NetworkNewsWire

Editorial Coverage: Artificial intelligence (“AI”) is an

increasingly important part of the financial technology sector,

specifically in analyzing stocks and providing insights into the

markets that human analysts alone can’t make. As such, AI-driven

funds hold an increasingly large portion of the market, moving this

technology into the mainstream. The result is a large opportunity

for investors using this technology or investing in the companies

producing it. Significant steps are being taken by companies such

as AnalytixInsight (TSX.V: ALY) (OTCQB: ATIXF)

(ATIXF

Profile), whose flagship CapitalCube

cloud-based analytics empowers investors to evaluate the potential

of companies and portfolios. Other companies are also taking note

of AI’s increasing value. TD Bank (NYSE: TD) has

snapped up a young but highly valued AI company as part of a

broader AI strategy, while Helios and Matheson Analytics,

Inc. (NASDAQ: HMNY) has seen its share price rise as it

expands its AI-driven big data strategy. Even Thomson

Reuters (NYSE: TRI), owner of the original human-driven

reporting and analysis company Reuters, has taken an interest in AI

analysis, as has Euronext NV (NASDAQ: EUXTF), a

European stock exchange.

AI Investment Strategies

AI can be an incredibly powerful tool for analysing markets. The

power of modern computing has made several techniques available

that weren’t before.

The most important feature of financial AI is its ability to

process large volumes of data. This lets the AI look for patterns

that a human might miss and recommend strategies based upon them.

Some of the data is obvious stuff – past performance of companies,

investment in competitors, and the behaviour of other investments.

But given the huge amount of data we all create as we go about our

lives, it goes beyond this. Credit card transactions, news items,

even social media chatter can be factored in by increasingly

complex analytical algorithms. Computer programs can identify

patterns too broad or too subtle for humans to notice, and use them

to direct more profitable investments.

Then there’s modelling. A different sort of program can be used

to predict the outcomes of investment options. The computer

considers what will happen to an investment in a range of different

circumstances and suggest an optimum strategy based on this. Like

academics producing economic forecasts, AI can predict what the

most profitable options are likely to be. This is tied to machine

learning, in which computers evolve their own thinking strategies

through observing what works and what doesn’t.

One of the greatest advantages of investment by computer is the

speed it allows. Conclusions can be drawn and acted upon much more

quickly. This allows the timely buying and selling of stocks in an

ever-accelerating market, ensuring that profitable opportunities

aren’t missed.

Big Data Insights

AnalytixInsight (TSX.V: ALY) (OTCQB:

ATIXF) has taken a leading start in this field, as

partially evidenced in its third-quarter revenues of $1.7 million,

the highest in the company’s history, along with a turn to profit

(http://nnw.fm/Gj5jQ).

An AI company specializing in financial analysis,

AnalytixInsight transforms big data into useful knowledge. The

company’s proprietary machine-learning technology analyzes huge

volumes of data, turning figures into actionable insights. With

strategic initiatives in fintech, blockchain and workflow

analytics, AnalytixInsight is exploring the potential of

data-driven decision-making for not just fintech but other sectors,

including sports, communications, healthcare, insurance and

government.

This analytical power is primarily deployed though

CapitalCube.com, a portal providing financial research and

analysis. CapitalCube carries out over 100 billion computations

daily, churning through the vast sea of financial data to create

meaningful insights for investors to act upon. Its outputs include

on-demand fundamental research, portfolio evaluation, and screening

tools on over 50,000 global equities and North American ETFs.

CapitalCube provides 3,000 reports a day, including in-depth

analysis, peer-to-peer performance evaluations, accounting and

earnings reports, dividend strength and information about likely

upcoming corporate actions such as dividend changes and

acquisitions. This empowers investors to make the best decisions

based upon the data.

Free access to basic financial information helps draw customers

to CapitalCube. Consumers have the option to pay $25 per month for

in-depth analysis and predictive analytics, or $300 per month for

customized peer analysis. Partnerships with Thomson Reuters, Africa

Investor, Euronext NV, Yahoo Finance, and The Wall Street Journal

add to the depth and breadth of CapitalCube’s coverage.

AnalytixInsight has recently announced plans to augment its AI

platform by working with blockchain technology (http://nnw.fm/qOXd6). Blockchain allows information,

including financial transactions, to be quickly and securely

transferred between users. By creating a distributed information

storage system, it allows quicker transactions which will lead to

reduced transaction costs and settlement times for users of

CapitalCube and the company’s other products. The company believes

that this will lead to even greater revenues from existing

multi-year agreements with partner companies.

This blockchain technology will also be used to enhance the

services provided by Marketwall, a 49% owned subsidiary of

AnalytixInsight. Marketwall is preparing to deploy a mobile stock

trading and banking app connected to the MarketHub trading

platform.

Projects such as the Marketwall app have the potential to

increase both the insights from the company and its customers’

ability to act upon them. Use of the mobile app will generate data

on investment patterns, which can in turn be used to power the big

data analysis that fuels CapitalCube.

The company’s analytical potential is further boosted by

Euclides Technologies, a subsidiary company focused on Field

Service Management software solutions. With worldwide customers

representing over 100,000 field service personnel across multiple

industries, Euclides Technologies has to work with the growing

volume of data generated by that industry. As a result, it is

developing analytics to turn big data into useful insights.

Strategic Partnerships for Better Analysis

The latest development for AnalytixInsight is a distribution

agreement with Thomson Reuters (NYSE: TRI), the

world’s leading source of news and information for professional

markets. Thomson Reuters will provide AnalytixInsight with

financial data gathered as part of its reporting work, and

distribute AnalytixInsight’s AI-driven financial research reports.

Together, the two companies will create AI research on public

stocks, which will be carried on TRI terminals to brokers across

North America. It’s a move that will boost the profile of

AnalytixInsight through association with the historic Reuters

brand.

The deal with Thomson Reuters reflects the reality of AI’s place

in fintech. Computer intelligence isn’t taking over from human

decision making. For the most part, it is providing extra insight

for human traders to work with. Systems such as CapitalCube can

provide insights that humans can’t, but the reverse is also true.

It’s through combining human and artificial intelligence that

companies like AnalytixInsight provides such profitable

results.

Another of AnalytixInsight’s partners is Euronext NV

(NASDAQ: EUXTF), a European stock exchange. Euronext now

provides access to CapitalCube for its customers, extending the

reach of the technology and its personalised reports.

The leading Pan-European marketplace, with offices across

Europe, Euronext focuses on bringing together buyers and sellers in

venues that are transparent, efficient and reliable. Combining

exchanges that have been at the heart of European capital markets

for centuries, it now combines that sense of tradition with a

forward-looking investment in new technologies such as AI.

Euronext provides a wide range of data products through its

Market Data portfolio, including real-time data feeds and

historical and reference information. It is a leading global

provider of indices, publishing more than 500 benchmark indices of

all sizes and profiles, including the benchmark AEX-Index® and CAC

40® Index, as well as third party and partner indices. These

provide insight into investor sentiment and the performance of the

Euronext markets. Combined with the insights provided by

CapitalCube, it gives a wide range of insights to subscribers.

Applying AI Elsewhere

TD Bank Group (NYSE: TD) has also shown a great

interest in developing AI as part of its fintech portfolio. Its

acquisition in January of Layer 6 Inc., a Toronto-based AI firm, is

only the latest in a series of such moves. TD has collaborations

with the Vector Institute for Artificial Intelligence, leading

conversational AI provider Kasisto, and retail giant Amazon. This

has allowed it to deploy AI not only in market analysis but also in

customer relations, providing faster, more accurate service.

Financial interest in AI beyond fintech is reflected in the rise

in shares of Helios and Matheson Analytics (NASDAQ:

HMNY) when its Zone Technologies subsidiary announced the

completion of beta testing of proprietary AI technology. Created by

a team headed by Dr. E.G. Rajan, who has spent over 30 years

researching AI and machine learning, the technology will appear in

the company’s RedZone Map app, which analyzes recent crime patterns

and predicts criminal activity.

The Complex Future of Fintech AI

AI undoubtedly has a significant place in the future of fintech.

The range of companies investing in this technology, together with

the positive response of investors to AI announcements, reflects

its increasingly important role. AI allows the effective analysis

of huge data sets to quickly provide insights that wouldn’t be

possible just through human judgement.

The big steps forward in AI analytics are likely to come from

companies with access to large data sets and a broad portfolio of

applied analytics. By partnering up with a range of companies on

CapitalCube and other products, AnalytixInsight has put itself in a

position to be one of those industry-changing companies.

For more information on AnalytixInsight, visit AnalytixInsight (TSX.V: ALY) (OTCQB:

ATIXF)

About NetworkNewsWire

NetworkNewsWire (NNW) is a financial news and content

distribution company that provides (1) access to a network of wire

services via NetworkWire to

reach all target markets, industries and demographics in the most

effective manner possible, (2) article and editorial syndication to

5,000+ news outlets (3), enhanced press release services to ensure

maximum impact, (4) social media distribution via the Investor

Brand Network (IBN) to nearly 2 million followers, and (5) a full

array of corporate communications solutions. As a multifaceted

organization with an extensive team of contributing journalists and

writers, NNW is uniquely positioned to best serve private and

public companies that desire to reach a wide audience of investors,

consumers, journalists and the general public. By cutting through

the overload of information in today’s market, NNW brings its

clients unparalleled visibility, recognition and brand awareness.

NNW is where news, content and information converge.

For more information, please visit https://www.NetworkNewsWire.com

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

Please see full terms of use and disclaimers on the

NetworkNewsWire website applicable to all content provided by NNW,

wherever published or re-published: http://NNW.fm/Disclaimer

DISCLAIMER: NetworkNewsWire (NNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by NNW are

solely those of NNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable NNW for any investment

decisions by their readers or subscribers. NNW is a news

dissemination and financial marketing solutions provider and are

NOT registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, NNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

NNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and NNW undertakes no

obligation to update such statements.

Source:

NetworkNewsWire

Contact:

NetworkNewsWire (NNW)

New York, New York

www.NetworkNewsWire.com

212.418.1217 Office

Editor@NetworkNewsWire.com

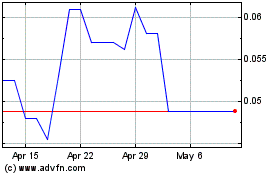

Analytixinsight (PK) (USOTC:ATIXF)

Historical Stock Chart

From Nov 2024 to Dec 2024

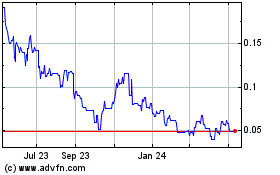

Analytixinsight (PK) (USOTC:ATIXF)

Historical Stock Chart

From Dec 2023 to Dec 2024