Crédit Agricole to Pay $787 Million in U.S. Sanctions Case -- Update

October 20 2015 - 6:27PM

Dow Jones News

By Christopher M. Matthews and Noemie Bisserbe

French bank Crédit Agricole SA agreed to pay $787 million

Tuesday to resolve U.S. allegations it handled illegal transactions

involving Iran, Sudan, Myanmar and Cuba, the latest European lender

caught up in a crackdown on sanctions violations.

Federal prosecutors accused the bank of conspiring to defraud

the U.S. government by violating economic sanctions between 2003

and 2008, according to a complaint filed in federal court in

Washington, D.C., Tuesday, and criminally charged one of its

subsidiaries. New York's top banking regulator, which came to its

own, related settlement, said the bank sent a total of $32 billion

through its New York branch on behalf of sanctioned countries.

The bank reached two separate criminal settlements with the

Justice Department and the Manhattan district attorney's office,

admitting wrongdoing, agreeing to adopt better safeguards and

promising to not commit further violations. If it abides by those

settlements, known as deferred prosecution agreements, the criminal

charges will be dropped within three years. The bank also settled

with other federal authorities Tuesday. No bank employees were

charged.

Crédit Agricole had set aside the equivalent of about $1.8

billion to cover total potential litigation costs. The bank's share

price fell less than 1% on Tuesday. In a statement, the bank said

it would continue to cooperate with American authorities.

The settlements are the latest to stem from a long-running

crackdown by U.S. authorities on European-headquartered banks that

allegedly did deals with countries under U.S. sanctions.

Last year, French bank BNP Paribas paid a record roughly $9

billion and pleaded guilty to violating U.S. sanctions, a

settlement that sent chills through the boardrooms of Europe's

largest lenders and led French officials to accuse the U.S. of

engaging in "economic warfare." Commerzbank AG, Credit Suisse Group

AG, HSBC Holdings PLC, Barclays PLC, and Standard Chartered PLC,

among others, have also agreed to pay billions of dollars in fines

to settle allegations.

Authorities alleged Tuesday that Crédit Agricole's efforts to

get around U.S. sanctions were condoned as institutional policy.

For example, a financial security employee at the bank sent an

email in 2007 telling a colleague dealing with wire transfers that

any "reference to IRAN in the free fields must be avoided, so as

not to have to provide lengthy justification to the Yankee

authorities," according to the statement of facts filed with the

Justice Department's deferred prosecution agreement.

The bank also continued to allow 11 Sudanese banks to maintain

their U.S. dollar accounts after the U.S. imposed sanctions on the

country, prosecutors said.

An anti-money-laundering committee at the bank created a

"Sudanese U-turn exception" to process illegal dollar transactions,

which the bank's Geneva employees were encouraged to use, even

though such an exception wasn't allowed under U.S. law, authorities

said. U-turn transactions involve the transfer of funds from a

foreign bank that pass through a U.S. bank and are then transferred

to a second foreign bank.

The New York Department of Financial Services said the vast

majority of employees involved in the illegal conduct were no

longer at the bank. The bank terminated a managing director

allegedly involved in the scheme as part of its settlement with the

New York regulator, it said.

The absence of charges against individuals may open enforcement

officials to further criticism. In a memo last month, a top Justice

Department official codified guidance encouraging prosecutors to

pursue individual prosecutions before entering into corporate

settlements, in response to long-running criticism about the lack

of prosecutions of employees at large banks.

The bank also settled with Treasury Department's Office of

Foreign Assets Control, and the Board of Governors of the Federal

Reserve System. The Manhattan district attorney's office filed

charges alleging Crédit Agricole violated New York state law by

falsifying business records, while the Washington, D.C., U.S.

attorney's office filed the federal criminal charge.

Aruna Viswanatha contributed to this article.

Write to Christopher M. Matthews at christopher.matthews@wsj.com

and Noemie Bisserbe at noemie.bisserbe@wsj.com

(END) Dow Jones Newswires

October 20, 2015 18:12 ET (22:12 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

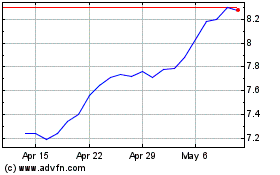

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2024 to Jul 2024

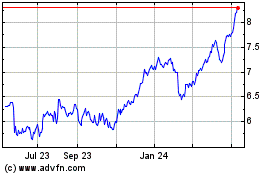

Credit Agricole (PK) (USOTC:CRARY)

Historical Stock Chart

From Jul 2023 to Jul 2024