BNP Paribas Profit Halved by Italian Write-Down

February 05 2016 - 1:40AM

Dow Jones News

PARIS—French bank BNP Paribas SA reported sharply lower

fourth-quarter net profit on Friday, hit by a hefty write down on

its Italian bank, BNL, and said it planned to trim its corporate

and investment bank to meet stricter financial regulation in

Europe.

The Paris-based lender, France's largest listed bank by assets,

said net profit fell 52% to €665 million ($745 million) in the

three months ended Dec. 31, from €1.38 billion a year ago. Revenue

increased 3% to €10.45 billion from €10.15 billion in the same

quarter last year.

BNP Paribas booked a €917 million write-down in the quarter

after European regulators asked the French bank to set aside

additional capital for BNL following an intensive review.

The French bank also said it planned to cut risk-weighted assets

at its investment bank by €20 billion by 2019 to wind-down

"unproductive" assets and "right-size low return activities." About

half of the capital freed-up will be reinvested in more profitable

and less capital intensive businesses, added the bank.

The target is to achieve average annual growth of 4% for

investment banking revenue between 2015 and 2019 and generate €1.6

billion in additional pretax income compared with 2015.

BNP Paribas's results this quarter and its new restructuring

plans underscore the enduring pressure on large banks in Europe to

continue to increase capital buffers to absorb potential future

losses, despite signs of a progressive economic recovery.

The European Central Bank recommended that BNP Paribas raise its

core tier one capital ratio to 11.5% by 2019, up from 10.9% in

December. A bank's core tier one capital ratio measures its top

quality capital such as equity and retained earnings against

risk-weighted assets. The ECB can prevent any bank that fails to

meet minimum requirements from paying dividends on stock and

bonuses to some employees.

This year, the bank said it would pay its shareholders a

dividend of €2.31 a share.

Its leverage ratio, another gauge of a bank's financial strength

that measures capital held against total assets, stood at 4% in

December, above the minimum 3% set by regulators for 2018.

BNP Paribas is the first major French bank to report

fourth-quarter earnings. Socié té Gé né rale SA and Cré dit

Agricole SA publish their results on Feb. 11 and Feb. 17

respectively.

Write to Noemie Bisserbe at noemie.bisserbe@wsj.com

(END) Dow Jones Newswires

February 05, 2016 01:25 ET (06:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

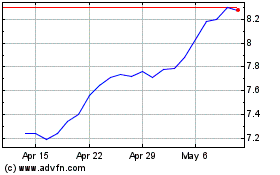

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2024 to Jul 2024

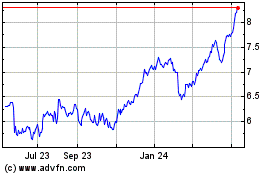

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024