UNISYNC Reports Rising Q2 Fiscal 2023 Revenues

May 15 2023 - 8:00AM

Unisync Corp. ("Unisync") (TSX:"UNI")

(OTCQX:"USYNF") announces its audited financial results for the

second quarter ended March 31, 2023 of its 2023 fiscal year (“Q2

2023”). Unisync operates through two business units: Unisync Group

Limited (“UGL”) with operations throughout Canada and the USA and

90% owned Peerless Garments LP (“Peerless”), a domestic

manufacturing operation based in Winnipeg, Manitoba. UGL is a

leading customer-focused provider of corporate apparel, serving

many leading Canadian and American iconic brands. Peerless

specializes in the production and distribution of highly technical

protective garments, including military operational clothing and

accessories for a broad spectrum of Federal, Provincial and

Municipal government departments and agencies.

Results for Q2 2023 versus Q2

2022

Revenue for Q2 2023 of $28.7 million rose by

$4.1 million or 17% from Q2 2022, due to a $6.4 million revenue

improvement in the UGL segment less a $2.3 million revenue decrease

in the Peerless segment. UGL segment revenue of $25.9 million

increased by 33% over the same period in the prior year on an

improvement in sales to the segment’s airline accounts. The

dramatic increase in sales to the Company’s airline accounts was

caused by the continued post pandemic rebound in the airline

industry where staffing levels have surged above pre-pandemic

levels. The revenue decrease in the Peerless segment in the current

quarter was due to lower uniform product sales to the Department of

National Defence (“DND”) on account of delays in the receipt of key

fabric and the exercise of contract options by the DND.

Gross profit for Q2 2023 of $4.1 million was

down $1.0 million from Q2 2022 and the gross profit margin declined

to 14.4% of revenue from 20.7% on account of the lower volume of

sales in the Peerless segment and the absorption of higher freight

costs in the UGL segment. The UGL segment realized a gross profit

of $3.4 million or 13% of segment revenue compared to $4.3 million

or 22% of segment revenue in the same quarter of the prior fiscal

year. Gross profit margins continue to be squeezed as UGL works

through higher-than-normal product costs caused in part by the

unprecedented increase in offshore delivery costs when container

rates peaked for an extended period at up to 10 times pre-pandemic

levels.

At $4.3 million, total general and

administrative expenses for Q2 2023 were down $0.6 million or 12%

from Q2 2022 when separation costs were incurred on the transition

to a new focused senior management leadership structure.

Interest expense of $0.9 million in Q2 2023 was

up $0.5 million from Q2 2022 due to higher interest costs combined

with the need for greater short-term borrowings to finance the

growth in inventory and receivable levels.

The Company reported a net loss before tax of

$0.8 million in Q2 2023 compared to a net loss of $0.3 million in

Q2 2022. Adjusted EBITDA was $1.1 million for Q2 2022 versus $1.3

million for Q2 2022.

More detailed information is contained in the

Company’s Consolidated Financial Statements for the quarter ended

March 31, 2023 and Management Discussion and Analysis dated May 12,

2023 which may be accessed at www.sedar.com.

Business Outlook

The Company’s North American airline accounts

continue to experience strong demand and have returned to

pre-pandemic passenger volumes. The Company expects that this will

continue to result in strong uniform sales to its airline accounts

throughout fiscal 2023. The flow of offshore ocean shipments

continues to improve, and the costs of container shipments have

stabilized at pre-pandemic levels following the inflated levels

experienced during the pandemic. New product orders are at an

all-time high as evidenced by the increase in deferred revenue to

$21.4 million at March 31, 2023 compared to $16.7 million as at

September 30, 2022 and $5.0 million as at September 30, 2021.

Approximately 60% of the deferred revenue at the end of Q2 2023

represents deposits on custom garment production in process, with

the balance representing customer deposits at full selling prices

covering slow moving inventory awaiting a disposition decision. The

Company believes that these trends will allow the Company to

continue to reduce its order delivery backlog and to right-size the

quantity of uniform products held in its distribution centres over

the balance of the fiscal year.

The Company continues to place strong focus on

the US market. UGL is in advanced discussions with a number of

major corporations with respect to their image wear programs

totalling close to US$100 million annually in potential new

business. Additionally, UGL has been added as an approved supplier

to an extensive list of major customers that are also scheduled to

come to market during the 2023 calendar year.

With $13 million in firm contracts and options

on hand as at March 31, 2023, the Peerless business segment is

positioned to maintain its current level of revenues and

profitability over the balance of fiscal 2023.

Our primary strategy has been concentrated to

date on building an infrastructure of strong management and

advanced systems and a referenceable base of iconic clients to fuel

future growth and profitability. As we move out of this platform

building phase, management and your board are committed to

achieving continued future growth and the development of an

improved level of profitability to enhance shareholder value.

On Behalf of the Board of Directors

Douglas F GoodCEO

Investor relations

contact:Douglas F Good, CEO at 778-370-1725 Email:

dgood@unisyncgroup.com

Forward Looking Statements

This news release may contain forward-looking

statements that involve known and unknown risk and uncertainties

that may cause the Company’s actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied in these

forward-looking statements. Any forward-looking statements

contained herein are made as of the date of this news release and

are expressly qualified in their entirety by this cautionary

statement. Except as required by law, the Company undertakes no

obligation to publicly update or revise any such forward-looking

statements to reflect any change in its expectations or in events,

conditions, or circumstances on which any such forward-looking

statements may be based, or that may affect the likelihood that

actual results will differ from those set forth in the

forward-looking statements. Neither the TSX nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX) accepts responsibility for the adequacy or accuracy of this

release.

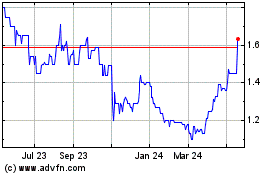

Unisync (TSX:UNI)

Historical Stock Chart

From Jan 2025 to Feb 2025

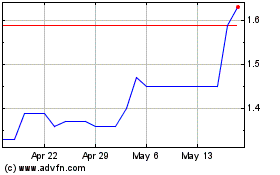

Unisync (TSX:UNI)

Historical Stock Chart

From Feb 2024 to Feb 2025