Danske Bank Lures Commerzbank CFO to Deal With Higher Costs, Regulatory Probes

September 05 2019 - 6:26PM

Dow Jones News

By Nina Trentmann and Kristin Broughton

Danske Bank A/S on Thursday replaced its chief financial

officer, a move that comes as the Danish lender continues to deal

with a money-laundering scandal.

The Copenhagen-based bank, the country's biggest, said Stephan

Engels would become its finance chief in April 2020. Mr. Engels

currently holds the CFO role at Commerzbank AG, Germany's

second-largest bank, which expects to identify a new finance head

before Mr. Engels departs.

Mr. Engels replaces Christian Baltzer, who took over Danske's

finances in 2018. Danske named Jakob Aarup-Andersen, its current

head of wealth management, as interim finance chief until Mr.

Engels joins.

"I received an offer that allows me to take on an exciting

international challenge," Mr. Engels said Thursday in an internal

memo to Commerzbank employees. "It was not a conscious decision to

leave the bank because of one reason or another, but rather a

personal decision to pursue an opportunity that has arisen

elsewhere."

The appointment is part of a wider management reshuffle under

Chris Vogelzang, Danske's new chief executive, who started in June.

Chief Operating Officer Jim Ditmore also is leaving the bank,

Danske said Thursday. His duties will be performed by Mr. Vogelzang

until a successor is found.

Mr. Engels, who has been CFO of Commerzbank since 2012, is said

to be a hands-on executive with a reputation for adeptly tackling

complicated tasks such as cost cutting and risk management.

Before his time at Commerzbank, he worked in various positions

at German car manufacturer Daimler AG, including head of internal

audit, CFO at DaimlerChrysler Bank AG and head of management group

controlling.

Stephan Engels "brings strong execution expertise and management

experience from banking and other sectors," Mr. Vogelzang said in a

statement.

Danske faces regulatory probes from a host of U.S. and European

authorities over allegations of potential money laundering. And the

Danish Financial Supervisory Authority last week said it referred

the bank to the police for misleading customers with an investment

product.

Rising costs from investments in anti-money-laundering controls

have weighed on Danske's quarterly costs. The bank's operating

costs during the first six months of 2019 rose 12% from a year

earlier, to 12.8 billion Danish kroner ($1.9 billion), due in part

to hiring additional compliance staff.

"Costs are the key concern within Danske," said Marcell Houben,

a vice president at investment bank Credit Suisse Group AG. "Mr.

Engels has a track record of managing costs well, so that's a good

match." Frankfurt-based Commerzbank in 2016 launched a program

called Commerzbank 4.0 aimed at digitizing work flows, resulting in

about 9,600 job cuts.

Mr. Engels comes on board as Danske looks to strengthen its

internal systems and controls. Compliance lapses at its Estonian

branch stemmed, in part, from its use of a separate IT platform

from the rest of the bank, Danske said in a September 2018

report.

That meant the Estonian branch, whose nonresident portfolio

included customers from Russia, didn't use the same transaction and

risk-monitoring systems as the rest of the bank, Danske said in the

report. The separate system also gave its corporate headquarters

limited visibility into the branch's operations, the bank said.

Danske said this year that regulators ordered the bank to close

down the Estonian branch. The bank acquired it as part of its 2007

purchase of Sampo Bank, which was based in Finland.

Mr. Engels will also have to manage credit spreads on Danske's

debt, which could rise owing to the prospect of potential fines

related to the ongoing investigations, said Niklas Kammer, an

equity analyst at financial services firm Morningstar Inc.

"Investigations into anti-money-laundering cases can turn out to

take multiple years and therefore weigh on margins for a while,"

Mr. Kammer said.

Mr. Engels comes with plenty of compliance experience.

Commerzbank in 2015 agreed to pay $1.45 billion to settle

allegations of sanctions and money-laundering violations, resolving

investigations by U.S. and New York state regulators and law

enforcement authorities. The bank allegedly violated laws barring

transactions on behalf of Iran, Sudan, Cuba and Myanmar.

Danske and Commerzbank have both seen their profitability

decline amid negative interest rates that apply to large parts of

Continental Europe. That is putting pressure on the banks'

management to find new sources of revenue, said Håkon Astrup, an

equity analyst at brokerage firm DNB Markets Inc.

Mr. Engels, together with Mr. Vogelzang, will also have to

rebuild the reputation of Danske, Mr. Houben said.

Write to Nina Trentmann at Nina.Trentmann@wsj.com and Kristin

Broughton at Kristin.Broughton@wsj.com

(END) Dow Jones Newswires

September 05, 2019 18:11 ET (22:11 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

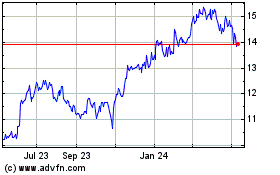

Danske Bank AVS (PK) (USOTC:DNKEY)

Historical Stock Chart

From Oct 2024 to Nov 2024

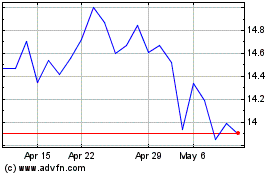

Danske Bank AVS (PK) (USOTC:DNKEY)

Historical Stock Chart

From Nov 2023 to Nov 2024