UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

Under the Securities Exchange Act of 1934

For the month of June, 2024

000-56241

(Commission File Number)

Cresco Labs Inc.

(Exact name of Registrant as specified in its charter)

600 W. Fulton Street, Suite 800

Chicago, IL 60661

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ☐ Form 40-F ☒

| | | | | | | | |

| EXHIBIT INDEX |

| | |

| Exhibit No. | | Description |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 99.4 | | |

| 99.5 | | |

| | | | | | | | | | | | | | |

| SIGNATURES |

| | | | |

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. |

| | | | |

| | | CRESCO LABS INC. |

| | | |

| Date: June 10, 2024 | | | By: | /s/ Charles Bachtell |

| | | | Charles Bachtell |

| | | | Chief Executive Officer |

CRESCO LABS INC.

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING AND

MANAGEMENT INFORMATION CIRCULAR

WITH RESPECT TO

THE ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS OF CRESCO LABS INC.

TO BE HELD ON JULY 10, 2024

DATED JUNE 3, 2024

CRESCO LABS INC.

NOTICE OF ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON JULY 10, 2024

NOTICE IS HEREBY GIVEN that the annual general and special meeting (the “Meeting”) of the holders (the “Shareholders”) of Subordinate Voting Shares, Proportionate Voting Shares, Super Voting Shares and Special Subordinate Voting Shares (collectively, the “Voting Shares”) of Cresco Labs Inc. (“Cresco” or the “Corporation”) will be held at 10:00 a.m. (Central Daylight Time) on July 10, 2024, and will be a virtual meeting conducted via live audio webcast. The Meeting will be held for the following purposes:

1.to receive and consider the Corporation’s financial statements for the years ended December 31, 2023 and 2022, together with the auditor’s report thereon (collectively, the “Financial Statements”);

2.to set the number of directors of the Corporation at eight;

3.to elect the directors of the Corporation to serve until the next annual meeting of Shareholders or until their successors are elected or appointed;

4.to appoint Marcum LLP as independent auditor of the Corporation to hold office until the next annual meeting of Shareholders and to authorize the directors to fix the remuneration thereof;

5.to consider and, if thought fit, to pass an ordinary resolution approving certain amendments to the Corporation’s Long-Term Incentive Plan and approving unallocated entitlements under the Long-Term Incentive Plan;

6.to approve the Cresco Option Exchange Program (the “Option Exchange”); and

7.to transact any other business as may properly be brought before the Meeting or any adjournment(s) or postponement thereof.

The details of all matters proposed to be put before the Shareholders at the Meeting are set forth in the management information circular accompanying this Notice of Annual General and Special Meeting (the “Information Circular”).

The record date for determination of the Shareholders entitled to receive notice of and to vote at the Meeting is May 31, 2024 (the “Record Date”). All Shareholders of record as of the close of business on the Record Date are entitled to virtually attend, participate and vote at the Meeting, or by proxy.

The Corporation is holding the Meeting as a completely virtual meeting, which will be conducted via live webcast, where all Shareholders regardless of geographic location and equity ownership will have an equal opportunity to participate at the Meeting and engage with directors of the Corporation and management as well as other Shareholders. Shareholders will not be able to attend the Meeting in person. Registered Shareholders and duly appointed proxyholders will be able to attend, participate and vote at the Meeting online at https://web.lumiconnect.com/290628777. Beneficial Shareholders (being Shareholders who hold their Voting Shares through a broker, investment dealer, bank, trust company, custodian, nominee or other intermediary) who have not duly appointed themselves as proxyholder will be able to attend as a guest and view the webcast but not be able to participate or vote at the Meeting.

As a Shareholder of the Corporation, it is very important that you read the Information Circular and other Meeting materials carefully. They contain important information with respect to voting your Voting Shares and attending and participating at the Meeting.

A Shareholder who wishes to appoint a person other than the management nominees identified on the form of proxy or voting instruction form, to represent him, her or it at the Meeting may do so by inserting such person’s name in the blank space provided in the form of proxy or voting instruction form and following the instructions for submitting such form of proxy or voting instruction form. This must be completed prior to registering such proxyholder, which is an additional step to be completed once you have submitted your form of proxy or voting instruction form. If you wish that a person other than the management nominees identified on the form of proxy or voting instruction form attend and participate at the Meeting as your proxy and vote your Voting Shares, including if you are a non-registered Shareholder and wish to appoint yourself as proxyholder to attend, participate and vote at the Meeting, you MUST register such proxyholder after having submitted your form of proxy or voting instruction form identifying such proxyholder. Failure to register the proxyholder will result in the proxyholder not receiving a Username to participate in the Meeting. Without a Username, proxyholders will not be able to attend, participate or vote at the Meeting. To register a proxyholder, shareholders MUST send an email to appointee@odysseytrust.com and provide Odyssey Trust Company (“Odyssey”) with their proxyholder’s contact information, amount of shares

appointed, name in which the shares are registered if they are a registered Shareholder, or name of broker where the shares are held if a beneficial Shareholder, so that Odyssey may provide the proxyholder with a Username via email.

Shareholders should follow the instructions on the forms they receive. If Shareholders with questions should contact their intermediaries or Odyssey, the Corporation’s transfer agent, toll free within North America at 1-888-290-1175, outside of North America at 1-587-885-0960 or by e-mail at proxy@odysseytrust.com.

The Corporation has elected to use the notice-and-access provisions under National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”) and National Instrument 51-102 – Continuous Disclosure Obligations (together with NI 54-101 (collectively, the “Notice-and-Access Provisions”)) for the Meeting. The Notice-and-Access Provisions are a set of rules developed by the Canadian Securities Administrators that allow issuers to post electronic versions of proxy-related materials on-line, via the System for Electronic Document Analysis and Retrieval + (“SEDAR+”) and one other website, rather than mailing paper copies of such materials to securityholders.

Electronic copies of this Notice of Annual General and Special Meeting of Shareholders, the Information Circular, the Corporation’s management discussion and analysis of the results of operations and financial condition of the Corporation for the year ended December 31, 2023, and the audited consolidated financial statements of the Corporation and accompanying notes for the years ended December 31, 2023 and 2022 together with the auditor’s report thereon (the “2023 MD&A and Financials”) may be found on SEDAR+ at www.sedarplus.ca and also on Cresco’s website at www.investors.crescolabs.com.

Shareholders will receive paper copies of a notice package (the “Notice Package”) via pre-paid mail containing a notice with information prescribed by NI 54-101 and a form of proxy (if you are a registered Shareholder) or a voting instruction form (if you are a non-registered Shareholder).

The Corporation will not use procedures known as ‘stratification’ in relation to the use of Notice-and-Access Provisions. Stratification occurs when an issuer using Notice-and-Access Provisions sends a paper copy of the Information Circular to some securityholders with a Notice Package.

Shareholders may obtain paper copies of the Information Circular and the 2023 MD&A and Financials free of charge by contacting Odyssey toll free within North America at 1-888-290-1175 and outside of North America at 1-587-885-0960.

Any shareholder wishing to obtain a paper copy of the meeting materials should submit their request no later than June 26, 2024, in order to receive paper copies of the meeting materials in time to vote before the Meeting. Shareholders may contact Odyssey toll free within North America at 1-888-290-1175 and outside of North America at 1-587-885-0960 to obtain more information about the Notice-and-Access Provisions. Under the Notice-and-Access Provisions, meeting materials will be available for viewing on the Corporation’s website for one year from the date of posting.

DATED as of the 3rd day of June, 2024.

Yours truly,

| | |

(signed) “Thomas J. Manning” |

| Thomas J. Manning |

| Chairman of the Board |

CRESCO LABS INC.

ANNUAL GENERAL AND SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON

JULY 10, 2024

MANAGEMENT INFORMATION CIRCULAR

GENERAL

This management information circular (the “Circular”) is furnished to holders (“Shareholders”) of Subordinate Voting Shares, Proportionate Voting Shares, Super Voting Shares and Special Subordinate Voting Shares (collectively, the “Voting Shares”) of Cresco Labs Inc. (the “Corporation” or “Cresco”) in connection with the solicitation of proxies by the management of the Corporation for use at the annual general and special meeting of Shareholders (the “Meeting”), and at any adjournment or postponement thereof, for the purposes set forth in the accompanying Notice of Annual General and Special Meeting (the “Notice of Meeting”). The Meeting will be held in a virtual, audio only, online format conducted via live webcast online at: https://web.lumiconnect.com/290628777.

Shareholders will not be able to attend the Meeting in person, but will be able to participate online during the Meeting regardless of their geographic location. Registered Shareholders and duly appointed proxyholders who participate in the Meeting over the internet will still have the opportunity to participate in the question and answer session and vote at the Meeting. Beneficial Shareholders (as defined herein) who do not appoint themselves as their proxyholder will not be able to vote at the Meeting, but will be able to attend the Meeting and observe proceedings as guests. See “Information Concerning Voting.”

The information contained herein is given as of May 31, 2024, the record date for the Meeting (the “Record Date”), except where otherwise indicated.

If you hold Voting Shares through a broker, investment dealer, bank, trust company, nominee or other intermediary (collectively, an “Intermediary”), you should contact your Intermediary for instructions and assistance in voting the Voting Shares that you beneficially own.

This solicitation is made on behalf of management of the Corporation. The costs incurred in the preparation of both the form of proxy and this Circular will be borne by the Corporation. In addition to the use of mail, subject to the use of Notice-and-Access Provisions (as defined below) in relation to delivery of the meeting materials, proxies may be solicited by telephone or any form of electronic communication or by directors, officers and employees of the Corporation who will not be directly compensated therefor.

No person is authorized to give any information or to make any representation other than those contained in this Circular and, if given or made, such information or representation should not be relied upon as having been authorized by the Corporation. The delivery of this Circular shall not, under any circumstances, create an implication that there has not been any change in the information set forth herein since the date hereof.

Please read this Circular carefully to obtain information about how you may participate at the Meeting either in person or through the use of proxies.

INFORMATION CONCERNING VOTING

Where and When the Meeting Will Be Held

The Meeting will be held in a virtual, audio only, online format conducted via live webcast online at: https://web.lumiconnect.com/290628777 on July 10, 2024, at 10:00 a.m. (Central Daylight Time) and at any adjournment(s) or postponement(s) thereof, for the purposes set forth in the accompanying Notice of Meeting.

How Do I Attend and Participate at the Meeting?

The Corporation is holding the Meeting as a completely virtual meeting, which will be conducted via live webcast. Shareholders will not be able to attend the Meeting in person. In order to attend, participate or vote at the Meeting (including voting and asking questions at the Meeting), Shareholders must have a valid Username.

Registered Shareholders and duly appointed proxyholders will be able to attend, participate and vote at the Meeting online at https://web.lumiconnect.com/290628777. Such persons may then enter the Meeting by clicking “I have a login” and entering a Username and Password before the start of the Meeting:

•Registered Shareholders: The control number located on the form of proxy (or in the email notification you received) is the Username. The Password to the Meeting is “cresco2024” (case sensitive). If as a registered Shareholder you are using your control number to login to the Meeting and you have previously voted, you do not need to vote again when the polls open. By voting at the Meeting, you will revoke your previous voting instructions received prior to voting cut-off.

•Duly appointed proxyholders: Odyssey Trust Company (“Odyssey”) will provide the proxyholder with a Username by e-mail after the voting deadline has passed. The Password to the Meeting is “cresco2024” (case sensitive). Only registered Shareholders and duly appointed proxyholders will be entitled to attend, participate and vote at the Meeting. Beneficial Shareholders who have not duly appointed themselves as proxyholder will be able to attend the meeting as a guest but not be able to participate or vote at the Meeting. Shareholders who wish to appoint a third party proxyholder to represent them at the Meeting (including Beneficial Shareholders who wish to appoint themselves as proxyholder to attend, participate or vote at the Meeting) MUST submit their duly completed proxy or voting instruction form AND register the proxyholder. See “Appointment of a Third Party as Proxy.”

For more information on how to vote at the Meeting, please refer to Schedule “C” of this Circular, which contains a virtual meeting guide.

Notice-and-Access

The Corporation has elected to use the notice-and-access provisions under National Instrument 54-101 – Communication with Beneficial Owners of Securities of a Reporting Issuer (“NI 54-101”) and National Instrument 51-102 – Continuous Disclosure Obligations (collectively, the “Notice-and-Access Provisions”) for the Meeting. The Notice-and-Access Provisions are a set of rules developed by the Canadian Securities Administrators that allow issuers to post electronic versions of proxy-related materials online, via the System for Electronic Document Analysis and Retrieval (“SEDAR+”) and one other website, rather than mailing paper copies of such materials to securityholders.

Electronic copies of this Notice of Annual General and Special Meeting of Shareholders, this Circular, the Corporation’s management’s discussion and analysis of the results of operations and financial condition of the Corporation for the year ended December 31, 2023, and the audited consolidated financial statements of the Corporation and accompanying notes for the years ended December 31, 2023 and 2022 together with the auditor’s report thereon (the “2023 MD&A and Financials”) may be found on SEDAR+ at www.sedarplus.ca and also on the Corporation’s website at www.investors.crescolabs.com.

Shareholders will receive paper copies of a notice package (the “Notice Package”) via pre-paid mail containing a notice with information prescribed by NI 54-101 and a form of proxy (if you are a registered Shareholder) or a voting instruction form (if you are a non-registered Shareholder).

The Corporation will not use procedures known as ‘stratification’ in relation to the use of Notice-and-Access Provisions. Stratification occurs when an issuer using Notice-and-Access Provisions sends a paper copy of this Circular to some securityholders with a Notice Package.

Shareholders may obtain paper copies of this Circular and the 2023 MD&A and Financials free of charge by contacting Odyssey toll free within North America at 1-888-290-1175 and outside of North America at 1-587-885-0960.

Any shareholder wishing to obtain a paper copy of the meeting materials should submit their request no later than June 26, 2024, in order to receive paper copies of the meeting materials in time to vote before the Meeting. Shareholders may contact Odyssey toll free within North America at 1-888-290-1175 and outside of North America at 1-587-885-0960 to obtain more information about the Notice-and-Access Provisions. Under the Notice-and-Access Provisions, meeting materials will be available for viewing on the Corporation’s website for one year from the date of posting.

PROXY RELATED INFORMATION

Voting at the Meeting

Registered Shareholders may vote at the Meeting by completing a ballot online during the Meeting, as further described above. See “How Do I Attend and Participate at the Meeting?”

Beneficial Shareholders who have not duly appointed themselves as proxyholder will not be able to attend, participate or vote at the Meeting. This is because the Corporation and its transfer agent do not have a record of the Beneficial Shareholders of the Corporation, and, as a result, will have no knowledge of your shareholdings or entitlement to vote, unless you appoint yourself as proxyholder. If you are a Beneficial Shareholder and wish to vote at the Meeting, you have to appoint yourself as proxyholder, by inserting your own name in the space provided on the voting instruction form sent to you and must follow all of the applicable instructions provided by your intermediary. See “Appointment of a Third Party as Proxy” and “How Do I Attend and Participate at the Meeting?”

Appointment of Third Party as Proxy

The persons named in the enclosed form of proxy are officers and/or directors of the Corporation and each is a management designee (collectively, the “Management Designees”). Management Designees will vote IN FAVOUR of each of the matters specified in the Notice of Meeting and all other matters proposed by management at the Meeting. Each Shareholder submitting a proxy has the right to appoint a person, who need not be a Shareholder (a “third party proxyholder”), to represent, attend, participate or vote at the Meeting on such Shareholder’s behalf, other than the Management Designees. A Shareholder may exercise this right by completing the steps set forth below and depositing the completed proxy to Odyssey prior to the Proxy Deadline (as defined below).

The following applies to Shareholders who wish to appoint a person (a “third party proxyholder”) other than the Management Designees set forth in the form of proxy or voting instruction form as proxyholder, including Beneficial Shareholders who wish to appoint themselves as proxyholder to attend, participate or vote at the Meeting.

Shareholders who wish to appoint a third party proxyholder to attend, participate or vote at the Meeting as their proxy and vote their Voting Shares MUST submit their proxy or voting instruction form (as applicable) appointing such third party proxyholder AND register the third party proxyholder, as described below. Registering your proxyholder is an additional step to be completed AFTER you have submitted your proxy or voting instruction form. Failure to register the proxyholder will result in the proxyholder not receiving a Username to attend, participate or vote at the Meeting.

•Step 1: Submit your proxy or voting instruction form: To appoint a third party proxyholder, insert such person’s name in the blank space provided in the form of proxy or voting instruction form (if permitted) and follow the instructions for submitting such form of proxy or voting instruction form. This must be completed prior to registering such proxyholder, which is an additional step to be completed once you have submitted your form of proxy or voting instruction form. If you are a Beneficial Shareholder located in the United States, you must also provide Odyssey with a duly completed legal proxy if you wish to attend, participate or vote at the Meeting or, if permitted, appoint a third party as your proxyholder. See below under this section for additional details.

•Register your proxyholder: To register a proxyholder, Shareholders MUST send an email to appointee@odysseytrust.com by 10:00 a.m. (Central Daylight Time) on July 8, 2024, (the “Proxy Deadline”) and provide Odyssey with the required proxyholder contact information, amount of shares appointed, name in which the shares are registered if they are a registered Shareholder, or name of broker where the shares are held if a Beneficial Shareholder, so that Odyssey may provide the proxyholder with a Username via email. Without a Username, proxyholders will not be able to attend, participate or vote at the Meeting.

If you are a Beneficial Shareholder and wish to attend, participate or vote at the Meeting, you have to insert your own name in the space provided on the voting instruction form sent to you by your intermediary, follow all of the applicable instructions provided by your intermediary AND register yourself as your proxyholder, as described above. By doing so, you are instructing your intermediary to appoint you as proxyholder. It is important that you comply with the signature and return instructions provided by your intermediary. Please also see further instructions above under the heading “How Do I Attend and Participate at the Meeting?”

Legal Proxy – U.S. Beneficial Shareholders

If you are a Beneficial Shareholder located in the United States and wish to attend, participate or vote at the Meeting or, if permitted, appoint a third party as your proxyholder, in addition to the steps described above under “How Do I Attend and Participate at the Meeting?”, you must obtain a valid legal proxy from your intermediary. Follow the instructions from your intermediary included with the legal proxy form and the voting information form sent to you, or contact your intermediary to request a legal proxy form or a legal proxy if you have not received one. After obtaining a valid legal proxy from your intermediary, you must then submit such legal proxy to Odyssey. Requests for registration from Beneficial Shareholders located in the United States that wish to attend, participate or vote at the Meeting or, if permitted, appoint a third party as their proxyholder must be sent by e-mail to appointee@odysseytrust.com and received by the Proxy Deadline.

Refusal of Proxy

The Corporation may refuse to recognize any instrument of proxy received later than the Proxy Deadline.

Revocability of Proxy

A Shareholder who has given a proxy has the power to revoke it at any time prior to the exercise thereof. In addition to revocation in any other manner permitted by law, a proxy may be revoked by:

(a)signing a proxy with a later date and delivering it to the place noted above prior to the Proxy Deadline;

(b)signing and dating a written notice of revocation and delivering it to Odyssey, or by transmitting a revocation by telephonic or electronic means, to Odyssey, at any time up to and including the last business day preceding the day of the Meeting, or any adjournment of it, at which the proxy is to be used, or delivering a written notice of revocation and delivering it to the Chair of the Meeting prior to the commencement of the Meeting or any adjournment or postponement thereof; or

(c)following the process for attending and voting at the Meeting online or any adjournment or postponement of the Meeting and registering with the scrutineer as a Shareholder present.

Advice to Beneficial Holders of Voting Shares

The information in this section is of significant importance to many Shareholders, as a substantial number of Shareholders do not hold their Voting Shares in their own name. Shareholders who do not hold their Voting Shares in their own name, referred to in this Circular as “Beneficial Shareholders,” are advised that only proxies deposited by Shareholders whose names appear on the records of the Corporation as the registered holders of Voting Shares can be recognized and acted upon at the Meeting. If Voting Shares are listed in an account statement provided to a Shareholder by an Intermediary, then in almost all cases those Voting Shares will not be registered in the Shareholder’s name on the records of the Corporation. Such Voting Shares will more likely be registered under the name of CDS & Co. (the registration name for CDS is Clearing and Depository Services Inc., which acts as nominee for many Canadian brokerage firms).

Existing regulatory policy requires Intermediaries to seek voting instructions from Beneficial Shareholders in advance of shareholders’ meetings. The various Intermediaries have their own mailing procedures and provide their own return instructions to clients, which should be carefully followed by Beneficial Shareholders in order to ensure that their Voting Shares are voted at the Meeting. The form of proxy supplied to a Beneficial Shareholder by its Intermediary (or the agent of the Intermediary) is substantially similar to the form of proxy provided directly to registered Shareholders by the Corporation. However, its purpose is limited to instructing the registered Shareholder (i.e., the Intermediary or agent of the Intermediary) how to vote on behalf of the Beneficial Shareholder. The vast majority of Intermediaries now delegate responsibility for obtaining instructions from clients to Broadridge Financial Solutions, Inc. (“Broadridge”) in Canada. Broadridge typically prepares a machine-readable voting instruction form, mails those forms to Beneficial Shareholders and asks Beneficial Shareholders to return the forms to Broadridge, or otherwise communicate voting instructions to Broadridge (by way of the internet or telephone, for example). Broadridge then tabulates the results of all instructions received and provides appropriate instructions respecting the voting of shares to be represented at the Meeting. A Beneficial Shareholder who receives a voting instruction form cannot use that form to vote Voting Shares directly at the Meeting, you will need to appoint yourself and return the voting instruction form in the envelope provided (or by following the instructions respecting the voting of Voting Shares) well in advance of the Meeting (by July 5, 2024) in order to have the Voting Shares voted. If you have any questions regarding the voting of Voting Shares held through an Intermediary, please contact that Intermediary for assistance.

Although a Beneficial Shareholder may not be recognized directly at the Meeting for the purposes of voting, Voting Shares registered in the name of an Intermediary, a Beneficial Shareholder may attend the Meeting as proxyholder

for the registered Shareholder and vote the Voting Shares in that capacity. Beneficial Shareholders who wish to virtually attend the Meeting and indirectly vote their Voting Shares as proxyholder for the registered Shareholder, should enter their own names in the blank space on the form of proxy provided to them and return the same to their Intermediary (or the Intermediary’s agent) in accordance with the instructions provided by such Intermediary.

For purposes of applicable securities regulatory policies relating to the dissemination of proxy-related materials and other security holder materials and the request for voting instructions from Beneficial Shareholders, there are two categories of Beneficial Shareholders. Non-objecting Beneficial Shareholders (“NOBOs”) are Beneficial Shareholders who have advised their Intermediary that they do not object to their Intermediary disclosing ownership information to the Corporation, consisting of their name, address, e-mail address, securities holdings and preferred language of communication. Securities legislation restricts the use of that information to matters strictly relating to the affairs of the Corporation. Objecting Beneficial Shareholders (“OBOs”) are Beneficial Shareholders who have advised their Intermediary that they object to their Intermediary disclosing such ownership information to the Corporation. Cresco will not send its proxy-related materials directly to NOBOs under National Instrument 54-101. Cresco does not intend to pay for Intermediaries to forward the proxy-related materials and the voting instruction form to OBOs under National Instrument 54-101. In the case of an OBO, the OBO will not receive the materials unless the OBO’s Intermediary assumes the cost of delivery.

Exercise of Discretion with Respect to Proxies

The Voting Shares represented by the enclosed proxy will be voted or withheld from voting on any motion, by ballot or otherwise, in accordance with any indicated instructions contained in a proxy. In the absence of any such direction, such shares will be voted IN FAVOUR of each of the matters set forth in the Notice of Meeting and in this Circular and all other matters proposed by management at the Meeting.

If any amendment or variation to matters identified in the Notice of Meeting is proposed at the Meeting or any adjournment or postponement thereof, or if any other matters properly come before the Meeting or any adjournment or postponement thereof, the enclosed proxy confers discretionary authority to vote on such amendments or variations or such other matters according to the best judgment of the appointed proxyholder. As at the date of this Circular, the management of the Corporation is not aware of any amendments or variations or other matters to come before the Meeting.

VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES

The authorized share capital of the Corporation consists of an unlimited number of Subordinate Voting Shares, of which 328,586,651 are issued and outstanding as of the Record Date, an unlimited number of Proportionate Voting Shares, of which 112,639 (which are convertible on a 1:200 basis into 22,527,738 Subordinate Voting Shares) are issued and outstanding as of the Record Date, an unlimited number of Super Voting Shares, of which 500,000 are issued and outstanding as of the Record Date, and an unlimited number of Special Subordinate Voting Shares, of which 158,940,757 (which are convertible on a 100,000:1 basis into 1,589 Subordinate Voting Shares) were issued and outstanding as of the Record Date.

Voting Rights

Each Subordinate Voting Share is entitled to one vote per Subordinate Voting Share, each Proportionate Voting Share is entitled to one vote in respect of each Subordinate Voting Share into which such Proportionate Voting Share could ultimately then be converted, which is currently equal to 200 votes per Proportionate Voting Share, each Super Voting Share is currently entitled to 2,000 votes per Super Voting Share and each Special Subordinate Voting Share is currently entitled to 0.00001 of a vote per Special Subordinate Voting Share on all matters upon which the holders of shares of the Corporation are entitled to vote, in each case as of the Record Date, and holders of Subordinate Voting Shares, Proportionate Voting Shares, Super Voting Shares and Special Subordinate Voting Shares will vote together on all matters subject to a vote of holders of each of those classes of shares as if they were one class of shares, except to the extent that a separate vote of holders as a separate class is required by law or provided by the articles of the Corporation.

As of the date of the Record Date, the Subordinate Voting Shares represent approximately 24%, the Proportionate Voting Shares represent approximately 2%, the Super Voting Shares represent approximately 74%, and the Special Subordinate Voting Shares represent approximately 0.0001% of the voting rights attached to outstanding Voting Shares of the Corporation.

Restricted Securities

The Subordinate Voting Shares, Proportionate Voting Shares and Special Subordinate Voting Shares are “restricted securities” within the meaning of such term under applicable Canadian securities laws. In the event that a take-over bid is made for the Super Voting Shares, the holders of Subordinate Voting Shares and Special Subordinate Voting Shares will not be entitled to participate in such offer and may not tender their shares into any such offer, whether under the terms of the Subordinate Voting Shares or under any coattail trust or similar agreement. Notwithstanding this, any take-over bid for solely the Super Voting Shares is unlikely, given that by the terms of the investment agreement entered into by the Corporation and the holders of the Super Voting Shares in connection with the issuance of the Super Voting Shares to such holders, upon any sale of Super Voting Shares to an unrelated third-party purchaser, such Super Voting Shares will be redeemed by the Corporation for their issue price. Additionally, holders of Subordinate Voting Shares are entitled to convert to Proportionate Voting Shares and tender to any take-over bid made solely to the holders of Proportionate Voting Shares. In the event that a take-over bid is made for the Subordinate Voting Shares, the holders of Special Subordinate Voting Shares will not be entitled to participate in such offer and may not tender their shares into any such offer, whether under the terms of the Special Subordinate Voting Shares or under any coattail trust or similar agreement, absent being permitted to convert such shares into Subordinate Voting Shares.

Record Date

May 31, 2024, is the Record Date for the determination of Shareholders entitled to receive notice of and to vote at the Meeting or any adjournment or postponement thereof. Accordingly, only Shareholders whose names have been entered in the register of Shareholders at the close of business on the Record Date will be entitled to receive notice of and to vote at the Meeting, or any adjournments or postponements thereof.

Principal Holders of Securities

To the best of the knowledge of the Corporation, based on publicly available filings, as of the Record Date, no person or company, owns, or controls or directs, directly or indirectly, Voting Shares carrying 10% or more of the voting rights attached to any class of Voting Shares of the Corporation, except for the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name of Shareholder | | Number and Percentage of Super Voting Shares Beneficially Owned, or Controlled or Directed, Directly or Indirectly | | Number and Percentage of Proportionate Voting Shares Beneficially Owned, or Controlled or Directed, Directly or Indirectly(1)(2)(3) | | Number and Percentage of Subordinate Voting Shares Beneficially Owned, or Controlled or Directed, Directly or Indirectly(2) | | Number and Percentage of Special Subordinate Voting Shares Beneficially Owned, or Controlled or Directed, Directly or Indirectly(2)(4) | | Percentage of Votes Attaching to All Outstanding Shares Beneficially Owned, or Controlled or Directed, Directly or Indirectly(5) |

Charles Bachtell | | 132,932 (26.59%) | | 5,313 (4.72%) | | 829,886 (0.25%) | | — | | 19.82% |

Brian McCormack | | 100,000 (20.00%) | | — | | 14,000 (<.01%) | | — | | 14.80% |

Robert M. Sampson | | 133,308 (26.66%) | | 4 (<.01%) | | 570,231 (0.17%) | | — | | 19.78% |

Thomas J. Manning | | 133,760 (26.75%) | | 500 (0.44%) | | — | | — | | 19.81% |

| | | | | |

| Notes: | |

| (1) | Proportionate Voting Shares convert to Subordinate Voting Shares on a 1:200 basis. |

| (2) | On an issued and undiluted basis, not giving effect to the conversion or exercise of securities convertible, redeemable or exchangeable into such shares held by such person, as applicable. |

| (3) | Excludes holdings of units in Cresco Labs, LLC that are redeemable for Proportionate Voting Shares. |

| (4) | Special Subordinate Voting Shares convert to Subordinate Voting Shares on a 100,000:1 basis. |

| (5) | Total voting percentage is based on actual number of votes. The voting percentages differ from beneficial ownership percentages as the Corporation’s Super Voting Shares carry 2,000 votes per Super Voting Share, the Proportionate Voting Shares carry 200 votes per Proportionate Voting Share and the Special Subordinate Voting Shares carry 0.00001 of a vote per Special Subordinate Voting Share. |

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

No person who has been a director or executive officer of the Corporation at any time since the beginning of the last financial year, nor any proposed nominee for election as a director of the Corporation, nor any associate or affiliate of any of the foregoing, has any material interest, directly or indirectly, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the Meeting.

MATTERS TO BE CONSIDERED AT THE MEETING

To the knowledge of the board of directors of the Corporation (the “Board”), the only matters to be brought before the Meeting are those matters set forth in the Notice of Meeting.

1.Receiving the Financial Statements

The financial statements of the Corporation for the years ended December 31, 2023 and 2022, together with the auditor’s report thereon (the “Financial Statements”), have been mailed to the Corporation’s registered and Beneficial Shareholders who requested to receive them. The Financial Statements are also available on SEDAR+ at www.sedarplus.ca.

2.Number of Directors

At the Meeting, Shareholders will be asked to (i) fix the number of directors of the Corporation at eight; and (ii) elect, on an individual basis, each of the eight nominees set forth in the table below (the “Cresco Nominees”) as directors of the Corporation to hold office until the next annual meeting of Shareholders or until their successors are duly elected or appointed pursuant to the articles of the Corporation, unless their offices are earlier vacated in accordance with the provisions of the Business Corporations Act (British Columbia) (“BCBCA”) or the Corporation’s articles. Each of the Cresco Nominees has consented to being named in this Circular and to serve as a director, if elected. The present term of office of each current director of the Corporation will expire at the Meeting.

3.Election of Directors

Nominees

The following table sets forth a brief background regarding the Cresco Nominees. The information contained herein is based upon information furnished by the respective nominees.

| | | | | | | | | | | | | | | | | | | | |

Name and Province or State and Country of Residence | | Director Since | | Principal Occupation for Past Five Years | | Voting Shares Beneficially Owned, Controlled or Directed, Directly or Indirectly(1) |

Charles Bachtell(2) Chicago, IL, United States | | November 2018 | | Chief Executive Officer of the Corporation; formerly Executive Vice President and General Counsel of Guaranteed Rate, a residential mortgage company. | | 132,932 Super Voting Shares 829,886 Subordinate Voting Shares 5,313 Proportionate Voting Shares 14,347,597 Cresco Redeemable Units |

Thomas J. Manning(5)(6) Evanston, IL, United States | | November 2018 | | Chairman of the Board of Directors of the Corporation; formerly Chairman and Chief Executive Officer of Dun and Bradstreet, a data and analytics company. | | 133,760 Super Voting Shares 500 Proportionate Voting Shares |

Tarik Brooks(4) Los Angeles, CA, United States | | April 2021 | | Former President of Combs Enterprises; Former Chief Operating Officer of Account Management and Trading at Bridgewater Associates, and Executive Vice President at RLJ Companies. | | 108,091 Subordinate Voting Shares |

Gerald F. Corcoran(2)(7) Winnetka, IL, United States | | November 2018 | | Chairman of the Board and Chief Executive Officer of R.J. O’Brien & Associates, LLC, a futures brokerage firm. | | 396,841 Subordinate Voting Shares 747,395 Cresco Redeemable Units |

Marc Lustig Vancouver, British Columbia, Canada | | January 2020 | | Non-Executive Chairman of IM Cannabis Corp. since 2019; Former Founder, Chairman and Chief Executive Officer of CannaRoyalty Corp. (dba Origin House) from 2016 to 2020; Head of Capital Markets at Dundee Capital Markets from 2012 to 2014. | | 39,184 Subordinate Voting Shares 158,940,757 Special Subordinate Voting Shares |

Randy D. Podolsky(3)(4) Lake Forest, IL, United States | | November 2018 | | Managing Principal of Podolsky Circle CORFAC International (now, Colliers International), a real estate company. | | 174,046 Subordinate Voting Shares 814,387 Cresco Redeemable Units |

Michele Roberts(8)(9) New York City, NY, United States | | June 2020 | | Executive Director of the National Basketball Players Association from 2014 to 2022; Former attorney with Skadden, Arps, Slate, Meagher & Flom LLP. | | 20,000 Subordinate Voting Shares |

Robert M. Sampson(3) Downers Grove, IL, United States | | November 2018 | | Executive Vice President of CrossCountry Mortgage, Inc.; formerly Chief Operating Officer the Corporation, Chief Executive Officer of bemortgage and Chief Operating Officer of Guaranteed Rate, a residential mortgage company. | | 133,308 Super Voting Shares 570,231 Subordinate Voting Shares 4 Proportionate Voting Shares 10,101,049 Cresco Redeemable Units |

| | | | | |

Notes: | |

| (1) | Information as to personal shareholdings is given to the Corporation’s knowledge based on publicly available sources and includes any units in Cresco Labs, LLC held by a Cresco Nominee that are redeemable for Proportionate Voting Shares (the “Cresco Redeemable Units”). |

| (2) | Member of the Executive Committee. |

| (3) | Member of the Audit Committee. |

| (4) | Member of the Nominating and Governance Committee. |

| (5) | Non-voting advisor to the special committee regarding corporate organizational structure (“Special Committee”). |

| (6) | Chair of the Executive Committee. |

| (7) | Chair of the Audit Committee. |

| (8) | Chair of the Nominating and Governance Committee. |

| (9) | Chair of the Special Committee. |

| * | As of the date of this Circular, the Compensation Committee is comprised of John R. Walter (Chair) and Carol A. Vallone. Promptly following the Meeting, the Board will designate new members of the Compensation Committee in view of Mr. Walter’s and Ms. Vallone’s departure from the Board. |

The enclosed form(s) of proxy allows the Shareholders to direct proxyholders to vote individually for each of the Cresco Nominees as a director of the Corporation. Unless otherwise directed, it is the intention of the persons named in the enclosed form of proxy to vote proxies IN FAVOUR of the election of each of the Cresco Nominees as directors of the Corporation.

Cease Trade Orders

To the knowledge of the Corporation, none of the Cresco Nominees (or any personal holding company of a Cresco Nominee) are, as at the date of this Circular, nor have they been within 10 years before the date of this Circular, a director, chief executive officer or chief financial officer of any company (including the Corporation) that, while acting in that capacity, was the subject of a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days, or after ceasing to be a director, chief executive officer or chief financial officer of the company, was the subject of a cease trade order, an order similar to a cease trade order or an order that denied the relevant company access to any exemption under securities legislation, for a period of more than 30 consecutive days, which resulted from an event that occurred while acting in such capacity.

Bankruptcies

To the knowledge of the Corporation, none of the Cresco Nominees (or any personal holding company of a Cresco Nominee) are, and have not within the past 10 years been, a director or executive officer of any company, including the Corporation, that, while acting in such capacity, or within a year of ceasing to act in such capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets or has, within the past 10 years, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold any of the Cresco Nominees’ assets.

Penalties and Sanctions

To the knowledge of the Corporation, none of the Cresco Nominees (or any personal holding company of a Cresco Nominee) have been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority, nor entered into a settlement agreement with a securities regulatory authority or been subject to any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable investor in deciding whether to vote for a proposed director.

4.Appointment of Auditors

On August 22, 2019, the Corporation first appointed Marcum LLP as independent auditors of the Corporation. At the Meeting, the Shareholders will be asked to reappoint Marcum LLP as independent auditors of the Corporation to serve until the close of the next annual meeting of Shareholders and to authorize the directors to fix their remuneration.

Unless otherwise directed to the contrary, it is the intention of the persons named in the enclosed form of proxy to vote proxies IN FAVOUR of the appointment of Marcum LLP as independent auditors of the Corporation at remuneration to be fixed by the Board. In order to be effective, the ordinary resolution must be approved by not less than a majority of the votes cast thereon by Shareholders who are present at the Meeting or by proxy.

5.Approval of Amended Plan and Unallocated Entitlements

At the Meeting, Shareholders will be asked to approve the amendment and restatement of the Cresco Labs Inc. 2018 Long-Term Incentive Plan (the “2018 Plan”). The 2018 Plan was originally approved by Shareholders on November 14, 2018. On May 29, 2024, the Board approved the Amended and Restated Cresco Labs Inc. 2018 Long-Term Incentive Plan (the “Amended Plan”), subject to Shareholder approval. The Amended Plan increases the share pool limit by adding 20,000,000 Subordinate Voting Shares to the Amended Plan as of its effective date. The share pool will remain at this increased amount until 10% of the issued and outstanding as-converted Subordinate Voting Shares (“As-converted SVS”) equals or exceeds such amount, after which the share pool will again be determined on a 10% rolling basis. As-converted SVS consists of Subordinate Voting Shares, Proportionate Voting Shares, Special Subordinate Voting Shares and Cresco Redeemable units. We are committed to a 10% rolling plan in the long-term, and the additional 20,000,000 Subordinate Voting Shares initially available under the Amended Plan will act as a temporary bridge to allow us to properly incentivize our employees and directors until the first date that there is equivalent capacity under a 10% rolling plan.

As of the Record Date, there were approximately 8,300,000 shares available under the 2018 Plan. This remaining share pool will not be sufficient to fulfill the Corporation’s equity compensation program during the next several years. We consider it important to maintain a strong association between compensation of our employees and our Shareholders’ long-term interests. Awards under the Amended Plan are intended to provide our employees significant incentive to protect and grow Shareholder value. We believe that there is an insufficient number of shares remaining available for new grants under our 2018 Plan to sustain these important stock-based incentives.

The number of shares available under the 2018 Plan, and that will be available under the Amended Plan, is based on the number of issued and outstanding Subordinate Voting Shares at any date of determination on an “as converted” basis after giving effect to the conversion of our other share classes and the redemption of the Cresco Redeemable Units for Subordinate Voting Shares. All references in this proposal to the number of issued and outstanding Subordinate Voting Shares refer to such number on an “as converted” basis.

Timing of Proposal

The last time we asked Shareholders to approve a long-term equity incentive plan, in full, was on November 14, 2018. The 2018 Plan has served us well, but approval of the Amended Plan by Shareholders will allow us to continue to grant equity incentive awards in order to secure and retain the services of our employees and directors and to provide long-term incentives that align the interests of our employees and directors with the interests of our Shareholders. Adopting the Amended Plan at this time will, as of the Effective Date, make an additional 20,000,000 Subordinate Voting Shares of the Corporation available for issuance to participants, bringing the total number of shares then available to approximately 28,300,000.

Amendment to the Amended Plan:

•Increase the number of shares currently available for awards under the Amended Plan such that the total share pool will be equal to the greater of (i) 10% of the issued and outstanding As-converted SVS, on a rolling basis, and (ii) the sum of (x) 10% of the issued and outstanding As-converted SVS as of the Effective Date plus (y) 20,000,000 additional Subordinate Voting Shares; provided that if the amount determined in accordance with clause (i) is at any time greater than or equal to the amount determined in accordance with clause (ii), then the share pool shall thereafter be the equal to 10% of the issued and outstanding As-converted SVS, on a rolling basis.

Key Features of the Amended Plan Designed to Protect Shareholders’ Interests

The Amended Plan’s design reflects our commitment to strong corporate governance and the desire to preserve and grow long-term Shareholder value as demonstrated by the following Amended Plan features:

•Independent Administrator. The Compensation Committee of the Board (“Compensation Committee”) will generally be the administrator of the Amended Plan. Administrative powers may be delegated to officers and other employees, but all determinations regarding awards to our executive officers must be made by the Board or the Compensation Committee.

•Repricing Prohibited. The Amended Plan requires that, except in connection with a corporate transaction involving the Corporation (including, without limitation, any stock dividend, stock split, extraordinary cash dividend, recapitalization, reorganization, merger, consolidation, split-up, spin-off, combination, or exchange of shares), Shareholder approval be obtained for any repricing, exchange or buyout of underwater awards.

•No Discount Awards; Maximum Term Specified. Stock options and stock appreciation rights must have an exercise price or base price no less than the higher of the closing price of our Subordinate Voting Shares on the date the award is granted or the trading date preceding the grant date and a term no longer than ten years.

•No Liberal Change in Control Definition. The change in control definition in the Amended Plan is not a “liberal” definition. A change in control transaction must actually occur in order for the change in control provisions in the Amended Plan to be triggered.

•Recoupment/Clawback. Awards granted under the Amended Plan may be subject to potential forfeiture to or recoupment by the Corporation as provided in the Amended Plan.

Why We Support the Proposal

The Amended Plan is key to our attracting and retaining top talent. Attracting and retaining top talent in this very competitive industry is one of our fundamental strategic imperatives. Our long-term equity compensation program for our officers and employees is a significant element of our compensation strategy for attracting and retaining our top employees and directors. We have found that equity-based awards are valued by our executives and employees.

That sense of value, when coupled with multi-year vesting periods, and performance-based vesting in certain cases, serves to enhance retention of these employees as well as collaboration among them. We believe an equity incentive plan is key to our long-term success and the future realization of value creation for our all of our Shareholders.

The Amended Plan will be used to align the long-term interests of our employees, with those of our Shareholders. We consider it crucial to maintain a strong association between compensation of our key employees and our Shareholders’ long-term interests. Our long-term equity compensation program is a significant factor in achieving this goal.

Governance-related Provisions. As discussed below, the Amended Plan includes terms that reflect our strong commitment to governance measures and plan design features considered important by key institutional shareholders and proxy advisory firms.

For these reasons, we are asking Shareholders to approve the additional shares authorized for issuance under the Amended Plan and thereby enable us to continue to implement our long-term equity compensation program.

Request for Approval of Share Pool Increase

If Shareholders do not approve our Amended Plan, our ability to grant equity awards to our existing employees and management team and to new hires will be severely limited, which would place us at a competitive disadvantage. After a review of our historical practices and our anticipated future growth, we believe that the shares that would become available under our Amended Plan if this proposal is approved would enable us to continue to grant equity awards for several years, which is vital to our ability to attract and retain the talent required to support our continued growth in the extremely competitive labor market in which we compete.

In determining the share pool under our Amended Plan, the Board considered the historical number of equity awards granted by the Corporation in the past three years. In 2023, 2022 and 2021, the Corporation made equity awards in respect of 9,825,000, 12,087,000 and 5,771,000 shares, respectively, under our 2018 Plan. The As-converted SVS issued and outstanding on December 31, 2023, 2022 and 2021 was 436,197,730, 407,336,912, and 406,955,055, respectively. The Corporation’s three-year average burn rate under the 2018 Plan is 2.2%. We believe our historical burn rate is within market range for a company of our size in our industry, especially given our broad-based use of equity awards to compensate our employees and directors. We believe a low burn rate reflects a judicious use of equity for compensation purposes. We will continue to monitor our equity use in future years to ensure our burn rate is within competitive market norms.

Outstanding Equity Awards

In setting the number of shares authorized for issuance under the Amended Plan, we considered the total outstanding equity awards under the 2018 Plan. Under the heading “Securities Authorized for Issuance Under Equity Compensation Plans” beginning on page 30, we provide certain information about Subordinate Voting Shares that may be issued under our equity compensation plans as of December 31, 2023. To facilitate the approval of the Amended Plan, set forth below is certain additional information as of the record date, May 31, 2024.

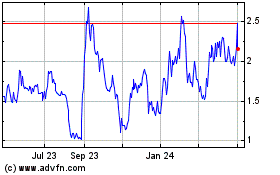

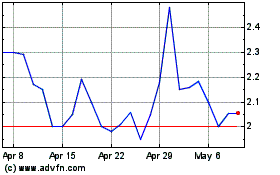

As of May 31, 2024, we had 346,815,776 As-converted SVS issued and outstanding. The closing price of the Subordinate Voting Shares as reported on the OTC on May 31, 2024, was US$1.91 and the closing price of the Subordinate Voting Shares on the Canadian Securities Exchange was C$2.62.

Historical Equity Award Granting Practices

We also considered both our total equity “overhang” and our historical and projected annual “burn rate” in developing our share increase to the Amended Plan and analyzing the impact of using equity as a means of compensation on our Shareholders.

Burn rate provides a measure of the potential dilutive impact of our equity award program which we calculate by dividing the number of shares subject to equity awards granted during the year by the As-converted SVS outstanding. In proposing the number of shares authorized for issuance under the Amended Plan, we considered the number of equity awards granted under the 2018 Plan in the past three fiscal years. In 2023, 2022 and 2021, the

Corporation granted equity awards representing a total of approximately 9,825,000 shares, 12,087,000 shares and 5,771,000 shares, respectively, as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In thousands except percentages) | | 2023 | | 2022 | | 2021 |

| Stock options granted | | 3,442 | | 7,578 | | 5,227 |

| Restricted stock units granted | | 6,276 | | 4,296 | | 544 |

Performance stock units granted1 | | 107 | | 213 | | — |

| As-converted SVS outstanding at year end | | 436,198 | | 407,337 | | 406,955 |

| Burn rate | | 2.3 | | % | | 3.0 | | % | | 1.4 | | % |

1 Performance stock units granted consisted of 36,000 options and 71,000 Restricted stock units ("RSUs") in 2023 and 71,000 options and 142,000 RSUs in 2022. |

We also considered our three-year average burn rate (2023, 2022, and 2021) which as noted above is 2.2%. We believe our historical burn rate is within market range for a company of our size in our industry, especially given our broad-based use of equity awards to compensate our employees and directors. We will continue to monitor our equity use in future years to ensure our burn rate is within competitive market norms.

Our future burn rate will depend on a number of factors, including the number of participants in the Amended Plan, the price per share of our Subordinate Voting Shares, any changes to our compensation strategy, changes in business practices or industry standards, changes in our capital structure due to stock splits or similar events, the compensation practices of our competitors or changes in compensation practices in the market generally, and the methodology used to establish the equity award mix.

Expected Share Usage Needs

In setting the number of shares authorized for issuance under the Amended Plan, we also considered the potential dilution that would result by approval of the authorization of the share pool for the Amended Plan, and major proxy advisory firms. The actual dilution will depend on several factors, including the types of awards made under the Amended Plan. The Board believes the number of shares requested represents a reasonable amount of potential equity dilution, within a competitive range of the median of similarly situated companies.

Summary of the Amended Plan

The following summary describes the most significant features of the Amended Plan. This summary is not intended to be complete and is qualified in its entirety by reference to the full text of the Amended Plan, a copy of which is attached as Schedule “A” to this Circular.

Eligibility and Participation

Any of the Corporation’s employees, officers, directors, or consultants (who are natural persons) are eligible to participate in the Amended Plan if selected by the Compensation Committee. The basis of participation of an individual under the Amended Plan, and the type and amount of any award that an individual will be entitled to receive under the Amended Plan, will be determined by the Compensation Committee based on its judgment as to the best interests of Cresco and its Shareholders.

Administration

The Compensation Committee will generally be the administrator of the Amended Plan. Except as provided otherwise under the Amended Plan, the administrator has plenary authority to grant awards pursuant to the terms of the Amended Plan to eligible individuals, determine the types of awards and the number of shares covered by the awards, establish the terms and conditions for awards and take all other actions necessary or desirable to carry out the purpose and intent of the Amended Plan.

The Compensation Committee may delegate to the officers and employees of the Corporation limited authority to perform administrative actions under the Amended Plan to assist in its administration to the extent permitted by applicable law and stock exchange rules. Such delegation of authority, however, shall not extend to the granting of, or exercise of discretion with respect to, awards to officers under Section 16 of the Exchange Act.

Shares Available Under the Amended Plan

The Subordinate Voting Shares issuable pursuant to awards under the Amended Plan will be shares authorized for issuance under our Articles. When the Amended Plan becomes effective, the number of Subordinate Voting Shares issuable pursuant to awards granted under the Amended Plan (the “Share Pool”) will be equal to the greater of (i) 10% of the issued and outstanding As-converted SVS, on a rolling basis, and (ii) the sum of (x) 10% of the issued and outstanding As-converted SVS as of the Effective Date plus (y) 20,000,000 additional Subordinate Voting Shares; provided that if the amount determined in accordance with clause (i) is at any time greater than or equal to the amount determined in accordance with clause (ii), then the Share Pool shall thereafter be the equal to 10% of the issued and outstanding As-converted SVS, on a rolling basis.

The number of “unallocated” entitlements is calculated by subtracting (i) the number of Subordinate Voting Shares issuable pursuant to outstanding entitlements under the Amended Plan from (ii) the Share Pool at the time.

Adjustments to Share Pool. Following the effective date of the Amended Plan, the Share Pool will be adjusted as follows:

•The Share Pool will be reduced by one share for each Subordinate Voting Shares made subject to an award granted under the Amended Plan.

•The Share Pool will be increased by the number of unissued Subordinate Voting Shares underlying or used as a reference measure for any award or portion of an award granted under the Amended Plan that is canceled, forfeited, expired, terminated unearned or settled in cash, in any such case without the issuance of shares.

•The Share Pool will not be increased by (A) shares tendered by recipients, or withheld by Cresco, as full or partial payment to Cresco upon the exercise of stock options granted under the Amended Plan, until such shares are cancelled; (B) shares reserved for issuance upon the grant of stock appreciation rights, to the extent the number of reserved shares exceeds the number of shares actually issued upon the exercise of the stock appreciation rights; and (C) shares withheld by, or otherwise remitted to, Cresco to satisfy a recipient’s tax withholding obligations upon the lapse of restrictions on stock awards or the exercise of stock options or stock appreciation rights granted under the Amended Plan, until such shares are cancelled.

In the event of a merger, consolidation, stock rights offering, statutory share exchange or similar event affecting the Corporation or a stock dividend, stock split, reverse stock split, separation, spinoff, reorganization, extraordinary dividend of cash or other property, share combination or subdivision, or recapitalization or similar event affecting the capital structure of the Corporation, the Compensation Committee will adjust the Share Pool proportionately to reflect the transaction or event. Similar adjustments will be made to the award limitations described below and to the terms of outstanding awards.

Types of Awards

The Amended Plan enables the grant of stock options, stock appreciation rights, stock awards, restricted stock unit awards, performance shares, performance units, and other stock-based awards, each of which may be granted separately or in tandem with other awards.

Stock Options and Stock Appreciation Rights. Stock options represent a right to purchase a specified number of our Subordinate Voting Shares from us at a specified price during a specified period of time. Stock options may be granted in the form of incentive stock options, which are intended to qualify for favorable treatment for the recipient under U.S. federal tax law, or as nonqualified stock options, which do not qualify for this favorable tax treatment. Only employees of the Corporation or its subsidiaries may receive tax-qualified incentive stock options within the U.S. Stock appreciation rights represent the right to receive an amount in cash, Subordinate Voting Shares or both equal to the fair market value of the shares subject to the award on the date of exercise minus the exercise price of the award. All stock options and stock appreciation rights must have a term of no longer than ten years’ duration. Stock options and stock appreciation rights generally must have an exercise price equal to or above the higher of the fair market value of our shares of Subordinate Voting Shares on the date of grant or the trading day preceding the date of grant except as provided under applicable law or with respect to stock options and stock appreciation rights that are granted in substitution of similar types of awards of a Corporation acquired by us or an affiliate or with which we or our affiliate combine (whether in connection with a corporate transaction, such as a merger, combination, consolidation or acquisition of property or stock, or otherwise) to preserve the intrinsic value of such awards.

As of May 31, 2024, the per share fair market value of our Subordinate Voting Shares was US$1.91 on the OTC and C$2.62 on the Canadian Securities Exchange.

Prohibition on Repricing. Except in connection with a corporate transaction involving the Corporation (including, without limitation, any stock dividend, stock split, extraordinary cash dividend, recapitalization, reorganization, merger, consolidation, split-up, spin-off, combination, or exchange of shares), the terms of stock options and stock appreciation rights granted under the Amended Plan may not be amended, after the date of grant, to reduce the exercise price of such stock options or stock appreciation rights, nor may outstanding stock options or stock appreciation rights be canceled in exchange for (i) cash, (ii) stock options or stock appreciation rights with an exercise price that is less than the exercise price of the original outstanding stock options or stock appreciation rights, or (iii) other awards, unless such action is approved by our Shareholders.

Restricted Stock. Awards of restricted stock are actual Subordinate Voting Shares that are issued to a participant, but that are subject to forfeiture if the participant does not remain employed by us for a certain period of time and/or if certain performance goals are not met. Except for these restrictions and any others imposed by the administrator, the participant will generally have all of the rights of a shareholder with respect to the restricted stock, including the right to vote the restricted stock, but will not be permitted to sell, assign, transfer, pledge or otherwise encumber shares of restricted stock before the risk of forfeiture lapses.

Dividends declared payable on shares of restricted stock that are granted subject to risk of forfeiture conditioned solely on continued service over a period of time will be deferred for payment to such later date as determined by the administrator, and may be paid in cash or as unrestricted shares of our Subordinate Voting Shares or may be reinvested in additional shares of restricted stock. Dividends declared payable on shares of restricted stock that are granted subject to risk of forfeiture conditioned on satisfaction of performance goals will be held by us and made subject to forfeiture at least until the applicable performance goal and/or service-based restriction related to such shares of restricted stock has been satisfied.

Restricted Stock Units. An award of restricted stock units represents a contractual obligation of the Corporation to deliver a number of Subordinate Voting Shares, an amount in cash equal to the fair market value of the specified number of shares subject to the award, or a combination of shares and cash. Until Subordinate Voting Shares are issued to the participant in settlement of stock units, the participant shall not have any rights of a shareholder of the Corporation with respect to the stock units or the shares issuable thereunder. Vesting of restricted stock units may be subject to performance goals, the continued service of the participant or both. The administrator may provide that dividend equivalents will be paid or credited with respect to restricted stock units, but such dividend equivalents will be held by us and made subject to forfeiture at least until any applicable performance goal related or other service-based restriction to such restricted stock units has been satisfied.

Performance Shares and Performance Units. The Amended Plan permits the granting of performance shares and performance units upon such terms as the Compensation Committee may establish. Performance shares refer to Subordinate Voting Shares or Units that are expressed in terms of Subordinate Voting Shares, the issuance, vesting, lapse of restrictions on or payment of which is contingent on performance as measured against performance objectives over a specified performance period. Performance units refer to Canadian dollar-denominated units established by the Compensation Committee, the issuance, vesting, lapse of restrictions on or payment of which is contingent on performance as measured against performance objectives over a specified performance period. Any earned performance shares and performance units will be settled in the form of shares, cash or a combination thereof as provided in the applicable award agreement.

Other Stock-Based Awards. The Compensation Committee may grant other stock-based awards, subject to the terms and conditions as the Compensation Committee determines are appropriate, which may include, without limitation, the grant of deferred shares or shares based on attainment of performance or other goals established by the Compensation Committee, or shares in lieu of cash under other incentive or bonus programs, or dividend equivalents based on the dividends actually declared and paid on outstanding shares (subject to the same vesting conditions as applicable to the underlying award). These other awards may be subject to such terms and conditions as the Compensation Committee establishes.

Award Limitations

The following limitations on awards are imposed under the Amended Plan:

ISO Award Limit. The maximum number of Subordinate Voting Shares that may be issued in connection with awards granted under the Amended Plan that are intended to qualify as incentive stock options under Section 422 of the Code shall be determined by the Board from time to time.

Effect of Certain Corporate Transactions

Change in Control. The Amended Plan provides that, in the event a Change in Control (as defined in the Amended Plan) occurs, outstanding awards will terminate upon the effective time of such Change in Control, unless provision

is made in connection with the transaction for the continuation or assumption of such awards, or for the issuance of substitute awards therefor, by the surviving entity. Solely with respect to awards that will terminate as provided in the immediately preceding sentence and except as otherwise provided in the applicable award agreement, the Amended Plan generally provides that, immediately before the effective time of the Change in Control, all outstanding awards will become vested (with any and all performance conditions deemed satisfied as if target performance was achieved), and will be exercisable or settled, as applicable, as promptly as practicable.

Subject to the above, the Compensation Committee may specify, on or after the date of grant, in an award agreement or amendment thereto, the consequences of a participant’s termination of service that occurs coincident with or following the occurrence of a Change in Control, if a Change in Control occurs under which provision is made in for the continuation or assumption of outstanding awards, or for the issuance of substitute awards therefor, by the surviving entity.

Adjustments for Stock Splits, Stock Dividends and Similar Events. The Amended Plan provides that, in the event of any stock dividend, stock split, spin-off, rights offering or recapitalization through an extraordinary dividend, the Compensation Committee shall cause an equitable adjustment to be made (i) in the number and kind of shares that may be delivered under the plan, (ii) with respect to outstanding awards, in the number and kind of shares subject to outstanding awards, (iii) with respect to outstanding awards, to the exercise price or the grant price of shares subject to outstanding awards, and (iv) any other value determinations applicable to any outstanding awards.

In the event of any other change in corporate capitalization, such as a merger, consolidation, stock rights offering or share exchange, the Compensation Committee may, in its sole discretion, cause an equitable adjustment as described above to be made to prevent dilution or enlargement of rights.

In the event of any changes in corporate structure as described above, the Compensation Committee may also make other adjustments in the terms of any awards as it deems appropriate, including, without limitation, (i) modifications of performance goals and/or performance periods, (ii) substitution of other property of equivalent value for shares available under the Amended Plan or shares covered by outstanding awards, and (iii) the substitution of equivalent awards, as determined in the sole discretion of the Compensation Committee, of the surviving or successor entity or a parent thereof.

In addition, the Compensation Committee may make adjustments in the terms and conditions of, and the criteria included in, awards in recognition of unusual or nonrecurring events affecting the Corporation or the financial statements of the Corporation or of changes in applicable laws, regulations, or accounting principles, whenever the Compensation Committee determines that such adjustments are appropriate in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the Amended Plan.

Nontransferability. Unless otherwise determined by the Compensation Committee, awards may not be assigned or transferred by a participant except by will or by the laws of descent and distribution, and any incentive stock option is exercisable during a participant’s lifetime only by the participant.

Amendment and Termination

The Board may terminate the Amended Plan at any time for any reason. The Amended Plan is scheduled to terminate ten years after its original effective date (November 29, 2028). The Board may also amend the Amended Plan. Amendments are to be submitted to shareholders for approval to the extent required by applicable laws, rules or regulations. Generally, no award of options or stock appreciation rights may be repriced, replaced or re-granted through cancellation without the approval of shareholders. In addition, except under limited circumstances (such as to comply with applicable law), without the written consent of the holder, no amendment or termination of the Amended Plan may materially and adversely modify the holder’s rights under the terms and conditions of an outstanding award.

Compliance with Listing Rules

While shares are listed for trading on any stock exchange or market, our Board agrees that it will not make any amendments, issue any awards or take any action under the Amended Plan unless such action complies with the relevant listing rules.

Registration with the Securities and Exchange Commission

The Corporation intends to file a Registration Statement on Form S-8 to register the additional Subordinate Voting Shares reserved for issuance under the Amended Plan with the Securities and Exchange Commission pursuant to the Securities Act of 1933, as amended, as soon as is practicable after approval of the Amended Plan by Shareholders.

Material U.S. Federal Income Tax Consequences of the Amended Plan

The following discussion is intended only as a general summary of the material U.S. federal income tax consequences of awards issued under the Amended Plan, based upon the provisions of the Code as of the date of this Circular, for the purposes of shareholders considering how to vote on this proposal. It is not intended as tax guidance to participants in the Amended Plan. This summary does not take into account certain circumstances that may change the income tax treatment of awards for individual participants, and it does not describe the state income tax consequences of any award or the taxation of awards in jurisdictions outside of the U.S.