Dundee Precious Metals Inc. (TSX:DPM)(TSX:DPM.WT)(TSX:DPM.WT.A) ("DPM" or "the

Company") is pleased to announce the 2011 exploration and development drill

results with the uncovering of "Shahumyan East", a newly discovered "blind"

domain of polymetallic (Au-Ag-Cu-Zn) mineralization, in multiple sub-parallel

zones, similar to that seen at the Shahumyan Mine, Kapan, Armenia, which is 100%

owned by the Company's subsidiary, Deno Gold Mining Company ("Deno Gold").

Surface Drill Results

Hole SHDDR0175 returns 11m @ 8.53g/t AuEq (5.19g/t Au, 79.77g/t Ag, 0.78%

Cu, 0.82% Zn) from 79m

Hole SHDDR0187 returns 29m @ 2.77g/t AuEq (1.05g/t Au, 43.65g/t Ag, 0.11%

Cu, 1.21% Zn) from 307m

Hole SHDDR0210 returns 23m @ 2.07g/t AuEq (0.54g/t Au, 29.56g/t Ag, 0.42%

Cu, 0.46% Zn) from 350m

Hole SHDDR0219 returns 9m @ 3.58g/t AuEq (2.03g/t Au, 23.23g/t Ag, 0.57% Cu,

0.27% Zn) from 292m

Underground Drill Results

Hole NXC02748_02 returns 31m @ 4.55g/t AuEq (3.40g/t Au, 26.49g/t Ag, 0.25%

Cu, 0.38% Zn) from 62m

"We are encouraged by the positive results of both our surface and underground

drill programs," said Jonathan Goodman, CEO of DPM. "The success of the programs

so far confirms our belief that the full extents of the Shahumyan deposit have

yet to be fully defined, both in terms of depth and lateral extents to the south

and east. Our strategy to fully explore the immediate Shahumyan deposit and to

extend the current life of the existing underground operations while we evaluate

a potential expansion with an open pit operation is on track."

Deno Gold currently owns and operates an underground polymetallic (Au-Ag-Cu-Zn)

mine and mill complex and surrounding exploration license in southern Armenia

which was acquired by DPM in 2006. The Kapan Exploration License covers

approximately 350 km2 and excludes existing populated areas, mine concessions

and related infrastructure. The mining concession is encapsulated within the

exploration license and consists of the Shahumyan mine and mill concession

(2.55km2). The Kapan Exploration License extends from the town of Kapan along a

northwest trending valley and covers an area of Jurassic-age intermediate

volcanics. The Shahumyan underground operation covers the extent of the mining

concession with production rates currently at 600,000 tonnes per year. The

deposit consists of closely spaced polymetallic (Au-Ag-Cu-Zn) veins and veinlets

displaying a broadly east-west strike and steep (70 - 85 degrees) dip to the

north or south.

Since 2006, DPM's exploration growth strategy for Armenia has been based on four

key components:

-- The Shahumyan Open Pit Project, which recognizes the possibility of

delineating a large open pittable Mineral Resource over the currently

operating Shahumyan underground mine 'footprint';

-- Advancing the underground Mineral Resource and Mineral Reserve base, in

order to extend the life of the current underground mine;

-- Methodically explore the +350 square kilometre Kapan Exploration License

to define additional Mineral Resources; and

-- Project evaluation work in Armenia as our understanding of the area

increases.

All four components are now being realized with the ramp-up of activities in 2011.

The Open Pit drill program commenced in July 2007 with 53,238 metres of reverse

circulation ("RC") and diamond drilling completed before it was shutdown in

October 2008 due to the global financial crisis. Drilling then recommenced in

December 2010 and a total of 55,333 metres were drilled in 2011 on a 160 x 160

metre grid over the Shahumyan mine 'footprint', covering an area of 2.5

kilometres x 1.0 kilometres using three DPM-owned Sandvik UDR200D LS diamond

drill rigs. Infill drilling then commenced in the central and southern portions

of the deposit as these areas were identified by pit optimization studies as

potential "starter pits".

Underground exploration below the 700 level of the Shahumyan underground mine

commenced in September, 2011 for a total of 2,397 metres with an Atlas Copco

Diamec underground diamond drill rig shipped from DPM's Chelopech mine in

Bulgaria. The SGS-managed Kapan Laboratory was re-established in 2011 in order

to accommodate the large volumes of samples produced by the concurrent drilling

programs.

Exploration activities on the Kapan Exploration License included completion of

regional mapping, re-evaluation of the 2008 helicopter-borne magnetic and

electromagnetic data and analysis of regional soil sample assay data which have

defined 'drill ready' targets for 2012.

Assay results from the Open Pit Project and underground drilling programs have

returned multiple, wide (up to 30 metres) polymetallic zones of potentially open

pittable mineralization (refer to Tables 1, 2 and 3 for all significant

intercepts). The mineralized zones comprise narrow (0.5 - 5 metre) high-grade

quartz veins, similar to those being mined underground, which are surrounded by

broader disseminated mineralization.

Drilling carried out as part of the Open Pit drilling program intersected the

"Shahumyan East" domain, located 50 to 160 metres beneath barren cover

lithologies, east of the Shahumyan East Fault. Limited drilling (4 drill holes)

in the 1960's intersected minor mineralization and an attempt was made to

develop a vein designated Vein 23, but with little success. Drill holes in some

areas were also too shallow and often failed to pass through the barren cover

sequence. Twinning of 'historical' drill holes indicates that selective sampling

missed disseminated and high-grade zones of mineralization, leading previous

explorers to downgrade the potential for the area to host significant

mineralization.

Based on a current drill spacing of 160 x 160 metres (and some infill drilling

at 80 x 80 metres), "Shahumyan East" covers an area of approximately 1.5 x 0.5

kilometres with mineralization open to the south and east (see Figure 1). The

vein sets and surrounding mineralized halos are steeply dipping to the south,

orientated east-west with a strike length of some 500 metres and depth of at

least 300 metres from the 750 - 450 mine levels (Figure 2). A total of 20 holes

have returned potentially economic grades and widths for either open pit or

underground operations (refer to Figure 1 and Table 2). A further 16 diamond

drill holes have pending assay results while 15 infill holes (as part of a 80 x

80 metre infill drilling program) are planned for this area.

DPM intends to systematically drill test the "Shahumyan East" domain as part of

the definition of the extents of the Shahumyan Deposit. The Company has the

equipment and resources to put into production a further three ROCKDRILL5000 RC

drill rigs which will be used for infill drilling. Drilling planned for 2012

comprises 87,700 metres of diamond drilling and up to 30,000 metres of RC

drilling.

SHAHUMYAN EAST & OPEN PIT PROJECT - SIGNIFICANT ASSAY RESULTS

Initial HQ diamond drilling within the Open Pit Project 'footprint' and east of

the current Shahumyan mine has returned multiple intercepts of potentially

mineable medium to high-grade polymetallic mineralization with selected

intercepts shown below (based on a 0.5g/t gold-equivalent cut-off grade):

SHDDR0150(i):

-- 8m @ 0.75g/t AuEq (0.25g/t Au, 4.01g/t Ag, 0.06% Cu, 0.59% Zn), from

312m

-- 3m @ 1.30g/t AuEq (0.2g/t Au, 16.9g/t Ag, 0.06% Cu, 1.23% Zn), from 363m

-- 11m @ 4.37g/t AuEq (2.08g/t Au, 52.45g/t Ag, 0.4% Cu, 1.07% Zn), from

435m

-- Including 2m @ 19.62g/t AuEq (8.88g/t Au, 252g/t Ag, 2.05% Cu, 4.24%

Zn), from 442m

SHDDR0155(i):

-- 15m @ 4.14g/t AuEq (3.85g/t Au, 9.73g/t Ag, 0.03% Cu, 0.09% Zn), from

228m

-- 14m @ 1.40g/t AuEq (0.23g/t Au, 17.22g/t Ag, 0.16% Cu, 1.02% Zn), from

365m

SHDDR0162(i):

-- 9m @ 0.95g/t AuEq (0.41g/t Au, 16.68g/t Ag, 0.04% Cu, 0.26% Zn), from

193m

-- 4m@ 1.09g/t AuEq (0.23g/t Au, 6.47g/t Ag, 0.06% Cu, 1.15% Zn), from 271m

-- 7m@ 0.85g/t AuEq (0.31g/t Au, 6.61g/t Ag, 0.02% Cu, 0.69% Zn), from 328m

-- 21m@ 1.24g/t AuEq (0.21g/t Au, 8.13g/t Ag, 0.06% Cu, 1.41% Zn), from

388m

SHDDR0187:

-- 29m @ 2.77g/t AuEq (1.05g/t Au, 43.65g/t Ag, 0.11% Cu, 1.21% Zn), from

307m

SHDDR0205:

-- 13m @ 0.65 g/t AuEq (0.16g/t Au, 4.35g/t Ag, 0.05% Cu, 0.57% Zn), from

220m

-- 4m @ 10.52g/t AuEq (7.42g/t Au, 75.7g/t Ag, 0.72% Cu, 0.76% Zn), from

296m

-- 10m @ 0.87g/t AuEq (0.62g/t Au, 5.14g/t Ag, 0.03% Cu, 0.17% Zn), from

342m

-- 7m @ 0.83g/tAuEq (0.23g/t Au, 3.26g/t Ag, 0.05% Cu, 0.81% Zn), from 377m

-- 5m @ 0.63g/t AuEq (0.18g/t Au, 7.08g/t Ag, 0.04% Cu, 0.44% Zn), from

388m

SHDDR0222:

-- 10m @ 1.39g/t AuEq (0.33g/t Au, 6.77g/t Ag, 0.15% Cu, 1.23% Zn), from

199m

Open Pit Project

SHDDR0177:

-- 9m @ 0.65g/t AuEq (0.21g/t Au, 2.17g/t Ag, 0.03% Cu, 0.65% Zn), from 98m

-- 8m @ 2.38g/t AuEq (0.54 g/t Au, 17.56g/t Ag, 0.48% Cu, 1.28% Zn), from

124m

-- 9m @ 2.01g/t AuEq (1.09g/t Au, 31.5g/t Ag, 0.04% Cu, 0.4% Zn), from 137m

-- 7m @ 1.13g/t AuEq (0.31g/t Au, 21.5g/t Ag, 0.03% Cu, 0.63% Zn), from

156m

SHDDR0206:

-- 10m @ 1.04g/t AuEq (0.37g/t Au, 8.63g/t Ag, 0.09% Cu, 0.65% Zn), from

103m

-- 15m @ 1.78g/t AuEq (0.57g/t Au, 15.89g/t Ag, 0.35% Cu, 0.59% Zn), from

137m

-- 3m @ 11.68g/t AuEq (8.46g/t Au, 82.37g/t Ag, 0.62% Cu, 1% Zn), from 222m

-- 14m @ 1.13g/t AuEq (0.37g/t Au, 9.87g/t Ag, 0.11% Cu, 0.69% Zn), from

265m

-- 6m @ 1.90g/t AuEq (0.77g/t Au, 29.05g/t Ag, 0.17% Cu, 0.51% Zn), from

285m

-- 5m @ 0.99g/t AuEq (0.2g/t Au, 3.22g/t Ag, 0.26% Cu, 0.55% Zn), from 309m

-- 9m @ 1.76g/t AuEq (0.76g/t Au, 10.42g/t Ag, 0.37% Cu, 0.32% Zn), from

318m

SHDDR0210:

-- 9m @ 0.68g/t AuEq (0.19g/t Au, 9.08g/t Ag, 0.03% Cu, 0.47% Zn), from 92m

-- 10m @ 0.58g/t AuEq (0.13g/t Au, 2.17g/t Ag, 0.03% Cu, 0.66% Zn), from

157m

-- 18m @ 0.69g/t AuEq (0.22g/t Au, 6.03g/t Ag, 0.05% Cu, 0.5% Zn), from

171m

-- 12m @ 0.62g/t AuEq (0.2g/t Au, 5.94g/t Ag, 0.1% Cu, 0.26% Zn), from 193m

-- 19m @ 0.75g/t AuEq (0.18g/t Au, 3.59g/t Ag, 0.14% Cu, 0.49% Zn), from

216m

-- 23m @ 2.07g/t AuEq (0.54g/t Au, 29.56g/t Ag, 0.42% Cu, 0.46% Zn), from

350m

SHDDR0256:

-- 22m @ 1.26g/t AuEq (1g/t Au, 2.39g/t Ag, 0.02% Cu, 0.35% Zn), from 44m

-- 9m @ 0.96g/t AuEq (0.57g/t Au, 8.58g/t Ag, 0.04% Cu, 0.3% Zn), from 100m

-- 8m @ 0.86g/t AuEq (0.4g/t Au, 7.3g/t Ag, 0.08% Cu, 0.32% Zn), from 160m

-- 7m @ 0.93g/t AuEq (0.48g/t Au, 13.1g/t Ag, 0.09% Cu, 0.08% Zn), from

206m

SHDDR0260:

-- 8m @ 1.45g/t Au Eq (0.57g/t Au, 13.8g/t Ag, 0.18% Cu, 0.57% Zn), from

146m

-- 8m @ 0.60g/t Au Eq (0.23g/t Au, 6.58g/t Ag, 0.02% Cu, 0.37% Zn), from

174m

-- 7m @ 1.57g/t Au Eq (1.03g/t Au, 13.16g/t Ag, 0.05% Cu, 0.36% Zn), from

211m

-- 15m @ 1.16g/t Au Eq (0.57g/t Au, 8.53g/t Ag, 0.07% Cu, 0.55% Zn), from

237m

-- 3m @ 4.78g/t AuEq (2.42g/t Au, 27.63g/t Ag, 0.78% Cu, 0.97% Zn), from

266m

SHDDR0271:

-- 19m @ 1.08g/t AuEq (0.56g/t Au, 8.53g/t Ag, 0.08% Cu, 0.4% Zn), from 20m

SHDDR0277:

-- 10m @ 1.25g/t AuEq (0.46g/t Au, 6.39g/t Ag, 0.19% Cu, 0.66% Zn), from

22m

Notes:

i. In situ gold equivalent (AuEq) grade based on the following 2011 long-

term metal prices: Au: US$1250/oz, Ag: US$25/oz, Cu: US$3.00/lb and Zn:

US$1.00/lb;

ii. Minimum width reported is 2 metres, with a minimum internal dilution of

4 metres;

iii.Drill Intersections are down hole with true width considered to be 90%

of the intersection length;

iv. Drill Intersections represent intercepts into an intermediate-

sulphidation vein-breccia epithermal system;

v. Assays are uncut;

vi. All samples assayed by SGS independently managed laboratory, Kapan,

Armenia;

vii.International reference standards and full QAQC samples (duplicates,

replicates and blanks) inserted with all exploration drill hole samples;

viii.Holes with an asterix were drilled as part of the 2007 and 2008

drilling campaign;

ix. All significant intercepts are shown in Tables 1 and 2; and

x. All drill hole data is shown in Table 4.

UNDERGROUND EXPLORATION

The first underground exploration target area to be drilled by widely spaced

drill holes (80 x 80 metres) defined significant zones of polymetallic

mineralization. Drilling from the 748 mine level in the Central Zone tested

veins 33, 34 and 37 below the 700 mine level. The drill results have emphasized

confidence in the mine with the discovery of new zones of mineralization, the

confirmation of existing vein sets and the extension of known vein systems down

to the 500 mine level. Underground drilling also defined the continuation of the

surrounding low-grade halos intersected in surface drilling (see Figure 3). It

is strongly evident that significant mineralization remains undiscovered as

selective sampling techniques were used by previous explorers in the underground

environment.

Underground drilling is ongoing to define the strike extents of this area. An

additional two Boart Longyear LM75 drill rigs have been ordered, with the first

expected to be commissioned in March 2012 and the second in July, 2012. These

rigs will be used to define the resource base below the 700 mining level in the

southern, central and northern zones of the Shahumyan mine with 27,200 metres

expected to be drilled in 2012 at a drill spacing of 80 x 80 metres and 40 x 40

metres in selected areas. Underground and surface drilling will be coordinated

to ensure that all areas of potential resource expansion are covered.

Underground - Significant Results

Initial BQ diamond drilling has returned numerous, potentially mineable widths

of medium to high-grade mineralization, with selected intervals displayed below

(1g/t gold equivalent cut-off grade):

NXC02748_01:

-- 6m @ 1.6g/t AuEq (0.35g/t Au, 8.86g/t Ag, 0.14% Cu, 1.55% Zn), from 36m

-- 2m @ 4.14g/t AuEq (3.59g/t Au, 13.24g/t Ag, 0.15% Cu, 0.08% Zn), from

93m

-- 3m @ 7.10g/t AuEq (3.70g/t Au, 104.37g/t Ag, 0.17% Cu, 1.89% Zn), from

105m

-- 4m @ 6.40g/t AuEq (2.54g/t Au, 33.42g/t Ag, 0.73% Cu, 3.64% Zn), from

241m

NXC02748_02:

-- 31m @ 4.55g/t AuEq (3.40g/t Au, 26.49g/t Ag, 0.25% Cu, 0.38% Zn), from

62m

-- Including 6m @ 5.05g/t AuEq (2.29g/t Au, 43.97g/t Ag, 1.08% Cu,

0.19% Zn), from 69m

-- Including 6m @ 13.09g/t AuEq (11.72g/t Au, 37.61g/t Ag, 0.24% Cu,

0.40% Zn), from 80m

-- Including 4m @ 6.43g/t AuEq (4.67g/t Au, 37.37g/t Ag, 0.14% Cu,

1.43% Zn), from 89m

-- 3m @ 2.28g/t AuEq (1.04g/t Au, 25.37g/t Ag, 0.13% Cu, 0.95% Zn), from

193m

-- 6m @ 1.94g/t AuEq (0.75g/t Au, 21.13g/t Ag, 0.38% Cu, 0.26% Zn), from

254m

NXC02748_03:

-- 9m @ 3.01g/t AuEq (1.13g/t Au, 43.86g/t Ag, 0.11% Cu, 1.48% Zn), from

70m

-- 3m @ 4.52g/t AuEq (1.79g/t Au, 47.67g/t Ag, 0.16% Cu, 2.79% Zn), from

257m

NXC02748_04:

-- 26m @ 1.90g/t AuEq (1.48g/t Au, 0.33g/t Ag, 0.06% Cu, 0.58% Zn), from

10m

-- Including 10m @ 3.72g/t (30.6g/t Au, 0.55g/t Ag, 0.04% Cu, 1.06%

Zn), from 26m

-- 2m @ 5.44g/t AuEq (0.48g/t Au, 28.07g/t Ag, 0.46% Cu, 6.66% Zn), from

217m

-- 5m @ 2.01g/t AuEq (0.26g/t Au, 32.34g/t Ag, 0.35% Cu, 0.96% Zn), from

277m

Notes:

i. In situ gold equivalent (AuEq) grade based on the following 2011 long-

term metal prices: Au: US$1250/oz, Ag: US$25/oz, Cu: US$3.00/lb and Zn:

US$1.00/lb;

ii. Minimum width reported is 2 metres, with a minimum internal dilution of

2 metres;

iii.Drill Intersections are down hole with true width considered to be 85%

of the intersection length;

iv. Drill Intersections represent intercepts into an intermediate-

sulphidation vein-breccia epithermal system;

v. Assays are uncut;

vi. All samples assayed by SGS independently managed laboratory, Kapan,

Armenia;

vii.International reference standards and full QAQC samples (duplicates,

replicates and blanks) inserted with all exploration drill hole samples;

viii.All significant intercepts are shown in Table 3; and

ix. All drill hole data is shown in Table 4.

CONCLUSIONS

-- A major mineralized corridor, some 1.5 kilometres by 1 kilometre, has

been discovered underneath barren cover lithologies by surface drilling.

The domain is open to the east and south, and has the potential to add

significant value to the current operation and increase confidence in

the potential for a major open pit scenario.

-- Review of the geology and drill intersections has confirmed the strong

similarity to the style of polymetallic (Au-Ag-Cu-Zn) mineralization

currently being mined at the Shahumyan underground operation.

-- Significant low to medium grade mineralization, surrounding known higher

grade veins and additional high-grade vein sets have been delineated by

DPM drilling. The mineralization was not previously identified by

earlier Shahumyan mining operators due to selective sampling, lack of

drilling and the ability to drill to depth.

-- The first underground exploration target area to be drilled by widely

spaced drill holes has returned significant zones of polymetallic

mineralization at widths of up to 32 metres and depth extents below the

current mining levels. The results to date are considered to be

extremely encouraging as they represent the first systematic underground

drilling between the 500 and 700 mining levels and indicate similar

epithermal vein style mineralization continues to depth below the

current underground mining which is currently at the 700 mining level.

-- After identifying the "Shahumyan East" domain, the exploration and

development strategy for the Open Pit Project has been revised with

exploration resources added to accomplish both wide spaced (160 x 160

metres) and infill drilling (80 x 80 metres) in 2012 to redefine the

project area.

To view Figures 1, 2 and 3 and Tables 1 through 4, please click the following

link: http://media3.marketwire.com/docs/dundee_precious_metals_feb16.pdf

GEOLOGY AND MINERALIZATION STYLE

The Kapan region lies within the extensive Tethyan orogenic belt, which is part

of a collision zone between the Eurasian and Afro-Arabian 'mega-continental'

plates. Within the Tethyan Belt, the DPM mining and exploration concession lies

within a Jurassic-Cretaceous volcanic arc, dominated by rocks of andesitic and

basaltic affinity. These rocks make up the Kapan Volcanic Complex, the majority

of which DPM holds within its greater than 350 square kilometre Kapan

Exploration Licence in Southern Armenia. Within the concession are the Shahumyan

polymetallic (Cu, Au, Ag & Zn) and Centralni Cu (+/-Zn & Au) deposits. In 2009,

the Centralni mining concession was terminated and handed back to the Armenian

Government.

The Shahumyan deposit is classified as a carbonate-base metal gold system

(intermediate-sulphide vein-breccia epithermal system). These systems generally

occur at higher crustal levels than quartz-sulphide Au+/-Cu systems and

typically contain gangue of carbonate, quartz, pyrite, sphalerite, galena and

chalcopyrite as fracture/vein/ breccias. Some of these systems may be

overprinted by bonanza epithermal quartz Au, Ag ores and others may be

telescoped upon deeper level quartz-sulphide Au+/-Cu mineralization. Deposits of

this style represent some of the more prolific gold producers (Victoria Veins at

Lepanto, Acupan, Kidston, Penjom and Kelian)

Approximately 3 kilometres northwest of the Shahumyan deposit is the Centralni

deposit which has been extracted by open pit and underground mining methods. The

Centralni deposit has an affinity with quartz-sulphide gold+/-copper deposits,

i.e. formed at deeper crustal levels close to porphyry intrusions and comprising

dominantly iron sulphides and quartz, mostly as veins and vein/breccias. The

quartz-sulphide veins at Centralni deposit correspond to D type veins of

porphyry deposits and it is quite possible that the lower levels of the deposit

(underground) represent a porphyry style of mineralization, including minerals

such as chalcopyrite, bornite, and chalcocite. The host rock is a feldspar

porphyritic andesite and within the open pit area the andesite has been

overprinted by a high-sulphidation hydraulic fracturing event represented by a

matrix dominated by fine grained pyrite and enargite with Au-Ag mineralization.

The Kapan mining district is an area which was dominated by a strong tensional

structural regime during the period of mineralization, and this is particularly

evident at the Shahumyan deposit. The Centralni deposit is at a higher

topographic setting than the Shahumyan deposit, which indicates that post

mineral faulting has been active in the region, as the Centralni deposit

represents a deeper formed style of mineralization.

In general, the Kapan Volcanic District has produced

porphyry-style/quartz-sulphide mineralization, carbonate-base metals vein style

and high-sulphidation epithermal mineralization with probable intermediate

styles of mineralization located to the immediate west of Centralni. There is

little doubt that the Kapan Volcanic Complex, held by DPM, contains the

essential components for ore deposit formation. The recognition of post mineral

cover and faulting events within the district are particularly encouraging as it

would suggest that potential exists for blind discoveries such as "Shahumyan

East".

SAMPLING AND ANALYSIS

All drill core is sampled in intervals up to a maximum of 3 metres, with 1.0

metre sample intervals most common within the mineralized zones. After transport

to the secure core facility, all core is marked up systematically for cutting by

diamond saw. HQ core is cut systematically with care to retain the orientation

line. BQ core is sampled whole, while HQ and NQ core is routinely sampled on the

right hand side with core samples submitted to the onsite, SGS managed,

laboratory facility for assaying. The residual half core is retained in plastic

core trays and is stored in a secure facility. Samples are routinely assayed for

Cu, Au, Ag, Zn and Pb. All drill core is photographed wet and dry by a

semi-automated digital system. Following DPM exploration standard quality

control and assurance procedures, a full suite of field and laboratory

duplicates and replicates along with internationally accredited standards

representing 5% for each sample type, have been submitted with each batch of

samples. In addition, SGS submits and reports its own standards, blanks and

control samples under the C-Class system.

Sample tickets are entered into the bags with a numbering system, which

reconciles sample and assayed results in the Acquire database. The average core

recovery within the modelled resource constraints is 96% overall. The weight of

a diamond core sample varies between 2kg and 7kg with an average weight of

approximately 3.5kg.

The technical information contained herein has been prepared in accordance with

Canadian regulatory requirements set out in National Instrument 43-101 Standards

of Disclosure for Mineral Projects ("NI 43-101"), and has been reviewed and

approved by Dr. Julian Barnes, B.Sc.Hon., PhD (Geology), Technical Consultant,

formerly Executive Vice President of DPM, who is a Qualified Person, as defined

under NI 43-101, and not independent of the Company.

Dundee Precious Metals Inc. is a well-financed, Canadian based, international

gold mining company engaged in the acquisition, exploration, development, mining

and processing of precious metals. The Company's principal operating assets

include the Chelopech operation, which produces a gold, copper and silver

concentrate, located east of Sofia, Bulgaria; the Kapan operation, which

produces a gold, copper, zinc and silver concentrate, located in southern

Armenia; and the Tsumeb smelter, a concentrate processing facility located in

Namibia. DPM also holds interests in a number of developing gold properties

located in Bulgaria, Serbia, and northern Canada, including interests held

through its 51.4% owned subsidiary, Avala Resources Ltd., its 47.7% interest in

Dunav Resources Ltd. and its 11.5% interest in Sabina Gold & Silver Corp.

FORWARD LOOKING STATEMENTS

This news release may contain certain information that constitutes

forward-looking statements. Forward-looking statements are frequently

characterized by words such as "plan," "expect," "project," "intend," "believe,"

"anticipate" and other similar words, or statements that certain events or

conditions "may" or "will" occur. Forward-looking statements are based on the

opinions and estimates of management at the date the statements are made, and

are subject to a variety of risks and uncertainties and other factors that could

cause actual events or results to differ materially from those projected in the

forward-looking statements. These factors include the inherent risks involved in

the exploration and development of mineral properties, the uncertainties

involved in interpreting drilling results and other geological data, fluctuating

metal prices and other factors described above and in the Company's most recent

annual information form under the heading "Risk Factors" which has been filed

electronically by means of the Canadian Securities Administrators' website

located at www.sedar.com. The Company disclaims any obligation to update or

revise any forward-looking statements if circumstances or management's estimates

or opinions should change. The reader is cautioned not to place undue reliance

on forward-looking statements.

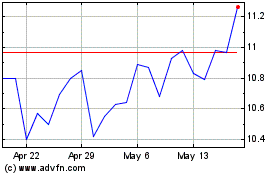

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2024 to Jul 2024

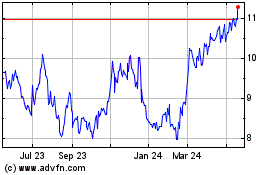

Dundee Precious Metals (TSX:DPM)

Historical Stock Chart

From Jul 2023 to Jul 2024