Crédit Agricole Profits From Market Volatility -- 2nd Update

February 15 2017 - 5:54AM

Dow Jones News

By Noemie Bisserbe

PARIS--French bank Crédit Agricole SA reported a drop in

fourth-quarter net profit on a write-down in its domestic retail

arm, but posted a solid investment-banking performance amid a

broader pickup in activity fueled in part by U.S. President Donald

Trump's election victory.

France's second-largest listed bank by assets said Wednesday

that net profit fell 67% to EUR291 million ($308 million) in the

three months through December, from EUR882 million a year earlier.

That undershot analysts' expectations of EUR301 million, according

to data provider FactSet.

But excluding one-off items, Crédit Agricole's net profit rose

53% to EUR904 million, lifted by strong investment-banking and

asset-management performances, and sending the bank's shares 5.5%

higher in early trading in Paris. Revenue rose 7% to EUR4.58

billion.

Banks benefited from a surge in trading activity in the fourth

quarter, as investors dumped government bonds and piled into

financial stocks on expectations that tax cuts, deregulation and

fiscal spending under the new Trump administration would kick-start

growth and inflation.

Net profit at Crédit Agricole's corporate-and-investment bank

surged to EUR271 million from EUR76 million a year earlier, buoyed

by volatile markets.

But at the same time, banks' margins have been pressured by

persistently low interest rates and loan renegotiations.

These factors prompted Crédit Agricole to book a EUR491 million

write-down on its retail bank LCL in the fourth quarter, announced

in January.

"There was a new wave of loan renegotiations in the second half

of the year," Chief Executive Philippe Brassac said at a press

conference in Paris. However, Mr. Brassac said he saw signs of

improvement in the fourth quarter.

Its insurance and asset-management business reported a 14%

increase in net profit to EUR448 million, while net profit for its

specialized financial-services business rose 15% to EUR170

million.

Amundi SA, Crédit Agricole's fund manager, plans to carry out a

capital increase in the first half of this year to help finance its

EUR3.9 billion takeover of Pioneer Investments, the

asset-management unit of Italian lender UniCredit SpA. Crédit

Agricole said it would retain a 70% stake in Amundi after the

capital increase.

Net profit for its international retail-banking business--which

includes Italy, Poland and Egypt--fell 38% to EUR24 million.

Despite lower earnings in the quarter, Crédit Agricole's core

Tier 1 ratio, which compares top-quality capital such as equity and

retained earnings with risk-weighted assets, stood at 12.1% in

December, up from 12% in September.

The bank's leverage ratio, which measures capital held by the

bank against its total assets, was 5% in December, compared with

4.7% at the end of September.

The bank said it would pay shareholders a dividend of EUR0.60 a

share for 2016.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com

(END) Dow Jones Newswires

February 15, 2017 05:39 ET (10:39 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

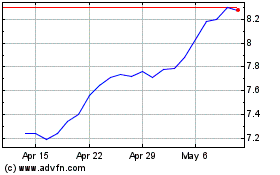

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2024 to Jul 2024

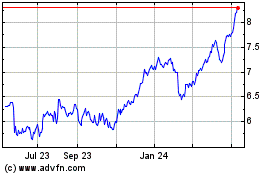

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024