Crédit Agricole Profit Hurt by Stake Sale -- Update

May 12 2016 - 4:20AM

Dow Jones News

By Noemie Bisserbe

PARIS--Crédit Agricole SA said Thursday that its net profit

plunged in the first quarter, hit by the planned sale of its 25%

stake in the group's regional banks and debt restructuring.

The Paris-based lender, France's second-largest listed bank by

assets, said net profit fell by 71% to EUR227 million ($259

million) in the three months to the end of March from EUR784

million a year ago. Revenue was down 13% at EUR3.8 billion.

The bank said it booked a EUR448 million charge to restructure

part of its debt and help reduce future costs. Crédit Agricole also

discounted the contribution from the group's regional lenders in

its first-quarter earnings.

The profit figure missed forecasts of EUR314 million according

to a FactSet poll, pushing the bank's shares sharply lower in early

trading Thursday.

Crédit Agricole is 56%-owned by the group's regional cooperative

lenders and in turn controls 25% of those banks. It warned earlier

this year that the sale of the 25% stake back to these regional

lenders would cut the bank's annual earnings by about EUR470

million.

Its earnings this quarter highlight the challenge faced by the

French bank in continuing to provide stable returns to investors

given its new revenue mix, particularly against a backdrop of

persistently low interest rates and volatile markets.

Higher revenue at its insurance, asset management and

specialized financial service units in the first quarter didn't

make up for a weak investment banking business, which was dented by

lower client demand and choppy markets.

Crédit Agricole's insurance and asset management business

reported a 10% increase in net profit to EUR379 million, while net

profit for its specialized financial services business rose 89% to

EUR129 million.

Net profit at its corporate and investment bank plunged 54% to

EUR163 million from EUR334 million a year earlier.

Net profit for its international retail banking business, which

includes Italy, Poland and Egypt, nearly doubled to EUR53 million

from EUR27 million a year earlier.

However, Crédit Agricole's own domestic retail arm, LCL,

reported a 32% drop in net profit to EUR85 million, pressured by

low interest rates despite a pickup in loan demand.

( Market Talk is a stream of real-time news and market analysis

available on Dow Jones Newswires.)

Excluding the impact of the stake sale and one-time items,

Crédit Agricole's net profit still fell by 9% to EUR394 million

from EUR435 million a year earlier.

Despite its lower earnings, Crédit Agricole's core tier-one

ratio, which compares top-quality capital such as equity and

retained earnings with risk-weighted assets, stood at 10.8%, up

from 10.7% in December.

The bank's leverage ratio, which measures capital held by the

bank against its total assets, was 4.4% compared with 4.6% at the

end of December.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com

(END) Dow Jones Newswires

May 12, 2016 04:05 ET (08:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

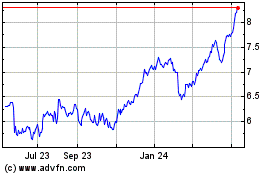

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2024 to Jul 2024

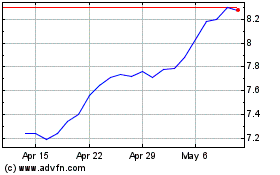

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024