Onex Partners and BPEA Complete Offering of Clarivate Shares

September 14 2021 - 5:00PM

Onex Corporation (“Onex”) (TSX: ONEX), Baring Private Equity

Asia (“BPEA”) and their affiliated funds (together the “Group”),

today announced they have sold 25 million ordinary shares of

Clarivate plc (“Clarivate”) (NYSE: CLVT) at a price of $25.25

per share. In addition, the underwriters were granted a 30-day

option to purchase up to 3.75 million ordinary shares from the

Group. Clarivate is a global leader in providing trusted

information and insights to accelerate the pace of innovation.

At the purchase price and before the

underwriters’ option, net proceeds to the Group were approximately

$630 million, of which Onex’ share was approximately

$120 million as a Limited Partner in Onex Partners IV and as a

co-investor. The Group will continue to hold approximately

59.5 million ordinary shares of Clarivate for an economic

interest of 9%. Onex will continue to hold approximately

16.2 million ordinary shares for a 3% interest.

A registration statement on Form S-3 (including

a prospectus) was filed with the Securities and Exchange Commission

(“SEC”) on July 1, 2021 and has become effective. This press

release shall not constitute an offer to sell or a solicitation of

an offer to buy these securities, nor shall there be any sale of

these securities in any state or jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

jurisdiction.

About Onex

Founded in 1984, Onex manages and invests

capital on behalf of its shareholders, institutional investors and

high net worth clients from around the world. Onex’ platforms

include: Onex Partners, private equity funds focused on mid- to

large-cap opportunities in North America and Western Europe; ONCAP,

private equity funds focused on middle market and smaller

opportunities in North America; Onex Credit, which manages

primarily non-investment grade debt through tradeable, private and

opportunistic credit strategies as well as actively managed public

equity and public credit funds; and Gluskin Sheff’s wealth

management services. In total, as of June 30, 2021, Onex has

approximately $46 billion of assets under management, of which

approximately $7.5 billion is its own investing capital. With

offices in Toronto, New York, New Jersey, Boston and London, Onex

and its experienced management teams are collectively the largest

investors across Onex’ platforms.

Onex shares trade on the Toronto Stock Exchange

under the stock symbol ONEX. For more information on Onex, visit

its website at www.onex.com. Onex’ security filings can also be

accessed at www.sedar.com.

About Baring Private Equity Asia

(BPEA)

Baring Private Equity Asia (BPEA) is one of

Asia's largest private alternative investment firms, with assets

under management of $27 billion. BPEA manages a private equity

investment program, sponsoring buyouts and providing growth capital

to companies for expansion or acquisitions with a particular focus

on the Asia Pacific region, as well as dedicated funds focused on

private real estate and private credit. The firm has a 24-year

history and over 200 employees located across nine offices in

Beijing, Delhi, Hong Kong, Los Angeles, Mumbai, Singapore,

Shanghai, Sydney, and Tokyo.

BPEA is a responsible investor that seeks to

create value for all stakeholders through a sustainable approach to

investing. The firm is a signatory to the UNPRI (United Nations

Principles for Responsible Investment) and is committed to action

within its own business and the companies in which it invests to

drive sustainability across a range of issues, from climate change

to social concerns to effective governance. For more information,

please visit www.bpeasia.com.

Forward-Looking Statements

This press release may contain, without

limitation, statements concerning possible or assumed future

operations, performance or results preceded by, followed by or that

include words such as “believes”, “expects”, “potential”,

“anticipates”, “estimates”, “intends”, “plans” and words of similar

connotation, which would constitute forward-looking statements.

Forward-looking statements are not guarantees. The reader should

not place undue reliance on forward-looking statements and

information because they involve significant and diverse risks and

uncertainties that may cause actual operations, performance or

results to be materially different from those indicated in these

forward-looking statements. Except as may be required by Canadian

securities law, Onex is under no obligation to update any

forward-looking statements contained herein should material facts

change due to new information, future events or other factors.

These cautionary statements expressly qualify all forward-looking

statements in this press release.

For Further Information

|

OnexJill HomenukManaging Director – Shareholder Relations and

Communications+1 416.362.7711 |

BPEAFergus HerriesNewgate Communicationsfergus.herries@newgate.asia

or +852.5970.3618 |

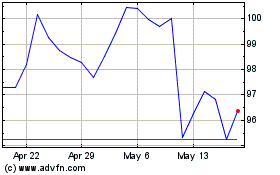

Onex (TSX:ONEX)

Historical Stock Chart

From Oct 2024 to Nov 2024

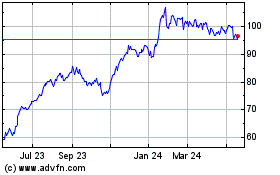

Onex (TSX:ONEX)

Historical Stock Chart

From Nov 2023 to Nov 2024