Numericable Completes Biggest Ever Sale of a Single Junk Bond

April 07 2016 - 9:50AM

Dow Jones News

French telecoms giant Numericable-SFR has sold $5.19 billion in

debt on in the largest ever sale of a single junk bond.

The debt sale showed investor appetite remains strong for

selected deals in the U.S. junk bond market, which sold off sharply

in late 2015 and earlier this year.

The sale in 10-year debt, which priced on Wednesday, was

increased from $2.25 billion amid strong investor demand. It is the

largest ever single-tranche debt sale in the junk bond market,

according to data provider Dealogic. There have been larger issues,

but deals sliced into various tranches.

"Throughout all this volatility, it is reinforcing the message

that the market is open for the right kind of credit," said Mitch

Reznick, co-head of credit at Hermè s Investment Management, who

bought some of the bonds.

Mr. Reznick said the company's shift away from acquisitions-led

growth towards focusing on stabilizing the business and investment

should be more beneficial for bondholders.

Numericable did not immediately comment.

The deal comes after a volatile period for U.S. junk bonds. The

average gap in yield between U.S. high-yield bonds and U.S.

Treasurys has narrowed to around 6.5 percentage points on

Wednesday, according to Barclays. That comes amid a global rally in

riskier assets and compares to a recent high of 8.4 percentage

points in mid-February.

The U.S. junk bond market sold off in late 2015, when a sharp

decline in commodity prices hit the resource companies that have

been big issuers of this debt. Investors were also spooked by the

closure of a credit fund overseen by Third Avenue Management

LLC.

Since then, conditions have improved for high-yield investors.

The oil price has rebounded and the Federal Reserve has signaled it

is in no hurry to raise interest rates, making higher yield

investments more attractive.

Investors poured $3.3 billion into high-yield bond funds in the

first three months of 2016, according to strategists at Bank of

America Corp. They pulled $684 billion out of these funds in the

final quarter of 2015.

Jeff Mueller, a portfolio manager at Eaton Vance, said

higher-rated junk bond deals should continue to see demand from

investors.

"But the question is how quickly does that translate to the

lower quality end of the market, and I think we still need to see

further stability at these levels before that is the case," said

Mr. Mueller, who also bought some of the Numericable bonds.

Numericable is rated B+ by Standard & Poor's Ratings

Services, and B1 by Moody's Investors Service.

Numericable has already smashed records in this market. It

issued $10.88 billion-worth of debt in April 2014, the largest junk

bond sale ever. That debt was sold to help parent company Altice SA

fund its acquisition of Vivendi's SA's telecom business, SFR.

In another sign of strong investor demand, banks were able to

slightly lower the interest rate paid on these May 2026 bonds from

around 7.5% to 7.375%, according to a person familiar with the

matter.

The bonds can be called after five years.

J.P. Morgan Chase & Co, BNP Paribas SA, Deutsche Bank AG,

Barclays PLC, Bank of America Corp, Cré dit Agricole SA, Goldman

Sachs Group Inc and Morgan Stanley were underwriting the deal.

(END) Dow Jones Newswires

April 07, 2016 09:35 ET (13:35 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

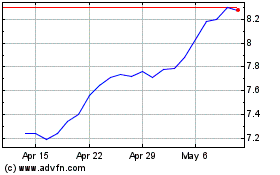

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2024 to Jul 2024

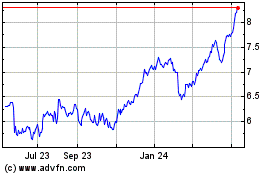

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024