Alaska Energy Metals Files NI 43-101 Technical Report for the Eureka Property, Nikolai Nickel Project, Alaska, USA

January 05 2024 - 11:56PM

Alaska Energy Metals Corporation (TSX-V: AEMC, OTCQB: AKEMF)

(“AEMC” or the “Company”) is pleased to announce that further to

its news release on November 20, 2023, it has filed its National

Instrument 43-101 Technical Report, dated January 5, 2024, on

SEDAR+ at www.sedarplus.com for its 100% owned Eureka Property,

Nikolai Nickel Project in Alaska, USA.

The Independent Mineral Resource Estimate (MRE) and technical

report were prepared by Stantec Consulting Services, Inc. in

accordance with National Instrument 43-101 regulations.

Furthermore, AEMC is pleased to announce that it has engaged

Stantec Consulting Services, Inc. to complete an updated MRE for

its Eureka Property. The updated MRE will incorporate the eight

diamond drill holes (totaling 4,138 meters) drilled during the

company’s 2023 exploration program and historical drilling,

purchased in August 2023, that fall within a reasonable search

distance for estimation and pass data verification procedures. The

work will start immediately.

Alaska Energy Metals President & CEO Gregory Beischer

commented: “Based on historical drilling, we have been able to

document over 1.5 billion pounds of nickel in an Inferred Resource.

With the drilling our company executed in summer of 2023, the metal

inventory should significantly increase. We are planning an

aggressive drilling program in 2024 to expand the bulk tonnage

resource further, and to explore for high-grade deposits.”

Table 1 – Nikolai Project Maiden Mineral

Resource Estimate (MRE) Effective November 20,

2023

|

Inferred Mineral Resource Tonnes and Grade |

|

Area |

Mineralized Zone |

NiEq Cutoff |

Tonnes |

Base and Battery Metals |

PGM and Precious Metals |

Total |

|

Ni |

Cu |

Co |

Pt |

Pd |

Au |

Ni Eq* |

|

(%) |

(MT) |

(%) |

(%) |

(%) |

(g/T) |

(g/T) |

(g/T) |

(%) |

|

Eureka East |

Eureka Zone 2 (EZ2) |

>= 0.200 |

88.6 |

0.24 |

0.08 |

0.02 |

0.056 |

0.124 |

0.012 |

0.35 |

|

Eureka West |

Eureka Zone 2 (EZ2) |

>= 0.200 |

182.8 |

0.21 |

0.05 |

0.02 |

0.036 |

0.071 |

0.013 |

0.28 |

|

Eureka Zone 3 (EZ3) |

>= 0.200 |

48.2 |

0.23 |

0.02 |

0.01 |

0.031 |

0.021 |

0.004 |

0.27 |

|

Total |

EZ2 + EZ2 + EZ3 |

>= 0.200 |

319.6 |

0.22 |

0.05 |

0.02 |

0.041 |

0.078 |

0.012 |

0.30 |

|

Inferred Mineral Resource Tonnes and Metal

Content |

|

Area |

Mineralized Zone |

NiEq Cutoff |

Tonnage |

Base and Battery Metals |

PGM and Precious Metals |

Total |

|

Ni |

Cu |

Co |

Pt |

Pd |

Au |

Ni Eq* |

|

(%) |

(MT) |

(Mlbs) |

(Mlbs) |

(Mlbs) |

(tOz) |

(tOz) |

(tOz) |

(Mlbs) |

|

Eureka East |

Eureka Zone 2 (EZ2) |

>= 0.200 |

88.6 |

471 |

165 |

34 |

160,373 |

353,993 |

34,359 |

676 |

|

Eureka West |

Eureka Zone 2 (EZ2) |

>= 0.200 |

182.8 |

841 |

189 |

65 |

210,018 |

415,335 |

79,036 |

1,135 |

|

Eureka Zone 3 (EZ3) |

>= 0.200 |

48.2 |

240 |

19 |

16 |

48,816 |

32,694 |

6,495 |

287 |

|

Total |

EZ2 + EZ2 + EZ3 |

>= 0.200 |

319.6 |

1,552 |

373 |

115 |

419,138 |

802,003 |

119,915 |

2,098 |

- CIM definitions are followed for

classification of Mineral Resource.

- Base case cutoff grade is 0.20% Ni

calculated from a Ni price of US$23,946/tonne (US$10.9 US$/lb),

surface mining cost of US$2.50 per tonne, and processing costs

US$25.00 per tonne.

- Mineral Resource are reported from

within an economic pit shell whose extent has been estimated using

a Ni price of US$23,946/tonne (US$10.9 US$/lb) and mining cost of

US$2.50 per tonne, from a Ni equivalent grade calculated from Ni,

Cu, Co, Pt, Pd, and Au, Ni recovery of 60% and 50% for other

metals, fixed density of 2.80- and 45-degree constant slope

angle.

- Equivalent grade formula is Ni EQ =

Ni/1 + Cu/2.7309 + Co/0.5321 + Pt/0.0008 + Pd/0.0004 +

Au/0.0004

- Metal pricing used to calculate Ni

EQ is based on observation of monthly metal pricing for the past 24

months up to end-October 2023 with Ni at US$23,946/tonne

(US$10.9/lb) (World Bank), Cu at US$ 8,768/tonne ($US4.0/lb) (World

Bank), Co 45,000 US$/tonne (US24/lb) (Trading Economics), Pt at

US$970/toz (World Bank), Pd at US$1,700/toz (Kitco), and Au at

1,855 (World Bank). Totals may not represent the sum of the parts

due to rounding.

- The Mineral

Resource estimate has been prepared by Derek Loveday, P. Geo. of

Stantec Consulting Services Inc. in conformity with CIM “Estimation

of Mineral Resource and Mineral Reserves Best Practices” guidelines

and is reported in accordance with the Canadian Securities

Administrators NI 43-101. Mineral resources are not mineral

reserves and do not have demonstrated economic viability. There is

no certainty that any mineral resource will be converted into

mineral reserve.

QUALIFIED PERSONMr. Derek Loveday, P. Geo. of

Stantec Consulting Services Inc. is the independent Qualified

Person as defined by National Instrument 43-101 Standards of

Disclosure for Mineral Projects, and has prepared, or supervised

the preparation of, or has reviewed and approved, the scientific

and technical data pertaining to the MRE and technical report. Mr.

Loveday declares he has read this press release and that the

scientific and technical information relating to the resource

estimate are correct.

Gabriel Graf, the Company’s Chief Geoscientist, is the qualified

person, as defined under National Instrument 43-101 guidelines, who

reviewed and approved the preparation of the technical information

in this news release.

For additional information, visit:

https://alaskaenergymetals.com/

ABOUT ALASKA ENERGY METALSAlaska Energy Metals

Corporation is focused on delineating and developing a large

polymetallic exploration target containing nickel, copper, cobalt,

chrome, iron, platinum, palladium, and gold. Located in central

Alaska, the Nikolai Nickel project is located near existing

transportation and power infrastructure, the project is

well-situated to become a significant, domestic source of critical

and strategic energy-related metals for the American market. The

Company is also exploring the Angliers Nickel project in

Quebec.

ON BEHALF OF THE BOARD“Gregory Beischer”Gregory

Beischer, President & CEO

FOR FURTHER INFORMATION, PLEASE CONTACT:Gregory

A. Beischer, President & CEOToll-Free: 877-217-8978 | Local:

604-638-3164

Sarah Mawji, Public RelationsFinal Edit Media and Public

Relations Email: sarah@finaleditpr.com

Some statements in this news release may contain forward-looking

information (within the meaning of Canadian securities

legislation), including, without limitation, that the Company (a)

complete an updated resource calculation, and b) execute further

drilling in 2024. These statements address future events and

conditions and, as such, involve known and unknown risks,

uncertainties, and other factors which may cause the actual

results, performance, or achievements to be materially different

from any future results, performance, or achievements expressed or

implied by the statements. Forward-looking statements speak only as

of the date those statements are made. Although the Company

believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guaranteeing of future performance and actual results may

differ materially from those in the forward-looking statements.

Factors that could cause the actual results to differ materially

from those in forward-looking statements include regulatory

actions, market prices, and continued availability of capital and

financing, and general economic, market or business conditions.

Investors are cautioned that any such statements are not guarantees

of future performance and actual results or developments may differ

materially from those projected in the forward-looking statements.

Forward-looking statements are based on the beliefs, estimates and

opinions of the Company's management on the date the statements are

made. Except as required by applicable law, the Company assumes no

obligation to update or to publicly announce the results of any

change to any forward-looking statement contained or incorporated

by reference herein to reflect actual results, future events or

developments, changes in assumptions, or changes in other factors

affecting the forward-looking statements. If the Company updates

any forward-looking statement(s), no inference should be drawn that

it will make additional updates with respect to those or other

forward-looking statements.

Neither the TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this press release.

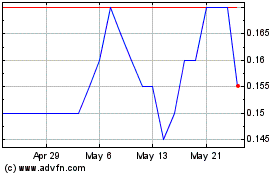

Alaska Energy Metals (TSXV:AEMC)

Historical Stock Chart

From Jun 2024 to Jul 2024

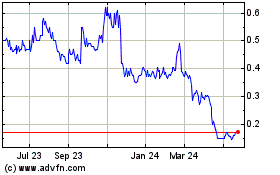

Alaska Energy Metals (TSXV:AEMC)

Historical Stock Chart

From Jul 2023 to Jul 2024