Crowdfunding - Amendment to Offering Statement (c/a)

September 07 2022 - 6:02AM

Edgar (US Regulatory)

schemaVersion:

The Securities and Exchange Commission has not necessarily reviewed the information in this filing and has not determined if it is accurate and complete.

The reader should not assume that the information is accurate and complete.

|

Form C: Issuer Information

Issuer Information

| Name of Issuer: | BOTS, Inc./PR |

| Check box if Amendment is material and investors will have five business days to reconfirm | ☐ |

| Describe the Nature of the Amendment: | updated financials for the fiscal year ending 04-30-2022 |

Legal Status of Issuer:

| |

| Form: | Corporation |

| Jurisdiction of Incorporation/Organization: |

PUERTO RICO

|

| Date of Incorporation/Organization: | 05-15-2020 |

Physical Address of Issuer:

| |

| Address 1: | 1064 AVE PONCE DE LEON |

| Address 2: | SUITE 200 |

| City: | SAN JUAN |

| State/Country: |

PUERTO RICO

|

| Mailing Zip/Postal Code: | 00907 |

| Website of Issuer: | www.Bots.BZ |

| Is there a Co-issuer? | ☐ Yes

☒ No

|

Intermediary through which the Offering will be Conducted:

| |

| CIK: | 0001667145 |

| Company Name: | truCrowd, Inc |

| Commission File Number: | 007-00015 |

Form C: Offering Information

Offering Information

|

Amount of compensation to be paid to the intermediary,

whether as a dollar amount or a percentage of the offering amount,

or a good faith estimate if the exact amount is not available at the time of the filing,

for conducting the offering, including the amount of referral and any other fees associated with the offering:

| The intermediary will get paid a success fee of 8% |

|

Any other financial interest in the issuer held by the intermediary, or any arrangement for the intermediary to acquire such an interest:

| None |

|

Type of Security Offered:

| Common Stock |

|

Target Number of Securities to be Offered:

| 200000 |

| Price: | 0.05000 |

| Price (or Method for Determining Price): | arbitrarily |

| Target Offering Amount: | 10000.00 |

| Maximum Offering Amount (if different from Target Offering Amount): | 250000.00 |

| Oversubscriptions Accepted: | ☒ Yes

☐ No

|

|

If yes, disclose how oversubscriptions will be allocated:

| First-come, first-served basis |

|

Deadline to reach the Target Offering Amount:

| 12-16-2022 |

|

NOTE: If the sum of the investment commitments does not equal

or exceed the target offering amount at the offering deadline,

no securities will be sold in the offering, investment commitments will be cancelled and committed funds will be returned.

|

Form C: Annual Report Disclosure Requirements

Annual Report Disclosure Requirements

| Current Number of Employees: | 4.00 |

| Total Assets Most Recent Fiscal Year-end: | 7523792.00 |

| Total Assets Prior Fiscal Year-end: | 8423266.00 |

| Cash and Cash Equivalents Most Recent Fiscal Year-end: | 25327.00 |

| Cash and Cash Equivalents Prior Fiscal Year-end: | 1236.00 |

| Accounts Receivable Most Recent Fiscal Year-end: | 10916.00 |

| Accounts Receivable Prior Fiscal Year-end: | 37.00 |

| Short-term Debt Most Recent Fiscal Year-end: | 19855.00 |

| Short-term Debt Prior Fiscal Year-end: | 274891.00 |

| Long-term Debt Most Recent Fiscal Year-end: | 232341.00 |

| Long-term Debt Prior Fiscal Year-end: | 460841.00 |

| Revenue/Sales Most Recent Fiscal Year-end: | 13981.00 |

| Revenue/Sales Prior Fiscal Year-end: | 0.00 |

| Cost of Goods Sold Most Recent Fiscal Year-end: | 1949.00 |

| Cost of Goods Sold Prior Fiscal Year-end: | 0.00 |

| Taxes Paid Most Recent Fiscal Year-end: | 0.00 |

| Taxes Paid Prior Fiscal Year-end: | 0.00 |

| Net Income Most Recent Fiscal Year-end: | -1354853.00 |

| Net Income Prior Fiscal Year-end: | -682477.00 |

|

Using the list below, select the jurisdictions in which the issuer intends to offer the securities:

| -

ALABAMA

-

ALASKA

-

ARIZONA

-

ARKANSAS

-

CALIFORNIA

-

COLORADO

-

CONNECTICUT

-

DELAWARE

-

DISTRICT OF COLUMBIA

-

FLORIDA

-

GEORGIA

-

HAWAII

-

IDAHO

-

ILLINOIS

-

INDIANA

-

IOWA

-

KANSAS

-

KENTUCKY

-

LOUISIANA

-

MAINE

-

MARYLAND

-

MASSACHUSETTS

-

MICHIGAN

-

MINNESOTA

-

MISSISSIPPI

-

MISSOURI

-

MONTANA

-

NEBRASKA

-

NEVADA

-

NEW HAMPSHIRE

-

NEW JERSEY

-

NEW MEXICO

-

NEW YORK

-

NORTH CAROLINA

-

NORTH DAKOTA

-

OHIO

-

OKLAHOMA

-

OREGON

-

PENNSYLVANIA

-

PUERTO RICO

-

RHODE ISLAND

-

SOUTH CAROLINA

-

SOUTH DAKOTA

-

TENNESSEE

-

TEXAS

-

UTAH

-

VERMONT

-

VIRGINIA

-

WASHINGTON

-

WEST VIRGINIA

-

WISCONSIN

-

WYOMING

-

ALBERTA, CANADA

-

BRITISH COLUMBIA, CANADA

-

MANITOBA, CANADA

-

NEW BRUNSWICK, CANADA

-

NEWFOUNDLAND, CANADA

-

NOVA SCOTIA, CANADA

-

ONTARIO, CANADA

-

PRINCE EDWARD ISLAND, CANADA

-

QUEBEC, CANADA

-

SASKATCHEWAN, CANADA

-

YUKON, CANADA

-

CANADA (FEDERAL LEVEL)

|

Form C: Signature

Signature

Pursuant to the requirements of Sections 4(a)(6) and 4A of the Securities Act of 1933 and Regulation Crowdfunding (§ 227.100-503),

the issuer certifies that it has reasonable grounds to believe that it meets all of the requirements

for filing on Form C and has duly caused this Form to be signed on its behalf by the duly authorized undersigned.

|

| Issuer | Signature | Title |

|---|

|

#BOTS, Inc./PR | S.Rubin | CEO |

Pursuant to the requirements of Sections 4(a)(6) and 4A of the Securities Act of 1933 and Regulation Crowdfunding

(§ 227.100-503), this Form C has been signed by the following persons in the capacities and on the dates indicated.

|

| Signature | Title | Date |

|---|

|

#S.Rubin | CEO | 09-06-2022 |

This regulatory filing also includes additional resources:

botsos20220906b.pdf

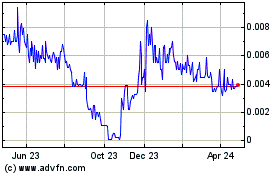

BOTS (PK) (USOTC:BTZI)

Historical Stock Chart

From Dec 2024 to Jan 2025

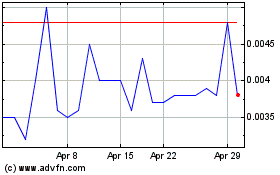

BOTS (PK) (USOTC:BTZI)

Historical Stock Chart

From Jan 2024 to Jan 2025