Cré dit Agricole, Socié té Gé né rale Buoyed by Stake Sales

August 03 2016 - 5:10AM

Dow Jones News

PARIS—French banks Cré dit Agricole SA and Socié té Gé né rale

SA on Wednesday reported a bigger-than-expected jump in

second-quarter net profit, as the sale of their respective shares

in Visa Europe helped offset pressure from volatile markets and

persistently low interest rates.

Cré dit Agricole's net profit rose 26% to €1.16 billion ($1.30

billion) in the three months to the end of June, while at Socié té

Gé né rale it increased 8% to â,¬1.46 billion. Revenue rose by 2%

at both banks, to €4.74 billion at Cré dit Agricole and to €6.98

billion at Socié té Gé né rale.

The Visa Europe stake sale gave Cré dit Agricole a gain of €328

million and Socié té Gé né rale €725 million.

The forecast-beating results cheered investors and In early

trading Wednesday Cré dit Agricole were up 2.9% while Socié té Gé

né rale's rose 3.1%.

Capital gains and a balanced business mix have helped French

banks navigate a difficult economy and choppy markets this quarter.

French lenders fared better than some of their European rivals such

as Credit Suisse Group and Deutsche Bank AG, that were badly hit by

a drop in equity trading and the impact of stricter financial

regulation.

Cré dit Agricole said that insurance, asset management and a

strong specialized financial services business helped make up for a

lower net profit from its investment bank.

Its insurance and asset management business reported an 8%

increase in net profit to €415 million, while net profit for its

specialized financial services business rose 23% to €154

million.

Net profit at its corporate and investment bank fell 8% to €365

million under pressure from volatile markets.

Cré dit Agricole's domestic retail arm, LCL, also reported a 38%

drop in net profit to €108 million, hurt by persistently low

interest rates.

At Socié té Gé né rale, international retail banking and

financial services helped offset sharply lower trading.

Its international retail banking and financial services division

posted a 36% jump in second-quarter net profit to €436 million,

while its global banking and investor solutions business—which

includes investment banking, security services and asset

management—posted a 36% drop in net profit to €448 million.

Net profit at Socié té Gé né rale's retail bank in France was

also down 5% at €403 million.

The two banks said their capital buffers remained comfortably

above regulatory thresholds.

Socié té Gé né rale's core tier one ratio, which compares top

quality capital such as equity and retained earnings with

risk-weighted assets, was stable at 11.1% in June while at Cré dit

Agricole's it rose to 11.2% in June from 10.8% in March.

The sale of Cré dit Agricole's 25% stake the bank holds in the

group's regional lenders should help lift its core tier one ratio

to 11.9%.

The bank, which is 56%-owned by the group's regional cooperative

lenders, said in February it would sell back the 25% stake it holds

in the group's regional lenders to ease concerns about its capital

strength.

Cré dit Agricole said on Wednesday that it would book a €1.25

billion gain on the stake sale in the third quarter of 2016.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com

(END) Dow Jones Newswires

August 03, 2016 04:55 ET (08:55 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

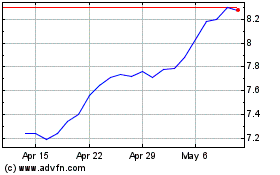

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2024 to Jul 2024

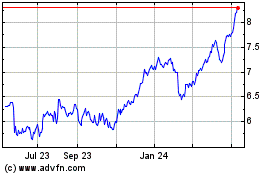

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024