Linamar Announces Third Quarter Results

November 04 2008 - 3:00PM

Marketwired Canada

Linamar Corporation (TSX:LNR), a diversified global manufacturing company of

highly engineered products, today announced its financial results for the third

quarter ended September 30, 2008. The company's Powertrain and Driveline

divisions ("Powertrain/Driveline") are world leaders in the collaborative

design, development and manufacture of precision metallic components, modules

and systems for global vehicle markets. The company's Industrial division

("Industrial") is a world leader in the design and production of innovative

mobile industrial products, notably its class-leading aerial work platforms.

With close to 12,000 employees in 37 manufacturing locations, 5 R&D centres and

11 sales offices in Canada, the US, Mexico, the UK, Germany, Hungary, China,

Korea and Japan, Linamar generated sales in excess of $2.3 billion in 2007. For

more information about Linamar Corporation and its industry leading products and

services, visit www.linamar.com.

(CDN dollars in thousands except per share figures)

Three Months Ended Nine Months Ended

Sept 30 Sept 30

2008 2007 2008 2007

----------------------------------------------------------------------------

$ $ $ $

Sales 540,360 581,559 1,780,314 1,785,371

Gross Margin 40,188 75,677 207,057 235,417

Selling, general and

administrative 32,957 28,193 97,552 88,259

Operating Earnings(1) 7,231 47,484 109,505 147,158

Earnings from Continuing

Operations 3,345 25,850 64,806 83,924

Net Earnings 11,484 25,850 72,945 83,924

----------------------------------------------------------------------------

Diluted Earnings per Share

from Continuing Operations 0.05 0.37 0.96 1.20

Diluted Earnings per Share 0.17 0.37 1.08 1.20

----------------------------------------------------------------------------

(1) "Operating earnings", as used by the chief operating decision makers and

management, monitors the performance of the business specifically at the

segmented level. Operating earnings is calculated by the company as

gross margin less selling, general and administrative expenses. Under

Canadian generally accepted accounting principles ("GAAP"), this

financial measure does not have a standardized meaning and is unlikely

to be comparable to similar measures presented by other issuers.

Third Quarter Operating Highlights

Sales for the third quarter of 2008 at $540.4 million were down $41.2 million

compared to $581.6 million for the third quarter of 2007. Sales for the

Powertrain/Driveline Segment ("Powertrain/Driveline") decreased by $12.1

million, or 2.7% in the third quarter compared with 2007. The decrease was

driven by significant volume reductions by North American OEMs notably GM,

Chrysler and Ford. The Industrial Segment ("Industrial") product sales decreased

21.3% or $29.2 million for the quarter. The sales for the third quarter of 2008

differed from the corresponding period in 2007 due to significant volume

reductions due to uncertainty in the market and the restricted credit

availability, particularly in Europe.

The company's operating earnings decreased to $7.3 million for the third quarter

of 2008 compared to $47.5 million for the third quarter of 2007, a decrease of

40.2 million. Third quarter operating earnings for Powertrain/Driveline were

lower by $27.1 million or 84.7% over the same quarter of 2007. Operating

Earnings for Industrial decreased $13.1 million or 84.5% over the third quarter

of 2007 to $2.4 million. The decrease in both segments were driven by under

absorption of fixed costs due to the significant volume reductions.

Earnings from continuing operations for the quarter were $3.3 million (0.6% of

sales) versus $25.9 million (4.5% of sales) in 2007, a decrease of 87.3%.

Dividends

The Board of Directors today declared an eligible dividend in respect to the

quarter ended September 30, 2008 of CDN$0.06 per share on the common shares of

the company, payable on or after December 12, 2008 to shareholders of record on

November 26, 2008.

Risk and Uncertainties (forward looking statements)

Linamar no longer provides a financial outlook.

Certain information provided by Linamar in these unaudited interim financial

statements, MD&A and other documents published throughout the year that are not

recitation of historical facts may constitute forward-looking statements. The

words "estimate", "believe", "expect" and similar expressions are intended to

identify forward-looking statements. Persons reading this report are cautioned

that such statements are only predictions and the actual events or results may

differ materially. In evaluating such forward-looking statements, readers should

specifically consider the various factors that could cause actual events or

results to differ materially from those indicated by such forward-looking

statements.

Such forward-looking information may involve important risks and uncertainties

that could materially alter results in the future from those expressed or

implied in any forward-looking statements made by, or on behalf of, Linamar.

Some risks and uncertainties may cause results to differ from current

expectations. The factors which are expected to have the greatest impact on

Linamar include but are not limited to (in the various economies in which

Linamar operates): the extent of OEM outsourcing, industry cyclicality, trade

and labour disruptions, pricing concessions and cost absorptions, delays in

program launches, the company's dependence on certain engine and transmission

programs and major OEM customers, currency exposure, and technological

developments by Linamar's competitors.

A large proportion of the company's cashflows are denominated in foreign

currencies. The movement of foreign currency exchange rates against the Canadian

dollar has the potential to have a negative impact on financial results. The

company has employed a hedging strategy as appropriate to attempt to mitigate

the impact but cannot be completely assured that the entire exchange effect has

been offset.

Other factors and risks and uncertainties that could cause results to differ

from current expectations are discussed in the MD&A and include, but are not

limited to: fluctuations in interest rates, environmental emission and safety

regulations, governmental, environmental and regulatory policies, and changes in

the competitive environment in which Linamar operates. Linamar assumes no

obligation to update the forward-looking statements, or to update the reasons

why actual results could differ from those reflected in the forward-looking

statements.

Conference Call Information

Q3 Conference Call Information:

Linamar will hold a conference call on November 4, 2008 at 5:00 p.m. EST to

discuss its third quarter results. The numbers for this call are (416) 642-5212

(local/overseas) or (866) 321-6651 (North America) confirmation number 3022641,

with a call-in required 10 minutes prior to the start of the conference call.

The conference call will be chaired by Linda Hasenfratz, Linamar's Chief

Executive Officer. A copy of the company's full quarterly financial statements,

including the Management's Discussion & Analysis will be available on the

company's website after 4 p.m. EST on November 4, 2008 and at www.sedar.com by

the start of business on November 5, 2008. A taped replay of the conference call

will also be made available starting at 11:00 p.m. on November 4, 2008 for seven

days. The number for replay is (647) 436-0148 or (888) 203-1112, Conference ID

3022641. The conference call can also be accessed by web cast at

www.linamar.com, by accessing the investor relations/events menu, and will be

available for a seven day period.

Q4 Conference Call Information

Linamar will hold a conference call on March 5, 2009 at 5:00 p.m. EST to discuss

its fourth quarter and year end results. The numbers for this call are (416)

642-5212 (local/overseas) or (866) 321-6651 (North America) confirmation number

2204708, with a call-in required 10 minutes prior to the start of the conference

call. The conference call will be chaired by Linda Hasenfratz, Linamar's Chief

Executive Officer. A copy of the company's full quarterly financial statements,

including the Management's Discussion & Analysis will be available on the

company's website after 4 p.m. EST on March 5, 2009 and at www.sedar.com by the

start of business on March 6, 2009. A taped replay of the conference call will

also be made available starting at 11:00 p.m. on March 5, 2009 for seven days.

The number for replay is (647) 436-0148 or (888) 203-1112, Conference ID

2204708. The conference call can also be accessed by web cast at

www.linamar.com, by accessing the investor relations/events menu, and will be

available for a seven day period.

Frank Hasenfratz Linda Hasenfratz

Chairman of the Board Chief Executive Officer

Guelph, Ontario

November 4, 2008

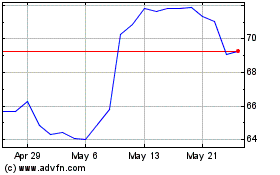

Linamar (TSX:LNR)

Historical Stock Chart

From Sep 2024 to Oct 2024

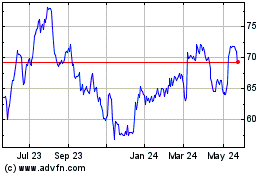

Linamar (TSX:LNR)

Historical Stock Chart

From Oct 2023 to Oct 2024