marketplace Rules of The Nasdaq Stock Market.

Board Committees

We intend to maintain

a board of directors that is composed of a majority of “independent” directors. We may appoint an audit committee,

nominating committee and/or compensation committee, to adopt charters relative to each such committee.

Shareholder Communications

Currently, we do not

have a policy with regard to the consideration of any director candidates recommended by security holders. To date,

no security holders have made any such recommendations.

Code of Ethics

We have adopted a

written code of ethics (the “Code of Ethics”) that applies to our principal executive officer, principal financial

officer, principal accounting officer or controller, and persons performing similar functions. We believe that the Code of Ethics

is reasonably designed to deter wrongdoing and promote honest and ethical conduct; provide full, fair, accurate, timely and understandable

disclosure in public reports; comply with applicable laws; ensure prompt internal reporting of code violations; and provide accountability

for adherence to the code. To request a copy of the Code of Ethics, please make written request to our Secretary, at

Dynastar Holdings, Inc., 1311 Herr Lane, Louisville, KY 40222.

Compliance with Section 16(a) of the

Exchange Act

Our common stock is

not registered pursuant to Section 12 of the Exchange Act. Accordingly, our officers, directors and principal shareholders are

not subject to the beneficial ownership reporting requirements of Section 16(a) of the Exchange Act.

|

|

ITEM 11.

|

EXECUTIVE COMPENSATION

|

The following table

sets forth information concerning the total compensation paid or accrued by Pubco during the last two fiscal years ended December

31, 2011 to (i) all individuals that served as Pubco’s principal executive officer or acted in a similar capacity for Pubco

at any time during the fiscal year ended December 31, 2011; (ii) all individuals that served as our principal financial officer

or acted in a similar capacity for us at any time during the fiscal year ended December 31, 2011; and (iii) all individuals that

served as executive officers of ours at any time during the fiscal year ended December 31, 2011 that received annual compensation

during the fiscal year ended December 31, 2011 in excess of $100,000.

Summary Compensation Table

Name and

Principal Position

(1)

|

|

Year

|

|

|

Salary

($)

|

|

|

Bonus

($)

|

|

|

Stock

Awards

($)

|

|

|

Option

Awards

($)

|

|

|

Non-

Equity

Incentive

Plan

Compen-

sation ($)

|

|

|

Change

in

Pension

Value

and Non-

qualified

Deferred

Compen-

sation

Earnings

($)

|

|

|

All Other

Compensation

($)

|

|

|

Total ($)

|

|

|

(a)

|

|

(b)

|

|

|

(c)

|

|

|

(d)

|

|

|

(e)

|

|

|

(f)

|

|

|

(g)

|

|

|

(h)

|

|

|

(i)

|

|

|

(j)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Kenneth Spiegeland,

Chief Executive Officer

|

|

|

2011

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

Dennis Carter, Chief Executive Officer

|

|

|

2011

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

Dennis Neclerio, Chief

|

|

|

2011

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

Executive Officer

|

|

|

2010

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

0

|

|

|

|

(1)

|

Mr. Neclerio resigned as Pubco’s Chief Executive Officer on August 1, 2011. Mr. Carter was

appointed as Pubco’s Chief Executive Officer on August 1, 2011 and resigned from that position on October 12, 2011. Mr. Speigeland

was appointed Pubco’s Chief Executive Officer On October 12, 2011 and resigned from that position on January 17, 2012

|

We have not issued

any stock options or maintained any stock option or other incentive plans other than our 2011 Plan. (See “Item 5. Market

for Common Equity and Related Stockholder Matters – Securities Authorized for Issuance Under Equity Compensation Plans”

above.) We have no other plans in place and have never maintained any plans that provide for the payment of retirement benefits

or benefits that will be paid primarily following retirement including, but not limited to, tax qualified deferred benefit plans,

supplemental executive retirement plans, tax-qualified deferred contribution plans and nonqualified deferred contribution plans.

Equity Compensation Plan Information

The following table sets forth information

about the Company’s equity compensation plans as of December 31, 2011:

|

Plan Category

|

|

Number of securities to be

issued upon exercise of

outstanding options,

warrants and rights

|

|

|

Weighted-average

exercise price of

outstanding options,

warrants and rights

|

|

|

Number of securities

remaining available

for future issuance

under equity

compensation plans

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity compensation plans approved by security holders

|

|

|

-

|

|

|

|

-

|

|

|

|

5,000,000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity compensation plans not approved by security holders

|

|

|

-

|

|

|

|

-

|

|

|

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

-

|

|

|

|

-

|

|

|

|

5,000,000

|

|

Compensation of Directors

None of our directors

receives any compensation for serving as such, for serving on committees (if any) of the Board of Directors or for special assignments.

During the fiscal year ended December 31, 2011, there were no arrangements between us and our directors that resulted in our making

payments to any of our directors for any services provided to us by them as directors.

|

|

ITEM 12.

|

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

AND RELATED STOCKHOLDER MATTERS

|

The following table

sets forth information with respect to the beneficial ownership of our common stock known by us as of March 27, 2012 by:

|

|

·

|

each person or entity known by us to be the beneficial owner of more than 5% of our common stock;

|

|

|

·

|

each of our executive officers; and

|

|

|

·

|

all of our directors and executive officers as a group.

|

Except as otherwise

indicated, the persons listed below have sole voting and investment power with respect to all shares of our common stock owned

by them, except to the extent such power may be shared with a spouse.

Name and Address

of Beneficial Owner

|

|

Shares of Common Stock

Beneficially Owned (1)

|

|

|

Percent of Common

Stock Beneficially

Owned (2)

|

|

|

|

|

|

|

|

|

|

|

John S. Henderson IV

|

|

|

4,500,000

|

(3)

|

|

|

11.8

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Robert R. Mohr

|

|

|

200,000

|

(4)

|

|

|

*

|

|

|

|

|

|

|

|

|

|

|

|

|

Kenneth Spiegeland

|

|

|

0

|

|

|

|

0.0

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Kevin S. Grangier

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sherman Henderson III

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All directors and executive officers as a group (5 persons)

|

|

|

4,700,000

|

|

|

|

12.3

|

%

|

|

|

|

|

|

|

|

|

|

|

Gottbetter Capital Group, Inc.

488 Madison Avenue, 12th Floor

New York, NY 10022

|

|

|

3,093,803

|

(5)

|

|

|

8.0

|

%

|

|

|

|

|

|

|

|

|

|

|

Jerry A. Hickson

403 Hazeltine Drive

Austin, TX78734

|

|

|

8,728,299

|

(6)

|

|

|

21.6

|

%

|

|

|

|

|

|

|

|

|

|

|

Michael Lichtenstein

17879 Monte Vista Drive

Boca Raton, FL 33496

|

|

|

3,958,101

|

(7)

|

|

|

10.1

|

%

|

|

|

|

|

|

|

|

|

|

|

Navesink Capital Advisors, LLC

1200 Federal Highway, Suite 200

Boca Raton, FL 33432

|

|

|

3,721,259

|

(8)

|

|

|

9.6

|

%

|

|

|

|

|

|

|

|

|

|

|

David Duggins

7005 New Bern Court

Prospect, KY 40059

|

|

|

4,500,000

|

(9)

|

|

|

11.8

|

%

|

* Less than 1%.

|

|

(1)

|

Beneficial ownership is determined in accordance with

the rules of the SEC and generally includes voting or investment power with respect to securities. Shares of common stock subject

to options or warrants currently exercisable or convertible, or exercisable or convertible within 60 days of the date of this

Annual Report on Form 10-K are deemed outstanding for computing the percentage of the person holding such options or warrants

but are not deemed outstanding for computing the percentage of any other person.

|

|

|

(2)

|

Percentage based on 38,084,247 shares of our common stock

issued and outstanding as of March 27, 2012 (including an aggregate of 15,872,000 shares issued in connection with the Merger

(the “Merger Shares”), 5,724,925 shares issued upon conversion of the Dynastar Bridge Notes and 258,781 shares in

payment of interest on the Dynastar Bridge Notes (the “Dynastar Bridge Note Interest Shares”) received by the former

Dynastar stockholders and Dynastar Bridge Notes holders in the Merger), after giving effect to the Merger and the first closing

of the Offering.

|

|

|

(3)

|

Consists of 4,500,000 Merger Shares. Does not include

1,000,000 shares of common stock that may be issued upon exercise of incentive stock options granted under our 2011 Plan, which

are not exercisable within 60 days.

|

|

|

(4)

|

Consists of 50,000 Merger Shares and 150,000 shares that

may be issued upon exercise of stock options granted under our 2011 Plan, which are exercisable within 60 days. Does not include

800,000 shares issuable upon exercise of such options, which are not exercisable within 60 days.

|

|

|

(5)

|

Includes 2,587,553 shares of our common stock and 500,000

shares that may be issued upon exercise of a warrant which is exercisable within 60 days. Also includes 6,250 shares of our

common stock that may be issued upon exercise of a broker warrant issued to Gottbetter Capital Markets, LLC. Adam Gottbetter has

voting and investment power with respect to the shares owned by, and issuable to, Gottbetter Capital Group, Inc. and Gottbetter

Capital Markets, LLC.

|

|

|

(6)

|

Consists of 1,207,500 shares of our common stock, 375,000

Merger Shares, 4,625,000 shares issued upon conversion of the Dynastar Bridge Notes, 208,299 Dynastar Bridge Note interest shares

and 2,312,500 shares that may be issued upon exercise of warrants issued in exchange for Dynastar Bridge Note warrants (the “Exchange

Warrants”), which are exercisable within 60 days.

|

|

|

(7)

|

Consists of 2,553,018 shares of our common stock, 250,000

Merger Shares, 100,000 shares issued upon conversion of the Dynastar Bridge Notes, 5,083 Dynastar Bridge Note interest shares,

50,000 shares that may be issued upon exercise of Exchange Warrants which are exercisable within 60 days and an additional 1,000,000

shares that may be issued upon exercise of other warrants which are exercisable within 60 days.

|

|

|

(8)

|

Consists of 2,369,453 shares of our common stock, 400,000

shares issued upon conversion of the Dynastar Bridge Notes, 14,303 Dynastar Bridge Note interest shares, 250,000 shares that may

be issued upon exercise of Exchange Warrants which are exercisable within 60 days, 500,000 shares that may be issued upon exercise

of an additional warrant which are exercisable within 60 days, 125,000 shares issued upon the initial closing of the Offering

and 62,500 shares that may be issued upon exercise of an Investor Warrant issued in the Offering, which is exercisable within

60 days.

|

|

|

(9)

|

Consists of 4,500,000 Merger Shares.

|

Securities Authorized for Issuance Under Equity Compensation

Plans

On

October 14, 2011, our Board of Directors adopted the 2011 Plan which reserves a total of 5,000,000 shares of common stock for issuance

under the 2011 Plan. If an incentive award granted under the 2011 Plan expires, terminates, is unexercised or is forfeited,

or if any shares are surrendered to us in connection with an incentive award, the shares subject to such award and the surrendered

shares will become available for further awards under the 2011 Plan.

Shares issued under

the 2011 Plan through the settlement, assumption or substitution of outstanding awards or obligations to grant future awards as

a condition of acquiring another entity are not expected to reduce the maximum number of shares available under the 2011 Plan. In

addition, the number of shares of common stock subject to the 2011 Plan and the number of shares and terms of any incentive award

are expected to be adjusted in the event of any stock dividend, spin-off, split-up, stock split, reverse stock split, recapitalization,

reclassification, merger, consolidation, liquidation, business combination or exchange of shares or similar transaction.

Administration

It is expected that

the compensation committee of the Board, or the Board in the absence of such a committee, will administer the 2011 Plan. Subject

to the terms of the 2011 Plan, the compensation committee would have complete authority and discretion to determine the terms of

awards under the 2011 Plan.

Eligible Recipients

Any officer or other

employee of the Company or its affiliates, or an individual that the Company or an affiliate has engaged to become an officer or

employee, or a consultant or advisor who provides services to the Company or its affiliates, including a non-employee director

of the Board, is eligible to receive awards under the 2011 Plan.

Grants

The 2011 Plan authorizes

the grant to eligible recipients of nonqualified stock options, incentive stock options, restricted stock awards, restricted stock

units, performance grants intended to comply with Section 162(m) of the Internal Revenue Code of 1986, as amended (the Code”)

and stock appreciation rights, as described below:

|

|

·

|

Options granted under the 2011 Plan entitle the grantee,

upon exercise, to purchase a specified number of shares from us at a specified exercise price per share. The exercise

price for shares of common stock covered by an option cannot be less than the fair market value of the common stock on the date

of grant unless agreed to otherwise at the time of the grant. Such awards may include vesting requirements.

|

|

|

·

|

Restricted stock awards and restricted stock units may

be awarded on terms and conditions established by the compensation committee, which may include performance conditions for restricted

stock awards and the lapse of restrictions on the achievement of one or more performance goals for restricted stock units.

|

|

|

·

|

The compensation committee may make performance grants,

each of which will contain performance goals for the award, including the performance criteria, the target and maximum amounts

payable, and other terms and conditions.

|

|

|

·

|

Stock awards are permissible. The compensation

committee will establish the number of shares of common stock to be awarded and the terms applicable to each award, including

performance restrictions.

|

|

|

·

|

Stock appreciation rights or SARs, entitle the participant

to receive a distribution in an amount not to exceed the number of shares of common stock subject to the portion of the SAR exercised

multiplied by the difference between the market price of a share of common stock on the date of exercise of the SAR and the market

price of a share of common stock on the date of grant of the SAR.

|

Duration, Amendment, and Termination

The Board may amend,

suspend or terminate the 2011 Plan without stockholder approval or ratification at any time or from time to time. No

change may be made that increases the total number of shares of common stock reserved for issuance pursuant to incentive awards

or reduces the minimum exercise price for options or exchange of options for other incentive awards, unless such change is authorized

by our stockholders within one year. Unless sooner terminated, the 2011 Plan terminates ten years after it is adopted.

|

|

ITEM 13.

|

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS, AND DIRECTOR

INDEPENDENCE

|

Transactions Involving

Pubco

Not applicable.

Transactions Involving

Dynastar Ventures, Inc.

Sherman Henderson

III, the father of John S. Henderson IV, our Chief Executive Officer, purchased $25,000 in principal amount of the Dynastar Bridge

Notes.

Transactions Involving the Company Following

the Closing of the Merger

Employment Agreements

As of and effective

upon the closing of the Merger, we have entered into three-year, renewable executive employment agreements with John S. Henderson,

our Chief Executive Officer, and Robert R. Mohr, our Chief Financial Officer, which agreements supersede and replace in the entirety

those existing agreements by and between Dynastar and each of Messrs. Henderson and Mohr.

Pursuant to these

employment agreements, Mr. Henderson will receive a base salary for the first twelve months of his agreement in the amount of $210,000

while Mr. Mohr will receive a base salary for the same period in the amount of $175,000. These amounts will be subject to annual

review by our Board and increase (but not decrease) as the Board determines. Our Board shall determine in its sole discretion,

following the closing of the Merger, what bonuses Messrs. Henderson and Mohr shall be entitled to, based on milestones to be agreed

upon by the Board.

Upon the closing

of the Merger, we granted (i) John S. Henderson IV, our Chief Executive Officer, options under the 2011 Plan to purchase

1,000,000 shares of our common stock vesting in three equal annual installments beginning on the first anniversary of the

Merger closing date, with an exercise price of $0.22 per share, to qualify as incentive stock options under the Internal

Revenue Code requirements for 10% stockholders and (ii) Robert R. Mohr , our Chief Financial Officer, options under the 2011

Plan to purchase (a) 450,000 shares of common stock, of which 150,000 shares were fully vested as of the Merger closing date

and the remaining 300,000 shares will vest in two equal annual installments on November 4, 2012 and November 4, 2013 and (b)

additional options to purchase 500,000 shares of common stock vesting in three equal annual installments beginning on the

first anniversary of the Merger closing date, each with an exercise price of $0.20 per share.

Transactions Between

the Company and Navesink Capital Advisors, LLC

Consulting Agreement

Effective upon the

closing of the Merger, we entered into an agreement with Navesink Capital Advisors, LLC (Navesink”) pursuant to which Navesink

agreed to provide us with certain professional consulting services relating to business development and corporate finance. This

agreement has a term of six months. As consideration under this agreement, we agreed to issue to Navesink a five year warrant exercisable

for two million (2,000,000) shares of our common stock at an exercise price of $0.20 per share. Shares underlying these warrants

are entitled to piggyback” registration rights at our discretion. Prior to the merger Closing Date, Navesink assigned to

certain third parties its right to receive warrants exercisable for one million five hundred thousand (1,500,000) shares, including

500,000 shares of which were assigned to Gottbetter Capital Group, Inc.

Navesink Investments

in Dynastar and the Company

In October 2011, Navesink

purchased $100,000 principal amount of the Dynastar Bridge Notes and received Dynastar warrants to purchase 125,000 shares of Dynastar

common stock. Upon the closing of the Merger, these Dynastar Bridge Notes were converted into 500,000 shares of our common stock

and the Dynastar warrants were exchanged for our warrants to purchase 250,000 shares of our common stock. Prior to the Merger closing,

Navesink sold to a third party its rights to receive 100,000 of the 500,000 shares of our common stock.

Effective upon the

closing of the merger, Navesink purchased 125,000 units in the initial closing of the Offering for a purchase price of $25,000.

As a result of this purchase, Navesink received 125,000 shares of our common stock and five year warrants to purchase 62,500 shares

of our common stock at a purchase price of $0.80 per share.

Director Independence

We are not currently

subject to listing requirements of any national securities exchange or inter-dealer quotation system which has requirements that

a majority of the board of directors be “independent” and, as a result, we are not at this time required to (and we

do not) have our Board of Directors comprised of a majority of “Independent Directors.”

Our

Board of Directors has considered the independence of its directors in reference to the definition of “independent director”

established by the Nasdaq Marketplace Rule 5605(a)(2). In doing so, the Board of Directors has reviewed all commercial and other

relationships of each director in making its determination as to the independence of its directors. After such review, the Board

of Directors has determined that Messrs. Spiegeland and Grangier qualify as independent under the requirements of the Nasdaq listing

standards.

|

|

ITEM 14.

|

PRINCIPAL ACCOUNTANT FEES AND SERVICES

|

Audit Fees

.

The aggregate fees

billed to us by our principal accountant for services rendered during the fiscal years ended December 31, 2011 and 2010 are set

forth in the table below:

|

Fee Category

|

|

Fiscal year ended December 31, 2011

|

|

|

Fiscal year ended December 31, 2010

|

|

|

Audit fees (1)

|

|

$

|

15,500

|

|

|

$

|

14,000

|

|

|

Audit-related fees (2)

|

|

|

-

|

|

|

|

|

|

|

Tax fees (3)

|

|

|

1,000

|

|

|

|

-

|

|

|

All other fees (4)

|

|

|

-

|

|

|

|

-

|

|

|

Total fees

|

|

$

|

16,500

|

|

|

$

|

14,000

|

|

|

|

(1)

|

Audit Fees — This category includes the audit of our annual financial statements included

in our Form 10-K Annual Report, review of financial statements included in our Form 10-Q Quarterly Reports and services that are

normally provided by the independent auditors in connection with engagements for those fiscal years. This category also includes

advice on audit and accounting matters that arose during, or as a result of, the audit or the review of interim financial statements.

|

|

|

(2)

|

Audit-Related Fees — This category consists of assurance and related services by the independent

auditors that are reasonably related to the performance of the audit or review of our financial statements and are not reported

above under “Audit Fees”. The services for the fees disclosed under this category include consultation regarding our

correspondence with the SEC and other accounting consulting.

|

|

|

(3)

|

Tax Fees — This category consists of professional services rendered by our independent auditors

for tax compliance and tax advice. The services for the fees disclosed under this category include tax return preparation and technical

tax advice.

|

|

|

(4)

|

All Other Fees — This category consists of fees for (i) attending annual stockholder meeting,

(ii) review of our response to SEC comments, and (iii) review of our registration statements.

|

Audit Committee’s Pre-Approval Practice

.

We

do not have an audit committee. Our board of directors performs the function of an audit committee. Section 10A(i) of the Exchange

Act prohibits our auditors from performing audit services for us as well as any services not considered to be audit services unless

such services are pre-approved by our audit committee or, in cases where no such committee exists, by our board of directors (in

lieu of an audit committee) or unless the services meet certain de minimis standards.

PART IV

|

|

ITEM 15.

|

EXHIBITS AND FINANCIAL STATEMENT SCHEDULES

|

Financial Statement Schedules

The consolidated financial

statements of Dynastar Holdings, Inc. are listed on the Index to Financial Statements on this annual report on Form 10-K beginning

on page F-1.

Exhibits

The following Exhibits are being filed with

this Annual Report on Form 10-K:

|

Exhibit No.

|

|

Description

|

|

|

|

|

|

2.1

|

|

Agreement and Plan of Merger and Reorganization dated as of January 17, 2012 by and among Registrant, Dynastar Acquisition Corp., and Dynastar Ventures Inc., (a Delaware corporation) (incorporated by reference to Exhibit 2.1 to Current Report on Form 8-K filed with the Securities and Exchange Commission (the SEC”) on January 23, 2012)

|

|

|

|

|

|

2.2

|

|

Certificate of Merger dated as of January 17, 2012 for the merger of Dynastar Acquisition Corp. into Dynastar Ventures Inc. (a Delaware corporation) (incorporated by reference to Exhibit 2.2 to Current Report on Form 8-K filed with SEC on January 23, 2012)

|

|

|

|

|

|

3.1

|

|

Articles of Incorporation of the Registrant (incorporated by reference to Exhibit 3.1 to the Registrant’s Registration Statement on Form SB-2 filed with the SEC on July 16, 2007)

|

|

|

|

|

|

3.2

|

|

Certificate of Amendment to Articles of Incorporation of the Registrant (incorporated by reference to Exhibit 3.1 to Current Report on Form 8-K filed with the SEC on October 14, 2011)

|

|

|

|

|

|

3.4

|

|

By-Laws of the Registrant (incorporated by reference to Exhibit 3.2 to the Registrant’s Registration Statement on Form SB-2 filed with the SEC on July 16, 2007)

|

|

|

|

|

|

4.1

|

|

Form of Investor Warrant (incorporated by reference to Exhibit 4.1 to Current Report on Form 8-K filed with SEC on January 23, 2012)

|

|

|

|

|

|

4.2

|

|

Form of Bridge Note Exchange Warrant (incorporated by reference to Exhibit 4.2 to Current Report on Form 8-K filed with the Securities and Exchange Commission (the SEC”) on January 27, 2012)

|

|

4.3

|

|

Form of Broker Warrant (incorporated by reference to Exhibit 4.3 to Current Report on Form 8-K filed with SEC on January 23, 2012)

|

|

|

|

|

|

4.4

|

|

Form of Navesink Warrant (incorporated by reference to Exhibit 4.4 to Current Report on Form 8-K filed with SEC on January 23, 2012)

|

|

|

|

|

|

10.1

|

|

Form of Subscription Agreement between the Registrant and the investors in the Unit Private Placement Offering (incorporated by reference to Exhibit 10.1 to Current Report on Form 8-K filed with SEC on January 23, 2012)

|

|

|

|

|

|

10.2

|

|

Subscription Escrow Agreement dated December 15, 2011, by and among the Registrant, Gottbetter Capital Markets, LLC, and CSC Trust Company of Delaware (incorporated by reference to Exhibit 10.2 to Current Report on Form 8-K filed with SEC on January 23, 2012)

|

|

|

|

|

|

10.3

|

|

Placement Agency Agreement dated as of October 27, 2011 by and between the Placement Agent and the Registrant (incorporated by reference to Exhibit 10.3 to Current Report on Form 8-K filed with SEC on January 23, 2012)

|

|

|

|

|

|

21

|

|

List of Subsidiaries

|

|

|

|

|

|

31.1

|

|

Certification of Principal Executive Officer, pursuant to SEC Rules 13a-14(a) and 15d-14(a), adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

|

|

|

|

31.2

|

|

Certification of Interim Principal Financial Officer, pursuant to SEC Rules 13a-14(a) and 15d-14(a), adopted pursuant to Section 302 of the Sarbanes-Oxley Act of 2002

|

|

|

|

|

|

32.1

|

|

Certification of Chief Executive Officer, pursuant to 18 U.S.C. Section 1350, adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002**

|

|

|

|

|

|

32.2

|

|

Certification of Interim Chief Financial Officer, pursuant to 18 U.S.C. Section 1350, adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002**

|

* Filed herewith.

** This certification is being furnished

and shall not be deemed “filed” with the SEC for purposes of Section 18 of the Exchange Act, or otherwise subject to

the liability of that section, and shall not be deemed to be incorporated by reference into any filing under the Securities Act

or the Exchange Act, except to the extent that the Registrant specifically incorporates it by reference.

In reviewing the agreements included as

exhibits and incorporated by reference to this Annual Report on Form 10-K, please remember that they are included to provide you

with information regarding their terms and are not intended to provide any other factual or disclosure information about the Company

or the other parties to the agreements. The agreements may contain representations and warranties by each of the parties to the

applicable agreement. These representations and warranties have been made solely for the benefit of the parties to the applicable

agreement and:

|

|

•

|

should not in all instances be treated as categorical statements of fact, but rather as a way of

allocating the risk to one of the parties if those statements prove to be inaccurate;

|

|

|

•

|

have been qualified by disclosures that were made to the other party in connection with the negotiation

of the applicable agreement, which disclosures are not necessarily reflected in the agreement;

|

|

|

•

|

may apply standards of materiality in a way that is different from what may be viewed as material

to you or other investors; and

|

|

|

•

|

were made only as of the date of the applicable agreement or such other date or dates as may be

specified in the agreement and are subject to more recent developments.

|

Accordingly, these representations and

warranties may not describe the actual state of affairs as of the date they were made or at any other time. Additional information

about the Company may be found elsewhere in this Annual Report on Form 10-K and the Company’s other public filings, which

are available without charge through the SEC’s website at

http://www.sec.gov

.

SIGNATURES

Pursuant to the requirements

of Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed

on its behalf by the undersigned, thereunto duly authorized.

|

|

|

DYNASTAR HOLDINGS, INC.

|

|

|

|

|

|

Dated: April 12, 2012

|

By:

|

/s/ John S. Henderson IV

|

|

|

|

John S. Henderson IV, President and Chief Executive Officer

|

|

|

|

|

|

Dated: April 12, 2012

|

By:

|

/s/ Robert R. Mohr

|

|

|

|

Robert R. Mohr, Treasurer and Chief Financial Officer

|

In accordance with