Titan Mining Corporation (TSX: TI, OTCQB: TIMCF)

(“

Titan” or the "

Company")

announces the results for the quarter ended September 30, 2024.

(All amounts are in U.S. dollars unless otherwise stated)

Don Taylor, Chief Executive Officer of Titan,

commented, “Despite the setback caused by Tropical Storm Debby,

management and staff at the mine were able to make full repairs and

stockpile ore during the recovery period while the crusher repairs

were being completed. As a result, Titan reiterates its full year

production guidance and fully expects Q4 cash costs to offset the

higher costs reflected in Q3. Additionally, in Q4,

Titan expects to release an updated Life of Mine Plan for its zinc

operations and a maiden resource estimate for its Kilbourne

graphite project.”

Q3 2024 HIGHLIGHTS:

-

Appointment of Rita Adiani as President of the Company

-

Zero Lost Time Injuries in the third quarter.

- Returned to full commercial

production on September 26, 2024 following the temporary suspension

of operations resulting from the historic flooding caused from

Tropical Storm Debby. There were no injuries to employees or damage

to the mobile fleet. Repairs were completed ahead of schedule and

under budget.

TABLE 1 Financial and Operating Highlights

| |

|

Q3 2024 |

Q2 2024 |

Q1 2024 |

Q4 2023 |

Q3 2023 |

|

Operating |

|

|

|

|

|

|

| Payable

Zinc Produced |

mlbs |

8.0 |

|

14.5 |

14.7 |

|

13.9 |

|

18.3 |

| Payable

Zinc Sold |

mlbs |

8.2 |

|

14.7 |

14.4 |

|

13.9 |

|

18.3 |

| Average Realized Zinc

Price |

$/lb |

1.27 |

|

1.30 |

1.11 |

|

1.13 |

|

1.10 |

|

Financial |

|

|

|

|

|

|

|

Revenue |

$m |

8.27 |

|

17.97 |

11.73 |

|

10.91 |

|

15.50 |

| Net

Income (loss) before tax |

$m |

(4.86 |

) |

2.62 |

(2.63 |

) |

(6.96 |

) |

0.50 |

|

Earnings (loss) per share - basic |

$/sh |

(0.04 |

) |

0.02 |

(0.02 |

) |

(0.05 |

) |

0.00 |

| Cash Flow from Operating

Activities before changes in non-cash working capital |

$m |

(1.68 |

) |

6.97 |

0.26 |

|

(1.36 |

) |

4.21 |

| Cash

and Cash Equivalents |

$m |

5.84 |

|

5.55 |

4.18 |

|

5.03 |

|

4.32 |

| Net Debt 1 |

$m |

30.78 |

|

30.63 |

32.44 |

|

30.75 |

|

32.93 |

1Net Debt is a non-GAAP measure. This term is

not a standardized financial measure under IFRS and might not be

comparable to similar financial measures disclosed by other

issuers. See Non-GAAP Performance Measures below for additional

information.

As a result of Tropical Storm Debby, revenues

were lower during the three and nine months ended September 30,

2024, largely due to the temporary suspension of operations at ESM

during the period from August 12, 2024 to September 26, 2024.

Additionally, AISC increased to $1.35 in Q3 2024 from $0.79/lb in

Q2 2024, primarily due to lower concentrate deliveries during

August and September.

OPERATIONS REVIEW

Mining in the third quarter of 2024 focused on

the Mahler, New Fold, and Mud Pond zones. Mining activities remain

suspended in the N2D zone while the Company reviews opportunities

to restart production in this area. Deepening of the Lower Mahler

ramp system provided access to higher-grade ore in the Lower Mahler

mining zone that supported higher than budgeted grades. Longhole

stope mining in New Fold provided above-target grades and tons. Ore

recovery from the longhole stoping in New Fold will continue into

the fourth quarter. It is expected that ore from New Fold and Lower

Mahler zones will continue to support budgeted head grades for the

remainder of the fiscal year. Mining will continue in these key

zones during the fourth quarter of 2024.

While crushing and hoisting activities were

halted from August 12, 2024 to September 26, 2024, mining

activities continued and ore was stockpiled in the underground. The

Company expects to hoist and mill budgeted tonnage in Q4 plus all

underground ore that was stockpiled in Q3. With the excess capacity

in the mill, the Company expects to meet full year guidance.

Work on projects focused mainly on the

rehabilitation of the underground crusher and associated electrical

components that were damaged during the flooding caused by Tropical

Storm Debby. In addition, a previously unknown raise at the old

Streeter Portal at the #2 mine area, which is suspected to have

been a major contributor to the inflow, was permanently plugged to

prevent any future inflow. Rod mill liners were installed in the

third quarter of 2024. In the fourth quarter of 2024, the Company

plans to initiate a market search for a replacement underground

haulage truck and a mechanical bolter.

EXPLORATION UPDATE

Kilbourne:

Titan has continued work on defining the

Kilbourne graphite target, a graphite exploration target hosted

within the same stratigraphic sequence as ESM’s zinc

mineralization. The host unit is Unit 2 of the lower marbles.

Historic mapping and drilling have documented roughly 25,000 ft

(7.6 km) of strike length, from surface to a depth of over 3,000 ft

(914 m). Roughly 8,500 ft (2.5 km) of this strike length is within

the affected area of the Empire State Mine. The remaining strike

length is securely within mineral rights held by Titan. Permitting

for bringing Kilbourne into production is subject to a state level

permitting process.

Phase I of drilling at Kilbourne was completed

in the second quarter of 2024 and totalled 11,916 ft (3,362 m).

Drilling indicates that host lithology can be divided into two

zones of mineralization. The upper mineralized zone with an average

thickness of 57 ft (17.4 m) and an average grade of 3.1% graphitic

carbon (Cg) and the lower mineralized zone with an average

thickness of 29 ft (8.8 m) and an average grade of 2.8% Cg. Phase I

of Kilbourne drilling successfully tested 8,255 ft of strike length

within the ESM active use permit.

Phase II of the metallurgical testing performed

by Forte Analytical of Wheatridge Colorado was completed in the

third quarter. The Company is awaiting assay results from these

tests. The Company has additionally sought the services of Metpro

Services to help in developing the next stages of metallurgical and

process testing. Phase III of metallurgy will take place at SGS

Lakefield and is likely to be completed by Q4 2024.

Qualified Person

The scientific and technical information

contained in this news release and the sampling, analytical and

test data underlying the scientific and technical information has

been reviewed, verified and approved by Donald R. Taylor, MSc., PG,

Chief Executive Officer of the Company, a qualified person for the

purposes of NI 43-101. Mr. Taylor has more than 25 years of mineral

exploration and mining experience and is a Registered Professional

Geologist through the SME (registered member #4029597). The data

was verified using data validation and quality assurance procedures

under high industry standards.

Assays and Quality Assurance/Quality

Control

To ensure reliable sample results, the Company

has a rigorous QA/QC program in place that monitors the

chain-of-custody of samples and includes the insertion of blanks

and certified reference standards at statistically derived

intervals within each batch of samples. Core is photographed and

split in half with one-half retained in a secured facility for

verification purposes. Drill core samples submitted for analysis

had a minimum weight of 0.6 lb (0.3 kg) and a maximum weight of 6.0

lb (2.7 kg), with an average weight of 3.6 lb (1.6 kg). Trench

samples submitted for analysis had a minimum weight of 4.2 lb (1.9

kg) and a maximum weight of 26.2 lb (11.9 kg), with an average

weight of 6.2 lb (13.6 kg).

Analysis has been performed as SGS Canada Inc.

(“SGS”) an independent ISO/IEC accredited lab. Sample preparation

(crushing and pulverizing) and total graphitic carbon analysis has

been completed at SGS Lakefield, Ontario, Canada. SGS prepares a

pulp of all samples and sends the pulps to their analytical

laboratory in Burnaby, B.C., Canada for multielement analysis. SGS

analyzes the pulp sample by leach and IR combustion for total

graphitic carbon (GC_CSA05V) and aqua regia digestion (GE-ICP21B20

for 34 elements) with an ICP – OES finish including Cu (copper), Pb

(lead), and Zn (zinc). All samples in which Cu (copper), Pb (lead),

or Zn (zinc) are greater than 10,000 ppm are re-run using aqua

regia digestion (GO_ICP21B100) with the elements reported in

percentage (%).

The Company has not identified any drilling,

sampling, recovery, or other factors that could materially affect

the accuracy or reliability of the data set out in this news

release. True widths of the mineralized zones described in this

news release are not presently known.

Non-GAAP Performance

Measures

This document includes non-GAAP performance

measures, discussed below, that do not have a standardized meaning

prescribed by IFRS. The performance measures may not be comparable

to similar measures reported by other issuers. The Company believes

that these performance measures are commonly used by certain

investors, in conjunction with conventional GAAP measures, to

enhance their understanding of the Company's performance. The

Company uses these performance measures extensively in internal

decision-making processes, including to assess how well the Empire

State Mine is performing and to assist in the assessment of the

overall efficiency and effectiveness of the mine site management

team. The tables below provide a reconciliation of these non-GAAP

measures to the most directly comparable IFRS measures as contained

within the Company's issued financial statements.

C1 cash cost per payable pound

sold

C1 cash cost is a non-GAAP measure. C1 cash cost

represents the cash cost incurred at each processing stage, from

mining through to recoverable metal delivered to customers,

including mine site operating and general and administrative costs,

freight, treatment and refining charges.

The C1 cash cost per payable pound sold is

calculated by dividing the total C1 cash costs by payable pounds of

metal sold.

All-In Sustaining Cost

(AISC)

AISC measures the estimated cash costs to

produce a pound of payable zinc plus the estimated capital

sustaining costs to maintain the mine and mill. This measure

includes the C1 cash cost and capital sustaining costs divided by

pounds of payable zinc sold. AISC does not include depreciation,

depletion, amortization, reclamation and exploration expenses.

|

|

Three months ended September 30, |

Nine months ended September 30, |

|

|

2024 |

2023 |

2024 |

2023 |

|

C1 cash cost per payable pound |

|

Total |

|

Per pound |

|

Total |

|

Per pound |

|

Total |

|

Per pound |

|

Total |

|

Per pound |

|

Pounds of payable zinc sold (millions) |

|

|

|

8.2 |

|

|

|

18.3 |

|

|

|

37.3 |

|

|

|

48.2 |

| Operating expenses and selling

costs |

$ |

9,206 |

$ |

1.12 |

$ |

9,761 |

$ |

0.53 |

$ |

29,121 |

$ |

0.78 |

$ |

34,991 |

$ |

0.72 |

| Concentrate smelting and

refining costs |

|

1,664 |

|

0.20 |

|

5,673 |

|

0.31 |

|

7,245 |

|

0.19 |

|

14,307 |

|

0.30 |

|

Total C1 cash cost |

$ |

10,871 |

$ |

1.32 |

$ |

15,434 |

$ |

0.84 |

$ |

36,366 |

$ |

0.97 |

$ |

49,298 |

$ |

1.02 |

|

Sustaining Capital Expenditures |

$ |

266 |

$ |

0.03 |

$ |

425 |

$ |

0.02 |

$ |

705 |

$ |

0.02 |

$ |

1,944 |

$ |

0.04 |

|

AISC |

$ |

11,137 |

$ |

1.35 |

$ |

15,859 |

$ |

0.86 |

$ |

37,071 |

$ |

0.99 |

$ |

51,242 |

$ |

1.06 |

Sustaining capital

expenditures

Sustaining capital expenditures are defined as

those expenditures which do not increase payable mineral production

at a mine site and excludes all expenditures at the Company’s

projects and certain expenditures at the Company’s operating sites

which are deemed expansionary in nature. Expansionary capital

expenditures are expenditures that are deemed expansionary in

nature. The following table reconciles sustaining capital

expenditures and expansionary capital expenditures to the Company’s

additions to mineral, properties, plant and equipment (or total

capital expenditures):

|

Nine months ended September 30, |

|

|

|

|

2024 |

|

2023 |

|

Sustaining capital expenditures |

|

$ |

705 |

$ |

1,944 |

|

Expansionary capital expenditures |

|

|

557 |

|

588 |

|

Additions to mineral, properties, plant and equipment |

|

$ |

1,262 |

$ |

2,532 |

Net Debt

Net debt is calculated as the sum of the current

and non-current portions of long-term debt, net of the cash and

cash equivalent balance as at the balance sheet date. A

reconciliation of net debt is provided below.

| |

As of September 30, |

|

As of December 31, |

|

|

|

|

2024 |

|

|

2023 |

|

|

Current portion of debt |

$ |

36,623 |

|

$ |

35,779 |

|

|

Non-current portion of debt |

|

- |

|

|

- |

|

|

Total debt |

$ |

36,623 |

|

$ |

35,779 |

|

| Less:

Cash and cash equivalents |

|

(5,844 |

) |

|

(5,031 |

) |

|

Net debt |

$ |

30,779 |

|

$ |

30,748 |

|

About Titan Mining

Corporation

Titan is an Augusta Group company which produces

zinc concentrate at its 100%-owned Empire State Mine located in New

York state. The Company is focused on value creation and operating

excellence, with a strong commitment to developing critical mineral

assets that enhance the security of the U.S. supply chain. For more

information on the Company, please visit our website

at www.titanminingcorp.com.

Contact

For further information, please contact: Investor

Relations: Email: info@titanminingcorp.com

Cautionary Note Regarding

Forward-Looking Information

Certain statements and information contained in

this new release constitute "forward-looking statements", and

"forward-looking information" within the meaning of applicable

securities laws (collectively, "forward-looking statements"). These

statements appear in a number of places in this news release and

include statements regarding our intent, or the beliefs or current

expectations of our officers and directors, including that in Q4,

Titan expects to release an updated Life of Mine Plan for its zinc

operations and a maiden resource estimate for Titan’s Kilbourne

graphite project; ore recovery from the longhole stoping in New

Fold will continue into the fourth quarter; it is

expected that ore from New Fold and Lower Mahler zones will

continue to support budgeted head grades for the remainder of the

fiscal year; mining will continue in these key zones during the

fourth quarter of 2024; the Company expects to hoist and mill

budgeted tonnage in Q4 plus all underground ore that was stockpiled

in Q3; With the excess capacity in the mill, the Company expects to

meet full year guidance; in the fourth quarter of 2024, the Company

plans to initiate a market search for a replacement underground

haulage truck and a mechanical bolter; any permitting for bringing

Kilbourne into production is likely to be subject to a streamlined

permitting process at state level; phase III of metallurgy will

take place at SGS Lakefield and is likely to be completed by Q4

2024. When used in this news release words such as “to be”, "will",

"planned", "expected", "potential", and similar expressions are

intended to identify these forward-looking statements. Although the

Company believes that the expectations reflected in such

forward-looking statements and/or information are reasonable, undue

reliance should not be placed on forward-looking statements since

the Company can give no assurance that such expectations will prove

to be correct. These statements involve known and unknown risks,

uncertainties and other factors that may cause actual results or

events to vary materially from those anticipated in such

forward-looking statements, including the risks, uncertainties and

other factors identified in the Company's periodic filings with

Canadian securities regulators. Such forward-looking statements are

based on various assumptions, including assumptions made with

regard to the ability to advance exploration efforts at ESM; the

results of such exploration efforts; the ability to secure adequate

financing (as needed); the permitting process for Kilbourne; the

Company maintaining its current strategy and objectives; and the

Company’s ability to achieve its growth objectives. While the

Company considers these assumptions to be reasonable, based on

information currently available, they may prove to be incorrect.

Except as required by applicable law, we assume no obligation to

update or to publicly announce the results of any change to any

forward-looking statement contained herein to reflect actual

results, future events or developments, changes in assumptions or

changes in other factors affecting the forward-looking statements.

If we update any one or more forward-looking statements, no

inference should be drawn that we will make additional updates with

respect to those or other forward-looking statements. You should

not place undue importance on forward-looking statements and should

not rely upon these statements as of any other date. All

forward-looking statements contained in this news release are

expressly qualified in their entirety by this cautionary

statement.

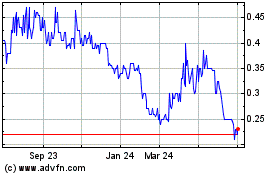

Titan Mining (TSX:TI)

Historical Stock Chart

From Nov 2024 to Dec 2024

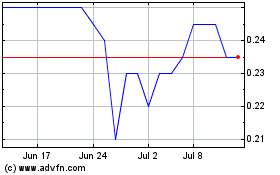

Titan Mining (TSX:TI)

Historical Stock Chart

From Dec 2023 to Dec 2024