BNP, Crédit Agricole Cited in Panama Papers--Report

May 11 2016 - 12:22PM

Dow Jones News

By Noemie Bisserbe

PARIS--French banks BNP Paribas SA and Crédit Agricole SA helped

wealthy customers park money in offshore shell companies set up by

Panamanian law firm Mossack Fonseca & Co., according to a new

report citing a leaked trove of confidential documents.

A cache of documents, now known as the Panama Papers, reveal

that Crédit Agricole used the services of Mossack Fonseca set up

1,129 firms in tax havens since the 1990s, of which 54 are still

active, French daily Le Monde reported Wednesday. The sole purpose

of most of these firms is to manage bank accounts, adds the

report.

Crédit Agricole said in a statement that it had stopped setting

up offshore accounts for its customers in 2015, and that the Le

Monde report was "misleading." It added that the bank "applied

strictly anti-money-laundering rules" and "systematically alerted

relevant authorities" in case it suspected any wrong doing.

BNP Paribas, France's largest-listed bank by assets, also worked

with the Panamanian firm to set up 468 firms for its clients since

the 1980s, according to the report. Only 6 of these accounts are

still active today. However, the documents showed the BNP Paribas

worked with other law firms in Panama, suggesting many more of its

clients may hold offshore accounts, it added.

A spokesman for BNP Paribas declined to comment.

French banks are under intense pressure to convince regulators

and law makers they are doing everything in their power to ensure

clients aren't using offshore accounts for money laundering or to

avoid taxes.

On Wednesday, Société Générale Chief executive Frédéric Oudéa

was summoned by law makers in the French Senate after media reports

last month revealed that the bank had worked with Mossack Fonseca

to set up several hundred offshore shell companies.

While Société Générale closed down its Panama units in 2012, it

still had 66 active offshore client accounts linked to the

Panamanian law firm at the end of March, said the bank.

"For us, these accounts are in compliance with tax rules," said

Mr. Oudéa.

"No offshore wealth company registered in Panama has been opened

using Mossack Fonseca since 2012 with the exception of one company

which was closed three months after its creation," he added.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com

(END) Dow Jones Newswires

May 11, 2016 12:07 ET (16:07 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

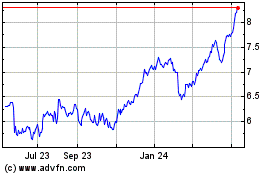

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2024 to Jul 2024

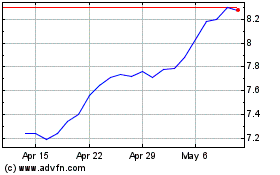

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024