Cré dit Agricole Profit Hurt by Stake Sale

May 12 2016 - 1:50AM

Dow Jones News

PARIS—Cré dit Agricole SA said Thursday that its net profit

plunged in the first quarter, hit by the planned sale of its 25%

stake in the group's regional banks and debt restructuring.

The Paris-based lender, France's second-largest listed bank by

assets, said net profit fell by 71% to €227 million ($259 million)

in the three months to the end of March from €784 million a year

ago. Revenue was down 13% at €3.8 billion.

The bank said it booked a €448 million charge to restructure

part of its debt and help reduce future costs. Cré dit Agricole

also discounted the contribution from the group's regional lenders

in its first-quarter earnings .

Cré dit Agricole is 56%-owned by the group's regional

cooperative lenders and in turn controls 25% of those banks. It

warned earlier this year that the sale of the 25% stake back to

these regional lenders would cut the bank's annual earnings by

about €470 million.

Its earnings this quarter highlight the challenge faced by the

French bank in continuing to provide stable returns to investors

given its new revenue mix, particularly against a backdrop of

persistently low interest rates and volatile markets.

Higher revenue at its insurance, asset management and

specialized financial service units in the first quarter didn't

make up for a weak investment banking business, which was dented by

lower client demand and choppy markets.

Cré dit Agricole's insurance and asset management business

reported a 10% increase in net profit to €379 million, while net

profit for its specialized financial services business rose 89% to

€129 million.

Net profit at its corporate and investment bank plunged 54% to

€163 million from €334 million a year earlier.

Net profit for its international retail banking business, which

includes Italy, Poland and Egypt, nearly doubled to €53 million

from €27 million a year earlier.

However, Cré dit Agricole's own domestic retail arm, LCL,

reported a 32% drop in net profit to €85 million, pressured by low

interest rates despite a pickup in loan demand.

Excluding the impact of the stake sale and one-time items, Cré

dit Agricole's net profit still fell by 9% to €394 million from

€435 million a year earlier.

Despite its lower earnings, Cré dit Agricole's core tier-one

ratio, which compares top-quality capital such as equity and

retained earnings with risk-weighted assets, stood at 10.8%, up

from 10.7% in December.

The bank's leverage ratio, which measures capital held by the

bank against its total assets, was 4.4% compared with 4.6% at the

end of December.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com

(END) Dow Jones Newswires

May 12, 2016 01:35 ET (05:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

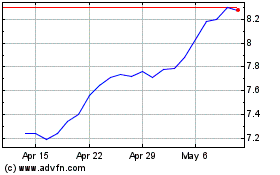

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2024 to Jul 2024

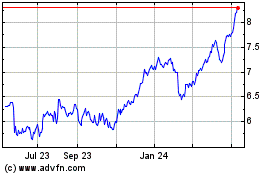

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024