Entourage Health Corp. (

TSX-V:ENTG)

(

OTCQX:ETRGF) (

FSE:4WE)

(“

Entourage” or the “

Company”), a

Canadian producer and distributor of award-winning cannabis

products, is pleased to announce it has amended its existing senior

secured credit facility entered into on March 29, 2019 (the

“

Senior Credit Facility”) between the Company and

Bank of Montreal, and its existing second secured credit facility

with an affiliate of the LiUNA Pension Fund of Central and Eastern

Canada (“

LPF”), entered into on September 30, 2020

(the “

Second Credit Facility”). The latest

amendments to the Senior Credit Facility and Second Credit Facility

modify the respective terms under which Entourage secured debt

financing (the “

Credit Facilities Amendments”).

Under the terms of the Credit Facilities

Amendments, Entourage secured an extension of the maturity date of

the Senior Credit Facility from June 30, 2022 to June 30, 2024, and

of the Second Credit Facility from August 15, 2022 to December 31,

2024, subject to certain conditions, the terms for which are

described herein.

“Today’s announcement reflects an important

strategic advancement in securing improvements to our debt position

and long-term capital structure as we align our liquidity resources

with ongoing growth plans – all with the crucial support from our

lenders,” said George Scorsis, CEO and Executive Chairman,

Entourage. “As part of our corporate transformation, we are

continuing to finesse our business operations to produce premium

products for added market share growth, whilst assuring that our

financial footing is stabilized. This added security provides all

our stakeholders with confidence that we are moving tactically in

the right direction to reach our profitability goals for long-term

success.”

Senior Credit Facility Terms

Under the terms of the amendment of the Senior

Credit Facility, the maturity date is extended to June 30, 2024,

subject to the satisfaction of certain conditions subsequent by

July 31, 2022, failing which the maturity date will instead become

October 31, 2023. The Company will report on the completion of the

applicable conditions subsequent on or before July 31, 2022.

The amendment of the Senior Credit Facility

includes changes to certain financial covenants which are

applicable to the Company, including but not limited to the

inclusion of an EBITDA target covenant, as more particularly set

out in the Credit Facilities Amendments. Additionally, the Company

secured deferral of certain of its financial covenants to January

1, 2024.

The Senior Credit Facility is secured by the

assets of the Company and its subsidiaries, including the Company’s

production facilities. Bank of Montreal’s security under the Senior

Credit Facility is in first position.

Second Credit Facility Terms

Under the terms of the amendment of the Second

Credit Facility, the maturity date is extended to December 31,

2024, subject to the satisfaction of certain conditions subsequent

by July 31, 2022, failing which the maturity date will instead

become April 30, 2024. The amendment of the Second Credit Facility

includes amendments to the financial covenants that mirror those

amendments to the Senior Credit Facility. The Company also secured

deferral of certain of its financial covenants to January 1,

2024.

The Second Credit Facility continues to bear an

interest rate of 15.25% per annum with the option, at the Company’s

discretion, to capitalize interest in lieu of cash payments of

interest. The Second Credit Facility is secured by the assets of

the Company and its subsidiaries, including the Company’s

production facilities, and contains customary financial and other

covenants. LPF’s security under the Second Credit Facility is in

second position to the Company’s senior creditor.

A copy of the Senior Credit Facility amendments

and Second Credit Facility amendments will be made available under

the Company’s profile on SEDAR at www.sedar.com.

Related Party Transaction

LPF is an insider of the Company as it owns

greater than 10% of the common shares of the Company. Accordingly,

the amending of the Second Credit Agreement represents a “related

party transaction” under Multilateral Instrument 61-101 -

Protection of Minority Security Holders in Special Transactions

(“MI 61-101”). The Company is relying on the

exemption from minority shareholder approval requirements under MI

61-101 as the Second Credit Facility is considered a non-equity

loan as described under Section 5.7(f) of MI 61-101, and obtained

by the Company on reasonable terms that are no less advantageous to

the Company than if the Second Credit Facility was obtained from an

arm’s length party. The funds borrowed under the Second Credit

Facility are not convertible into or repayable by the issuance of

equity or voting securities of the Company. The material change

report will not be filed more than 21 days prior to the entering

into of the amended Second Credit Agreement due to the timing of

the announcement and closing thereof occurring in less than 21

days.

Visit Entourage’s website here to access the

latest Company updates.

About Entourage Health

Corp.

Entourage Health Corp. is the publicly traded

parent company of Entourage Brands Corp. (formerly WeedMD RX Inc.)

and CannTx Life Sciences Inc., licence holders producing and

distributing cannabis products for both the medical and adult-use

markets. The Company owns and operates a state-of-the-art hybrid

greenhouse and processing facility located on 158-acres in

Strathroy, ON; a fully licensed 26,000 sq. ft. Aylmer, ON

processing facility, specializing in cannabis extraction; and a

micropropagation, tissue culture and genetics centre-of-excellence

in Guelph, Ontario. With its Starseed Medicinal medical-centric

brand, Entourage has expanded its multi-channeled distribution

strategy. Starseed’s industry-first, exclusive partnership with

LiUNA, the largest construction union in Canada, along with

employers and union groups complements Entourage’s direct sales to

medical patients. Entourage’s elite adult-use product portfolio

includes Color Cannabis, Saturday Cannabis and Royal City Cannabis

Co.– sold across eight provincial distribution agencies. The

Company also maintains strategic relationships in the seniors’

market and supply agreements with Shoppers Drug Mart. It is the

exclusive Canadian producer and distributor of award-winning

U.S.-based wellness brand Mary’s Medicinals sold in both medical

and adult-use channels. Under a collaboration with The Boston Beer

Company subsidiary, Entourage is also the exclusive distributor of

cannabis-infused beverages ‘TeaPot’ in Canada, expected to launch

in 2022.

For more information, please visit us at

www.entouragehealthcorp.com

Follow Entourage and its brands on LinkedIn

Twitter: Entourage, Color Cannabis, Saturday

Cannabis, Starseed & Royal City Cannabis Co.

Instagram: Entourage, Color Cannabis, Saturday

Cannabis, Starseed & Royal City Cannabis Co.

For further information, please

contact:

For Investor Enquiries:Valter

Pinto or Scott EcksteinKCSA Strategic

Communications1-212-896-1254entourage@kcsa.cominvestor@entouragecorp.com

For Media Enquiries:Marianella

delaBarreraSVP, Communications & Corporate

Affairs416-897-6644marianella@entouragecorp.com

Forward Looking Information

This press release contains "forward-looking information" within

the meaning of applicable Canadian securities legislation which are

based upon Entourage's current internal expectations, estimates,

projections, assumptions and beliefs and views of future events.

Forward-looking information can be identified by the use of

forward-looking terminology such as "expect", "likely", "may",

"will", "should", "intend", "anticipate", "potential", "proposed",

"estimate" and other similar words, including negative and

grammatical variations thereof, or statements that certain events

or conditions "may", "would" or "will" happen, or by discussions of

strategy. Forward-looking information included in this press

release includes, but is not limited to, statements in respect of

the satisfaction of certain conditions of the Credit Facilities

Amendments.

The forward-looking information in this news

release is based upon the expectations, estimates, projections,

assumptions and views of future events which management believes to

be reasonable in the circumstances. Forward-looking information

includes estimates, plans, expectations, opinions, forecasts,

projections, targets, guidance or other statements that are not

statements of fact. Forward-looking information necessarily involve

known and unknown risks, including, without limitation, risks

associated with general economic conditions; adverse industry

events; loss of markets; future legislative and regulatory

developments; inability to access sufficient capital from internal

and external sources, and/or inability to access sufficient capital

on favourable terms; the cannabis industry

in Canada generally; the ability of Entourage to

implement its business strategies; the COVID-19 pandemic;

competition; crop failure; and other risks.

Any forward-looking information speaks only as

of the date on which it is made, and, except as required by law,

Entourage does not undertake any obligation to update or revise any

forward-looking information, whether as a result of new

information, future events or otherwise. New factors emerge from

time to time, and it is not possible for Entourage to predict all

such factors. When considering this forward-looking information,

readers should keep in mind the risk factors and other cautionary

statements in Entourage’s disclosure documents filed with the

applicable Canadian securities regulatory authorities on SEDAR at

www.sedar.com. The risk factors and other factors noted in the

disclosure documents could cause actual events or results to differ

materially from those described in any forward-looking

information.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS

REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE

POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR

THE ADEQUACY OR ACCURACY OF THIS RELEASE

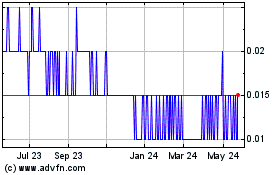

Entourage Health (TSXV:ENTG)

Historical Stock Chart

From Feb 2025 to Mar 2025

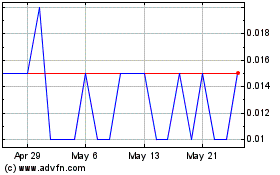

Entourage Health (TSXV:ENTG)

Historical Stock Chart

From Mar 2024 to Mar 2025