TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or the Company)

released its third quarter results today. François Poirier, TC

Energy’s President and Chief Executive Officer commented, “During

the third quarter, we made monumental progress on Coastal GasLink

and have achieved mechanical completion ahead of our year-end

target. The team’s exceptional safety and construction execution on

this challenging project means that we have reached 100 per cent

pipeline installation, including the successful hydrotesting of the

full 670 km pipeline length. The project remains on track with the

approximately $14.5 billion cost estimate." Poirier continued, "We

are also delivering on our 2023 strategic priorities, including

strengthening the balance sheet with the recent receipt of $5.3

billion of asset sale proceeds that will be utilized for debt

repayment and funding, along with maximizing the value of our

assets with the announced intention to spin off our Liquids

Pipelines business. Our focus on safety and the reliability of our

assets continues to deliver strong year-over-year growth, and we

remain on track to deliver a record year for 2023 comparable EBITDA

despite macroeconomic headwinds.”

Highlights

(All financial figures are unaudited and in

Canadian dollars unless otherwise noted)

- Delivered approximately seven per cent comparable EBITDA1

growth of $2.6 billion in third quarter 2023 compared to $2.5

billion in third quarter 2022. Segmented earnings were $0.6 billion

in third quarter 2023 compared to $1.8 billion in third quarter

2022, largely due to the after-tax impairment charge of $1,179

million for the three months ended September 30, 2023 related to TC

Energy's equity investment in Coastal GasLink Pipeline Limited

Partnership (Coastal GasLink LP)

- Third quarter 2023 results were underpinned by solid

utilization and reliability across our assets. While our Natural

Gas Pipelines business does not carry material volumetric or price

risk, strong utilization rates demonstrate the demand for our

services and the longer-term criticality of our assets

- NGTL System receipts averaged 14.0 Bcf/d, up 0.5 Bcf/d from

third quarter 2022

- NGTL System daily receipts reached 14.6 Bcf on August 6, 2023,

the highest single day average on the pipeline

- U.S. Natural Gas Pipelines LNG deliveries averaged 3.1 Bcf/d,

up 1.4 per cent from third quarter 2022

- U.S. Natural Gas Pipelines business achieved a new record of

deliveries to power generators of 5.2 Bcf on July 28, 2023

- Gas Transmission Northwest (GTN) system achieved an all-time

delivery record of 2.96 Bcf on July 25, 2023

- Keystone Pipeline System achieved 93.7 per cent operational

reliability year-to-date

- Successfully completed two open seasons on Marketlink,

supporting the sustained demand for Canadian crude on the Keystone

Pipeline and Marketlink systems

- Alberta cogeneration power plant fleet achieved approximately

98 per cent peak price availability

- Bruce Power achieved 94 per cent availability and successfully

completed the Unit 6 Major Component Replacement (MCR) within

budget and ahead of schedule

- Third quarter 2023 financial results:

- Net losses attributable to common shares of $0.2 billion or

$0.19 per common share compared to net income of $0.8 billion or

$0.84 per common share in third quarter 2022. Comparable earnings2

of $1.0 billion or $1.00 per common share compared to $1.1 billion

or $1.07 per common share in 2022

- Comparable EBITDA of $2.6 billion compared to $2.5 billion in

2022 and segmented earnings of $0.6 billion compared to $1.8

billion in 2022

- Reflecting strong year-to-date operational and financial

performance, we now expect 2023 comparable EBITDA to be at the

upper end of the five to seven per cent outlook compared to 2022,

while 2023 comparable earnings per common share is expected to be

generally consistent with 2022

- Year to date, we have placed approximately $5 billion of

projects into service on our natural gas and liquids pipeline

systems, as well as the Bruce Power Unit 6 MCR which was declared

commercially operational on September 14, 2023

- Placed the lateral section of the Villa de Reyes (VdR) pipeline

in commercial service

- Placed substantially all assets of the NGTL System/Foothills

West Path Delivery Program into service on November 1, 2023

- On October 4, 2023, we successfully completed the sale of a 40

per cent non-controlling equity interest in Columbia Gas

Transmission, LLC (Columbia Gas) and Columbia Gulf Transmission,

LLC (Columbia Gulf) systems to Global Infrastructure Partners (GIP)

for total cash proceeds of $5.3 billion (US$3.9 billion), which

were directed towards reducing leverage

- Coastal GasLink has achieved mechanical completion, ahead of

its year-end target and the project remains on track with the cost

estimate of approximately $14.5 billion

- The Southeast Gateway Pipeline project continues to progress to

our US$4.5 billion cost estimate and schedule. Land rights and

rights of way negotiations have closed and all critical permits for

onshore construction have been received. We are advancing

construction of on-shore facilities and landfalls. Offshore

engineering is complete and offshore installation expected to

commence prior to the end of 2023

- Approved the Bison XPress expansion project on Northern Border

and Bison systems that will replace and upgrade certain facilities

and provide production egress from the Bakken basin to a delivery

point at the Cheyenne Hub

- GTN XPress project received FERC approval to expand the GTN

system that will provide for the transport of incremental

contracted export capacity facilitated by the NGTL System/Foothills

West Path Delivery Program

- John E. Lowe will be appointed as TC Energy's Board Chair,

effective January 1, 2024

- Progressing proposed Liquids Pipelines spinoff with the

announcement of the Board Chair and company name, South Bow

Corporation

- Declared a quarterly dividend of $0.93 per common share for the

quarter ending December 31, 2023.

|

|

|

three months ended September 30 |

|

nine months ended September 30 |

|

(millions of $, except per share amounts) |

|

|

2023 |

|

|

|

2022 |

|

|

|

2023 |

|

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

| Income |

|

|

|

|

|

|

|

|

| Net income (loss) attributable

to common shares |

|

|

(197 |

) |

|

|

841 |

|

|

|

1,366 |

|

|

|

2,088 |

|

| per common share – basic |

|

($0.19 |

) |

|

$0.84 |

|

|

$1.33 |

|

|

$2.11 |

|

| |

|

|

|

|

|

|

|

|

| Segmented earnings

(losses) |

|

|

|

|

|

|

|

|

| Canadian Natural Gas

Pipelines |

|

|

(799 |

) |

|

|

409 |

|

|

|

(782 |

) |

|

|

1,152 |

|

| U.S. Natural Gas

Pipelines |

|

|

782 |

|

|

|

714 |

|

|

|

2,576 |

|

|

|

1,735 |

|

| Mexico Natural Gas

Pipelines |

|

|

210 |

|

|

|

113 |

|

|

|

646 |

|

|

|

395 |

|

| Liquids Pipelines |

|

|

253 |

|

|

|

268 |

|

|

|

702 |

|

|

|

801 |

|

| Power and Energy

Solutions |

|

|

234 |

|

|

|

289 |

|

|

|

741 |

|

|

|

535 |

|

|

Corporate |

|

|

(36 |

) |

|

|

(9 |

) |

|

|

(74 |

) |

|

|

12 |

|

|

Total segmented earnings (losses) |

|

|

644 |

|

|

|

1,784 |

|

|

|

3,809 |

|

|

|

4,630 |

|

|

|

|

|

|

|

|

|

|

|

| Comparable

EBITDA |

|

|

|

|

|

|

|

|

| Canadian Natural Gas

Pipelines |

|

|

781 |

|

|

|

713 |

|

|

|

2,301 |

|

|

|

2,038 |

|

| U.S. Natural Gas

Pipelines |

|

|

968 |

|

|

|

926 |

|

|

|

3,160 |

|

|

|

2,948 |

|

| Mexico Natural Gas

Pipelines |

|

|

232 |

|

|

|

204 |

|

|

|

597 |

|

|

|

542 |

|

| Liquids Pipelines |

|

|

398 |

|

|

|

332 |

|

|

|

1,078 |

|

|

|

1,002 |

|

| Power and Energy

Solutions |

|

|

256 |

|

|

|

295 |

|

|

|

754 |

|

|

|

704 |

|

|

Corporate |

|

|

(3 |

) |

|

|

(9 |

) |

|

|

(9 |

) |

|

|

(16 |

) |

|

Comparable EBITDA |

|

|

2,632 |

|

|

|

2,461 |

|

|

|

7,881 |

|

|

|

7,218 |

|

|

Depreciation and amortization |

|

|

(690 |

) |

|

|

(653 |

) |

|

|

(2,061 |

) |

|

|

(1,914 |

) |

| Interest expense included in

comparable earnings |

|

|

(865 |

) |

|

|

(666 |

) |

|

|

(2,413 |

) |

|

|

(1,866 |

) |

| Allowance for funds used

during construction |

|

|

164 |

|

|

|

116 |

|

|

|

443 |

|

|

|

254 |

|

| Foreign exchange gains

(losses), net included in comparable earnings |

|

|

(25 |

) |

|

|

6 |

|

|

|

78 |

|

|

|

32 |

|

| Interest income and other

included in comparable earnings |

|

|

63 |

|

|

|

35 |

|

|

|

157 |

|

|

|

93 |

|

| Income tax (expense) recovery

included in comparable earnings |

|

|

(220 |

) |

|

|

(202 |

) |

|

|

(749 |

) |

|

|

(554 |

) |

| Net (income) loss attributable

to non-controlling interests |

|

|

(1 |

) |

|

|

(8 |

) |

|

|

(18 |

) |

|

|

(28 |

) |

|

Preferred share dividends |

|

|

(23 |

) |

|

|

(21 |

) |

|

|

(69 |

) |

|

|

(85 |

) |

|

Comparable earnings |

|

|

1,035 |

|

|

|

1,068 |

|

|

|

3,249 |

|

|

|

3,150 |

|

|

Comparable earnings per common share |

|

$1.00 |

|

|

$1.07 |

|

|

$3.16 |

|

|

$3.19 |

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by

operations |

|

|

1,824 |

|

|

|

1,701 |

|

|

|

5,408 |

|

|

|

4,350 |

|

| Comparable funds generated

from operationsi |

|

|

1,755 |

|

|

|

1,637 |

|

|

|

5,575 |

|

|

|

5,068 |

|

| Capital spendingii |

|

|

3,289 |

|

|

|

2,594 |

|

|

|

9,313 |

|

|

|

5,822 |

|

| |

|

|

|

|

|

|

|

|

| Dividends

declared |

|

|

|

|

|

|

|

|

| per common share |

|

$0.93 |

|

|

$0.90 |

|

|

$2.79 |

|

|

$2.70 |

|

| |

|

|

|

|

|

|

|

|

| Basic common shares

outstanding (millions) |

|

|

|

|

|

|

|

|

| – weighted average for the

period |

|

|

1,035 |

|

|

|

1,000 |

|

|

|

1,028 |

|

|

|

988 |

|

| –

issued and outstanding at end of period |

|

|

1,037 |

|

|

|

1,012 |

|

|

|

1,037 |

|

|

|

1,012 |

|

i Comparable funds generated from operations is a

non-GAAP measure used throughout this release. This measure does

not have any standardized meaning under GAAP and therefore is

unlikely to be comparable in similar measures presented by other

companies. The most directly comparable GAAP measure is Net cash

provided by operations. For more information on non-GAAP measures,

refer to the Non-GAAP Measures section of this

release. ii Includes Capital expenditures, Capital

projects in development and Contributions to equity investments.

Refer to the Financial condition – Cash (used in) provided by

investing activities section for additional information.

CEO Message

In the third quarter of 2023, we made significant

progress towards our 2023 strategic priorities that include safely

executing on major projects including Coastal GasLink and Southeast

Gateway, bringing other capacity capital projects into service,

accelerating our deleveraging by advancing our $5+ billion asset

divestiture program, and continuing to maximize the value and

performance of our assets through safe operations and reliable

service.

Project execution: Coastal GasLink achieves

mechanical completion, while continuing to advance Southeast

GatewayWe are pleased to announce that the Coastal GasLink

project has achieved mechanical completion ahead of our year-end

target. In October, the project achieved 100 per cent pipe

installation following the final weld at the base of Cable Crane

Hill. This monumental milestone includes the installation of all

800 water crossings and the successful hydrotesting of the full

length of the 670 km pipeline. Achieving mechanical completion

allows us to safely commence the introduction of natural gas. With

the most challenging work completed, we have substantially

mitigated the remaining risks associated with the project, and with

the cost estimate of approximately $14.5 billion remains on track.

Throughout the remainder of 2023, the project will complete

pipeline commissioning activities to be ready to deliver

commissioning gas to the LNG Canada facility by the end of the

year, and we will continue reclamation work in 2024. In Mexico, our

team made important progress on the Southeast Gateway Pipeline

project. Land rights and rights of way negotiations have closed,

and all critical permits for onshore construction have been

received. Onshore construction at the three landfall sites

continues to progress on plan, with all land acquisitions complete.

Offshore engineering is complete and concrete coating is on track,

supporting offshore installation which is expected to commence

prior to the end of 2023. We also placed the lateral section of the

VdR pipeline into commercial service, serving power generation in

the state of Guanajuato. With the support of the Comisión Federal

de Electricidad (CFE) and state governments, we are targeting the

south section of VdR to be in-service by the second half of

2024.

Accelerating deleveraging by advancing our

$5+ billion asset divestiture programOn October 4, we

announced the successful completion of the sale of a 40 per cent

non-controlling equity interest in our Columbia Gas and Columbia

Gulf systems to GIP, for total cash proceeds of $5.3 billion

(US$3.9 billion). Cash proceeds from this transaction were directed

towards reducing our year-end 2023 debt-to-EBITDA3 metric by over

0.4 times. Closing of this transaction is a major step towards

reaching TC Energy’s 2024 year-end leverage target of 4.75 times

debt-to-EBITDA. As we announced in July, we continue to evaluate an

incremental $3 billion of capital rotation opportunities to further

support our deleveraging targets. Collectively, these actions are

expected to enable TC Energy to continue strengthening its balance

sheet and reinforce long-term, sustainable annual dividend growth

of three to five per cent.

Demand for our services during nine months

of the year drives nine per cent year-over-year growth in

comparable EBITDAStrong operational performance during the

third quarter is a testament to our ability to safely and reliably

deliver essential services across North America. Within our

integrated Natural Gas Pipelines business, total NGTL System

receipts averaged 14.0 Bcf/d and the NGTL System achieved record

single-day receipts of 14.6 Bcf on August 6. U.S. Natural Gas

(USNG) LNG deliveries averaged 3.1 Bcf/d during the quarter, up 1.4

per cent compared to third quarter 2022, and our USNG business

achieved a new record for deliveries to power generators of 5.2 Bcf

on July 28. Our GTN system also achieved an all-time delivery

record of 2.96 Bcf on July 25. In October, FERC approved our GTN

XPress project, an expansion of the GTN system that will provide

for incremental contracted export capacity facilitated by the NGTL

System/Foothills West Path Delivery Program with an anticipated

in-service date in 2024. The Liquids Pipelines business has

delivered approximately eight per cent comparable EBITDA growth

year-to-date compared 2022. Ensuring the continued delivery of all

contracted volumes, the Keystone Pipeline System has achieved 93.7

per cent operational reliability year-to-date. Marketlink

throughput increased over 250,000 Bbl/d year-over-year, driven by

strong demand and additional last-mile connectivity. Throughout the

year we have successfully completed two open seasons on Marketlink,

supporting the sustained demand for Canadian crude on the Keystone

Pipeline and Marketlink systems. Within Power and Energy Solutions,

the Alberta cogeneration power plant fleet reached approximately 98

per cent peak price availability, while Bruce Power achieved 94 per

cent availability in the quarter. Highlighting our shared

commitment to project execution, Bruce Power announced the

successful completion of the Unit 6 MCR within budget and ahead of

schedule. Unit 6 has fully returned to service, achieving a

significant milestone in Ontario’s largest clean-energy initiative

and one of Canada’s largest infrastructure projects.

2023 outlook and dividend

declarationReflecting strong year-to-date operational and

financial performance, we now expect 2023 comparable EBITDA to be

at the upper end of the five to seven per cent outlook compared to

2022 and 2023 comparable earnings per share to be generally

consistent with 2022. Total capital expenditures for 2023 are now

expected to be approximately $12.0 billion to $12.5 billion. While

the estimated capital costs associated with our major projects

remains consistent, the increase from the range as outlined in our

2022 Annual Report is primarily related to shifts in timing for

some of our growth projects and maintenance capital expenditures in

our natural gas pipelines businesses, as well as the foreign

exchange impact of a stronger U.S. dollar. We continue to work on

cost mitigation strategies and assess developments in our

construction projects and market conditions for changes to our

overall capital program. To date, we have placed approximately $5

billion of assets into service on budget, further supporting

comparable EBITDA growth. Beyond 2024, we remain committed to

limiting annual sanctioned net capital expenditures to $6 billion

to $7 billion. At this level, we believe we can continue to grow

our business at a commensurate rate with our dividend growth

outlook of three to five per cent, while also providing the

optionality to further reduce leverage and/or return incremental

capital to shareholders. TC Energy’s Board of Directors declared a

quarterly dividend of $0.93 per common share for the quarter ending

December 31, 2023, equating to $3.72 on an annualized basis.

Executing on commitment of enhanced

governanceOn November 8, TC Energy announced on behalf of

its Board of Directors that John E. Lowe will be appointed as Chair

of the Board, effective January 1, 2024. Delivering on his

commitment to align with TC Energy’s revised governance guidelines

regarding board commitments as outlined in the 2023 Management

Information Circular, Siim A. Vanaselja has announced he will be

stepping down as Board Chair effective December 31, 2023. Mr.

Vanaselja joined the Board of Directors in 2014 and was appointed

as Board Chair in 2017. He will continue to serve as a valued

member of the Board to ensure an orderly succession and allow TC

Energy the continued benefit of his expertise. Mr. Lowe has been a

member of TC Energy’s Board of Directors since 2015 and currently

serves as Chair of the Governance committee, a member of the

Health, Safety, Sustainability and Environment committee, and has

previously served as Chair of the Audit committee. Mr. Lowe’s

extensive governance experience is paired with over 25 years of

various executive and management positions within the midstream and

energy industry.

Progressing our proposed Liquids Pipelines

spinoffWe have already achieved significant milestones in

the few short months following our July 27 announcement to spin off

our Liquids Pipelines business to create two independent,

investment-grade, publicly listed companies. First, we announced

that Hal Kvisle has agreed to be appointed as Chair of South Bow

Corporation Board of Directors. Hal has extensive industry

experience and intimate knowledge of TC Energy’s highly competitive

North American liquids system. Second, we remain on track with all

major separation activities to successfully execute the transaction

during the second half of 2024, including required regulatory and

tax status applications. And third, we are excited to announce

South Bow Corporation as the name of the new Liquids Pipeline

Company. This name symbolizes the historical roots of the company

in Alberta, Canada, while acknowledging the pipeline system's

strategic corridor, which enables the company to deliver a premium

service to the strongest U.S. demand markets. This

symbolism—grounded in history and pointing towards our future—is

reflective of the new company's vision, which is rooted in safety

and operational excellence and guided by a team dedicated to

providing highly competitive service to our customers and

ultimately, North America.

The series of announcements TC Energy has made in

recent months are complementary efforts. When taken together,

spinning off the Liquids Pipelines business, integrating our

natural gas businesses and advancing deleveraging targets through

asset sales, all directly serve our long-term strategy and

commitment to maximizing the value of our assets. As we look

forward, we are aligning our portfolio mix and strategy to protect

and enhance the value of our strategic corridors to deliver long

term enduring shareholder value.

Teleconference and WebcastWe will

hold a teleconference and webcast on Wednesday, November 8,

2023 at 6:30 a.m. (MST) / 8:30 a.m. (EST) to discuss our third

quarter 2023 financial results and company developments. Presenters

will include François Poirier, President and Chief Executive

Officer; Joel Hunter, Executive Vice-President and Chief Financial

Officer; and other members of the executive leadership team.

Members of the investment community and other

interested parties are invited to participate by calling

1.800.319.4610. No passcode is required. Please

dial in 15 minutes prior to the start of the call. Alternatively,

participants may pre-register for the call here. Upon registering,

you will receive a calendar booking by email with dial in details

and a unique PIN. This process will bypass the operator and avoid

the queue. Registration will remain open until the end of the

conference call.

A live webcast of the teleconference will be

available on TC Energy's website at www.TCEnergy.com/events or

via the following URL: https://www.gowebcasting.com/12930. The

webcast will be available for the replay following the meeting.

A replay of the teleconference will be available

two hours after the conclusion of the call until midnight EST on

November 15, 2023. Please call 1.855.669.9658 and enter passcode

0502.

The unaudited interim Condensed

consolidated financial statements and Management’s Discussion and

Analysis (MD&A) are available on our website at

www.TCEnergy.com and will be filed

today under TC Energy's profile on SEDAR+ at

www.sedarplus.ca and with the U.S.

Securities and Exchange Commission on EDGAR at

www.sec.gov.

About TC EnergyWe’re a team of

7,000+ energy problem solvers working to move, generate and store

the energy North America relies on. Today, we’re taking action to

make that energy more sustainable and more secure. We’re innovating

and modernizing to reduce emissions from our business. And, we’re

delivering new energy solutions – from natural gas and renewables

to carbon capture and hydrogen – to help other businesses and

industries decarbonize too. Along the way, we invest in communities

and partner with our neighbours, customers and governments to build

the energy system of the future.

TC Energy's common shares trade on the Toronto

(TSX) and New York (NYSE) stock exchanges under the symbol TRP. To

learn more, visit us at www.TCEnergy.com

Forward-Looking InformationThis

release contains certain information that is forward-looking and is

subject to important risks and uncertainties and is based on

certain key assumptions. Forward-looking statements are usually

accompanied by words such as "anticipate", "expect", "believe",

"may", "will", "should", "estimate" or other similar words.

Forward-looking statements in this document may include, but are

not limited to, statements on the progress of Coastal GasLink,

Southeast Gateway and GTN XPress projects, including mechanical

completion, offshore installations and in-service dates, our

projected comparable EBITDA and debt-to-EBITDA leverage metrics for

2023 and 2024, our targeted leverage metrics, and our expected

capital expenditures and dividend outlook and the proposed Liquids

Pipelines spinoff, including the structure, conditions, timing and

tax effect thereof. Our forward-looking information is subject to

important risks and uncertainties and is based on certain key

assumptions. Forward-looking statements in this document are

intended to provide TC Energy security holders and potential

investors with information regarding TC Energy and its

subsidiaries, including management's assessment of TC Energy's and

its subsidiaries' future plans and financial outlook. All

forward-looking statements reflect TC Energy's beliefs and

assumptions based on information available at the time the

statements were made and as such are not guarantees of future

performance. As actual results could vary significantly from the

forward-looking information, you should not put undue reliance on

forward-looking information and should not use future-oriented

information or financial outlooks for anything other than their

intended purpose. We do not update our forward-looking information

due to new information or future events, unless we are required to

by law. For additional information on the assumptions made, and the

risks and uncertainties which could cause actual results to differ

from the anticipated results, refer to the most recent Quarterly

Report to Shareholders and the 2022 Annual Report filed under TC

Energy's profile on SEDAR+ at

www.sedarplus.ca and with the U.S. Securities

and Exchange Commission at www.sec.gov and

the "Forward-looking information" section of our Report on

Sustainability and our GHG Emissions Reduction Plan which are

available on our website at www.TCEnergy.com.

Non-GAAP MeasuresThis release

contains references to the following non-GAAP measures: comparable

EBITDA, comparable earnings, comparable earnings per common share

and comparable funds generated from operations. It also contains

references to debt-to-EBITDA, a non-GAAP ratio, which is calculated

using adjusted debt and adjusted comparable EBITDA, each of which

are non-GAAP measures. These non-GAAP measures do not have any

standardized meaning as prescribed by GAAP and therefore may not be

comparable to similar measures presented by other entities. These

non-GAAP measures are calculated by adjusting certain GAAP measures

for specific items we believe are significant but not reflective of

our underlying operations in the period. These comparable measures

are calculated on a consistent basis from period to period and are

adjusted for specific items in each period, as applicable except as

otherwise described in the Condensed consolidated financial

statements and MD&A. Refer to: (i) each business segment for a

reconciliation of comparable EBITDA to segmented earnings (losses);

(ii) Consolidated results section for reconciliations of comparable

earnings and comparable earnings per common share to Net income

attributable to common shares and Net income per common share,

respectively; and (iii) Financial condition section for a

reconciliation of comparable funds generated from operations to Net

cash provided by operations. Refer to the Non-GAAP Measures section

of the MD&A in our most recent quarterly report for more

information about the non-GAAP measures we use, the MD&A is

included in this release. The MD&A can be found on SEDAR+ at

www.sedarplus.ca under TC Energy's

profile.

With respect to non-GAAP measures used in the

calculation of debt-to-EBITDA, adjusted debt is defined as the sum

of Reported Total debt, including Notes payable, Long-term debt,

Current portion of long-term debt and Junior subordinated notes, as

reported on our Consolidated balance sheet as well as Operating

lease liabilities recognized on our Consolidated balance sheet and

50 per cent of Preferred shares as reported on our Consolidated

balance sheet due to the debt-like nature of their contractual and

financial obligations, less Cash and cash equivalents as reported

on our Consolidated balance sheet and 50 per cent of Junior

subordinated notes as reported on our Consolidated balance sheet

due to the equity-like nature of their contractual and financial

obligations. Adjusted comparable EBITDA is calculated as comparable

EBITDA excluding operating lease costs recorded in Plant operating

costs and other in our Consolidated statement of income and

adjusted for Distributions received in excess of (income) loss from

equity investments as reported in our Consolidated statement of

cash flows which is more reflective of the cash flows available to

TC Energy to service our debt and other long-term commitments. We

believe that debt-to-EBITDA provides investors with useful

information as it reflects our ability to service our debt and

other long-term commitments. See the Reconciliation section for

reconciliations of adjusted debt and adjusted comparable EBITDA for

the years ended December 31, 2021 and 2022.

ReconciliationThe following is a

reconciliation of adjusted debt and adjusted comparable

EBITDAi.

|

|

|

year ended December 31 |

|

(millions of Canadian $) |

|

2022 |

|

|

2021 |

|

|

|

|

|

|

|

| Reported total

debt |

|

58,300 |

|

|

52,766 |

|

| Management adjustments: |

|

|

|

|

| Debt treatment of preferred

sharesii |

|

1,250 |

|

|

1,744 |

|

| Equity treatment of junior

subordinated notesiii |

|

(5,248 |

) |

|

(4,470 |

) |

| Cash and cash equivalents |

|

(620 |

) |

|

(673 |

) |

|

Operating lease liabilities |

|

433 |

|

|

429 |

|

|

Adjusted debt |

|

54,115 |

|

|

49,796 |

|

|

|

|

|

|

|

| Comparable EBITDAiv |

|

9,901 |

|

|

9,368 |

|

| Operating lease cost |

|

106 |

|

|

105 |

|

|

Distributions received in excess of (income) loss from equity

investments |

|

(29 |

) |

|

77 |

|

|

Adjusted Comparable EBITDA |

|

9,978 |

|

|

9,550 |

|

|

|

|

|

|

|

|

Adjusted Debt/Adjusted Comparable EBITDAi |

|

5.4 |

|

|

5.2 |

|

i Comparable EBITDA is a non-GAAP measure.

Management methodology. Individual rating agency calculations will

differ.ii 50 per cent debt treatment on $2.5 billion of preferred

shares as of December 31, 2022.iii 50 per cent equity treatment on

$10.5 billion of junior subordinated notes as of December 31, 2022.

U.S. dollar-denominated notes translated at December 31, 2022,

U.S./Canada foreign exchange rate of 1.35.iv Comparable EBITDA is a

non-GAAP financial measure. See the Forward-looking information and

Non-GAAP measures sections for more information.

Media Inquiries:Media

Relationsmedia@tcenergy.com 403.920.7859 or 800.608.7859

Investor & Analyst

Inquiries: Gavin

Wylie / Hunter Mau

investor_relations@tcenergy.com 403.920.7911 or

800.361.6522

Download full report here:

https://www.tcenergy.com/siteassets/pdfs/investors/reports-and-filings/annual-and-quarterly-reports/2023/tc-2023-q3-quarterly-report.pdf

1 Comparable EBITDA is a non-GAAP measure used

throughout this news release. This measure does not have any

standardized meaning under GAAP and therefore is unlikely to be

comparable to similar measures presented by other companies. The

most directly comparable GAAP measure is Segmented earnings. For

more information on non-GAAP measures, refer to the Non-GAAP

Measures section of this news release.

2 Comparable earnings and comparable earnings per

common share are non-GAAP measures used throughout this news

release. These measures do not have any standardized meaning under

GAAP and therefore are unlikely to be comparable to similar

measures presented by other companies. The most directly comparable

GAAP measures are Net income attributable to common shares and Net

income per common share, respectively. For more information on

non-GAAP measures, refer to the Non-GAAP Measures section of this

news release.

3 Debt-to-EBITDA is a non-GAAP ratio. Adjusted debt

and adjusted comparable EBITDA are non-GAAP measures used to

calculate debt-to-EBITDA. See the Forward-looking information,

Non-GAAP measures and Reconciliation sections for more

information.

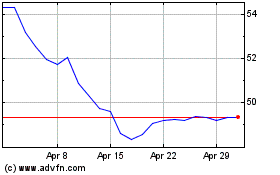

TC Energy (TSX:TRP)

Historical Stock Chart

From Nov 2024 to Dec 2024

TC Energy (TSX:TRP)

Historical Stock Chart

From Dec 2023 to Dec 2024