As

filed with the U.S. Securities and Exchange Commission on July 26, 2023.

Registration

Statement No. 333-272128

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

Amendment

No. 6 to

FORM

S-1

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

ARIDIS

PHARMACEUTICALS, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

2834 |

|

47-2641188 |

(State

or other jurisdiction of

incorporation or organization) |

|

(Primary

Standard Industrial

Classification Code Number) |

|

(I.R.S.

Employer

Identification Number) |

983

University Avenue, Bldg. B

Los

Gatos, California 95032

(408)

385-1742

(Address

and telephone number of registrant’s principal executive offices)

Dr.

Vu L. Truong

Chief

Executive Officer

Aridis

Pharmaceuticals, Inc.

983

University Avenue, Bldg. B

Los

Gatos, California 95032

(408)

385-1742

(Name,

address, including zip code, and telephone number, including area code, of agent for service)

| Copies

to: |

Jeffrey

J. Fessler, Esq.

Sheppard,

Mullin, Richter & Hampton LLP

30

Rockefeller Plaza

New

York, New York 10112-0015

(212)

653-8700 |

|

Robert

F. Charron, Esq. Ellenoff

Grossman & Schole LLP

1345

Avenue of the Americas, 11th Fl. New

York, New York 10105

(212)

370-1300

|

Approximate

date of commencement of proposed sale to the public:

As

soon as practicable after the effective date of this registration statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the

following box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting

company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,”

“smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

Non-accelerated filer ☒ |

Smaller

reporting company ☒

Emerging

growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided to Section 7(a)(2)(B) of the Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date

as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject

to completion, dated July 26, 2023

Preliminary

Prospectus

Up

to 9,090,909 Shares of Common Stock

9,090,909

Pre-Funded Warrants to Purchase up to 9,090,909

Shares of Common Stock

9,090,909

Warrants to Purchase up to 9,090,909

Shares of Common Stock

Up

to 18,181,818 Shares of Common Stock underlying the Pre-Funded Warrants and Warrants

Aridis

Pharmaceuticals, Inc.

We

are offering up to 9,090,909 shares of our common stock together with 9,090,909 warrants to purchase up to 9,090,909

shares of common stock. Each share of our common stock, or a pre-funded warrant in lieu thereof as described below, is being sold

together with one warrant to purchase one share of our common stock (a “common warrant”). The shares of common stock and

common warrants are immediately separable and will be issued separately in this offering, but must be purchased together in this offering.

The assumed public offering price for one share of common stock and accompanying common warrant is $0.22, which was the last reported

sale price of our common stock on the OTC Markets Pink Sheets trading system on July 24, 2023. Each common warrant will have an

exercise price per share of $____ and will be exercisable beginning on the date of issuance. The common warrants will expire on the five-year

anniversary of the date of issuance.

We

are also offering to certain purchasers whose purchase of shares of common stock in this offering would otherwise result in the purchaser,

together with its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser,

9.99%) of our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if any such

purchaser so chooses, pre-funded warrants, in lieu of shares of common stock that would otherwise result in such purchaser’s beneficial

ownership exceeding 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding common stock. The public offering price of

one pre-funded warrant and accompanying common warrant will be equal to the price at which one share of common stock and accompanying

common warrant is sold to the public in this offering, minus $0.0001, and the exercise price of each pre-funded warrant will be $0.0001

per share. The pre-funded warrants will be immediately exercisable and may be exercised at any time until all of the pre-funded warrants

are exercised in full. The pre-funded warrants and common warrants are immediately separable and will be issued separately in this offering,

but must be purchased together in this offering. For each pre-funded warrant we sell, the number of shares of common stock we are offering

will be decreased on a one-for-one basis.

This

offering will terminate on August 4, 2023, unless we decide to terminate the offering (which we may do at any time in our discretion)

prior to that date. We will have one closing for all the securities purchased in this offering. The public offering price per share (or

pre-funded warrant) and accompanying common warrant will be fixed for the duration of this offering.

Until

July 18, 2023, our common stock was listed on The Nasdaq Capital Market under the symbol “ARDS.” On July 17, 2023, we received

written notice from the Nasdaq Stock Market, LLC that it would delist our shares of common stock from the Nasdaq Capital Market upon

the opening of trading on July 19, 2023. As of July 19, 2023, our common stock was quoted on the OTC Markets Pink Sheets trading system.

On July 24, 2023, the last report sale price of our common stock on the OTC Markets Pink Sheets was $0.22 per share.

The public offering price per share of common stock

and accompanying common warrant and per pre-funded warrant and accompanying common warrant will be determined between us and the investors

based on market conditions at the time of pricing, and may be at a discount to the then current market price of our common stock. The

recent market price used throughout this prospectus may not be indicative of the actual offering price. The actual public offering price

may be based upon a number of factors, including our history and our prospects, the industry in which we operate, our past and present

operating results, the previous experience of our executive officers and the general condition of the securities markets at the time

of this offering. There is no established public trading market for the pre-funded warrants and the common warrants and we do not expect

a market to develop. Without an active trading market, the liquidity of the pre-funded warrants and the common warrants will be limited.

In addition, we do not intend to list the pre-funded warrants or the common warrants on the OTC Markets Pink Sheets, any national securities

exchange or any other trading system.

We have engaged H.C. Wainwright & Co., LLC,

or the placement agent, to act as our exclusive placement agent in connection with this offering. The placement agent has agreed

to use its reasonable best efforts to arrange for the sale of the securities offered by this prospectus. The placement agent is not purchasing

or selling any of the securities we are offering and the placement agent is not required to arrange the purchase or sale of any specific

number of securities or dollar amount. We have agreed to pay to the placement agent the placement agent fees set forth in the table below,

which assumes that we sell all of the securities offered by this prospectus. There is no arrangement for funds to be received in escrow,

trust or similar arrangement. There is no minimum offering requirement as a condition of closing of this offering. Because there is no

minimum offering amount required as a condition to closing this offering, we may sell fewer than all of the securities offered hereby,

which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a refund in the

event that we do not sell all of the securities offered hereby. We will bear all costs associated with the offering. See “Plan

of Distribution” on page 122 of this prospectus for more information regarding these arrangements.

We

are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act,

and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing

in our securities involves a high degree of risk. See “Risk Factors” beginning on page 6 of

this prospectus for a discussion of information that should be considered in connection with an investment in our securities.

Neither

the Securities and Exchange Commission, nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | |

Per Share and

Common Warrant | | |

Per Pre- Funded

Warrant and

Common

Warrant | | |

Total | |

| Public offering price | |

$ | | | |

$ | | | |

$ | | |

| Placement agent fees(1) | |

$ | | | |

$ | | | |

$ | | |

| Proceeds to us, before expenses | |

$ | | | |

$ | | | |

$ | | |

| (1) | We

have also agreed to reimburse the placement agent for certain of its offering-related expenses,

including a reimbursement for legal fees and expenses in the amount of up to $100,000, $20,000

for its non-accountable expense in the offering, and for its clearing expenses in the amount

of $15,950. For a description of the compensation to be received by the placement agent,

see “Plan of Distribution” for more information. |

The

placement agent expects to deliver the securities to the purchasers on or about July __, 2023, subject to satisfaction of customary

closing conditions.

H.C. Wainwright & Co.

The

date of this prospectus is , 2023

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

We

incorporate by reference important information into this prospectus. You may obtain the information incorporated by reference without

charge by following the instructions under “Where You Can Find More Information.” You should carefully read this prospectus

as well as additional information described under “Information Incorporated by Reference,” before deciding to invest in our

securities.

Neither

we nor the placement agent has authorized anyone to provide you with additional information or information different from that

contained or incorporated by reference in this prospectus filed with the Securities and Exchange Commission (the “SEC”).

We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

The placement agent is offering to sell, and seeking offers to buy, our securities only in jurisdictions where offers and sales are permitted.

The information contained in this prospectus, or any document incorporated by reference in this prospectus, is accurate only as of the

date of those respective documents, regardless of the time of delivery of this prospectus or any sale of our securities. Our business,

financial condition, results of operations and prospects may have changed since that date.

The

information incorporated by reference or provided in this prospectus contains estimates and other statistical data made by independent

parties and by us relating to market size and growth and other data about our industry. We obtained the industry and market data in this

prospectus from our own research as well as from industry and general publications, surveys and studies conducted by third parties. This

data involves a number of assumptions and limitations and contains projections and estimates of the future performance of the industries

in which we operate that are subject to a high degree of uncertainty, including those discussed in “Risk Factors.” We caution

you not to give undue weight to such projections, assumptions, and estimates. Further, industry and general publications, studies and

surveys generally state that they have been obtained from sources believed to be reliable, although they do not guarantee the accuracy

or completeness of such information. While we believe that these publications, studies, and surveys are reliable, we have not independently

verified the data contained in them. In addition, while we believe that the results and estimates from our internal research are reliable,

such results and estimates have not been verified by any independent source.

For

investors outside the United States (“U.S.”): We and the placement agent have not done anything that would permit

this offering or the possession or distribution of this prospectus in any jurisdiction where action for those purposes is required, other

than in the U.S. Persons outside the U.S. who come into possession of this prospectus must inform themselves about, and observe any restrictions

relating to, the offering of the securities and the distribution of this prospectus outside of the U.S.

PROSPECTUS

SUMMARY

The

following information is a summary of the prospectus and does not contain all of the information you should consider before investing

in our common stock. You should read the entire prospectus carefully, including the matters set forth under “Risk Factors,”

“Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and our consolidated financial

statements and the notes relating to the consolidated financial statements, included elsewhere in this prospectus. Unless the context

requires otherwise, references to “Aridis,” “Company,” “we,” “us” or “our”

refer to Aridis Pharmaceuticals, Inc., a Delaware corporation and its subsidiaries.

Overview

We

are a late-stage biopharmaceutical company focused on the discovery and development of targeted immunotherapy using fully human monoclonal

antibodies, or mAbs, to treat life-threatening infections. mAbs represent a fundamentally new treatment approach in the infectious disease

market and are designed to overcome key issues associated with current therapies, including drug resistance, short duration of response,

tolerability, negative impact on the human microbiome, and lack of differentiation between treatment alternatives. Our proprietary product

pipeline is comprised of fully human mAbs targeting specific pathogens associated with life-threatening bacterial and viral infections,

primarily hospital-acquired pneumonia, or HAP, ventilator-associated pneumonia, or VAP and cystic fibrosis. Our clinical stage product

candidates have exhibited promising preclinical data and clinical data. Our lead product candidates, AR-301 and AR-320, target the alpha

toxin produced by gram-positive bacteria Staphylococcus aureus, or S. aureus, a common pathogen associated with HAP and

VAP. AR-501 is a broad spectrum small molecule anti-infective we are developing in addition to our targeted mAb product candidates.

The

majority of candidates from our product pipeline are derived by employing our differentiated antibody discovery platform called MabIgXTM

and λPEXTM. This platform is designed to comprehensively screen the B-cell repertoire and isolate human antibody-producing

B-cells from individuals who have either successfully overcome an infection by a particular pathogen or have been vaccinated against

a particular pathogen. We believe that B-cells from these patients are the ideal source of highly protective and efficacious mAbs which

can been administered safely to other patients. λPEXTM complements and further extends the capabilities of MabIgX to

quickly screen large number of antibody producing B-cells from patients and generation of high mAb producing mammalian production cell

line at a speed not previously attainable. As a result, we can significantly reduce time for antibody discovery and manufacturing compared

to conventional approaches.

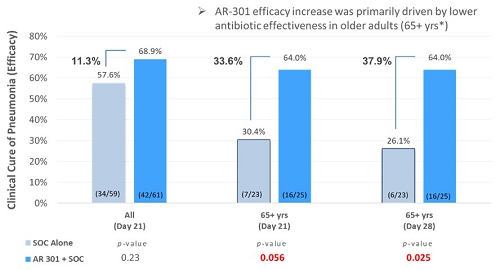

Two

of our mAbs in advanced clinical development are being developed for treatment of HAP and VAP in intensive care units or ICUs. Our initial

clinical indication for AR-301 is for adjunctive therapeutic treatment with standard of care, or SOC, antibiotics for HAP and VAP. AR-320

is being developed as a pre-emptive treatment of mortality and morbidity associated with HAP and VAP. Current SOC antibiotics used to

treat HAP and VAP typically involve a combination of several broad-spectrum antibiotics that are prescribed empirically at the start

of treatment. The specific empirical antibiotic regimens that are prescribed vary widely among physicians, and generally result in modest

clinical benefits due to a number of reasons, which can include an infection by an antibiotic resistant strain, immune deficiency, or

potential mismatch of the antibiotics regimen to the etiologic agent. Recently, rapid diagnostic tests have been introduced that allow

the identification of infection-causing agents within hours. These increasingly common rapid tests allow physicians to prescribe a more

appropriate antibiotics regimen, and eventually more targeted anti-infectives such as AR-301 and AR-320 earlier in the course of infection.

This evidenced-based treatment approach is designed to remove issues associated with empirical broad-spectrum antibiotics such as inappropriate

antibiotic selection and promotion of antibiotic resistance. In contrast to the lack of differentiation among SOC antibiotics, mAbs are

highly differentiated from SOC antibiotics in mechanism of action, pharmacokinetic and pharmacodynamic profile, and thus are well suited

to complement antibiotics when used together. As an adjunctive treatment, AR-301 has the potential to improve the effectiveness of SOC

antibiotics and cover antibiotic resistant S. aureus strains, while not competing directly with antibiotics. To emphasize the

benefits of our product candidates as an adjunctive therapy, we design clinical trials based on superiority endpoints.

AR-301

and AR-320 neutralize alpha-toxin from Staphylococcus aureus bacteria, leading to protection from alpha-toxin mediated

destruction of host cells, including cells from the immune system. This mode of action is independent of the antibiotic resistance

profile of S. aureus, and as such AR-301 and AR-320 are active against infections caused by both MRSA (methicillin-resistant staphylococcus

aureus) and MSSA (methicillin-sensitive staphylococcus aureus). AR-320 and AR-301 are complementary products. AR-320

treatment focuses on preventive treatment of S. aureus pneumonia, which complements Aridis’ AR-301 Phase 3 mAb program

that is being developed as a therapeutic treatment of S. aureus pneumonia. We believe that AR-301 will be first-line

treatment, first to market, first-in-class pre-emptive treatment of S. aureus colonized patients. The same first-line, first

to market and first-in-class strategy applies to the acute treatment with the monoclonal antibody AR-320. As these programs are

in the final stages of clinical development before licensure, we are giving significant consideration to partnering or entering into

strategic transactions with larger pharmaceutical companies.

On

March 20, 2023, we received written notice from MedImmune Limited (“MedImmune”) that it has terminated that certain License

Agreement by and between MedImmune and us dated as of July 12, 2021, and as amended by Amendment No. 1 to License Agreement, dated as

of August 9, 2021 (the “License Agreement”), pursuant to Section 9.2.1 of the License Agreement for non-payment of the Upfront

Cash Payment which was due on December 31, 2021. The notice states that such termination shall be effective on March 30, 2023. As a result

of the termination notice, the on-going AR-320-003 Phase 3 clinical study has been put on hold. We do not agree that we are in material

breach of the License Agreement. Based on the failure of MedImmune to assist in the necessary technology transfer pursuant to Section

3.5.2 of the License Agreement, we notified MedImmune on March 24, 2023 that it was in material breach of Section 3.5.2 and requested

that the material breach be cured as soon as possible. We are in active discussions to resolve the matter to the mutual interests

of both parties.

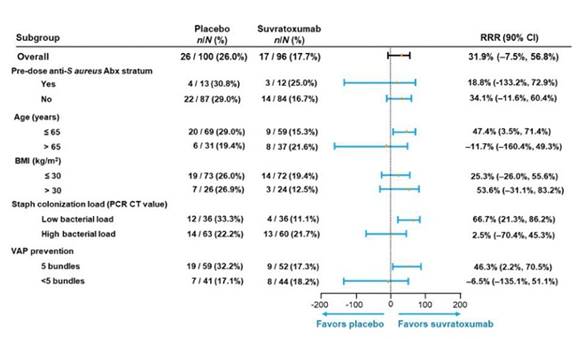

AR-320

is being developed for pre-emptive treatment of high-risk patients under 65 years old for prevention of nosocomial pneumonia caused by

S. aureus, which is associated with significant morbidity and mortality despite current standard of care, including antibiotics

and infection control practices like ventilator-associated pneumonia (VAP) bundles. Currently, there are no treatments available for

prevention or early preemptive management of patients at high-risk of developing S. aureus pneumonia. AR-320 has the potential

to address this unmet medical need by reducing the incidence of S. aureus pneumonia in patients at high-risk of developing the

disease, e.g., mechanically ventilated patients in the intensive care unit (ICU) who are colonized with S. aureus in their respiratory

tract.

HAP

and VAP pose serious challenges in the hospital setting, as SOC antibiotics are becoming inadequate in treating infected patients. There

are approximately 3,000,000 cases of pneumonia reported in the U.S. per year and approximately 628,000 annual cases of HAP and VAP caused

by gram negative bacteria and MRSA (DRG, 2016). These patients are typically at high risk of mortality, which is compounded by other

life-threatening co-morbidities and the rise in antibiotic resistance. Epidemiology studies estimate that the probability of death attributed

to S. aureus ranges from 29% to 55%. In addition, pneumonia infections can prolong patient stays in ICUs and the use of mechanical

ventilation, creating a major economic burden on patients, hospital systems and payors. For example, ICU cost of care for a ventilated

pneumonia patient is approximately $10,000 per day in the U.S., and the duration of ICU stays are typically twice that of a non-ventilated

patient (Infection Control and Hospital Epidemiology. 2010, vol. 31, pp. 509-515). The average cost of care per pneumonia patient is

approximately $41,250 which increases 86% for HAP/VAP patients to approximately $76,730. We estimate that our two clinical mAb candidates

have an addressable market of $25 billion and the potential to address approximately 325,000 HAP and VAP patients in the U.S.

Recent Developments

Our cash and cash equivalents were approximately $50,000 as of July

15, 2023. We will need to obtain financing in order to continue to fund our operations on or before July 31, 2023. Any failure or

delay to secure such financing could force us to delay, limit or terminate our operations, make reductions in our workforce, liquidate

all or a portion of our assets and/or seek protection under Chapters 7 or 11 of the United States Bankruptcy Code. There can be no assurance

that our implementation of these contingency plans will not have a material adverse effect on our business. This offering is being made

on a best efforts basis and we may sell fewer than all of the securities offered hereby and may receive significantly less in net proceeds

from this offering.

If the net proceeds from this offering are $1.6 million (assuming

an offering with gross proceeds of $2,000,000), we believe we will be able to fund our operations until September 2023

under our current business plan. If the net proceeds from this offering are $664,000 (assuming an offering with gross proceeds

of $1,000,000), we believe we will be able to fund our operations until mid-August 2023 under our current business plan.

Potential income such as income from on-going pharma partnering discussions and future financings

are not included in the projections.

On

July 17, 2023, we received written notice (the “Notice”) from the Nasdaq Stock Market, LLC (“Nasdaq”) that it

would delist our shares of common stock from the Nasdaq Capital Market upon the opening of trading on July 19, 2023. As of July 19, 2023,

our common stock began trading on the OTC Markets Pink Sheets.

Pursuant

to Section 4(ii) of the Note Purchase Agreement (the “Note Agreement”) dated as of November 23, 2021 between us and

Streeterville Capital, LLC (“Streeterville”), we covenanted that until all of our obligation under the notes issued pursuant to the Note Agreement are paid and

performed in full, our common stock would be

listed or quoted for trading on any of (a) NYSE, (b) NASDAQ, (c) OTCQX, or (d) OTCQB. As a result of the delisting from Nasdaq and

our common stock trading on the OTC Markets Pink Sheets, the covenant has been breached. Pursuant to Section 4.1(l) of Secured

Promissory Note #1 dated November 23, 2021 with Streeterville, an Event of Default has occurred as a result of our failing to

observe or perform any covenant set forth in Section 4 of the Note Agreement.

In

addition, pursuant to Sections 4(ii) and 4(iii) of the Note Purchase and Loan Restructuring Agreement dated as of April 26, 2023 (the

“Note Purchase Agreement”), we covenanted that until all of our obligations under the notes issued pursuant to the Note Purchase

Agreement, our common stock shall be listed or quoted for trading on either of (a) NYSE, or (b) NASDAQ and trading in our common stock

will not be suspended, halted, chilled, frozen, reach zero bid or otherwise cease trading on our principal trading market. As a result

of the delisting from Nasdaq and our common stock trading on the OTC Markets Pink Sheets, a Triggering Event (as defined in the April

2023 Note) has occurred pursuant to Section 4.1(h) of the Secured Promissory Note dated April 26, 2023 (the “April 2023 Note”)

and if not cured within 5 trading days will automatically result in an Event of Default.

On

July 20, 2023, Streeterville provided a waiver with respect to the breach of Section 4(ii) of that certain Note Purchase Agreement dated

November 23, 2021, in connection with the recent delisting of the Company’s common stock from Nasdaq to OTC Markets Pink Sheets.

This in turn means that no such Event of Default has occurred pursuant to Section 4.1(l) of Secured Promissory Note #1 dated November

23, 2021, with respect to the recent delisting.

Additionally,

Streeterville provided a waiver with respect to the breach of Section 4(ii) and 4(iii) of that certain Note Purchase and Loan Restructuring

Agreement dated April 26, 2023, in connection with the recent delisting of our common stock from Nasdaq to OTC Markets Pink Sheets. This

in turn means that no such Triggering Event has occurred pursuant to Section 4.1(h) of Secured Promissory Note dated April 26, 2023,

with respect to the recent delisting.

These

are one-time waivers with respect to the recent delisting of our common stock and are not waivers with respect to any other

event.

Corporate

Information

We

were formed under the name “Aridis, LLC” in the State of California on April 24, 2003 as a limited liability company. On

August 30, 2004, we changed our name to “Aridis Pharmaceuticals, LLC.” On May 21, 2014, we converted into a Delaware corporation

named “Aridis Pharmaceuticals, Inc.” Our fiscal year end is December 31. Our principal executive offices are located at 983

University Avenue, Building B, Los Gatos , California 95032. Our telephone number is (408) 385-1742. Our website address is www.aridispharma.com.

The information contained on, or that can be accessed through, our website is not a part of this prospectus. We have included our website

address in this prospectus solely as an inactive textual reference.

We

have proprietary rights to a number of trademarks used in this prospectus which are important to our business. Solely for convenience,

the trademarks and trade names in this prospectus are referred to without the ® and TM symbols, but such references should

not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights

thereto. All other trademarks, trade names and service marks appearing in this prospectus are the property of their respective owners.

Implications

of Being an Emerging Growth Company

As

a company with less than $1.235 billion in revenues during our last fiscal year, we qualify as an emerging growth company as defined

in the Jumpstart Our Business Startups Act (“JOBS Act”) enacted in 2012. As an emerging growth company, we expect to take

advantage of reduced reporting requirements that are otherwise applicable to public companies. These provisions include, but are not

limited to:

| |

● |

being

permitted to present only two years of audited financial statements, in addition to any required unaudited interim financial statements,

with correspondingly reduced “Management’s Discussion and Analysis of Financial Condition and Results of Operations”

disclosure in this prospectus; |

| |

|

|

| |

● |

not

being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act of 2002, as amended (“Sarbanes-Oxley

Act”); |

| |

|

|

| |

● |

reduced

disclosure obligations regarding executive compensation in our periodic reports, proxy statements and registration statements; and |

| |

|

|

| |

● |

exemptions

from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute

payments not previously approved. |

We

may use these provisions until the last day of our fiscal year following the fifth anniversary of the completion of our initial public

offering. However, if certain events occur prior to the end of such five-year period, including if we become a “large accelerated

filer,” our annual gross revenues exceed $1.235 billion or we issue more than $1.0 billion of non-convertible debt in any three-year

period, we will cease to be an emerging growth company prior to the end of such five-year period.

The

JOBS Act provides that an emerging growth company can take advantage of an extended transition period for complying with new or revised

accounting standards. As an emerging growth company, we intend to take advantage of an extended transition period for complying with

new or revised accounting standards as permitted by The JOBS Act.

To

the extent that we continue to qualify as a “smaller reporting company,” as such term is defined in Rule 12b-2 under the

Securities Exchange Act of 1934, after we cease to qualify as an emerging growth company, certain of the exemptions available to us as

an emerging growth company may continue to be available to us as a smaller reporting company, including: (i) not being required to comply

with the auditor attestation requirements of Section 404(b) of the Sarbanes Oxley Act; (ii) scaled executive compensation disclosures;

and (iii) the requirement to provide only two years of audited financial statements, instead of three years.

THE

OFFERING

| Securities

we are offering |

|

Up

to 9,090,909 shares of common stock and 9,090,909 warrants to purchase up to

9,090,909 shares of common stock, or pre-funded warrants to purchase shares of common

stock and common warrants to purchase shares of common stock. The shares of common stock

or pre-funded warrants, respectively, and common warrants are immediately separable and will

be issued separately in this offering, but must initially be purchased together in this offering.

Each common warrant has an exercise price of $___ per share of common stock and is exercisable

on the issuance date of the common warrants and will expire five years from the issuance

date of the common warrants. We are also registering the shares of common stock issuable

upon exercise of the pre-funded warrants and the common warrants pursuant to this prospectus. |

| |

|

|

| Pre-funded

warrants offered by us |

|

We

are also offering to each purchaser whose purchase of shares in this offering would otherwise result in the purchaser, together with

its affiliates and certain related parties, beneficially owning more than 4.99% (or, at the election of the purchaser, 9.99%) of

our outstanding common stock immediately following the consummation of this offering, the opportunity to purchase, if the purchaser

so chooses, pre-funded warrants (each pre-funded warrant to purchase one share of our common stock) in lieu of shares that would

otherwise result in the purchaser’s beneficial ownership exceeding 4.99% of our outstanding common stock (or, at the election

of the purchaser, 9.99%). The purchase price of each pre-funded warrant and accompanying common warrant will equal the price at which

one share of common stock and accompanying common warrant are being sold to the public in this offering, minus $0.0001,

and the exercise price of each pre-funded warrant will be $0.0001 per share. The pre-funded warrants will be exercisable

immediately and may be exercised at any time until all of the pre-funded warrants are exercised in full. For each pre-funded warrant

we sell, the number of shares we are offering will be decreased on a one-for-one basis. See “Description of Securities We Are

Offering” for additional information. |

| |

|

|

| Terms

of the offering |

|

This

offering will terminate on August 4, 2023, unless we decide to terminate the offering (which we may do at any time in our

discretion) prior to that date. |

| Common

stock outstanding prior to this offering |

|

36,213,

952 shares of common

stock. |

| |

|

|

| Common

stock outstanding after this offering |

|

45,304,861

shares, assuming no

sale of pre-funded warrants, which, if sold, would reduce the number of shares of common stock that we are offering on a one-for-one

basis, and no exercise of the common warrants issued in this offering. |

| |

|

|

| Use

of proceeds |

|

We

estimate that the net proceeds from this offering will be approximately $1.6 million, based on an assumed public offering

price of $0.22 per share, which was the last reported sale price of our common stock on July 24, 2023 on the

OTC Markets Pink Sheets and an assumed offering amount of $2,000,000 in gross proceeds, after deducting the placement agent

fees and estimated offering expenses payable by us. We intend to use the net proceeds to fund our planned clinical trials, manufacturing

and process development, analytical testing, regulatory expenses and for general corporate purposes, including working capital and

repaying a portion of certain secured promissory notes (the “Notes”) held by Streeterville in the event we do not negotiate

a deferral of payment from Streeterville. Beginning in August 2023, we will be required to repay $495,000 on Note 1 on a monthly

basis and beginning in October 2023, 16.667% of the outstanding balance on Note 2 monthly. See “Use of Proceeds” for

a more complete description of the intended use of proceeds from this offering. |

| |

|

|

| Risk

Factors |

|

You

should read the “Risk Factors” section starting on page 6 for a discussion of factors to consider carefully before

deciding to invest in our securities. |

| |

|

|

| OTC

Pink symbol |

|

“ARDS.”

There is no established public trading market for the common warrants or pre-funded warrants

, and we do not expect such a market to develop. We do not intend to list the common warrants or pre-funded warrants on any securities

exchange or other trading market. Without an active trading market, the liquidity of the pre-funded warrants and the warrants will

be extremely limited. |

The

number of shares of our common stock that will be outstanding after this offering is based on 36,213,952 shares of our common

stock outstanding as of July 12, 2023, and excludes:

| |

● |

2,330,576

shares of our common stock issuable upon the

exercise of options to purchase shares of our common stock outstanding as of July 12, 2023, with a weighted-average exercise price

of $6.18 per share; |

| |

|

|

| |

● |

10,742,404

shares of our common stock issuable upon the exercise of warrants to purchase common stock outstanding as of July 12, 2023,

with a weighted-average exercise price of $1.23 per share; |

| |

|

|

| |

● |

182,120 shares of our common stock issuable upon the

vesting of restricted stock units outstanding as of July 12, 2023; and |

| |

|

|

| |

● |

234,442

shares of our common stock reserved for future

issuance under our stock incentive plans. |

| |

|

|

| |

● |

Unless

expressly indicated or the context requires otherwise, all information in this prospectus assumes no (i) no purchaser elects to purchase

pre-funded warrants and (ii) no exercise of the common warrants offered hereby. |

RISK

FACTORS

An

investment in our common stock involves a high degree of risk. You should give careful consideration to the following risk factors, in

addition to the other information included in this prospectus, including our financial statements and related notes, before deciding

whether to invest in shares of our common stock. The occurrence of any of the adverse developments described in the following risk factors

could materially and adversely harm our business, financial condition, results of operations or prospects. In that case, the trading

price of our common stock could decline, and you may lose all or part of your investment.

Risks

Relating to Our Financial Position and Need for Additional Capital

We

expect to continue to incur increasing net losses for the foreseeable future, and we may never achieve or maintain profitability.

We

are a late-stage biopharmaceutical company with a limited operating history. Investment in biopharmaceutical product development

is highly speculative because it entails substantial upfront capital expenditures and significant risk that any potential product candidate

will fail to demonstrate adequate effect or an acceptable safety profile, gain regulatory approval and become commercially viable. We

have no products approved for commercial sale and have not generated any revenue from product sales to date, and we continue to incur

significant research and development and other expenses related to our ongoing operations. As a result, we are not profitable and have

incurred losses in each period since our inception. For the year ended December 31, 2022 and the three months ended March 31, 2023, we

reported a net loss of approximately $30.4 million and $6.8 million, respectively. As of December 31, 2022 and March 31, 2023, we had

an accumulated deficit of $195.7 million and $202.5 million, respectively.

To

become and remain profitable, we or our partners must succeed in developing our product candidates, obtaining regulatory approval for

them, and manufacturing, marketing and selling those products for which we or our partners may obtain regulatory approval. We or they

may not succeed in these activities, and we may never generate revenue from product sales that is significant enough to achieve profitability.

Because of the numerous risks and uncertainties associated with biopharmaceutical product development and commercialization, we are unable

to accurately predict the timing or amount of future expenses or when, or if, we will be able to achieve or maintain profitability. Currently,

we have no products approved for commercial sale, and to date we have not generated any product revenue. We have financed our operations

primarily through the sale of equity securities, upfront payments pursuant to collaboration and license agreements, government grants,

debt and capital lease and equipment financing. The size of our future net losses will depend, in part, on the rate of growth or contraction

of our expenses and the level and rate of growth, if any, of our revenues. Our ability to achieve profitability is dependent on our ability,

alone or with others, to complete the development of our products successfully, obtain the required regulatory approvals, manufacture

and market our proposed products successfully or have such products manufactured and marketed by others, and gain market acceptance for

such products. There can be no assurance as to whether or when we will achieve profitability.

The

report of our independent registered public accounting firm on our consolidated

financial statements as of and for the year ended December 31, 2022 includes an explanatory paragraph that expresses substantial

doubt about our ability to continue as a going concern, indicating the possibility that we may not be able to operate in the future.

Primarily

as a result of our losses incurred to date, our expected continued future losses, and limited cash balances, we have included disclosure

in our consolidated financial statements expressing substantial doubt about our ability to continue as a going concern. We do not have

sufficient cash on hand and available liquidity to meet our obligations through the twelve months following the date the consolidated

financial statements are issued. Our cash and cash equivalents were approximately $50,000 as of July 15, 2023. We will need to obtain

financing in order to fund our operations on or before July 31, 2023. Our ability to continue as a going concern is contingent upon,

among other factors, the sale of the shares of our common stock or obtaining alternate financing. Any failure or delay to secure such

financing could force us to delay, limit or terminate our operations, make reductions in our workforce, liquidate all or a portion of

our assets and/or seek protection (“Bankruptcy Protection”) under Chapters 7 or 11 of the United States Bankruptcy Code.

If the net proceeds from this offering are $1.6 million (assuming an offering with gross proceeds of $2,000,000), we believe

we will be able to fund our operations until September 2023 under our current business plan. If the net proceeds from this offering

are $664,000 (assuming an offering with gross proceeds of $1,000,000), we believe we will be able to fund our operations

until mid-August 2023 under the current business plan. Potential income such income from on-going pharma partnering discussions

and future financings are not included in the projections.

In

the event we pursue Bankruptcy Protection, we will be subject to the risks and uncertainties associated with such proceedings.

In

the event we file for relief under the United States Bankruptcy Code, our operations, our ability to develop and execute our business

plan and our continuation as a going concern will be subject to the risks and uncertainties associated with bankruptcy proceedings, including,

among others: our ability to execute, confirm and consummate a plan of reorganization; the additional, significant costs of bankruptcy

proceedings and related fees; our ability to obtain sufficient financing to allow us to emerge from bankruptcy and execute our business

plan post-emergence, and our ability to comply with terms and conditions of that financing; our ability to continue our operations in

the ordinary course; our ability to maintain our relationships with our consumers, business partners, counterparties, employees and other

third parties; our ability to obtain, maintain or renew contracts that are critical to our operations on reasonably acceptable terms

and conditions; our ability to attract, motivate and retain key employees; the ability of third parties to use certain limited safe harbor

provisions of the United States Bankruptcy Code to terminate contracts without first seeking Bankruptcy Court approval; the ability of

third parties to force us to into Chapter 7 proceedings rather than Chapter 11 proceedings and the actions and decisions of our stakeholders

and other third parties who have interests in our bankruptcy proceedings that may be inconsistent with our operational and strategic

plans. Any delays in our bankruptcy proceedings would increase the risks of our being unable to reorganize our business and emerge from

bankruptcy proceedings and may increase our costs associated with the bankruptcy process or result in prolonged operational disruption

for us. Also, we would need the prior approval of the bankruptcy court for transactions outside the ordinary course of business during

the course of any bankruptcy proceedings, which may limit our ability to respond timely to certain events or take advantage of certain

opportunities. Because of the risks and uncertainties associated with any bankruptcy proceedings, we cannot accurately predict or quantify

the ultimate impact of events that could occur during any such proceedings. There can be no guarantees that if we seek Bankruptcy Protection

we will emerge from Bankruptcy Protection as a going concern or that holders of our common stock will receive any recovery from any bankruptcy

proceedings.

In

the event we are unable to pursue Bankruptcy Protection under Chapter 11 of the United States Bankruptcy Code, or, if pursued, successfully

emerge from such proceedings, it may be necessary to pursue Bankruptcy Protection under Chapter 7 of the United States Bankruptcy Code

for all or a part of our businesses.

In

the event we are unable to pursue Bankruptcy Protection under Chapter 11 of the United States Bankruptcy Code, or, if pursued, successfully

emerge from such proceedings, it may be necessary for us to pursue Bankruptcy Protection under Chapter 7 of the United States Bankruptcy

Code for all or a part of our businesses. In such event, a Chapter 7 trustee would be appointed or elected to liquidate our assets for

distribution in accordance with the priorities established by the United States Bankruptcy Code. We believe that liquidation under Chapter

7 would result in significantly smaller distributions being made to our stakeholders than those we might obtain under Chapter 11 primarily

because of the likelihood that the assets would have to be sold or otherwise disposed of in a distressed fashion over a short period

of time rather than in a controlled manner and as a going concern.

Our obligations

to Streeterville are secured by a security interest in all of our assets, so if we default on those obligations, Streeterville could

foreclose on our assets.

Our

obligations under the Notes issued to Streeterville are secured by a first-position security interest in all right, title, interest,

claims and demands of us in and to the property as provided in the Security Agreement, dated April 26, 2023 between us and

Streeterville. As of June 30, 2023, approximately $11.0 million was owed to Streeterville under the Notes including accrued

interest. Beginning in August 2023, we will be required to repay $495,000 on Note 1 on a monthly basis and beginning in

October 2023 we will be required to pay 16.667% of the outstanding balance on Note 2 monthly. The maturity date of the Notes are

November 2023 and April 2024. If we default on our obligations under these agreements, Streeterville could foreclose on its security

interests and liquidate some or all of these assets, which would harm our financial condition and results of operations and would

require us to reduce or cease operations and possibly seek Bankruptcy Protection.

We

will require substantial additional capital in the future. If additional capital is not available, we will have to delay, reduce or cease

operations.

Developing

pharmaceutical products, including conducting preclinical studies and clinical trials, is expensive. Development of our product candidates

will require substantial additional funds to conduct research, development and clinical trials necessary to bring such product candidates

to market and to establish manufacturing, marketing and distribution capabilities. We expect our development expenses to substantially

increase in connection with our ongoing activities, particularly as we advance our clinical programs. Our future capital requirements

will depend on many factors, including, among others:

| |

● |

the

scope, rate of progress, results and costs of our preclinical and non-clinical studies, clinical trials and other research and development

activities; |

| |

|

|

| |

● |

the

scope, rate of progress and costs of our manufacturing development and commercial manufacturing activities; |

| |

|

|

| |

● |

the

cost, timing and outcomes of regulatory proceedings, including FDA review of any Biologics License Application, or BLA, or New Drug

Application, or NDA, that we file; |

| |

|

|

| |

● |

payments

required with respect to development milestones we achieve under our in-licensing agreements, including any such payments to University

of Chicago, University of Iowa, Brigham and Women’s Hospital, Inc., Brigham Young University, Public Health Service and Kenta

Biotech Ltd., Massachusetts Institute of Technology-Broad Institute, University of Alabama at Birmingham Research Foundation, and

Medimmune Ltd.; |

| |

|

|

| |

● |

the

costs involved in preparing, filing, prosecuting, maintaining and enforcing patent claims; |

| |

|

|

| |

● |

the

costs associated with commercializing our product candidates if they receive regulatory approval; |

| |

|

|

| |

● |

the

cost and timing of establishing sales and marketing capabilities; |

| |

● |

competing

technological efforts and market developments; |

| |

|

|

| |

● |

changes

in our existing research relationships; |

| |

|

|

| |

● |

our

ability to establish collaborative arrangements to the extent necessary; |

| |

|

|

| |

● |

revenues

received from any future products; |

| |

|

|

| |

● |

the

ability to achieve and receive milestone payments for products licensed to collaborators; and |

| |

|

|

| |

● |

payments

received under any future strategic collaborations. |

We

anticipate that we will continue to generate significant losses for the next several years as we incur expenses to complete our clinical

trial programs for our product candidates, build commercial capabilities, develop our pipeline and expand our corporate infrastructure.

There is a risk of delay or failure at any stage of developing a product candidate, and the time required and costs involved in successfully

accomplishing our objectives cannot be accurately predicted. Actual drug research and development costs could substantially exceed budgeted

amounts, which could force us to delay, reduce the scope of or eliminate one or more of our research or development programs. Additionally,

if the Cystic Fibrosis Foundation does not continue to provide funding support, we may not be able to complete the Phase 1/2a clinical

trial relating to AR-501. Furthermore, if the European Commission’s IMI (Innovative Medicines Initiative) does not continue to

provide support, we may not be able to complete the Phase 3 clinical trial relating to AR-320.

We

may never be able to generate a sufficient amount of product revenue to cover our expenses. Until we do, we expect to seek additional

funding through public or private equity or debt financings, collaborative relationships, license agreements, capital lease transactions

or other available financing transactions. However, there can be no assurance that additional financing will be available on acceptable

terms, if at all, and such financings could be dilutive to existing security holders. Moreover, in the event that additional funds are

obtained through arrangements with collaborators, such arrangements may require us to relinquish rights to certain of our technologies,

product candidates or products that we would otherwise seek to develop or commercialize ourselves.

If

adequate funds are not available, we may be required to delay, reduce the scope of or eliminate one or more of our research or development

programs. Our failure to obtain adequate financing when needed and on acceptable terms would have a material adverse effect on our business,

financial condition and results of operations.

If

we cannot meet requirements under our license and sublicense agreements, we could lose the rights to our products, which could have a

material adverse effect on our business.

We

depend on licensing and sublicensing agreements with third parties such as the University of Chicago, University of Iowa, Brigham and

Women’s Hospital, Inc., Brigham Young University, Public Health Service, Kenta Biotech Ltd., Massachusetts Institute of Technology-Broad

Institute, University of Alabama at Birmingham Research Foundation, and Medimmune Ltd. to maintain the intellectual property rights to

certain of our product candidates. These agreements require us to make payments and satisfy performance obligations in order to maintain

our rights under these agreements. All of these agreements last either throughout the life of the patents that are the subject of the

agreements, or with respect to other licensed technology, for a number of years after the first commercial sale of the relevant product.

If we fail to comply with the obligations under our license agreements or use the intellectual property licensed to us in an unauthorized

manner, we may be required to pay damages and our licensors may have the right to terminate the license. If our license agreements are

terminated, we may not be able to develop, manufacture, market or sell the products covered by our agreements and those being tested

or approved in combination with such products. Such an occurrence could materially adversely affect the value of the product candidate

being developed under any such agreement and any other product candidates being developed or tested in combination.

In

addition, we are responsible for the cost of filing and prosecuting certain patent applications and maintaining certain issued patents

licensed to us. If we do not meet our obligations under our license agreements in a timely manner, or use the intellectual property licensed

to us in an unauthorized manner, we could be required to pay damages and we could lose the rights to our proprietary technology if our

licensor terminated the license. If our license agreements are terminated, we may not be able to develop, manufacture, market or sell

the products covered by our agreements and any being tested or approved in combination with such products. Such an occurrence could have

a material adverse effect on our business, results of operations and financial condition.

Our

license agreement with MedImmune may no longer be effective as a result of MedImmune’s termination

notice.

On

March 20, 2023, we received written notice from MedImmune that it has terminated that certain License Agreement pursuant to Section 9.2.1

of the License Agreement for non-payment of the Upfront Cash Payment which was due on December 31, 2021. Such termination was effective

as of March 30, 2023. As a result of the termination notice, the on-going AR-320-003 Phase 3 clinical study has been put on hold. We

do not agree that we are in material breach of the License Agreement. In the event the License Agreement is no longer effective, all

rights and licenses granted by MedImmune pursuant to the License Agreement would terminate and we would be required pursuant to the License

Agreement to take certain actions to return intellectual property and drug product to MedImmune. The termination of the AR-320 program

pursuant to any termination of the License Agreement may have a material adverse effect on our business, financial condition and results

of operations.

The

delayed filing of some of our periodic SEC reports has made us currently ineligible to use a registration statement on Form S-3 to register

the offer and sale of securities, which could adversely affect our ability to raise future capital.

As

a result of the delayed filing of some of our periodic reports with the SEC, we are not currently eligible to register the offer and

sale of our securities using a registration statement on Form S-3. To regain eligibility to use Form S-3, we must be timely and current

in our public reporting for a period of 12 months preceding our intended S-3 filing. Should we wish to register the offer and sale of

our securities to the public prior to the time we are eligible to use Form S-3, both our transaction costs and the amount of time required

to complete the transaction could increase, making it more difficult to execute any such transaction successfully and potentially harming

our financial condition.

Risks

Relating to Clinical Development and Commercialization of Our Product Candidates

If

we fail to successfully complete clinical trials, fail to obtain regulatory approval or fail to successfully commercialize our product

candidates, our business would be harmed and the value of our securities would decline.

We

must be evaluated in light of the uncertainties and complexities affecting a pre-commercial biopharmaceutical company. We have not completed

clinical development for any of our product candidates. Our five lead product candidates are AR-301, AR320, AR-501 and AR-101, and AR-701.

We initiated a Phase 3 pivotal trial of AR-301 in VAP patients, AR-501 is in Phase 1/2a clinical testing and AR-101 is ready for Phase

2/3 pivotal testing. The Phase 3 clinical trial evaluating AR-320 for the prevention of VAP has been put on hold. We cannot be assured

that our planned clinical development for our product candidates will be completed in a timely manner, or at all, or that we, or any

future partner, will be able to obtain approval for our product candidates from the FDA or any foreign regulatory authority.

Regulatory

agencies, including the FDA must approve our product candidates before they can be marketed or sold. The approval process is lengthy,

requires significant capital expenditures, and is uncertain as to outcome. Our ability to obtain regulatory approval of any product candidate

depends on, among other things, completion of additional clinical trials, whether our clinical trials demonstrate statistically significant

efficacy with safety issues that do not potentially outweigh the therapeutic benefit of the product candidates, and whether the regulatory

agencies agree that the data from our future clinical trials are sufficient to support approval for any of our product candidates. The

final results of our current and future clinical trials may not meet FDA or other regulatory agencies’ requirements to approve

a product candidate for marketing, and the regulatory agencies may otherwise determine that our manufacturing processes or facilities

are insufficient to support approval. We, and our current and potential future collaborators, may need to conduct more clinical trials

than we currently anticipate. Even if we do receive FDA or other regulatory agency approval, we or our collaborators may not be successful

in commercializing approved product candidates. If any of these events occur, our business could be materially harmed and the value of

our securities would decline.

We,

or our collaborators, may face delays in completing our clinical trials, and may not be able to complete them at all.

Clinical

trials necessary to support an application for approval to market any of our product candidates have not been completed. Our, or our

collaborators,’ current and future clinical trials may be delayed, unsuccessful, or terminated as a result of many factors, including,

but not limited to:

| |

● |

delays

in reaching agreement on trial design and clinical study protocol with investigators and regulatory authorities in various countries

where our clinical trials are being conducted; |

| |

|

|

| |

● |

governmental

or regulatory delays, failure to obtain regulatory approval or changes in regulatory requirements, policy or guidelines; |

| |

|

|

| |

● |

adding

new clinical trial sites; |

| |

|

|

| |

● |

reaching

agreement on acceptable terms with prospective contract research organizations, or CROs, and clinical trial sites, the terms of which

can be subject to extensive negotiation and may vary significantly among different CROs and trial sites; |

| |

|

|

| |

● |

the

actual performance of CROs and clinical trial sites in ensuring the proper and timely conduct of our clinical trials; |

| |

|

|

| |

● |

developing

and validating companion diagnostics on a timely basis; |

| |

|

|

| |

● |

adverse

effects experienced by subjects in clinical trials; |

| |

|

|

| |

● |

manufacturing

sufficient quantities of product candidates for use in clinical trials; |

| |

● |

delay

or failure in achieving study efficacy endpoints and completing data analysis for a trial; |

| |

|

|

| |

● |

regulators

or institutional review boards, or IRBs, may not authorize us to commence a clinical trial; |

| |

|

|

| |

● |

regulators

or IRBs may suspend or terminate clinical research for various reasons, including noncompliance with regulatory requirements or concerns

about patient safety; |

| |

|

|

| |

● |

we

may suspend or terminate our clinical trials if we believe that they expose the participating patients to unacceptable health risks; |

| |

|

|

| |

● |

patients

may not complete clinical trials due to safety issues, side effects, such as injection site discomfort, a belief that they are receiving

placebo instead of our product candidates, or other reasons; |

| |

|

|

| |

● |

patients

with serious diseases included in our clinical trials may die or suffer other adverse medical events for reasons that may not be

related to our product candidates; |

| |

|

|

| |

● |

in

those trials where our product candidate is being tested in combination with one or more other therapies, deaths may occur that may

be attributable to the other therapies; |

| |

|

|

| |

● |

we

may have difficulty in maintaining contact with patients after treatment, preventing us from collecting the data required by our

study protocol; |

| |

|

|

| |

● |

product

candidates may demonstrate a lack of efficacy during clinical trials; |

| |

|

|

| |

● |

personnel

conducting clinical trials may fail to properly administer our product candidates; |

| |

|

|

| |

● |

COVID-19

pandemic may be protracted and cause a significant decline in patient enrollment rate; and |

| |

|

|

| |

● |

our

collaborators may decide not to pursue further clinical trials. |

In

addition, we rely on academic institutions, medical institutions, physician practices and CROs to conduct, supervise or monitor some

or all aspects of clinical trials involving our product candidates. We have less control over the timing and other aspects of these clinical

trials than if we conducted the monitoring and supervision entirely on our own. Third parties may not perform their responsibilities

for our clinical trials on our anticipated schedule or consistent with a clinical trial protocol or applicable regulations. We also may

rely on CROs to perform our data management and analysis. They may not provide these services as required or in a timely or compliant

manner, and we may be held legally responsible for any or all of their performance failures or inadequacies.

If

we or our collaborators experience delays in the completion of, or termination of, any clinical trial of our product candidates, the

commercial prospects of our product candidates will be harmed, and our ability to generate product revenues from any of these product

candidates will be delayed or eliminated. In addition, any delays in completing our clinical trials will increase our costs, slow our

product candidate development and approval process, and jeopardize our ability to commence product sales and generate revenues. Any of

these occurrences may harm our business, financial condition and prospects. In addition, many of the factors that cause, or lead to,

a delay in the commencement or completion of clinical trials may also lead to the denial of regulatory approval of our product candidates.

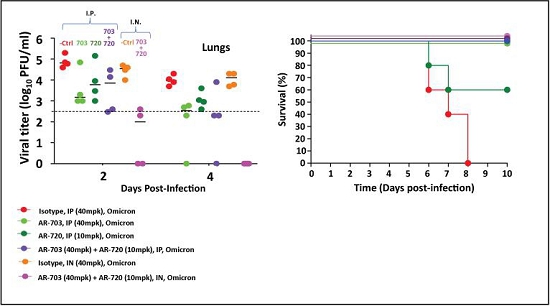

Our

development of a COVID-19 therapeutic candidate is at an early stage and we may not be able to successfully develop an effective therapeutic

to treat COVID-19 in a timely manner, if at all.

Various

government entities, including the U.S. government, are offering incentives, grants, and contracts to encourage additional investment

by commercial organizations into preventative and therapeutic agents against COVID-19, and this may have the effect of increasing the

number of competitors and/or providing advantages to known competitors. We are aware of a substantial number of companies, individuals

and institutions working to develop a treatment for COVID-19, many of which have substantially greater financial, scientific, and other

resources than us, and another party may be successful in producing an effective treatment against COVID-19 before we do. The rapid expansion

of development programs directed at COVID-19 may also generate a scarcity of manufacturing capacity among contract research organizations

that provide cGMP materials for development and commercialization of biopharmaceutical products.

We

are currently unable to commit adequate financial resources to the development of a monoclonal antibody treatment for COVID-19, which

may cause delays in or otherwise negatively impact our other development programs. Similarly resources committed to other development

programs may negatively impact the financial resources available for our COVID-19 therapeutic development. In addition, our management

and scientific teams have dedicated substantial efforts to our COVID-19 therapeutic development. As of the date of this report, we have

26 employees, which may make us more reliant on our individual employees and on outside contractors than companies with a greater number

of employees. If we fail to attract and retain management and scientific personnel, we may be unable to successfully produce, develop

and commercialize our therapeutic candidates.

In

addition, any success in preclinical testing we might observe for our COVID-19 therapeutic candidate may not be predictive of the results

of later-stage human clinical trials. Factors such as safety, efficacy and adverse events can emerge at any time in clinical testing

and have the potential to have adverse consequences for our ability to proceed with clinical trials. Other factors such as the emergence

of new SARS-CoV-2 mutant virus variants rendering a reduction or complete loss of binding or neutralization by the mAbs, manufacturing

challenges, availability of raw materials, and slow-downs in the global supply chain may delay or prevent us from receiving regulatory

approval of our therapeutic candidate or, if we do receive regulatory approval, prevent a successful product launch. We may not be successful

in developing a therapeutic, or another party may be successful in producing a more efficacious vaccine or other treatment for COVID-19.

If

we encounter difficulties enrolling patients in our clinical trials, our clinical trials could be delayed or otherwise adversely affected.

Clinical

trials for our product candidates require us to identify and enroll a large number of patients with the disease under investigation.

We may not be able to enroll a sufficient number of patients with required or desired characteristics to conduct our clinical trials

in a timely manner, if at all. Patient enrollment is affected by factors including, but not limited to:

| |

● |

severity

of the disease under investigation; |

| |

|

|

| |

● |

design

of the trial protocol; |

| |

|

|

| |

● |

the

size and nature of the patient population; |

| |

|

|

| |

● |

eligibility

criteria for the study in question; |

| |

|

|

| |

● |

lack

of a sufficient number of patients who meet the enrollment criteria for our clinical trials; |

| |

|

|

| |

● |

delays

in characterizing a patient’s infection to allow us to select a product candidate, which may lead patients to seek to enroll

in other clinical trials or seek alternative treatments; |

| |

|

|

| |

● |

perceived

risks and benefits of the product candidate under study; |

| |

|

|

| |

● |

availability

of competing therapies and clinical trials; |

| |

|

|

| |

● |

efforts

to facilitate timely enrollment in clinical trials; |

| |

● |

clinical

trial sites being overtaxed by treating COVID-19 patients; |

| |

|

|

| |

● |

scheduling

conflicts with participating clinicians; |

| |

|

|

| |

● |

patient

referral practices of physicians; |

| |

|

|

| |

● |

the

ability to monitor patients adequately during and after treatment; and |

| |

|

|

| |

● |

proximity

and availability of clinical trial sites for prospective patients. |

The

COVID-19 pandemic continues to impact on clinical trial enrollment worldwide. We have experienced slower enrollment of patients in our

clinical trials due to the pace in which clinical sites were being initiated for enrollment and may experience similar difficulties in

the future. In addition, AR-301 has been granted orphan drug designation for the treatment of S. aureus in the EU, and the low

prevalence of such diseases relative to the total population may make it harder to identify patients to enroll. If we have difficulty

enrolling a sufficient number or diversity of patients to conduct our clinical trials as planned, we may need to delay or terminate ongoing

or planned clinical trials, either of which would have an adverse effect on our business.

Our

product candidates are based on a novel technology, which may raise development issues we may not be able to resolve, regulatory issues

that could delay or prevent approval, or personnel issues that may keep us from being able to develop our product candidates.

Our

product candidates are based on our mAb technology and gallium-based anti-infective platforms. There can be no assurance that development

problems related to our novel technologies will not arise in the future that will cause significant delays or that we will able to resolve.

Regulatory

approval of novel product candidates such as ours can be more expensive and take longer than for other, more well-known or extensively

studied pharmaceutical or biopharmaceutical product candidates due to our and regulatory agencies’ lack of experience with them.

We believe three mAbs have been approved by the FDA to date, and four other mAbs have received Emergency Use Authorization (for COVID-19

treatment). The approved mAbs are Synagis® which stimulates the immune system to target a viral infection, Anthim® which treats

inhalational anthrax in combination with appropriate antibiotics, and ZINPLAVA® to reduce recurrence of Clostridium difficile

infections. The novelty of our platform may lengthen the regulatory review process, require us to conduct additional studies or clinical

trials, increase our development costs, lead to changes in regulatory positions and interpretations, delay or prevent approval and commercialization

of our product candidates or lead to significant post-approval limitations or restrictions. For example, the FDA could require additional

studies that may be difficult or impossible to perform.

The

novel nature of our product candidates also means that fewer people are trained in or experienced with product candidates of this type,