false

0001448597

00000

0001448597

2024-09-05

2024-09-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of report (date of earliest event reported): September 5, 2024

AUGUSTA GOLD CORP.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-54653 |

|

41-2252162 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| Suite 555 – 999 Canada Place, Vancouver, BC, Canada |

|

V6C 3E1 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (604) 687-1717

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act: None

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter)

or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation

FD

On September 5, 2024,

the Company issued a press release announcing the results of feasibility study for its 100% owned, construction-ready Reward Project in

the Walker Lane gold district of Nevada. A copy of the press release is furnished herewith as Exhibit 99.1.

The information furnished

under this Item 7.01, including the press release, shall not be deemed “filed” for purposes of Section 18 of the Securities

Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall

be expressly set forth by reference to such filing.

Item 9.01 Financial

Statements and Exhibits.

(d)

Exhibits.

The

exhibits listed in the following Exhibit Index are filed as part of this Current Report on Form 8-K.

SIGNATURE

Pursuant to the requirement of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| |

AUGUSTA GOLD CORP. |

| |

|

|

| Date: September 5, 2024 |

By: |

/s/ Tom Ladner |

| |

Name: |

Tom Ladner |

| |

Title: |

VP Legal |

| |

2

Exhibit 99.1

AUGUSTA GOLD ANNOUNCES FEASIBILITY STUDY RESULTS

FOR ITS 100% OWNED, CONSTRUCTION-READY REWARD PROJECT; INITIATES STRATEGIC PROCESS

Vancouver, B.C., September 5, 2024 –

Augusta Gold Corp. (TSX: G; OTCQB: AUGG; FSE:11B) (“Augusta Gold” or the “Company”) is pleased to

announce the results of the Feasibility Study for its 100% owned, construction-ready Reward Project (the “Project”)

located in the Walker Lane gold district of southern Nevada near the town of Beatty.

Highlights

| ● | Proven

and Probable Mineral Reserves of 370,000 oz of

gold grading 0.025 oz/t gold (0.86 g/t) in a conventional open pit, heap leach operation

with a life-of-mine (LOM) strip ratio of 2.37:1 |

| ● | Project has all required permits in place to commence construction |

| ● | The Company’s Bullfrog Project is located seven miles to the northwest

and hosts Measured and Indicated Mineral Resources of 1,209,290 oz gold grading

0.53 g/t gold and Inferred Mineral Resources of 257,900 oz gold grading 0.48 g/t gold |

| ● | Significant synergies from the

Reward Project are expected to be realized for the Company’s larger Bullfrog project located across the valley |

| ● | The Company has also initiated a strategic review process to evaluate alternative

opportunities to maximize shareholder return |

| ● | The Company has agreed in principle

with its lender, Augusta Investments Inc. (the “Lender”), to extend the term of its loan with the Lender through to

February 28, 2025 |

President and CEO Don Taylor commented, “The

Reward Project is construction-ready, strategically located and anticipated to be our first development in the district and will help

support the development of our larger Bullfrog Project located seven miles away. The Reward Project could be in production within 12 months

of commencing full-scale construction, in a rapidly growing and highly prolific district. Our goal is to be a low cost, 150,000 oz Au

per annum producer in Nevada by 2027. Given the project is construction-ready, it is important to highlight that at a price of US$2,400/oz

Au, the Project reflects a US$127M NPV and 33.4% IRR.” NPV and IRR values are shown in Table 5 below.

The Reward Project is a planned open pit, heap

leach operation processing 5,479 tons per day with average annual gold production of 39 koz over the LOM, with a peak of 47 koz. Ore will

be crushed to P80 1/4” and placed on the leach pad using conveyors and radial stackers. The initial lift will be agglomerated

to ensure pad stability and LOM permeability. Contract mining will be employed at Reward to lower pre-production capital requirements.

Metallurgical testing by McClelland labs has indicated

gold recoveries of approximately 81%. Recoveries used for the Reward study are 79% applying a 2% deduction for potential operational losses.

The Reward Project contains 370,000 oz of Proven

and Probable Mineral Reserves at an average grade of 0.025 opt gold (0.86 g/t). The potential for additional reserves has been identified

at the bottom of the current reserve pit outline but will require drilling before this opportunity can be quantified further.

Both of the company’s Reward and Bullfrog

projects are strategically located in the prolific Beatty district in Nevada, an area where AngloGold Ashanti PLC (“AGA”)

and other companies are very active in exploration, development, and asset consolidation.

AGA spent US$370 million to acquire Corvus Gold

and another US$150 million to acquire Coeur Mining Inc.’s Beatty district properties (both in 2022) and has stated its intention

to make the Beatty district into a new gold production centre for AGA. AGA’s most advanced property in the district is the North

Bullfrog Project, which hosts mineral reserves of 1.0M oz Au grading 0.43 g/t Au. AGA continues to seek requisite permitting and approvals

for construction of the North Bullfrog Project, which AGA does not anticipate receiving this year.

Augusta Gold’s completion of its Reward

feasibility study and having obtained all required permits to commence construction at the Reward Project therefore strategically places

Augusta Gold on track to becoming the first modern gold producer in the district.

Table 1. Reward Mineral Reserves

| | |

Reward Mineral Reserves | |

| | |

k tons | | |

oz Au/ton | | |

k oz Au | |

| Proven | |

| 6,052 | | |

| 0.027 | | |

| 164 | |

| Probable | |

| 8,999 | | |

| 0.023 | | |

| 205 | |

| Proven and Probable | |

| 15,052 | | |

| 0.025 | | |

| 370 | |

Notes:

| 1. | All estimates of Mineral Reserves have been prepared in accordance

with National Instrument 43 - 101 – Standards of Disclosure for Mineral Projects (“NI

43-101”) and Item 1300 of Regulation S-K of the United States Securities Exchange Act of 1934, as amended (“SK 1300”) |

| 2. | Thomas L. Dyer, PE, RESPEC of Reno, Nevada, is a Qualified Person

as defined in NI 43-101 and SK 1300, is responsible for reporting Proven and Probable Mineral

Reserves for the Reward Project. Mr. Dyer is independent of the Company. |

| 3. | Mineral Reserves are based on prices of $1,850 per ounce Au.

The reserves were defined based on pit designs that were created to follow optimized pit shells created in Whittle. |

| 4. | Reserves are reported using a 0.008 oz Au per ton cut-off grade |

| 5. | The Mineral Reserves point of reference is the point where is

material is fed into the crusher. |

| 6. | The effective date of the Mineral Reserves estimate is September

3, 2024. |

| 7. | Columns may not sum due to rounding. |

Table 2. Reward Feasibility Study Summary

| Contained Au, oz | |

| 369,692 | |

| Annual Au oz (avg payable oz) | |

| 38,563 | |

| Max Annual Au oz | |

| 46,595 | |

| Total Au Recovered (oz) | |

| 292,057 | |

| Payable Ounces | |

| 291,210 | |

| LOM ore grade (opt Au) | |

| 0.025 | |

| LOM Tons | |

| 15,051,695 | |

| Mine Life (years) | |

| 7.6 | |

| All-in Sustaining Cost per ounce | |

$ | 1,328 | |

| Pre-Production Capital Cost | |

$ | 89,700,000 | |

| 1. | All-in Sustaining Cost per ounce is a non-GAAP financial measure.

See “Note Regarding Non-GAAP Financial Measures” below for a discussion on non-GAAP financial measures and a reconciliation

to U.S. GAAP. The Company believes that these measures provide investors with an improved ability to evaluate the prospects of the Company.

As the Project is not in production the prospective non-GAAP financial measures or ratios may not be reconciliated to the nearest comparable

measures under U.S. GAAP and the equivalent historical non-GAAP financial measure for each prospective non-GAAP measure or ratio discussed

herein is nil$. |

Table 3. Capital Cost Summary

| Description | |

Cost3

(US$M) | |

| Pre-Production Process Capital | |

$ | 78.9 | |

| Mining Capital | |

$ | 10.8 | |

| Total Initial Capital1 | |

$ | 89.7 | |

| Sustaining Capital – Mine & Process | |

$ | 32.1 | |

| Working Capital & Initial Fills2 | |

$ | 7.4 | |

| 1. | Numbers are rounded and may not sum perfectly. |

| 2. | Working capital credited in Years 7 and 8. |

| 3. | Costs reflect standalone costs of the Reward project with 100%

of capital expensed to Reward, and does not include any potential capital cost synergies from development of the Bullfrog project. |

Table 4. Life of Mine Operating Cost Summary

| Description |

|

LOM Cost

(US$/ton ore) |

|

| Mine |

|

$ |

10.92 |

|

| Process & Support Services |

|

$ |

8.09 |

|

| Site G & A |

|

$ |

2.88 |

|

| Total1 |

|

$ |

21.88 |

|

| 1. | Numbers are rounded and may not sum perfectly |

Table 5. Sensitivity Assessment for the Reward

Project

| Au Price ($/oz) USD |

|

|

After-Tax NPV 5% ($M)1 |

|

|

After-Tax IRR |

|

|

Payback (years) |

|

| $ |

2,600 |

|

|

$ |

163.5 |

|

|

|

41.1 |

% |

|

|

1.9 |

|

| $ |

2,400 |

|

|

$ |

126.9 |

|

|

|

33.4 |

% |

|

|

2.4 |

|

| $ |

2,200 |

|

|

$ |

91.0 |

|

|

|

25.7 |

% |

|

|

3.3 |

|

| $ |

1,9752 |

|

|

$ |

50.6 |

|

|

|

16.6 |

% |

|

|

5.1 |

|

| $ |

1,800 |

|

|

$ |

15.2 |

|

|

|

8.6 |

% |

|

|

6.3 |

|

| $ |

1,725 |

|

|

$ |

0 |

|

|

|

5.0 |

% |

|

|

6.9 |

|

| 1. | Costs reflect standalone costs of the Reward project with 100%

of capital expensed to Reward, excluding any potential capital or operating cost synergies from the Bullfrog project. |

| 2. | The feasibility study results use a base case of $1,975/oz Au. |

Permitting highlights

The following principal permits and authorizations have been granted

for the Reward Project allowing for ground clearing and construction:

| ● | Mine Plan of Operations N-82840, authorized by

U.S. Department of the Interior – Bureau of Land Management (BLM). |

| ● | Water Pollution Control Permit NEV2007101, issued

by the Nevada Division of Environmental Protection – Bureau of Mining Regulation and Reclamation (NDEP-BMRR). |

| ● | Mine Reclamation Permit #0300, issued by the

NDEP-BMRR. |

| ● | Water appropriation permits 76390 and 89658,

issued by the Nevada Division of Water Resources (NDWR) for mining, milling, dewatering, and domestic uses. |

| ● | Biological Opinion 84320-2008-F-0293, approved

by U.S. Fish and Wildlife Service (USFWS). |

| ● | Class II Air Quality Permit AP1041-2492, issued

by NDEP – Bureau of Air Pollution Control (BAPC). |

Figure 1 – Reward Project Strategically Located in a Top Tier

Mining District

Strategic Review and Loan Terms

The Company has also initiated a strategic review

process to evaluate opportunities to maximize shareholder return. The strategic alternatives review could include, among other things,

a joint venture transaction, a sale of the Company, the Project, or all the assets of the Company, a merger or other business combination,

or another form of strategic transaction. The Company has not made any decisions related to any strategic alternatives at this time and

there can be no assurance that the strategic review will lead to any transaction or any other change or outcome.

The Company has agreed in principle with its Lender

to extend the term of its loan with the Lender through to February 28, 2025. Exact terms will be disclosed in the coming days once finalized

and once all requisite approvals have been obtained. The Company is also considering further alternatives with its Lender to manage its

existing debt position in a manner that facilitates obtaining construction financing for Reward. These alternatives include, but are not

limited to, converting part or all of the Lender’s current debt to equity. Other than the decision to extend the term of the loan,

the Company has not made any decisions related to alternatives with its Lender at this time and there can be no assurance that this consideration

will lead to any transaction or any other change or outcome.

The Company does not intend to provide announcements

or updates unless or until it determines that further disclosure is appropriate or necessary.

Technical Report and Qualified Persons

The comprehensive feasibility study for the Reward

Project was led by Kappes Cassidy & Associates from Reno, NV with support from SRK, RESPEC, Knight Piesold, NewFields and APEX Geoscience

Ltd.

The qualified persons are Mark Gorman of Kappes,

Cassiday & Associates; Thomas Dyer of RESPEC; Mike Dufresne of APEX Geoscience Ltd.; Timothy D. Scott of Kappes, Cassiday & Associates;

Mathew Haley of NewFields; James Cremeens of Knight Piesold Consulting; and Mark Willow of SRK Consulting (U.S.), Inc.; each of whom is

an independent “Qualified Person” under NI 43-101 and SK 1300.

A technical report supporting the results disclosed

herein will be published within 45 days. The effective date of the technical report is September 3, 2024. For readers to fully understand

the information in this release they should read the technical report in its entirety when it is available on SEDAR+ and EDGAR, including

all qualifications, assumptions, exclusions and risks. The technical report is intended to be read as a whole and sections should not

be read or relied upon out of context.

The scientific and technical information contained

in this news release relating to the Reward Project and the sampling, analytical and test data underlying the scientific and technical

information has been reviewed, approved and verified by the QPs for the technical report. The data was verified using data validation

and quality assurance procedures under high industry standards.

QA/QC of Underlying Data

From 2015 to early 2017, CR Reward LLC completed

a compilation, audit and update of the drill hole database. Drill hole locations, survey data and readily accessible assay certificates

were uploaded into the commercially-available DataShed software package. Assays that did not have assay certificates were retained in

an Excel spreadsheet and combined with the DataShed assays for the assay verification. Lithology, alteration, structure, and quartz vein

data from selected holes were digitized from geologic paper logs in January 2017. These data were also brought into DataShed. The drill

hole database consisting of 348 historical holes was audited, compiled, and verified by CR Reward LLC in 2016 and 2017 based on provided

electronic files, for all historical drilling, and assay certificates. CR Reward LLC completed additional drilling in 2017 and 2018 consisting

of 3,443 meters in 28 core holes.

The historical gold values at the Project were

validated by comparing the historical analytical certificates (and logs) to the digital assay database. All available downhole surveys

were digitized and utilized to properly plot analytical data down-hole. Drill hole collar data was verified versus geological logs or

survey files with collar elevations checked against a modern lidar survey. Drillholes with questionable data were omitted from the database

and were not used to generate the underlying mineral resource estimate. All of the 2017 and 2018 drill hole data provided by CR Reward

LLC was verified by the appropriate QPs. The results of the validation program indicate that the sample database is of sufficient accuracy

and precision to be used for the generation of the feasibility study results.

Bullfrog

Mineral Resource Estimate

| Classification | |

Tonnes

(Mt) | | |

Au grade

(g/t) | | |

Ag grade

(g/t) | | |

Au

Contained

(koz) | | |

Ag

Contained

(koz) | |

| Measured | |

| 30.13 | | |

| 0.544 | | |

| 1.35 | | |

| 526.68 | | |

| 1,309.13 | |

| Indicated | |

| 40.88 | | |

| 0.519 | | |

| 1.18 | | |

| 682.61 | | |

| 1,557.49 | |

| Measured and Indicated | |

| 71.01 | | |

| 0.530 | | |

| 1.26 | | |

| 1,209.29 | | |

| 2,866.62 | |

| Inferred | |

| 16.69 | | |

| 0.481 | | |

| 0.96 | | |

| 257.90 | | |

| 515.72 | |

Notes:

| 1. | Oxide estimated Mineral Resources are reported within a pit

shell using the Lerch Grossman algorithm, a gold price of US$1,550/oz and a recovery of 82% for Au and silver price of US$20/oz and a

recovery of 20% For Ag. |

| 2. | Sulphide estimated Mineral Resources are reported within a pit

shell using the Lerch Grossman algorithm, a gold price of US$1,550/oz and a recovery of 50% for Au and silver price of US$20/oz and a

recovery of 12% for Ag. No sulphide material was reported for Montgomery-Shoshone or Bonanza. |

| 3. | Mining costs for mineralized material and waste are US$2.25/tonne. |

| 4. | Processing, general and administration, and refining costs are

US$5.00/tonne, US$0.50/tonne, and US$0.05/tonne respectively. |

| 5. | Due to rounding, some columns or rows may not compute as shown. |

| 6. | Estimated Mineral Resources are stated as in situ dry metric

tonnes. |

| 7. | The estimate of Mineral Resources may be materially affected

by legal, title, taxation, socio-political, marketing, or other relevant issues. |

| 8. | The effective date of the Bullfrog mineral resource estimate

is December 31, 2021. |

The scientific and technical information contained

in this news release related to the Bullfrog Project is based upon the technical report summary, prepared pursuant to S-K 1300, entitled

“S-K 1300 Technical Report, Mineral Resource Estimate, Bullfrog Gold Project, Nye County, Nevada” with an effective date of

December 31, 2021, an issue date of March 16, 2022, and an amended issue date of December 18, 2023. The mineral resource estimate is also

prepared in accordance with NI 43-101. The Bullfrog technical report was prepared by Forte Dynamics, Inc., a QP firm, in compliance with

S-K 1300 and was based upon information prepared by QPs Russ Downer and Adam House. A current technical report for the Bullfrog Project

can be found on both the Company’s EDGAR and SEDAR+ profiles.

North Bullfrog

AGA’s mineral reserve estimate at North

Bullfrog was derived from AGA’s Mineral Resource and Mineral Reserve Report as of December 31, 2023, available on AGA’s website

at https://www.anglogoldashanti.com/. Per AGA’s report, the estimate was based on information signed off by Mrs. TM Flitton, a Qualified

Person who is a full-time employee of AGA.

Enquiries

Telephone: 604-638-1468

Email: info@augustagold.com

About Augusta Gold

Augusta Gold is an exploration and development

company focused on building a long-term business that delivers stakeholder value through developing the Reward and Bullfrog gold projects

and pursing accretive M&A opportunities. The Reward and Bullfrog gold projects are located in the prolific Bullfrog mining district

approximately 120 miles north-west of Las Vegas, Nevada and just outside of Beatty, Nevada. The Company is led by a management team and

board of directors with a proven track record of success in financing and developing mining assets and delivering shareholder value.

For more information, please visit www.augustagold.com.

Forward Looking Statements

Certain statements and information contained in

this new release constitute “forward-looking statements”, and “forward-looking information” within the meaning

of applicable securities laws (collectively, “forward-looking statements”). These statements appear in a number of places

in this new release and include statements regarding our intent, or the beliefs or current expectations of our officers and directors,

including that significant synergies from the Reward Project are expected to be realized for the Company’s larger Bullfrog project

located across the valley; Augusta Gold is on track to becoming the first modern gold producer in the district; the Reward Project is

construction-ready, strategically located and anticipated to be our first development in the district, and will help support the development

of our larger Bullfrog Project located seven miles away; the Reward Project could be in production within 12 months of commencing full-scale

construction, in a rapidly growing and highly prolific district; our goal is to be a low cost, 150,000 oz Au per annum producer in Nevada

by 2027; the Reward Project is a planned open pit, heap leach operation processing 5,479 tons per day with average annual gold production

of 39 koz over the LOM, with a peak of 47 koz; ore will be crushed to P80 1/4” and placed on the leach pad using conveyors and radial

stackers; the initial lift will be agglomerated to ensure pad stability and LOM permeability; contract mining will be employed at Reward

to lower pre-production capital requirements; metallurgical testing by McClelland labs has indicated gold recoveries of approximately

81%; recoveries for the Reward study are set at 79% applying a 2% deduction for potential operational losses; the potential for additional

reserves has been identified at the bottom of the current reserve pit outline but will require drilling before this opportunity can be

quantified further; the strategic alternatives review could include, among other things, a joint venture transaction, a sale of the Company,

the Project, or all the assets of the Company, a merger or other business combination, or another form of strategic transaction; that

the Company will extend the terms of its loan with its Lender through to February 28, 2025; the Company is also considering further alternatives

with the Lender to manage its existing debt position in a manner that facilitates obtaining construction financing for Reward; these alternatives

include, but are not limited to, converting part or all of the Lender’s current debt to equity; a technical report supporting the

results disclosed herein will be published within 45 days; planned operations at Reward (including tons per day processed, strip ratio,

ore processing and agglomeration; the financial results of the Feasibility Study (including recoveries, NPV, IRR, and payback period).

When used in this news release words such as “to be”, “will”, “planned”, “expected”, “potential”,

“anticipated” and similar expressions are intended to identify these forward-looking statements. Although the Company believes

that the expectations reflected in such forward-looking statements and/or information are reasonable, undue reliance should not be placed

on forward-looking statements since the Company can give no assurance that such expectations will prove to be correct. These statements

involve known and unknown risks, uncertainties and other factors that may cause actual results or events to vary materially from those

anticipated in such forward-looking statements, including risks generally related to uncertainty of resource and reserve estimates; uncertainty

as to the Company’s future operating costs and ability to raise capital; risks relating to cost increases for capital and operating

costs; risks of shortages and fluctuating costs of equipment or supplies; risks relating to fluctuations in the price of gold; the inherently

hazardous nature of mining-related activities; potential effects on our operations of environmental regulations in Nevada; risks due to

legal proceedings; risks related to construction of mining projects generally; that the Company will be able to finalize terms for an

extension of its loan and obtain all requisite approvals therefor; and the risks, uncertainties and other factors identified in the Company’s

periodic filings with Canadian securities regulators and the United States Securities and Exchange Commission. Such forward-looking statements

are based on various assumptions, including assumptions made with regard to the Company securing adequate financing; the results of the

Company’s economic studies at Bullfrog; the Company making affirmative production decisions at Reward and Bullfrog; our forecasts

and expected cash flows; our projected capital and operating costs; our expectations regarding mining and metallurgical recoveries; mine

life and production rates; that laws or regulations impacting mine development or mining activities will remain consistent; our approved

business plans, our mineral resource and reserve estimates and results of the feasibility study; our experience with regulators; political

and social support of the mining industry in Nevada; our experience and knowledge of the Nevada mining industry and our expectations of

economic conditions and the price of gold. While the Company considers these assumptions to be reasonable, based on information currently

available, they may prove to be incorrect. Except as required by applicable law, we assume no obligation to update or to publicly announce

the results of any change to any forward-looking statement contained herein to reflect actual results, future events or developments,

changes in assumptions or changes in other factors affecting the forward- looking statements. If we update any one or more forward-looking

statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

You should not place undue importance on forward-looking statements and should not rely upon these statements as of any other date. All

forward-looking statements contained in this news release are expressly qualified in their entirety by this cautionary statement.

Note Regarding Non-GAAP Financial Measures

(Reward Project)

In this press release,

we have provided information prepared or calculated according to U.S. GAAP, as well as provided certain non-U.S. GAAP prospective financial

performance measures. Because the non-U.S. GAAP performance measures do not have standardized meanings prescribed by U.S. GAAP, they may

not be comparable to similar measures presented by other companies. These measures should not be considered in isolation or as substitutes

for measures of performance prepared in accordance with U.S. GAAP. There are limitations associated with the use of such non-U.S. GAAP

measures. Since these measures do not incorporate revenues, changes in working capital and non-operating cash costs, they are not necessarily

indicative of potential operating profit or loss, or cash flow from operations as determined in accordance with U.S. GAAP.

The non-U.S. GAAP measures

associated with All-In sustaining costs (“AISC”), Cash Operating Costs and Cash Costs, as defined below, and the resulting

AISC per ounce metric are not, and are not intended to be, presentations in accordance with U.S. GAAP. These metrics represent costs and

unit-cost measured related to the Reward Project.

We believe that these

metrics help investors understand the economics of the Reward Project. We present the non-U.S. GAAP financial measures for our Reward

Project in the tables below. Actual U.S. GAAP results may vary from the amounts disclosed in this news release. Other companies may calculate

these measures differently.

AISC and Respective

Unit Cost Measure

AISC consists of Cash Costs (as described below), plus sustaining capital costs. The sum of these costs is divided

by the corresponding payable gold ounces to determine the per ounce metric stated in this press release above.

Cash Costs consist of

Cash Operating Costs (as described below), plus royalties.

Cash Costs and AISC are

non-U.S. GAAP metrics developed by the World Gold Council to provide transparency into the costs associated with producing gold and provide

a comparable standard. The Company reports Cash Costs and AISC on a per ounce basis because we believe this metric more completely reflects

mining costs over the life of mine. Similar metrics are widely used in the gold mining industry as comparative benchmarks of performance.

Cash Operating Costs

is a non-U.S. GAAP metric used by the Company to measure aggregate costs of operations that will generally be within the Company’s

direct control. We believe this metric reflects the operating performance potential for the Reward Project for the mining, processing,

administration, and sales functions. Contractual obligations for surface land rights (project royalties) are excluded from this metric.

Cash Operating Costs consist of Reward Project operating costs and refining costs, and exclude royalties.

Other costs excluded

from Cash Operating Costs, Cash Costs, and AISC include depreciation and amortization, income taxes, government royalties, financing charges,

costs related to business combinations, asset acquisitions other than sustaining capital, and asset dispositions.

The following tables

demonstrate the calculation of Cash Operating Costs, Cash Costs, AISC, and related AISC unit-cost metric as presented in this press release:

| | |

Units | |

Life of Mine | |

| Payable Gold | |

koz | |

| 291.21 | |

| Total Operating Costs | |

US$ millions | |

$ | 329.39 | |

| Refining & Transportation Charge | |

US$ millions | |

$ | 0.62 | |

| Total Operating Costs & Refining & Transportation Charge | |

US$ millions | |

$ | 330.01 | |

| Royalty Payable | |

US$ millions | |

$ | 15.21 | |

| Total Operating Costs, Refining & Royalties1 | |

US$ millions | |

$ | 345.22 | |

| | |

| |

| | |

| Cash Cost per ounce1 | |

US$/oz | |

$ | 1,185 | |

| | |

| |

| | |

| Sustaining Capital and Reclamation & Closure | |

US$ millions | |

$ | 41.57 | |

| All-In-Sustaining Costs | |

US$ millions | |

$ | 386.79 | |

| | |

| |

| | |

| AISC per ounce | |

US$/oz | |

$ | 1,328 | |

| | |

Units | |

Life of Mine | |

| Payable Gold | |

koz | |

| 291.21 | |

| Mining Costs | |

US$ millions | |

$ | 164.33 | |

| Processing Costs | |

US$ millions | |

$ | 121.77 | |

| Site General and Administrative Costs | |

US$ millions | |

$ | 43.29 | |

| Total Operating Costs | |

US$ millions | |

$ | 329.39 | |

| Refining & Transportation Charge | |

US$ millions | |

$ | 0.62 | |

| Total Operating Costs & Refining & Transportation Charge | |

US$ millions | |

$ | 330.01 | |

| Royalty Payable | |

US$ millions | |

$ | 15.21 | |

| Total Operating Costs, Refining & Royalties1 | |

US$ millions | |

$ | 345.22 | |

| 1. | Cash

Cost = Total Operating Costs & Refining & Transportation Charge + Royalty Payable |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

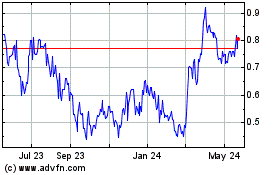

Augusta Gold (QB) (USOTC:AUGG)

Historical Stock Chart

From Oct 2024 to Nov 2024

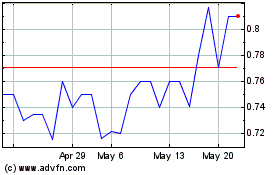

Augusta Gold (QB) (USOTC:AUGG)

Historical Stock Chart

From Nov 2023 to Nov 2024