Linamar Comments on General Motors Bankruptcy Announcement

June 01 2009 - 9:45AM

Marketwired Canada

Given the filing for Chapter 11 bankruptcy protection by General Motors (GM)

today, Linamar (TSX:LNR) is clarifying its position with respect to its

outstanding GM receivables.

As already outlined previously in its press releases dated April 2 and April 30,

2009, Linamar has limited exposure to GM on both the receivables and sales

volume side. With respect to receivables, the outstanding balance owing from GM

that is older than 20 days for GM American entities is estimated at less than

$2.8 million.

For better assurance of full recovery, Linamar has EDC insurance coverage in

place to fully cover the overall balance of outstanding receivables.

Additionally, over the past few months, Linamar has been working with GM to

minimize the outstanding receivables balance.

"We are of course disappointed that GM was unable to successfully negotiate with

stakeholders a satisfactory solution to allow them to avoid Chapter 11, however,

we feel that we are in a strong position to weather the situation given steps we

have taken over the past months to minimize our exposure", said Linamar CEO

Linda Hasenfratz.

Linamar is confident that given the steps previously taken, it will recover the

majority of its receivables either within or outside of the Chapter 11 process.

Linamar looks forward to continuing to work with its valued customer, GM, as it

moves through this restructuring process.

Linamar Corporation (TSX:LNR) is a diversified global manufacturing company of

highly engineered products. The company's Powertrain and Driveline focused

divisions are world leaders in the collaborative design, development and

manufacture of precision metallic components, modules and systems for global

vehicle and power generation markets. The company's Industrial division is a

world leader in the design and production of innovative mobile industrial

equipment, notably its class-leading aerial work platforms and telehandlers.

With more than 9,000 employees in 37 manufacturing locations, 5 R&D centers and

11 sales offices in Canada, the US, Mexico, Germany, Hungary, the UK, China,

Korea and Japan Linamar generated sales of over $2.2 Billion in 2008. For more

information about Linamar Corporation and its industry leading products and

services, visit www.linamar.com.

Certain information regarding Linamar set forth in this document, including

management's assessment of the Company's future plans and operations may

constitute forward-looking statements. This information is based on current

expectations that are subject to significant risks and uncertainties that are

difficult to predict. Actual results may differ materially from these

anticipated in the forward-looking statements due to factors such as customer

demand and timing of buying decisions, product mix, competitive products and

pricing pressure. In addition, uncertainties and difficulties in domestic and

foreign financial markets and economies could adversely affect demand from

customers. These factors, as well as general economic and political conditions,

may in turn have a material adverse effect on the Company's financial results.

The Company assumes no obligation to update the forward-looking statements, or

to update the reasons why actual results could differ from those reflected in

the forward-looking statements.

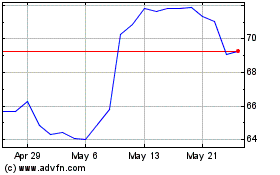

Linamar (TSX:LNR)

Historical Stock Chart

From Sep 2024 to Oct 2024

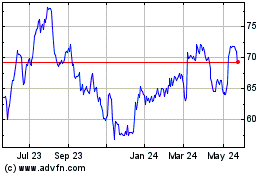

Linamar (TSX:LNR)

Historical Stock Chart

From Oct 2023 to Oct 2024