Linamar Announces First Quarter Results

May 04 2009 - 4:00PM

Marketwired Canada

Linamar Corporation (TSX:LNR) is a diversified global manufacturing company of

highly engineered products. The company's Powertrain and Driveline focused

divisions are world leaders in the collaborative design, development and

manufacture of precision metallic components, modules and systems for global

vehicle and power generation markets. The company's Industrial division is a

world leader in the design and production of innovative mobile industrial

equipment, notably its class-leading aerial work platforms and telehandlers.

With more than 10,000 employees in 37 manufacturing locations, 5 R&D centers and

11 sales offices in Canada, the US, Mexico, Germany, Hungary, the UK, China,

Korea and Japan Linamar generated sales of over $2.2 Billion in 2008. For more

information about Linamar Corporation and its industry leading products and

services, visit www.linamar.com.

(CDN dollars in thousands except per share figures) Three Months Ended

March 31

2009 2008

$ $

----------------------------------------------------------------------------

Sales 424,874 614,516

Gross Margin 23,754 80,378

Selling, general and administrative 22,596 30,441

Operating Earnings 1,158 49,937

Earnings from Continuing Operations (894) 29,487

Net Earnings (Loss) (12,612) 29,487

----------------------------------------------------------------------------

Diluted Earnings (Loss) per Share

from Continuing Operations (0.01) 0.43

Diluted Earnings (Loss) per Share (0.19) 0.43

----------------------------------------------------------------------------

Certain unusual items affected earnings in both the first quarter of 2009

and 2008 as noted in the table below:

Three Months Ended

March 31

(in millions of dollars, except per share figures) 2009 2008

----------------------------------------------------------------------------

Net Earnings (Loss) $ (12.6) $ 29.5

Adjustments due to unusual items

Taxable Items before Tax

1) Severance related to the slow down in the

Automotive Industry 4.4 -

2) Ontario Capital Tax - eliminated retroactively

to Jan 1, 2007 - (4.4)

3) Program specific asset write down - 4.7

------------------------

4.4 0.3

Tax Impact (4.1) (0.1)

------------------------

0.3 0.2

Non-Taxable Items

4) Foreign Exchange loss (gain) on Hungarian

Forints held in Escrow - (2.0)

5) Goodwill Impairments 11.7 -

------------------------

11.7 (2.0)

------------------------

Adjusted Net Earnings (Loss) $ (0.6) $ 27.7

------------------------

------------------------

As a percentage of Sales -0.1% 4.5%

Change over Prior Year -102.2%

Earnings per Share (0.01) 0.40

First Quarter Operating Highlights

The company's operating earnings for the first quarter of 2009 were $5.6 million

after adjusting for unusual items in the quarter. This compares to $48.2 million

adjusted operating earnings for the first quarter of 2008, a decrease of $42.6

million:

- First quarter operating earnings for the Powertrain/Driveline segment were

lower by $29.4 million or 94.5% to a profit of $1.7 million over the same

quarter of 2008 where operating earnings were $31.1 million.

- The operating losses for the Industrial segment were $0.5 million in first

quarter of 2009, a decrease of $19.3 million or 102.7% over the first quarter of

2008.

- The decrease in both segments was driven by under absorption of fixed costs

due to the significant volume reductions in global markets minimized by

significant fixed and overhead cost reductions.

Taking into account the unusual items of the first quarters of each year,

adjusted net loss for the first quarter of 2009 was $0.6 million ($0.01 net loss

per share) versus a profit of $27.7 million ($0.40 net earnings per share) in

the first quarter of 2008.

Sales for the first quarter of 2009 were $424.9 million, down $189.6 million

from $614.5 million for the first quarter of 2008:

- Sales for the Powertrain/Driveline segment decreased by $110.6 million, or

22.8% in the first quarter to $373.5 million compared to $484.1 million in the

first quarter of 2008. The decrease was driven by significant volume reductions

in global vehicle markets.

- Content per vehicle in North America increased by 52.1% to $161.15 in

comparison to the first quarter of 2008.

- Industrial segment sales decreased 60.6% or $79.0 million for the quarter from

$130.4 million in the first quarter of 2008 to $51.4 million in the first

quarter of 2009. The sales for the first quarter of 2009 differed from the

corresponding period in 2008 due to significant global volume reductions as a

result of uncertainty in the market and restricted credit availability on a

global basis.

The company generated $72.8 million in operational cash flow, $29.0 million of

which was from reductions in working capital. At March 31, 2009 the amount

available under the company's syndicated revolving credit facility was $249.6

million, up $32.3 million from December 31, 2008. On April 16, 2009 the company

withdrew $100 million from this same line with the intention to use these funds

to repay the Series A Private Placement Notes ($80 million usd) due in October

2009.

"Despite Q1 2009 being one of the most difficult economic periods to manage

through in our company's history, Linamar has managed to dramatically increase

market share, execute on significant cost savings and generate more than $30

million of cash to pay down debt levels.", said Linamar CEO Linda Hasenfratz,

"We have a plan, are successfully executing on such and seeing the results."

Dividends

The Board of Directors today declared an eligible dividend in respect of the

quarter ended March 31, 2009 of CDN$0.03 per share on the common shares of the

company, payable on or after June 5, 2009 to shareholders of record on May 26,

2009.

Risk and Uncertainties (forward looking statements)

Linamar no longer provides a financial outlook.

Certain information provided by Linamar in these unaudited interim financial

statements, MD&A and other documents published throughout the year that are not

recitation of historical facts may constitute forward-looking statements. The

words "estimate", "believe", "expect" and similar expressions are intended to

identify forward-looking statements. Persons reading this report are cautioned

that such statements are only predictions and the actual events or results may

differ materially. In evaluating such forward-looking statements, readers should

specifically consider the various factors that could cause actual events or

results to differ materially from those indicated by such forward-looking

statements.

Such forward-looking information may involve important risks and uncertainties

that could materially alter results in the future from those expressed or

implied in any forward-looking statements made by, or on behalf of, Linamar.

Some risks and uncertainties may cause results to differ from current

expectations. The factors which are expected to have the greatest impact on

Linamar include but are not limited to (in the various economies in which

Linamar operates): the extent of OEM outsourcing, industry cyclicality, trade

and labour disruptions, pricing concessions and cost absorptions, delays in

program launches, the company's dependence on certain engine and transmission

programs and major OEM customers, currency exposure, and technological

developments by Linamar's competitors.

A large proportion of the company's cash flows are denominated in foreign

currencies. The movement of foreign currency exchange rates against the Canadian

dollar has the potential to have a negative impact on financial results. The

company has employed a hedging strategy as appropriate to attempt to mitigate

the impact but cannot be completely assured that the entire exchange effect has

been offset.

Other factors and risks and uncertainties that could cause results to differ

from current expectations are discussed in the MD&A and include, but are not

limited to: fluctuations in interest rates, environmental emission and safety

regulations, governmental, environmental and regulatory policies, and changes in

the competitive environment in which Linamar operates. Linamar assumes no

obligation to update the forward-looking statements, or to update the reasons

why actual results could differ from those reflected in the forward-looking

statements.

Conference Call Information

Q1 Conference Call Information

Linamar will hold a conference call on May 4, 2009 at 5:00 pm. EST to discuss

its first quarter results. The numbers for this call are (416) 640-3404

(local/overseas) or (866) 322-1159 (North America) confirmation number 5141377,

with a call-in required 10 minutes prior to the start of the conference call.

The conference call will be chaired by Linda Hasenfratz, Linamar's Chief

Executive Officer. A copy of the company's full quarterly financial statements,

including the Management's Discussion & Analysis will be available on the

company's website after 4 p.m. EST on May 4, 2009 and at www.sedar.com by the

start of business on May 5, 2009. A taped replay of the conference call will

also be made available starting at 11:00 p.m. on May 5, 2009 for seven days. The

number for replay is (647) 436-0148 or (888) 203-1112, Replay Passcode 5141377.

The conference call can also be accessed by web cast at www.linamar.com, by

accessing the investor relations/events menu, and will be available for a 7 day

period.

Q2 Conference Call Information

Linamar will hold a conference call on August 13, 2009 at 5:00 pm. EST to

discuss its second quarter results. The numbers for this call are (416) 640-5933

(local/overseas) or (866) 399-6716 (North America) confirmation number 2594477,

with a call-in required 10 minutes prior to the start of the conference call.

The conference call will be chaired by Linda Hasenfratz, Linamar's Chief

Executive Officer. A copy of the company's full quarterly financial statements,

including the Management's Discussion & Analysis will be available on the

company's website after 4 p.m. EST on August 13, 2009 and at www.sedar.com by

the start of business on August 14, 2009. A taped replay of the conference call

will also be made available starting at 11:00 p.m. on August 13, 2009 for seven

days. The number for replay is (647) 436-0148 or (888) 203-1112, Replay Passcode

25944777. The conference call can also be accessed by web cast at

www.linamar.com, by accessing the investor relations/events menu, and will be

available for a 7 day period.

Frank Hasenfratz Linda Hasenfratz

Chairman of the Board Chief Executive Officer

Guelph, Ontario

May 4, 2009

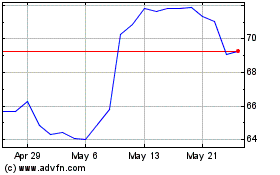

Linamar (TSX:LNR)

Historical Stock Chart

From Sep 2024 to Oct 2024

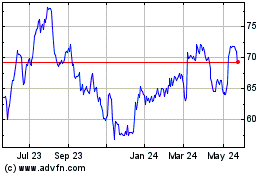

Linamar (TSX:LNR)

Historical Stock Chart

From Oct 2023 to Oct 2024