Banco BPM Surges After Agreement With Credit Agricole, Update on Bad Loans Sale -- Update

December 03 2018 - 7:33AM

Dow Jones News

Adds shares price, analysts comments, deal details

By Pietro Lombardi

Shares in Italy's Banco BPM SpA (BAMI.MI) trade sharply higher

Monday after the bank said it has reached a consumer-credit

agreement with France's Credit Agricole SA (ACA.FR) and is pushing

ahead with the sale of a multi-billion euro bad-loan portfolio.

The deal with the French bank will boost Banco BPM's capital

ratio and help offset the impact of the bad-loan sale, it said late

Friday.

Banco BPM will sell its consumer-loans business ProFamily SpA to

Agos Ducato SpA, a joint venture between Banco BPM and Credit

Agricole, for 310 million euros ($350.8 million) as part of an

agreement between the two banks to extend their partnership in

consumer finance for 15 years.

Shares in the Italian bank trade 5.2% higher at 1200 GMT.

"Overall, we view these announcements as positive, broadly

aligned with our view about [Banco BPM] looking on track to

accelerate its de-risking process without further compromising its

solvency and preserving Agos' (sizeable) earnings stream," UBS

analysts said.

Banco BPM and Credit Agricole will also consider an IPO of Agos

in the next two years, the companies said. "Such transaction

provides additional flexibility to both shareholders while

preserving their respective strong commitment for the future

development of the company," the Italian bank said.

Banco BPM will keep its 39% stake in Agos for now, with the

French bank owning the remaining 61%. However, should the IPO take

place, Banco BPM would have the option to cut its stake in Agos

while maintaining a minimum stake of 10%.

The French bank has also granted Banco BPM an option to sell a

10% stake in Agos in June 2021 for EUR150 million. The Italian bank

said it is unlikely to exercise the option "given the wide gap

between...EUR150 million and the intrinsic value of Agos."

"In our view, pricing and structure of the consumer-credit

reorganization are optimal," Deutsche Bank said.

The bank said the consumer-credit deal should have a positive

impact on its pro-forma fully loaded CET1 ratio of roughly 80 basis

points. This is larger than anticipated, according to UBS, while

"earnings power is preserved" as Banco BPM's "stake in Agos remains

unchanged."

Banco BPM said it is continuing negotiations with three groups

over the sale of up to EUR7.8 billion of bad loans.

This is "well above the targeted amount of EUR3.5 billion

previously envisaged in the plan and with a capital impact in any

case lower than the benefit coming from the reorganization in

consumer credit," it said.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com

(END) Dow Jones Newswires

December 03, 2018 07:18 ET (12:18 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

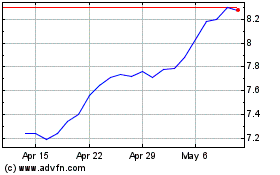

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jun 2024 to Jul 2024

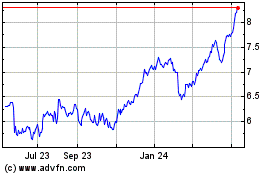

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024