Pieridae Energy Limited (“Pieridae” or the “Company”) (TSX:

PEA) is pleased to announce that it is offering

rights (the “

Rights Offering”) to eligible holders

of its common shares (the “

Common Shares”) of

record at the close of business on September 9, 2024 (the

“

Record Date”).

Pursuant to the Rights Offering, each holder of

Common Shares resident in a province or territory in Canada (the

“Eligible Jurisdictions”) will receive one right

(a “Right”) for each one Common Share held. Each

Right will entitle the holder to subscribe for 0.71286 of a Common

Share (the “Basic Subscription Privilege”). As a

result, holders of Common Shares may exercise 1.4028 Rights and pay

$0.2448 per share (the “Subscription Price”) to

acquire one Common Share. The Subscription Price represents a

discount of 25% to the 5-day volume weighted average trading price

of the Common Shares on the Toronto Stock Exchange (the

“TSX”) prior to the date hereof, the discount

applied to meet the requirements of the TSX.

Pieridae expects to raise gross proceeds of up

to $30 million from the Rights Offering and intends to use the

proceeds to repay indebtedness, for working capital and general

corporate purposes and to fund certain value-accretive optimization

projects. The expected closing date of the Rights Offering is

October 7, 2024.

The Rights issued under the Rights Offering will

expire at 3:00 p.m. MDT on October 2, 2024 (the “Expiry

Date”), after which time unexercised Rights will be void

and of no value. The Rights Offering includes an additional

subscription privilege under which eligible holders of Rights who

fully exercise their Basic Subscription Privilege will be entitled

to subscribe for additional available Common Shares on a pro rata

basis that are not otherwise subscribed for under the Basic

Subscription Privilege.

In connection with the Rights Offering, the

Company has entered into a standby purchase agreement (the

“Standby Purchase Agreement”) with Alberta

Investment Management Corporation (“AIMCo”), which

has agreed, subject to the satisfaction of certain conditions, to

fully exercise its Basic Subscription Privilege to purchase

24,498,749 Common Shares and to purchase up to an additional

77,625,434 Common Shares not otherwise subscribed for under the

Rights Offering (the “Standby Commitment”), which

will ensure that the Company receives gross proceeds under the

Rights Offering of at least $25 million. If the Standby Commitment

is utilized in full and no other Pieridae shareholders exercise

Rights, AIMCo will own approximately 49.81% of the issued and

outstanding Common Shares on completion of the Rights Offering.

Completion of the Rights Offering is subject to the satisfaction or

waiver of the conditions under the Standby Purchase Agreement.

Darcy Reding, President and CEO commented, “We

are extremely pleased to provide our shareholders with the

opportunity to directly participate in Pieridae’s future through a

backstopped rights offering. The ongoing support of our valued

shareholders, particularly AIMCo which is committing up to $25

million, is instrumental in accelerating our strategic execution.

Investing in value-enhancing well optimization, facility

consolidation and debottlenecking projects is expected to improve

revenue, lower costs and increase processing capacity to meet

growing third-party demand at our processing facilities.”

On closing of the Rights Offering, Pieridae will

enter into an investor rights agreement (the “Investor

Rights Agreement”) and a registration rights agreement

(the “Registration Rights Agreement”) with AIMCo.

The Investor Rights Agreement will grant AIMCo certain board

nomination and observer rights, and the Registration Rights

Agreement will grant AIMCo certain distribution and registration

rights, in each case as mutually agreed by Pieridae and AIMCo. The

Investor Rights Agreement and Registration Rights Agreement will

each terminate at such time that AIMCo and its affiliates together

hold less than 10% of the Common Shares.

Copies of the Standby Purchase Agreement,

Investor Rights Agreement, and Registration Rights Agreement will

be filed under Pieridae’s profile on SEDAR+ at

www.sedarplus.ca.

There are currently 171,911,336 Common Shares

outstanding. An aggregate of 171,911,336 Rights are expected to be

issued to subscribe for up to 122,549,019 Common Shares pursuant to

the Rights Offering. The final number of Rights to be issued will

depend on the actual number of issued and outstanding Common Shares

on the Record Date. Following completion of the Rights Offering and

assuming the exercise of all Rights, Pieridae expects that there

will be approximately 294,460,355 Common Shares outstanding.

No fractional Common Shares will be issued and,

where the exercise of Rights would otherwise entitle the holder of

Rights to fractional Common Shares, the holder’s entitlement will

be reduced to the next lowest whole number of Common Shares. No

cash or other consideration will be paid in lieu thereof.

The Rights will be listed for trading on the TSX

under the symbol “PEA.RT” commencing on September

9, 2024 and will be de-listed from the TSX at 10:00 a.m. MDT on the

Expiry Date.

The Rights Offering will be conducted only in

the Eligible Jurisdictions. Accordingly, and subject to the

detailed provisions of Pieridae’s Rights Offering circular (the

“Circular”), Rights will not be delivered to, nor

will they be exercisable by, persons resident outside of the

Eligible Jurisdictions (“Ineligible Holders”),

unless an Ineligible Holder satisfies Pieridae that their

participation in the Rights Offering is lawful and in compliance

with all applicable securities and other legislation, in which case

Pieridae may direct the depositary and subscription agent, Odyssey

Trust Company (“Odyssey”), to issue Rights to such

Ineligible Holder who will no longer be an Ineligible Holder. After

3:00 p.m. MDT on September 22, 2024 (10 days prior to the Expiry

Date), any Rights still held by Odyssey on behalf of Ineligible

Holders may be sold on their behalf by Odyssey.

Details of the Rights Offering are set out in

Pieridae’s Rights Offering notice (the “Notice”)

and Circular, which will be available under Pieridae’s profile on

SEDAR+ at www.sedarplus.ca. It is expected that the Notice, a

direct registration system advice representing the Rights (the

“DRS Advice”) and a subscription form (the

“Subscription Form”) will be mailed to each

registered shareholder of the Company resident in the Eligible

Jurisdictions as at the Record Date. Registered shareholders who

wish to exercise their Rights must deliver the DRS Advice, together

with the completed Subscription Form and the applicable funds, to

Odyssey at or before 3:00 p.m. MDT on the Expiry Date. Shareholders

who hold their Common Shares through an intermediary, such as a

bank, trust company, securities dealer, or broker, are expected to

receive materials and instructions from their intermediary.

The Rights and the Common Shares issuable upon

exercise of the Rights have not been, and will not be, registered

under the United States Securities Act of 1933, as amended and,

accordingly, the Rights and the Common Shares are not being

publicly offered for sale in the “United States” or to “U.S.

persons” (as such terms are defined in Regulation S under the

United States Securities Act of 1933, as amended). This press

release does not constitute an offer to sell or the solicitation of

an offer to buy the securities in any jurisdiction. There shall be

no sale of the securities in any jurisdiction in which an offer to

sell, a solicitation of an offer to buy, or a sale would be

unlawful.

ADVISORS

Peters & Co. Limited is acting as exclusive

financial advisor to Pieridae with respect to the Rights Offering.

Norton Rose Fulbright Canada LLP is acting as Pieridae’s legal

advisor.

ABOUT PIERIDAE

Pieridae is a Canadian energy company

headquartered in Calgary, Alberta. The Company is a significant

upstream producer and midstream custom processor of natural gas,

natural gas liquids, condensate, and sulphur from the Canadian

Foothills and adjacent areas in Alberta and in northeast British

Columbia. Pieridae’s vision is to provide responsible, affordable

natural gas and derived products to meet society’s energy security

needs. Pieridae’s Common Shares trade on the TSX under the symbol

“PEA”.

For further information, visit

www.pieridaeenergy.com, or please contact:

| Darcy

Reding, President & Chief Executive Officer |

Adam

Gray, Chief Financial Officer |

| Telephone: (403) 261-5900 |

Telephone: (403) 261-5900 |

| |

|

| Investor Relations |

|

| investors@pieridaeenergy.com |

|

| |

|

Forward-Looking Statements

Certain of the statements contained herein may

constitute “forward-looking statements” or “forward-looking

information” within the meaning of applicable securities laws

(collectively “forward-looking statements”). Words such as “may”,

“will”, “should”, “could”, “would”, “intends”, “expects”,

“anticipates”, “assumes”, “increase”, “reduce”, “accelerate”,

“growing”, “condition”, “completion”, “vision”, “project”,

“future”, “strategy”, “proposition”, “ongoing” and other similar

words and expressions may be used to identify the forward-looking

statements contained herein. These statements reflect management’s

current beliefs and are based on information currently available to

management. Forward-looking statements contained herein include,

without limitation: expected gross proceeds under the Rights

Offering; intended use of proceeds from the Rights Offering;

anticipated benefits of the Rights Offering, including, but not

limited to, accelerating the Company’s strategic execution,

improving revenue, lowering costs and increasing processing

capacity to meet third-party demands; expectations with respect to

ongoing support from the Company’s shareholders, including AIMCo;

anticipated shareholder participation in the Rights Offering;

expectations with respect to the Standby Purchase Agreement,

including satisfaction of closing conditions thereunder; fulfilment

of the Standby Commitment and AIMCo’s ownership position following

completion of the Rights Offering; expectations with respect to

entering into the Investor Rights Agreement and the Registration

Rights Agreement; the anticipated number of Rights to be issued

under the Rights Offering and number of Common Shares that will be

outstanding following completion of the Rights Offering;

expectations with respect to the closing of the Rights Offering,

including timing thereof; expectations with respect to mailing the

Notice, a DRS Advice and a Subscription Form to each registered

shareholder of the Company resident in the Eligible Jurisdictions

as of the Record Date; expectations with respect to participation

of Ineligible Holders in the Rights Offering, including the

Company’s decision to allow any Ineligible Holder to participate;

and the Company’s vision to provide responsible, affordable natural

gas and derived products.

Forward-looking statements involve significant

risk and uncertainties. A number of factors could cause actual

results to differ materially from the results discussed in the

forward-looking statements including, but not limited to, the risks

associated with oil and gas exploration, development, exploitation,

production, processing, marketing and transportation, loss of

markets, volatility of commodity prices, currency fluctuations,

imprecision of resources estimates, environmental risks,

competition from other producers, incorrect assessment of the value

of acquisitions, failure to realize the anticipated benefits of

acquisitions, delays resulting from or inability to obtain required

regulatory approvals, and ability to access sufficient capital from

internal and external sources. These and other risk factors are

discussed in more detail under “Risk Factors” and elsewhere in

Pieridae’s Annual Information Form for the year ended December 31,

2023 and under “Risk Factors” in the Circular, copies of which are

available on the Company’s profile on SEDAR+ at www.sedarplus.ca.

Additional risk factors include, but are not limited to: the Rights

Offering may not be completed, or may not be completed on the terms

and timeline as currently expected, including with respect to the

Standby Commitment.

Forward-looking statements are based on a number

of factors and assumptions which have been used to develop such

forward-looking statements, but which may prove to be incorrect.

Although Pieridae believes that the expectations reflected in such

forward-looking statements are reasonable, undue reliance should

not be placed on forward-looking statements because Pieridae can

give no assurance that such expectations will prove to be correct.

In addition to other factors and assumptions which may be

identified in this document, assumptions have been made regarding,

among other things: the impact of increasing competition; the

general stability of the economic and political environment in

which Pieridae operates; the ability of Pieridae to obtain and

retain qualified staff, equipment and services in a timely and cost

efficient manner; the ability of the operator of the projects which

Pieridae has an interest in to operate the field in a safe,

efficient and effective manner; the ability of Pieridae to obtain

financing on acceptable terms; the ability to replace and expand

oil and natural gas resources through acquisition, development and

exploration; the timing and costs of pipeline, storage and facility

construction and expansion and the ability of Pieridae to secure

adequate product transportation; future oil and natural gas prices;

currency, exchange and interest rates; the regulatory framework

regarding royalties, taxes and environmental matters in the

jurisdictions in which Pieridae operates; timing and amount of

capital expenditures; future sources of funding; production levels;

weather conditions; success of exploration and development

activities; access to gathering, processing and pipeline systems;

advancing technologies; and the ability of Pieridae to successfully

market its oil and natural gas products.

Readers are cautioned that the foregoing list of

assumptions and risk factors is not exhaustive. Additional

information on these and other factors that could affect Pieridae’s

operations and financial results are included in reports on file

with Canadian securities regulatory authorities and may be accessed

through the SEDAR+ website (www.sedarplus.ca), and at Pieridae’s

website (www.pieridaeenergy.com).

Although the forward-looking statements

contained herein are based upon what management believes to be

reasonable assumptions, management cannot assure that actual

results will be consistent with these forward-looking statements.

Investors should not place undue reliance on forward-looking

statements. These forward-looking statements are made as of the

date hereof and Pieridae assumes no obligation to update or review

them to reflect new events or circumstances except as required by

applicable securities laws.

Forward-looking statements contained herein

concerning the oil and gas industry and Pieridae’s general

expectations concerning this industry are based on estimates

prepared by management using data from publicly available industry

sources as well as from reserve reports, market research and

industry analysis and on assumptions based on data and knowledge of

this industry which Pieridae believes to be reasonable. However,

this data is inherently imprecise, although generally indicative of

relative market positions, market shares and performance

characteristics. While Pieridae is not aware of any misstatements

regarding any industry data presented herein, the industry involves

risks and uncertainties and is subject to change based on various

factors.

Neither TSX nor its Regulation Services

Provider (as that term is defined in policies of the TSX) accepts

responsibility for the adequacy or accuracy of this

release.

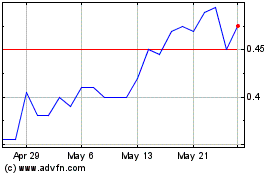

Pieridae Energy (TSX:PEA)

Historical Stock Chart

From Feb 2025 to Mar 2025

Pieridae Energy (TSX:PEA)

Historical Stock Chart

From Mar 2024 to Mar 2025