Quarterly Report (10-q)

June 13 2014 - 12:23PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

[X] QUARTERLY REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE

ACT OF 1934

For the quarterly period ended April 30, 2014

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE EXCHANGE ACT

For the transition period from __________ to __________

Commission file number 000-53048

Concrete Leveling Systems, Inc.

(Exact name of small business issuer as specified in its charter)

Nevada 26-0851977

(State or other jurisdiction (IRS Employer

of incorporation or organization) Identification No.)

5046 E. Boulevard, NW, Canton, OH 44718

(Address of principal executive offices)

(330) 966-8120

(Issuer's telephone number)

|

(Former name, former address and former fiscal year,

if changed since last report)

Check whether the issuer (1) has filed all reports required to be filed by

Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for

such shorter period that the registrant was required to file such reports), and

(2) has been subject to such filing requirements for the past 90 days. YES [X]

NO [ ]

Indicate by check mark whether the registrant has submitted electronically and

posted on its corporate web site, if any, every Interactive Data File required

to be submitted and posted pursuant to Rule 405 of Regulation S-T (ss. 232.405

of this chapter) during the preceding 12 month (or for such shorter period that

the registrant was required to submit and post such files). YES [X] NO [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an

accelerated filer, or a non-accelerated filer (as defined in Rule 12b-2 of the

Exchange Act).

Large accelerated filer [ ] Accelerated filer [ ]

Non-accelerated filer [ ] Smaller reporting company [X]

Indicate by check mark whether the registrant is a shell company (as defined in

Rule 12b-2 of the Exchange Act). YES [ ] NO [X]

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY

PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Indicate by check mark whether the registrant has filed all documents and

reports required to be filed by Section 12, 13 or 15(d) of the Securities

Exchange Act of 1934 subsequent to the distribution of securities under a plan

confirmed by a court. Yes [ ] No [ ]

APPLICABLE ONLY TO CORPORATE ISSUERS

Indicate the number of shares outstanding of each of the issuer's classes of

common stock, as of the latest practicable date: 6,395,418

PART I - FINANCIAL INFORMATION

ITEM 1 - FINANCIAL STATEMENTS

Concrete Leveling Systems, Inc.

Balance Sheets

April 30, 2014 and July 31, 2013

April 30 July 31

---------- ----------

(Unaudited) (Audited)

Assets

Current Assets

Cash in bank $ 641 $ 2,171

Accounts receivable 4,495 4,495

Current portion of notes receivable 39,537 30,113

Interest receivable 4,279 2,447

Deposits -- 12,000

Inventory 13,802 1,070

---------- ----------

Total Current Assets 62,754 52,296

---------- ----------

Property, Plant and Equipment

Equipment 700 700

Less: Accumulated depreciation (700) (700)

---------- ----------

Total Property, Plant and Equipment -- --

---------- ----------

Other Assets

Notes receivable, net of current portion 21,022 33,337

Deposits 10 10

---------- ----------

21,032 33,347

---------- ----------

TOTAL ASSETS $ 83,786 $ 85,643

========== ==========

LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT)

Current Liabilities

Accounts payable $ 29,643 $ 36,450

Accounts payable - stockholders 36,074 36,074

Advances - stockholders 45,200 15,000

Notes payable - stockholders 62,450 62,750

Other accrued expenses 24,204 23,172

---------- ----------

Total Current Liabilites 197,571 173,446

---------- ----------

Stockholders' Equity (Deficit)

Common stock (par value $0.001)

100,000,000 shares authorized:

6,395,418 shares issued and outstanding at

April 30, 2014 and July 31, 2013 6,395 6,395

Additional paid-in capital 405,355 405,355

Retained (deficit) (525,535) (499,553)

---------- ----------

Total Stockholders' Equity (Deficit) (113,785) (87,803)

---------- ----------

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY (DEFICIT) $ 83,786 $ 85,643

========== ==========

|

See notes to financial statements.

2

Concrete Leveling Systems, Inc.

Statements of Income

For the 3 and 9 Months Ended April 30, 2014

3 Months Ended 9 Months Ended

April 30, 2014 April 30, 2014

-------------- --------------

(Unaudited) (Unaudited)

Equipment and parts sales $ -- $ --

---------- ----------

Cost of Sales -- --

---------- ----------

Gross Margin -- --

---------- ----------

Expenses

Selling, general and administration 5,323 27,784

---------- ----------

(Loss) from Operations (5,323) (27,784)

---------- ----------

Other Income (Expense)

Interest income 837 2,439

Interest expense (224) (637)

---------- ----------

Total Other Income (Expense) 613 1,802

---------- ----------

Net (Loss) Before Income Taxes (4,710) (25,982)

Provision for Income Taxes -- --

---------- ----------

Net (Loss) $ (4,710) $ (25,982)

========== ==========

Net (Loss) per Share - Basic and Fully Diluted $ (0.00) $ (0.00)

========== ==========

Weighted average number of common shares

outstanding - basic and fully diluted 6,395,418 6,395,418

========== ==========

|

See notes to financial statements.

3

Concrete Leveling Systems, Inc.

Statements of Income

For the 3 and 9 Months Ended April 30, 2013

3 Months Ended 9 Months Ended

April 30, 2013 April 30, 2013

-------------- --------------

(Unaudited) (Unaudited)

Equipment and parts sales $ -- $ 54,879

---------- -----------

Cost of Sales -- 21,333

---------- -----------

Gross Margin -- 33,546

---------- -----------

Expenses

Selling, general and administration 24,812 92,871

---------- -----------

(Loss) from Operations (24,812) (59,325)

Other Income (Expense)

Interest income 947 2,859

Interest expense (1,802) (5,542)

---------- -----------

Total Other Income (Expense) (855) (2,683)

---------- -----------

Net (Loss) Before Income Taxes (25,667) (62,008)

Provision for Income Taxes -- --

---------- -----------

Net (Loss) $ (25,667) $ (62,008)

========== ===========

Net (Loss) per Share - Basic and Fully Diluted $ (0.00) $ (0.01)

========== ===========

Weighted average number of common shares

outstanding - basic and fully diluted 6,395,418 6,395,418

========== ===========

|

See notes to financial statements.

4

Concrete Leveling Systems, Inc.

Statements of Cash Flows

For the Nine Months Ended April 30, 2014 and 2013

April 30, 2014 April 30, 2013

-------------- --------------

(Unaudited) (Unaudited)

CASH FLOWS FROM OPERATING ACTIVITIES

Net (loss) $(25,982) $(62,008)

Adjustments to reconcile net income (loss) to net

cash used in operating activities:

(Increase) in accounts receivable -- (3,695)

(Increase) in interest receivable (1,832) --

Decrease (Increase) in inventory (12,732) 13,845

Decrease (Increase) in Deposits 12,000 (5,000)

Increase (Decrease) in accounts payable (6,807) 74,563

Increase (Decrease) in other accrued expenses 1,032 (45,305)

-------- --------

Net cash from (used by) operating activities (34,321) (27,600)

-------- --------

CASH FLOWS FROM INVESTING ACTIVITIES

Payments on notes receivable 2,891 5,242

-------- --------

CASH FLOWS FROM FINANCING ACTIVITIES

Loans and advances from stockholders 29,900 13,300

-------- --------

Net (decrease) in cash (1,530) (9,058)

Cash and equivalents - beginning 2,171 9,658

-------- --------

Cash and equivalents - ending $ 641 $ 600

======== ========

SUPPLEMENTAL DISCLOSURE OF CASH FLOWS INFORMATION

Interest $ 637 $ 213

======== ========

Income Taxes $ -- $ --

======== ========

|

See notes to financial statements.

5

Concrete Leveling Systems, Inc.

Notes to Financial Statements

April 30, 2014

NOTE A - BASIS OF PRESENTATION

The accompanying unaudited financial statements have been prepared in accordance

with accounting principles generally accepted in the United States of America

for interim financial information and with the instructions to Form 10?Q and

Article 8 of Regulation S-X. Accordingly, they do not include all the

information and footnotes required by accounting principles generally accepted

in the United States of America for complete financial statements. In the

opinion of management, all adjustments (consisting of normal recurring accruals)

considered necessary for a fair presentation have been included. For further

information, refer to the financial statements and footnotes thereto included in

the Concrete Leveling Systems, Inc. Form 10-K filing for the period ended July

31, 2013.

NOTE B - GOING CONCERN

As shown in the financial statements, the Company incurred a net loss of $4,710

for the three months ended April 30, 2014, and has incurred substantial net

losses since its inception. At April 30, 2014, current liabilities exceed

current assets by $134,817. These factors raise substantial doubt about the

Company's ability to continue as a going concern. The financial statements do

not include any adjustments relating to the recoverability and classification of

recorded assets, or the amounts and classification of liabilities that might be

necessary in the event the Company cannot continue existence.

6

ITEM 2 - MANAGEMENT'S DISCUSSION AND ANALYSIS OR PLAN OF OPERATION

Concrete Leveling Systems, Inc. ("CLS" or "The Company") became an

operating company in 2009. As of April 30, 2014, CLS has cash assets of $641,

accounts receivable in the amount of $4,495 and notes receivable in the amount

of $60,559. As of April 30, 2014, the Company was carrying inventory valued at

$13,802.

The Company's cash flow is currently not sufficient to maintain operations.

However, the Company is receiving monthly payments from the self financed sale

of its concrete leveling service units, which creates some cash flow for the

Company. Mr. Edward A. Barth has continued to contact companies regarding the

service unit, but did not receive any positive leads during the last quarter.

CLS continues to have cash flow issues. As of April 30, 2014, it had total

current liabilities of $197,571, which includes advances from stockholders and

notes and accounts payable to stockholders in the amount of $143,742. The

company continues to experience negative income figures for the quarter. Mr.

Barth continues to remain in contact with potential purchasers, who have

expressed an interest in purchasing a service unit.

There are no off balance sheet arrangements involving CLS at this time.

Liquidity Issues. Since its inception, the Company has experienced

continued need for additional liquidity in order to provide for operating

expenses and to purchase components for the assembly of its product. The company

maintains an inventory of one partially completed service unit. In the event the

Company receives an order for a concrete leveling service unit, it will seek a

down payment in an amount sufficient to complete the unit, in order not to have

to borrow additional funds.

Capital Resources. CLS has made no material commitments for capital

expenditures as of the end of its fiscal quarter ending April 30, 2014 and does

not anticipate any immediate need for material capital expenditures over the

next quarter.

Result of Operations. During the quarter ended April, 2014, the Company has

experienced little activity. The Company has devoted a limited amount of its

resources to marketing its product during the last quarter. Management has

concentrated its efforts on field training for its current customers, in order

to assure repayment of the outstanding receivables. At present, it is not in

discussions with any potential buyers of its concrete leveling service units.

ITEM 4 - CONTROLS AND PROCEDURES

Disclosure Controls and Procedures. Pursuant to Rule 13a-15(b) of the

Securities Exchange Act of 1934 ("Exchange Act"), the Company carried out an

evaluation, with the participation of the Company's management, which consists

of the Company's Chief Executive Officer (CEO) and Chief Financial Officer

(CFO), of the effectiveness of the Company's disclosure controls and procedures

(as defined under Rule 13a-15(e) of the Exchange Act) as of the end of the

period covered by this report. Based upon that evaluation, the Company concluded

that the Company's disclosure controls and procedures are effective to ensure

that information required to be disclosed by the Company in the reports that the

Company files or submits under the Exchange Act, is recorded, processed,

summarized and reported, within the time period specified by the United States

Securities and Exchange Commission rules and forms, and that such information is

accumulated and communicated to the Company's management, including the

Company's CEO and CFO, as appropriate, to allow timely decisions regarding

required disclosure.

Changes in Internal Control Over Financial Reporting. There are no changes

in the Company's internal controls over financial reporting that occurred during

the three months ended April 30, 2014 that have materially affected, or are

reasonably likely to materially affect, the internal controls over financial

reporting.

7

PART II - OTHER INFORMATION

ITEM 1 - LEGAL PROCEEDINGS

To the best of its knowledge, management of CLS is not aware of any legal

proceedings in which CLS is currently involved.

ITEM 2 - UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS

There were no unregistered sales of equity securities during this quarter.

ITEM 3 - DEFAULTS UPON SENIOR SECURITIES

There are no defaults upon any senior securities.

ITEM 4 - MINE SAFETY DISCLOSURES

Not applicable.

ITEM 5 - OTHER INFORMATION

CLS is in the process of converting its web domain name. Its website can

currently be found at www.clsfab.net. The new web address will be

www.clsfabricating.com.

ITEM 6 - EXHIBITS

A. The following are filed as Exhibits to this report. The numbers refer to the

exhibit table of Item 601 of regulation S-K: Reference is hereby made to the

exhibits contained in the registration statement (Form SB-2) filed by Concrete

Leveling Systems, Inc.

Exhibit 31.1 - Rule 13a-14(a)/15d-14(a) - Certification

Exhibit 31.2 - Rule 13a-14(a)/15d-14(a) - Certification

Exhibit 32 - Section 1350 - Certification

Exhibit 101 - Interactive Data Files Pursuant to Rule 405 of Regulation S-T

8

SIGNATURES

In accordance with the requirements of the Exchange Act, the registrant

caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

CONCRETE LEVELING SYSTEMS, INC.

Date: June 13, 2014 By: /s/ Edward A. Barth

---------------------------------------------

Edward A. Barth, Principal Executive Officer

Date: June 13,2014 By: /s/ Suzanne I. Barth

---------------------------------------------

Suzanne I. Barth, Principal Financial Officer

|

9

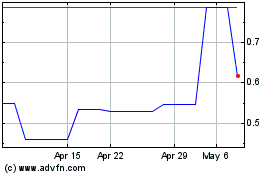

Concrete Leveling Systems (PK) (USOTC:CLEV)

Historical Stock Chart

From Jul 2024 to Jul 2024

Concrete Leveling Systems (PK) (USOTC:CLEV)

Historical Stock Chart

From Jul 2023 to Jul 2024