NuLegacy Gold reports on the second of several new

consultancies as part of our strategy to expand our geo-team to

increase and capitalize on the values we have established.

We are pleased to welcome Mr. Michael Penick,

B.S. Geology, who has joined our team of Carlin-type gold system

discovery consultants in developing our 2023 drilling program for

our 108 sq. km flagship Red Hill property in Nevada’s famed Cortez

gold-trend, one of the world’s premier gold mining

jurisdictions.

Mr. Penick was an integral part of the

Exploration team that was responsible for the discovery of the

multi-million-ounce Goldrush gold deposit just to the northeast of

our Red Hill property1.

Mr. Penick has had a long and successful career

in mineral exploration and management in copper, uranium and most

particularly gold. Most notably, Mike held numerous positions in

Nevada and globally for Barrick Gold, initially as Chief Mine

Geologist at the Betze-Post Open Pit Goldstrike Mine where he was

responsible for mine geology, geotechnical engineering, and

resource modeling activities.

Later, after serving as Geological Services

Manager at Kennecott’s Bingham Canyon Copper Mine, he held the

position of Chief Exploration Geologist for Barrick’s Cortez

district.

Mike was then promoted to Director-USA Minesite

Exploration of numerous Barrick-owned mine camps in the US

including the Cortez, Goldstrike, Turquoise Ridge, Bald Mountain

and Ruby Hill properties, after which, he became part of Barrick’s

efforts in exploration support on all global mine sites as

Manager-Minex.

Both Nancy Richter, formerly US Exploration

Manager, Barrick Gold Exploration Inc., who recently became a

consultant to NuLegacy Gold, and our longtime Exploration Manager,

Charles Weakly worked under Mike’s guidance while at Barrick.

Together they will focus our summer 2023

drilling program and select the 5 or 6 best holes to be drilled

initially out of the 25+ possible drill sites that the geo-crew has

selected.

The rigorous drill hole selection process, which

was started with a geo-technical review session held in Reno March

6-7, is scheduled to be completed by May 8-9 in Elko, (coincident

with our touring the property with a number of ‘friends of the

court’) with the intent of making a discovery, or further narrowing

the field of opportunity. Preliminary information thereon will be

made available shortly.

Drilling and logistical supply contracts are

being finalized and a meeting with the assay lab provider is

forthcoming. Drilling is still scheduled to commence June 1, 2023

(plus/minus a week), and finish in late-July, with the initial

assays for gold in hand for reporting in the second half of

August.

The drilling will require financing as our

current treasury (~ C $1.8 million) is reserved for maintenance of

the Red Hill property and minimal staffing and professional fees as

required for executing on the exit strategy – enrolling one of the

four or five currently identified and qualified acquirors of the

Red Hill property. When appropriate we plan to announce a modest

equity unit financing.

______________________________

1 The Red Hill targets are on trend and

adjacentI to three, multi-million ounce Carlin-type gold deposits

(the Pipeline, Cortez Hills and Goldrush deposits) which are ranked

amongst the world’s thirty largest, lowest cost and politically

safest gold mines and are three of Nevada Gold Mines’ most

profitable mines.II

ON

BEHALF OF THE

BOARD OF

NULEGACY

GOLD

CORPORATION

Albert J. Matter, Chief Executive Officer &

CoFounding Director Tel: +1 (604) 639-3640; Email:

albert@nuggold.com

For more information about NuLegacy visit: www.nulegacygold.com

or www.sedar.com

NuLegacy Gold is focused on confirming potential

high-grade Carlin-style gold deposits within its flagship 108 sq.

km (42 sq. mile) district scale Red Hill Property in the Cortez

gold trend of Nevada. The targets are on trend and adjacentI to

three, multi-million ounce Carlin-type gold deposits (the Pipeline,

Cortez Hills and Goldrush deposits) which are ranked amongst the

world’s thirty largest, lowest cost and politically safest gold

mines and are three of Nevada Gold Mines’ most profitable

mines.II

I The similarity and proximity of

these deposits in the Cortez Trend including Goldrush are not

necessarily indicative of the gold mineralization in NuLegacy’s Red

Hill Property.II Currently structured as an underground mine

Goldrush contains P&P: 7.8 M oz @ 7.29 g/t; M&I: 8.5 M oz @

7.07 g/t (inclusive of P&P); and Inferred: 4.5 M oz @ 6.0 g/t

(as of December 31, 2021). Source: Corporate presentation of Nevada

Gold Mines – Goldrush Underground dated September 22, 2022.

Dr. Roger Steininger, a Director of NuLegacy, is

a Certified Professional Geologist (CPG 7417) and the qualified

person as defined by NI 43-101, Standards of Disclosure for Mineral

Projects, responsible for approving the scientific and technical

information contained in this news release.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

in the United States. The securities have not been and will not be

registered under the United States Securities Act of 1933, as

amended (the “U.S. Securities Act”), or any state

securities laws and may not be offered or sold within the United

States or to or for the account or benefit of a U.S. person (as

defined in Regulation S under the U.S. Securities Act) unless

registered under the U.S. Securities Act and applicable state

securities laws or an exemption from such registration is

available.

Cautionary Statement on Forward-Looking

Information: This news release contains forward-looking

information and statements under applicable securities laws, which

information and/or statements relate to future events or future

performance (including, but not limited to, NuLegacy’s plans and

objectives for expanding its geological team, the prospective

nature of the Red Hill Property and its potential for hosting a

significant Carlin-style gold deposit; the current modeling and

potential future exploration and drill programs for the Red Hill

Property including NuLegacy’s proposed 2023 drill program and the

size, targets, timing and anticipated cost thereof; the existence

of potential mineral resources; NuLegacy’s proposed future equity

financing and the terms, minimum pricing, size and timing thereof,

and proposed exit strategy to support further exploration and

financing including the sale of the Red Hill Property to, or the

merger of the Company with, a producing company and the timing

thereof) and reflect management’s current expectations and beliefs

based on assumptions made by and information currently available to

the Company. Readers are cautioned that such forward-looking

information and statements are neither promises nor guarantees, and

are subject to risks and uncertainties that may cause future

results to differ materially from those expected including, but not

limited to, market conditions, availability of financing, actual

results of exploration activities and drilling, unanticipated

geological, stratigraphic and structural formations, environmental

risks, operating risks, accidents, labor issues, delays in

obtaining governmental approvals and permits, delays in receipt of

assay results from third party laboratories, inflation, future

prices for gold, changes in personnel and other risks in the mining

industry. There are no assurances that the Company will

successfully complete an equity financing on the terms presently

contemplated or at all to raise sufficient funds to carry out the

proposed 2023 drill program or engage a third-party producing

company to purchase the Red Hill Property or merge with the Company

to carry out further exploration and drilling of Red Hill as

currently contemplated or at all. Furthermore, there are no known

mineral resources or reserves in the Red Hill Property, any

proposed exploration programs are exploratory searches for bodies

of ore and the presence of gold resources on properties adjacent or

near the Red Hill Property including Goldrush and the Cortez

Fourmile deposit is not necessarily indicative of the gold

mineralization on the Red Hill Property. There is also uncertainty

about the continued spread and severity of COVID-19, the ongoing

war in Ukraine and rising inflation and interest rates and the

impact they will have on the NuLegacy’s operations, personnel,

supply chains, ability to raise capital, access properties or

procure exploration equipment, supplies, contractors and other

personnel on a timely basis or at all and economic activity in

general. All the forward-looking information and statements made in

this news release are qualified by these cautionary statements and

those in our continuous disclosure filings available on SEDAR at

www.sedar.com. The forward-looking information and statements in

this news release are made as of the date hereof and the Company

does not assume any obligation to update or revise them to reflect

new events or circumstances save as required by applicable law.

Accordingly, readers should not place undue reliance on

forward-looking information and statements.

Neither the TSX Venture Exchange nor its

Regulation Services Provider (as that term is defined in the

policies of the TSX Venture Exchange) accepts responsibility for

the adequacy or accuracy of this release.

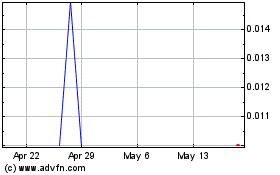

Nulegacy Gold (TSXV:NUG)

Historical Stock Chart

From Oct 2024 to Nov 2024

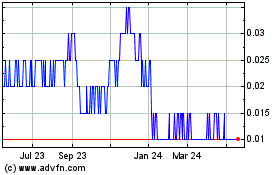

Nulegacy Gold (TSXV:NUG)

Historical Stock Chart

From Nov 2023 to Nov 2024