Vior Adopts Shareholder Rights Plan

February 11 2008 - 10:10AM

Marketwired

QUEBEC CITY, QUEBEC (FRANKFURT: VL5) announces that its board of

Directors (the "Board") has adopted a Shareholder Rights Plan (the

"Plan") to encourage the fair treatment of Shareholders, should a

take-over bid be made for Vior. The Plan is effective today and

will provide the Board and the Shareholders, more time to consider

any unsolicited take-over bid for Vior. The Plan is intended to

discourage coercive or unfair take-over bids and gives the Board

time to pursue alternatives to maximize Shareholder value, if

appropriate, in the event of an unsolicited take-over bid.

The Plan has not been adopted in response to, or in

contemplation of, any specific proposal to acquire control of Vior.

The Plan is subject to acceptance by the TSX Venture Exchange and

must be ratified by the Shareholders within a period of six (6)

months following its adoption by the Board. In this regard, the

Board plans to hold a shareholders meeting before August 11, 2008.

Unless otherwise terminated in accordance with its terms, the Plan

will terminate at the close of the third Annual Meeting of Vior

Shareholders following the meeting at which the Plan is ratified by

the Shareholders, unless the Plan is reconfirmed and extended at

such meeting.

The Board is of the view that the publication of its most recent

National Instrument 43-101 compliant independent report on the

Douay project (see PR dated November 7, 2007) might have created an

environment where an opportunistic take-over offer could be made

for Vior. Such an offer may not be in the best interest of all

Shareholders. Consequently, the Board has adopted the Plan, the

benefits of which extend to Vior Shareholders should an offer be

made for Vior.

The Rights issued under the Plan will become exercisable only

when a person, including any party related to such person, acquires

or announces its intention to acquire 20% or more of the

outstanding shares of Vior without complying with the "Permitted

Bid" provisions of the Plan or without the approval of the Board.

Should such an acquisition occur, each Right will, upon exercise,

entitle a Right holder other than the acquiring person or related

persons, to purchase shares of Vior at a substantial discount to

the market price at the time.

Under the Plan, a "Permitted Bid" is defined as a bid made to

all shareholders of Vior and that is open for acceptance for not

less than 60 days. If, at the end of such 60-day period, at least

50% of the outstanding shares, other than those owned by the

Offeror or certain related parties, have been tendered, the offeror

may take up and pay for the shares but must extend the bid for a

further 10 days to allow other Shareholders to tender.

The Plan is similar to other shareholder rights plans recently

adopted by other Canadian companies and approved by their

respective shareholders. A complete copy of the Plan will be

available shortly on the SEDAR website at www.sedar.com.

Profile

Vior is a growing mining company focused on acquiring and

developing high quality, low risk gold and base metal resource

prospects in accessible mining areas of Quebec. The Company wholly

owns the Douay gold project which, according to the latest NI

43-101 compliant independent resources evaluation, contains 1.85

million ounces of gold in the inferred category and 269,000 ounces

of gold in the measured and indicated categories (See press release

dated November 7, 2007). The Company is aggressively pursuing

opportunities to develop working interests in mineral properties

that offer significant upside exploration potential. Vale Inco

Limited is the largest shareholder of Vior with an 11%

interest.

The TSX Venture Exchange (TSX Venture) does not accept

responsibility for the adequacy or accuracy of this Press

Release.

Contacts: Vior Inc. Patrick Bradley President 514-235-1409

pbradley@vior.ca www.vior.ca

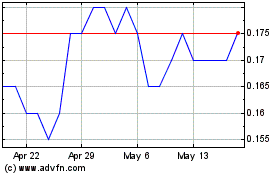

Vior (TSXV:VIO)

Historical Stock Chart

From Sep 2024 to Oct 2024

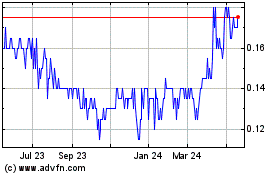

Vior (TSXV:VIO)

Historical Stock Chart

From Oct 2023 to Oct 2024