TeraGo Reports First Quarter 2014 Results; Solid First Step in

Transition Year

- Immediate Improvements in Churn and Customer Additions

- Signs Commitment Letter for Credit Facilities of Up to $50

million

- Data Center Operations Expanding

TORONTO, ONTARIO--(Marketwired - May 7, 2014) - TeraGo Inc.

(TSX:TGO) (www.terago.ca) today announced financial and operating

results for the quarter ended March 31, 2014.

Stewart Lyons, President and CEO, TeraGo Inc., commented,

"TeraGo made a solid start to what is planned to be a transitional

and transformational year. We further expanded our data center

capability and now operate three facilities, including a new Data

Center in downtown Vancouver where we are now up to 14,000 square

feet of space. In our access business, we moved decisively to

implement enhanced customer retention programs that generated a

marked improvement in churn and customer additions, with some

expected decrease in ARPU."

Mr. Lyons concluded, "TeraGo's objective remains to transform

our leadership in broadband services into a multi-product IT

services company, controlling more of the value chain to serve the

growing business need for data center and cloud services, and

enhance the loyalty of our unique base of small and medium

businesses across Canada. With the progress made in Q1, we are

well-positioned for Q2 and are moving onto our next steps in in

rolling out our strategy. In short, we are focused on achieving

growth in data centers; establishing a presence in cloud services,

and creating stability in access services to drive improved returns

on assets for our shareholders."

First Quarter 2014 Financial and Operational Highlights

- Total revenue for the three months ended March 31, 2014 was

$12.9 million compared to $12.6 million for the same period in

2013, an increase of 2.4%;

- Gross profit margin for the three months ended March 31, 2014

was 77.7% compared to 78.0% for the same period in 2013;

- Adjusted EBITDA for the three months ended March 31, 2014 was

$3.8 million compared to $4.3 million for the same period in 2013,

a decrease of 12%. The adjusted EBITDA decrease was due to a

decrease in access revenue and selective investments in sales and

marketing;

- Net loss for the three months ended March 31, 2014 was $1.1

million compared to net earnings of $1.3 million for the same

period in 2013, a decrease of 182%;

- For the three months ended March 31, 2014, basic and diluted

loss per share were $(0.10) compared to basic and diluted earnings

per share of $0.12 and $0.11, respectively, for the same period in

2013;

- Ended the period with $1.0 million of cash, cash equivalents

and short-term investments;

- As at March 31, 2014, $19.0 million of the Company's $41.8

million credit facilities remains undrawn and available for future

use;

- Average monthly churn rate for the three months ended March 31,

2014 was 1.01% for access customer locations compared to 1.50% for

the three months ended December 31, 2013 and 1.21% for the same

period in 2013 which is a result of the enhanced retention programs

now in place;

- Net access customer locations increased by 22 in the first

quarter 2014 ending the period with 6,475 net access customer

locations in service compared to 80 net access customers locations

lost in the fourth quarter of 2013 and 12 net access customer

locations lost in the same period in 2013. This increase results

from management's continued focus on retention initiatives and

offerings, customer service, the needs of small and medium-sized

businesses ("SMB") and renewed sales activity with competitive

product offerings;

- Average revenue per access customer location ("ARPU") for the

three months ended March 31, 2014 was $615 compared to $624 for the

same period in 2013. This is primarily the result of the retention

program launched by the Company for customers coming to the end of

contract term by offering them lower pricing in exchange for

long-term contract renewals as well as the impact of competitive

pricing on both customer renewals and new sales.

First Quarter 2014 Key Developments

- The Company announced that its Board of Directors has appointed

Stewart Lyons as President and CEO of the company and a member of

the Board of Directors effective January 16, 2014 and appointed Joe

Prodan as Chief Financial Officer of the company effective February

4, 2014.

- The Company has received notice that a new wireless entrant

customer will be disconnecting their services during 2014.

- The Company announced that it has established a fibre-optic

core network in Western Canada through the acquisition of newly

constructed fibre facilities in downtown Vancouver, British

Columbia ("BC"). These fibre facilities connect the Company's

Vancouver data center facility, as well as twelve high customer

density buildings in downtown Vancouver. This will ensure secure

broadband connectivity between customer locations and the data

center. In January 2014, the Company drew down $0.6 million from

its term debt facility with the Royal Bank of Canada ("RBC") to

finance this. This facility bears interest at the rate of

4.17%.

Events subsequent to March 31, 2014

- To strengthen the Company's balance sheet and provide

flexibility to pursue additional opportunities, the Company signed

a commitment letter with National Bank of Canada and RBC for Credit

Facilities totaling $50.0 million, consisting of a $5.0 million

revolving operating credit facility, a $20.0 million non-revolving

term credit facility to refinance the existing credit facility and

a $25.0 million non-revolving acquisitions and capital expenditure

facility (collectively, the "Credit Facilities"). The Credit

Facilities would replace TeraGo's existing facility and are

expected to close prior to May 31, 2014.

- In April 2014, the Company announced that it has continued to

expand its data center business in Western Canada through the

acquisition of an additional 7,000 square foot data center facility

in downtown Vancouver, BC, bringing the total amount of its data

center capacity in downtown Vancouver to 14,000 square feet.

- For the third consecutive year, the Company has earned a place

in the top 100 among Canada's top technology companies on the

Branham 300 list.

Key Financial & Operational Highlights

(All financial results are in thousands of dollars, except gross

profit margin, earnings per share and operating metrics)

|

|

Three months ended March 31 |

|

|

|

2014 |

|

2013 |

|

|

|

(unaudited) |

|

(unaudited) |

|

|

Financial |

|

|

|

|

|

Revenue |

$ |

12,874 |

|

$ |

12,570 |

|

| Cost

of Services |

$ |

2,874 |

|

$ |

2,770 |

|

| Gross

profit margin |

|

77.7 |

% |

|

78.0 |

% |

|

EBITDA* |

$ |

3,291 |

|

$ |

4,333 |

|

|

Adjusted EBITDA* |

$ |

3,802 |

|

$ |

4,333 |

|

|

Earnings (loss) from operations |

$ |

(760 |

) |

$ |

1,539 |

|

| Net

earnings (loss) |

$ |

(1,093 |

) |

$ |

1,340 |

|

| Basic

earnings (loss) per share |

$ |

(0.10 |

) |

$ |

0.12 |

|

|

Diluted earnings (loss) per share |

$ |

(0.10 |

) |

$ |

0.11 |

|

|

|

|

|

|

|

|

|

Operating |

|

|

|

|

|

|

| Churn

rate* |

|

1.01 |

% |

|

1.21 |

% |

|

Customer locations in service |

|

6,475 |

|

|

6,563 |

|

|

ARPU* |

$ |

615 |

|

$ |

624 |

|

|

Number of employees |

|

190 |

|

|

187 |

|

|

|

|

|

|

|

|

| *See Key Performance Indicators, Additional GAAP and

Non-GAAP Measures below |

The table below reconciles net earnings to EBITDA and Adjusted

EBITDA for the three months ended March 31, 2014 and 2013.

|

Three months ended March 31 |

|

|

2014 |

|

2013 |

|

|

(unaudited) |

|

(unaudited) |

|

| Net earnings (loss) for the period |

$ |

(1,093 |

) |

$ |

1,340 |

|

| Foreign exchange (gain) |

|

33 |

|

|

19 |

|

| Finance costs |

|

319 |

|

|

188 |

|

| Finance income |

|

(19 |

) |

|

(8 |

) |

| Earnings (loss) from operations |

|

(760 |

) |

|

1,539 |

|

| Add: |

|

|

|

|

|

|

|

Depreciation of networks assets, property and equipment and

amortization of intangible assets |

|

3,288 |

|

|

2,846 |

|

|

Loss

(gain) on disposal of network assets |

|

12 |

|

|

(39 |

) |

|

Stock-based compensation expense (recovery) |

|

751 |

|

|

(13 |

) |

| EBITDA |

$ |

3,291 |

|

|

4,333 |

|

| Restructuring, acquisition-related and integration

costs |

|

511 |

|

|

- |

|

| Adjusted EBITDA |

$ |

3,802 |

|

$ |

4,333 |

|

First Quarter 2014 Results of Operations

The Company's cash flow and earnings are typically impacted in

the first quarter of the year due to several annual agreements

requiring payments in the first quarter including annual spectrum

payments, annual rate increases in long-term contracts and the

restart on January 1st of payroll taxes and other levies related to

employee compensation.

Revenue

Total revenue increased 2.4% to $12.9 million for the three

months ended March 31, 2014 compared to $12.6 million for the same

period in 2013.

Service revenue increased by 3.4% to $12.7 million for the three

months ended March 31, 2014 compared to $12.3 million for the same

period in 2013. The increase in service revenue was driven

primarily by revenue from the data center partially offset by a

reduction in access revenue. Revenue from the data center was $0.8

million for the three months ended March 31, 2014.

Installation revenue was $0.2 million for the three months ended

March 31, 2014 compared to $0.3 million for the same period in

2013.

Customer locations

Total customer locations in service decreased to 6,475 as at

March 31, 2014 compared to 6,563 as at March 31, 2013. Net access

customer locations increased by 22 in the first quarter 2014 ending

the period with 6,475 net access customer locations in service

compared to 80 net access customers locations lost in the fourth

quarter of 2013 and 12 net access customer locations lost in the

same period in 2013. This increase results from management's

continued focus on retention initiatives and offerings, customer

service, the needs of small and medium-sized businesses ("SMB") and

renewed sales activity with competitive product offerings.

Churn rate

The average monthly churn rate was 1.01% for the three months

ended March 31, 2014 compared to 1.21% for the same period in 2013

primarily as a result of the enhanced retention focus now in place.

Management continues to focus on retention initiatives and

offerings, customer service, the needs of small and medium-sized

businesses ("SMB") and renewed sales activity with competitive

product offerings in addition to monitoring customer

creditworthiness and churn levels.

ARPU

ARPU from access customers decreased to $615 for the three

months ended March 31, 2014 compared to $624 for the same period in

2013. The decrease in ARPU was driven primarily by lower usage

revenue in the quarter as the company offers incentives in the form

of free or discounted usage packages to increase our customer

renewal rate, the result of the retention program launched by the

Company for customers coming to the end of contract term by

offering them lower pricing in exchange for long-term contract

renewals as well as the impact of competitive pricing on new sales.

The Company believes the current retention campaign will help

long-term revenue growth by offering more complimentary services

such as data center and IT services to its existing base.

Gross margin

For the three months ended March 31, 2014, gross profit margin

was 77.7% compared to 78.0% for the same period in 2013. This

decrease is primarily due to an increase in property access

costs.

SG&A

For the three months ended March 31, 2014, SG&A expenses

increased to $6.8 million compared to $5.4 million for the same

period in 2013. The increase was primarily due to higher

stock-based compensation of $0.6 million relating to a tax

indemnity claim by a former officer, restructuring costs due to a

re-aligning of Company strategy and acquisition costs, selective

investments in sales and marketing and higher utility and

facilities expenses from the operations of the data centre. As of

March 31, 2014, the number of direct sales personnel was 32

compared to 28 as of March 31, 2013.

EBITDA and Adjusted EBITDA

Adjusted EBITDA for the three months ended March 31, 2014 was

$3.8 million compared to $4.3 million for the same period in 2013,

a decrease of 12%. EBITDA for the three months ended March 31, 2014

was $3.3 million compared to $4.3 million for the same period in

2013, a decrease of 24%. The adjusted EBITDA decrease was due to a

decrease in access revenue and selective investments in sales and

marketing as discussed above. The decrease in EBITDA also included

restructuring costs due to a re-aligning of Company strategy and

acquisition related costs related to searching for new

opportunities. This is in line with management's expectation as the

Company continued to focus on transforming into a multi-product IT

services company. Consistent with prior years, EBITDA and Adjusted

EBITDA for the quarter ended March 31, 2014 is impacted due to the

seasonal nature of certain expenses.

Deferred income taxes

The Company reviewed and updated the assumptions and projections

regarding future profitability as at March 31, 2014. Based on

management's analysis, no additional deferred income tax assets

resulting from temporary tax differences were recognized in the

three months ended March 31, 2014.

Net earnings (loss)

For the three months ended March 31, 2014, net loss was $1.1

million compared to net earnings of $1.3 million for the same

period in 2013. The changes are due to the items noted above.

Capital resources

As at March 31, 2014, the Company had cash and cash equivalents

and short-term investments of $1.0 million and access to the $19.0

million undrawn portion of its $41.8 million credit facilities.

The Company anticipates incurring additional capital

expenditures for the purchase and installation of network assets

and customer premise equipment. As economic conditions warrant, the

Company may expand its network coverage into new Canadian markets

using wireless or fibre optics and making additional investments in

data centers and other IT services through acquisitions or

expansion.

Management believes the Company's current cash, short-term

investments, anticipated cash from operations, access to the

undrawn portion of debt facilities and its access to additional

financing in the form of debt or equity will be sufficient to meet

its working capital and capital expenditure requirements for the

foreseeable future.

Share Capital

As of March 31, 2014, there were 11,552,398 Common Shares and

two Class B Shares outstanding.

Conference Call and Webcast

Management will host a conference call on Thursday, May 8, 2014,

at 9:00 am EDT to discuss these results. To access the conference

call, please dial 416-340-8527 or 1-800-766-6630. The call will

also be available via webcast at www.terago.ca or

http://www.investorcalendar.com/IC/CEPage.asp?ID=172646. An

archived recording of the conference call will be available until

May 8, 2015 at midnight EDT. To listen to this recording, call

905-694-9451 or 1-800-408-3053 and enter passcode 8479162.

TeraGo's unaudited financial statements for the three months

ended March 31, 2014, and the notes thereto, and its Management

Discussion and Analysis for the same period, have been filed on

SEDAR at www.sedar.com.

Key Performance Indicators, Additional GAAP and Non-GAAP

Measures

EBITDA and Adjusted EBITDA

The term "EBITDA" refers to earnings before deducting interest,

taxes, depreciation and amortization. The Company believes that

EBITDA and Adjusted EBITDA are useful additional information to

management, the Board and investors as it provides an indication of

the operational results generated by its business activities prior

to taking into consideration how those activities are financed and

taxed and also prior to taking into consideration asset

depreciation and amortization. The Company believes that Adjusted

EBITDA is useful additional information to management, the Board

and investors as it excludes items that could affect the

comparability of our operational results and could potentially

alter the trends analysis in business performance. Excluding these

items does not imply they are non-recurring. The Company calculates

EBITDA as earnings before deducting interest, taxes, depreciation

and amortization, foreign exchange gain or loss, finance costs,

finance income, gain or loss on disposal of network assets,

property and equipment and stock-based compensation. In addition,

the Company excludes restructuring, acquisition-related and

integration costs in its calculation of Adjusted EBITDA. Investors

are cautioned that EBITDA and Adjusted EBITDA should not be

construed as an alternative to operating earnings or net earnings

determined in accordance with IFRS as an indicator of our financial

performance or as a measure of our liquidity and cash flows. EBITDA

and Adjusted EBITDA do not take into account the impact of working

capital changes, capital expenditures, debt principal reductions

and other sources and uses of cash, which are disclosed in the

consolidated statements of cash flows.

TeraGo's method of calculating EBITDA and Adjusted EBITDA may

differ from other issuers and, accordingly, EBITDA and Adjusted

EBITDA may not be comparable to similar measures presented by other

issuers. See "Results of Operations - EBITDA" for reconciliation of

net earnings (loss) to EBITDA and Adjusted EBITDA.

ARPU

The term "ARPU" refers to the Company's average revenue per

customer location. The Company believes that ARPU is useful

supplemental information as it provides an indication of our

revenue from an individual customer location on a per month basis.

ARPU is not a recognized measure under IFRS and, accordingly,

investors are cautioned that ARPU should not be construed as an

alternative to revenue determined in accordance with IFRS as an

indicator of our financial performance. The Company calculates ARPU

by dividing our service revenue by the average number of customer

locations in service during the period and we express ARPU as a

rate per month. TeraGo's method of calculating ARPU may differ from

other issuers and, accordingly, ARPU may not be comparable to

similar measures presented by other issuers.

Churn

The term "churn" or "churn rate" is a measure, expressed as a

percentage, of customer locations terminated in a particular month.

Churn represents the number of customer locations disconnected per

month as a percentage of total number of customer locations in

service during the month. The Company calculates churn by dividing

the number of customer locations disconnected during a period by

the total number of customer locations in service during the

period. Churn and churn rate are not recognized measures under IFRS

and, accordingly, investors are cautioned in using it. TeraGo's

method of calculating churn and churn rate may differ from other

issuers and, accordingly, churn may not be comparable to similar

measures presented by other issuers.

Earnings (loss) from operations

Earnings (loss) from operations exclude foreign exchange gain

(loss), income taxes, finance costs and finance income. We include

earnings (loss) from operations as an additional GAAP measure in

our consolidated statement of earnings. We consider earnings (loss)

from operations to be representative of the activities that would

normally be regarded as operating for the Company. We believe this

measure provides relevant information that can be used to assess

the consolidated performance of the Company and therefore, provides

meaningful information to investors.

Forward-Looking Statements

This press release includes certain forward-looking statements

that are made as of the date hereof and based upon current

expectations, which involve risks and uncertainties associated with

our business and the economic environment in which the business

operates. All such statements are made pursuant to the 'safe

harbour' provisions of, and are intended to be forward-looking

statements under, applicable Canadian securities laws. Any

statements contained herein that are not statements of historical

facts may be deemed to be forward-looking statements. For example,

the words anticipate, believe, plan, estimate, expect, intend,

should, may, could, objective and similar expressions are intended

to identify forward-looking statements. By their nature,

forward-looking statements require us to make assumptions and are

subject to inherent risks and uncertainties. We caution readers of

this document not to place undue reliance on our forward-looking

statements as a number of factors could cause actual future

results, conditions, actions or events to differ materially from

the targets, expectations, estimates or intentions expressed with

the forward-looking statements. When relying on forward-looking

statements to make decisions with respect to the Company, you

should carefully consider the risks set forth herein and other

uncertainties and potential events. Except as may be required by

applicable Canadian securities laws, we do not intend, and disclaim

any obligation, to update or revise any forward-looking statements

whether in words, oral or written as a result of new information,

future events or otherwise.

About TeraGo Networks

TeraGo Networks Inc. provides businesses across Canada with

carrier-grade broadband, data and voice communications services.

Colocation and disaster recovery solutions are also provided by

Data Centers Canada, a division of TeraGo Networks. The national

service provider owns and manages its IP network servicing over

6,400 customer locations in 46 major markets across Canada

including Toronto, Montreal, Calgary, Edmonton, Vancouver and

Winnipeg. TeraGo Networks is a Competitive Local Exchange Carrier

(CLEC) and is a wholly owned subsidiary of TeraGo Inc. (TSX:TGO).

More information about TeraGo is available at www.terago.ca.

TeraGo Inc.Stewart LyonsPresident and CEO 1-877-982-3688

IR@terago.caTeraGo Inc.Joe ProdanChief Financial

Officer1-877-982-3688IR@terago.caLHAJody Burfening/Carolyn

Capaccio212-838-3777ccapaccio@lhai.com

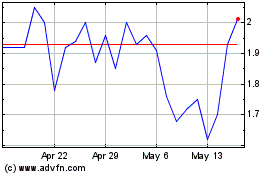

TeraGo (TSX:TGO)

Historical Stock Chart

From Jun 2024 to Jul 2024

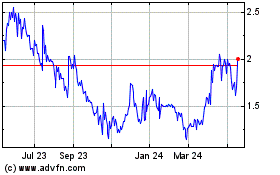

TeraGo (TSX:TGO)

Historical Stock Chart

From Jul 2023 to Jul 2024