Current Report Filing (8-k)

May 26 2022 - 4:58PM

Edgar (US Regulatory)

0001164256

false

0001164256

2022-05-26

2022-05-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): May

26, 2022 (May 24, 2022)

DAYBREAK OIL AND GAS, INC.

(Exact Name of Registrant as Specified in its Charter)

| Washington |

000-50107 |

91-0626366 |

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

1101 N. Argonne Road, Suite A 211

Spokane Valley, WA |

|

99212 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant's telephone number, including area code:

(509) 232-7674

(Former Name or Former Address if Changed Since Last

Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| |

o |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

o |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

o |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

o |

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange

on which registered |

| n/a |

n/a |

n/a |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934

(§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

¨

| Item 1.01 | Entry into a Material Definitive Agreement. |

Effective as of May 24, 2022, Daybreak Oil and Gas,

Inc. (OCT PINK:DBRM), a Washington corporation (“Daybreak” or the “Company”), entered into an amendment (the “Amendment”)

with Gaelic Resources Ltd., a private company incorporated in the Isle of Man and the 100% owner of Reabold (“Gaelic”), to

amend the Equity Exchange Agreement (the “Exchange Agreement”) dated as of October 20, 2021 and amended on February 22, 2022

by and between Daybreak, Reabold California, LLC, a California limited liability company (“Reabold”), and Gaelic. Pursuant

to the Amendment, Daybreak and Gaelic agreed to amend the “Long-Stop Date” set forth in the Exchange Agreement from April

29, 2022 to May 31, 2022 (the “Long-Stop Date”), meaning Daybreak will not be obligated to issue $500,000 worth of its common

stock to Gaelic at the closing due to the transaction closing after the Long-Stop Date. The parties also agreed that, in lieu of Daybreak’s

prior agreement to pay Gaelic $250,000 following the closing of the transactions contemplated by the Exchange Agreement, it would instead,

within 60 days following the closing, pay an amount equal to Reabold’s cash balance at closing plus $81,000 of approved capital

expenditures, for a total payment of $263,619.24.

| Item 2.01 | Completion of Acquisition or Disposition of Assets. |

The information in Item 1.01 is incorporated by reference

herein. On May 25, 2022, Daybreak, Reabold, and Gaelic closed the transactions contemplated by the Exchange Agreement. At the closing,

(i) Gaelic irrevocably assigned and transferred all of its ownership interests in Reabold to Daybreak, and (ii) Daybreak authorized the

issuance of 160,964,489 shares of its common stock to Gaelic, as a result of which Reabold became a wholly-owned subsidiary of Daybreak

and Gaelic became the largest shareholder of Daybreak (the foregoing transaction, the “Equity Exchange”). At the closing,

the parties also entered into (a) a voting agreement by and among Daybreak, Gaelic and Daybreak’s President and Chief Executive

Officer, James F. Westmoreland, where, on the terms therein, Daybreak and the shareholder parties thereto agree to nominate a person designated

by Gaelic and a person designated by James F. Westmoreland to Daybreak’s board of directors, and the parties thereto agree to vote

their shares in favor of such candidates, (b) a registration rights agreement between Daybreak, Gaelic, Portillion Capital Ltd., a private

company incorporated in the United Kingdom (“Portillion”), and Kamran Sattar, the principal of Portillion and the holder of

27,764,706 shares of common stock of Daybreak due to his conversion of a previously disclosed convertible promissory note issued by the

Company on February 15, 2022, and (c) indemnification agreements between Company and its directors. The closing of the Equity Exchange

and the transactions contemplated thereby was approved by the shareholders of the Company at the Special Meeting of Shareholders held

on May 20, 2022.

| Item 3.02 | Unregistered Sales of Equity Securities. |

On May 26, 2022, Daybreak completed the sale of 125,000,000 shares of its

common stock, par value $0.001, to Portillion for a purchase price of $0.02 per share, or $2,500,000 in the aggregate, pursuant to the

previously disclosed Subscription Agreement dated May 5, 2022 (the “Capital Raise”). In connection with the closing of the

Capital Raise, Daybreak also paid Portillion (1) an incentive fee equal to 20% of the subscription amount, payable 17.5% in cash ($437,000)

and 2.5% in additional shares of common stock (3,125,000 shares); and (2) an equity exchange fee equal to 3% of the subscription amount.

The common stock was issued pursuant to the exemption

from registration promulgated under Regulation S of the Securities Act of 1933, as amended. The sale and purchase of the shares did not

involve any public offering, the offer and sale of the shares took place outside the United States, Daybreak reasonably believes the purchaser

to be an “accredited investor” as that term is defined under Rule 501 of Regulation D, the purchaser had access to information

about Daybreak and its investment, the purchaser took the securities for investment and not resale, and Daybreak took appropriate measures

to restrict the transfer of the securities.

| Item 5.01 | Changes in Control of the Registrant. |

The information in Items 1.01, 2.01, and 3.02 are

incorporated by reference herein. As a result of the closings of the Equity Exchange and the Capital Raise, a change in control of Daybreak

has occurred, in that more than 50% of the issued and outstanding shares of common stock of Daybreak are now held by persons other than

the shareholders of Daybreak immediately prior to the closings of the transactions. The shares of common stock previously owned, and

issued pursuant to the transactions contemplated by

the Equity Exchange and the Capital Raise as of May 26, 2022, are as follows:

| |

Shares

of Common Stock Owned |

Percentage

Ownership |

| Daybreak Existing Shareholders |

67,802,273 |

18% |

| Gaelic Resources Ltd |

160,964,489 |

42% |

| Portillion Capital Ltd |

128,125,000 |

33% |

| Kamran Sattar (affiliate of Portillion Capital Ltd) |

27,764,706 |

7% |

| Total |

384,656,468 |

100% |

The source of funds of Portillion’s purchase

of shares of the Company was CitiBank.

Gaelic is a party to the Voting Agreement described

under Item 2.01 above.

Daybreak is not aware of any arrangements, including

any pledge by any person of securities of the Company or any of its parents, the operation of which may at a subsequent date result in

another change in control of the Company.

| Item 9.01 | Financial Statements and Exhibits. |

The financial statements and pro forma financial information

required by Item 9.01(a) and (b) will be filed by an amendment to this report not later than 71calendar days after the date of this report.

(d) Exhibits.

| 104 | Cover Page Interactive Data File (formatted in Inline XBRL) |

* Filed

herewith.

[signature page follows]

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

DAYBREAK OIL AND GAS, INC.

| By: /s/ JAMES F. WESTMORELAND |

James F. Westmoreland, President and Chief Executive Officer

Date: May 26, 2022

5

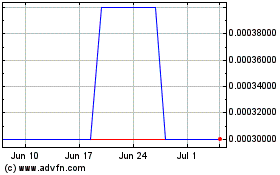

Daybreak Oil and Gas (CE) (USOTC:DBRM)

Historical Stock Chart

From Oct 2024 to Nov 2024

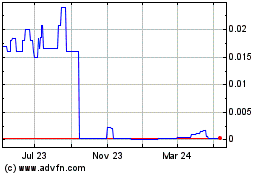

Daybreak Oil and Gas (CE) (USOTC:DBRM)

Historical Stock Chart

From Nov 2023 to Nov 2024